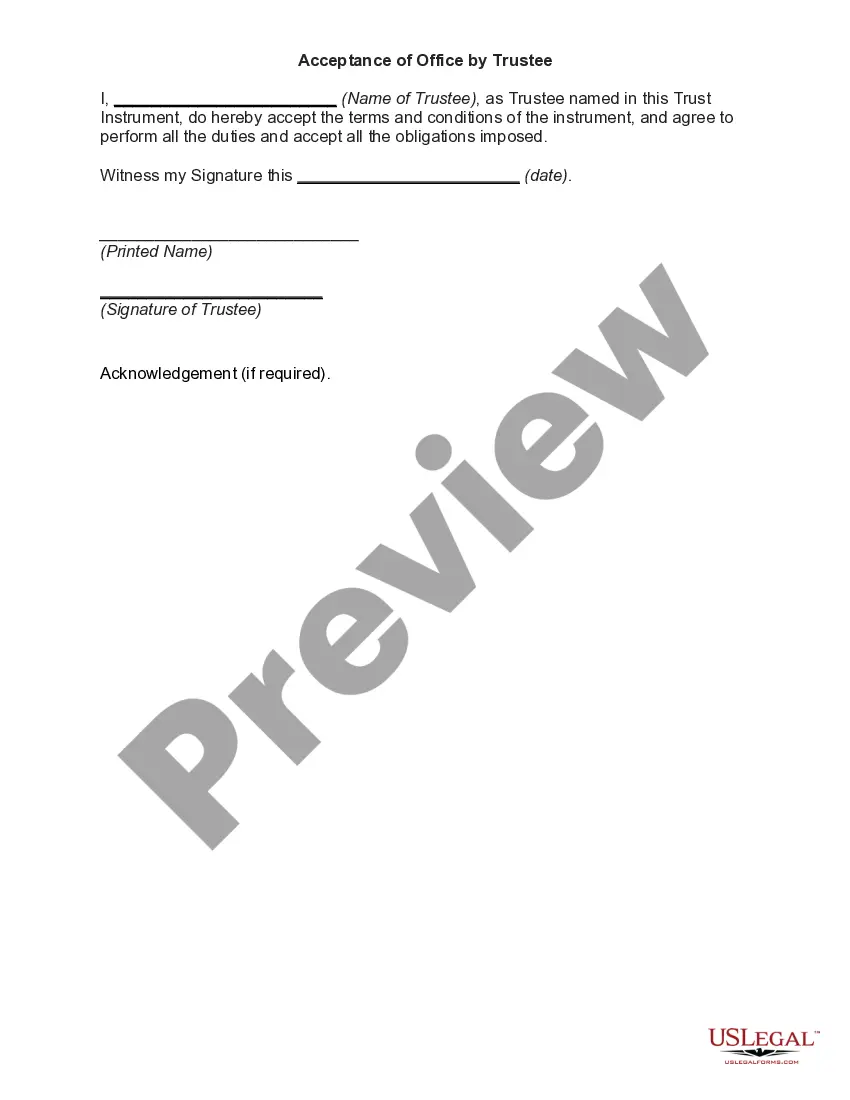

Oath: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Oath of Administrator, Administrator CTA, Executor, or Fiduciary for an Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Oath Of Administrator, Administrator CTA, Executor, Or Fiduciary For An Estate?

Steer clear of expensive attorneys and locate the North Carolina Oath of Administrator, Administrator CTA, Executor, or Fiduciary for an Estate you require at an affordable price on the US Legal Forms website.

Utilize our straightforward grouping feature to discover and acquire legal and tax documents. Examine their descriptions and review them thoroughly before downloading.

Make payment via credit card or PayPal. Choose to receive the document in PDF or DOCX format. Click Download and locate your form in the My documents section. You can save the form to your device or print it out. After downloading, you may complete the North Carolina Oath of Administrator, Administrator CTA, Executor, or Fiduciary for an Estate manually or with editing software. Print it out and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms offers clients detailed guidance on how to download and fill out each template.

- US Legal Forms users simply need to sign in and retrieve the particular document they need from their My documents section.

- Individuals who haven't subscribed yet should adhere to the following steps.

- Verify that the North Carolina Oath of Administrator, Administrator CTA, Executor, or Fiduciary for an Estate is applicable for use in your location.

- If possible, review the description and utilize the Preview option just prior to downloading the templates.

- If you are certain the document satisfies your requirements, click on Buy Now.

- If the template is incorrect, use the search function to find the appropriate one.

- Subsequently, set up your account and select a subscription plan.

Form popularity

FAQ

A fiduciary is a person who stands in a position of trust with you (or your estate after your death) and your beneficiaries. There are different types of fiduciaries depending on the context: an executor or executrix is named in a will; a trustee is named by a trust; an agent is appointed by a power of attorney.

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person.

Pay the estate's taxes and debts. Distribute any assets to beneficiaries and dispose of any leftover property. Maintain the estate, including homes and property, until it can be distributed or sold.

Trustees, executors, administrators and other types of personal representatives are all fiduciaries.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

Fiduciary - An individual or bank or trust company that acts for the benefit of another. Trustees, executors, and personal representatives are all fiduciaries.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

An executor (male) or executrix (female) is the person named in a will to perform these duties. An administrator (male) or administratrix (female) is the person appointed by the probate court to complete these tasks when there is no will or no executor or executrix has been named in the will.

The difference between executor and administrator of estate in comes down to how the person came to be in charge of the estate. Someone who is appointed through the will of the person who died is called executor. Someone who is appointed because of any other reason is called administrator.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.