North Carolina Additional Advance and Modification Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

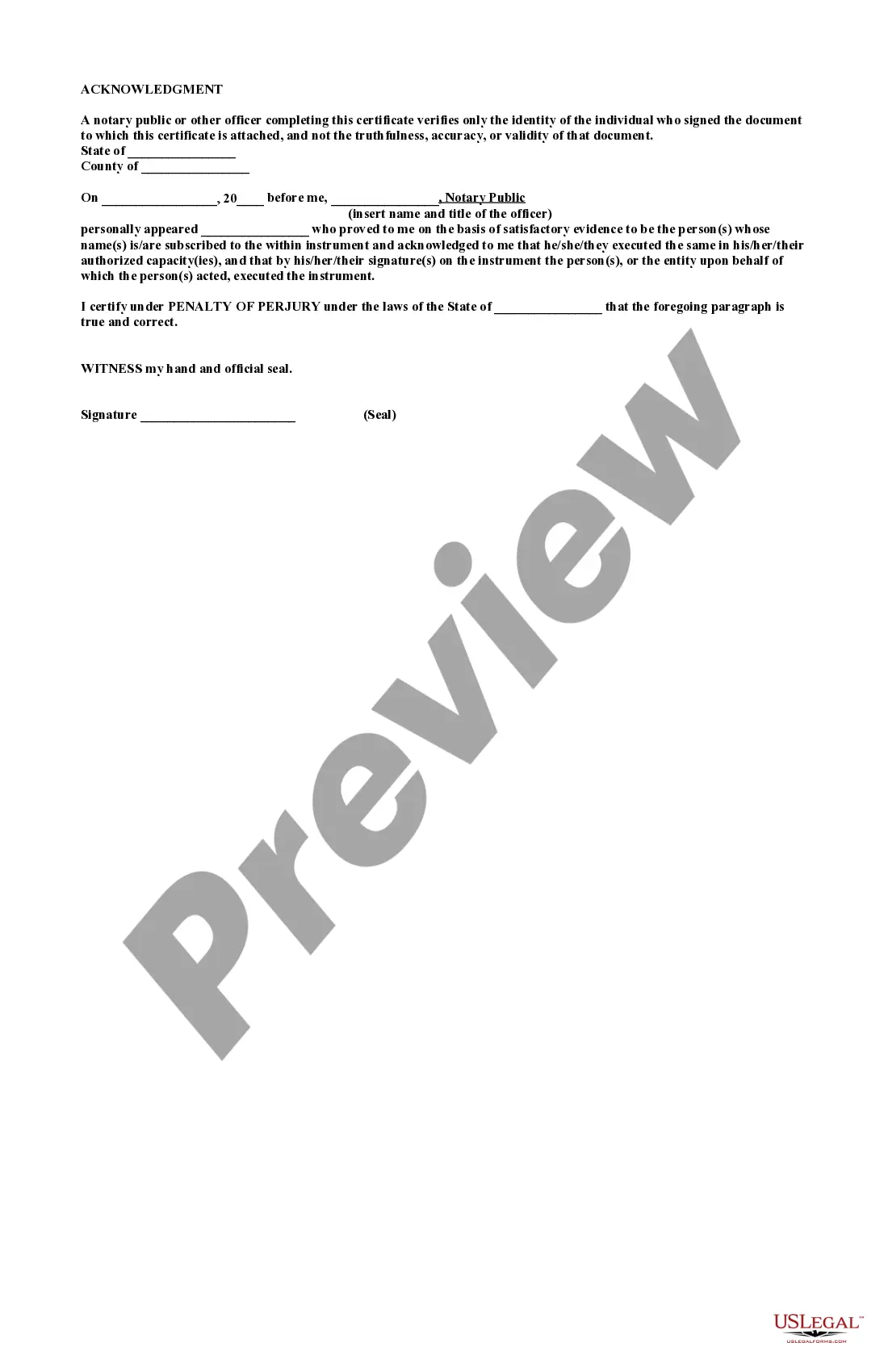

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Additional Advance And Modification Agreement?

Steer clear of pricey attorneys and discover the North Carolina Additional Advance and Modification Agreement you require at an affordable rate on the US Legal Forms site.

Utilize our straightforward categories feature to locate and download legal and tax documents. Review their descriptions and preview them prior to downloading.

Opt to download the form in PDF or DOCX format. Click on Download and locate your template in the My documents section. You are welcome to save the form to your device or print it out. After downloading, you can complete the North Carolina Additional Advance and Modification Agreement by hand or with editing software. Print it out and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Furthermore, US Legal Forms provides users with detailed guidance on how to obtain and complete each template.

- US Legal Forms subscribers simply need to Log In and download the specific document they require to their My documents section.

- Individuals who have not yet subscribed should follow the instructions below.

- Verify that the North Carolina Additional Advance and Modification Agreement is suitable for use in your location.

- If available, examine the description and utilize the Preview feature before downloading the template.

- If you are confident that the document meets your needs, click on Buy Now.

- If the form is incorrect, use the search box to find the appropriate one.

- Next, create your account and select a subscription option.

- Make payment using a credit card or PayPal.

Form popularity

FAQ

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

A loan modification is a change that the lender makes to the original terms of your mortgage, typically due to financial hardship. The goal is to reduce your monthly payment to an amount that you can afford, which you can achieve in a variety of ways.

The most common examples of hardship include: Illness or injury. Change of employment status. Loss of income.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.

Yes, it is possible to get a second loan modification though statistically it's obvious that you are less likely to get a second modification if you've had a first, and a third if you were lucky enough to get a second. It is possible though.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.