Montana Amended Equity Fund Partnership Agreement

Description

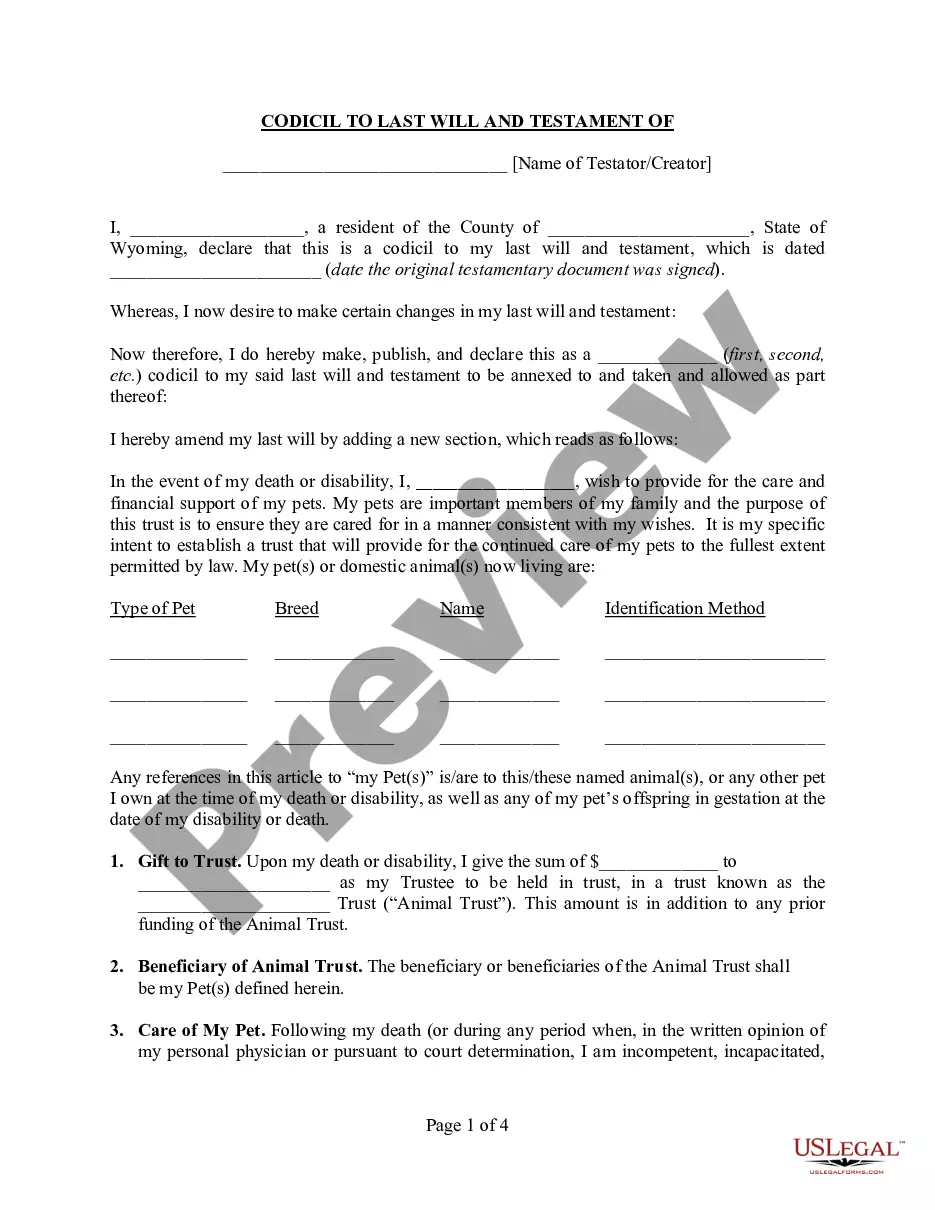

How to fill out Amended Equity Fund Partnership Agreement?

If you have to comprehensive, download, or print legitimate file themes, use US Legal Forms, the greatest assortment of legitimate types, that can be found online. Make use of the site`s simple and hassle-free research to get the papers you want. Various themes for company and specific purposes are categorized by groups and states, or search phrases. Use US Legal Forms to get the Montana Amended Equity Fund Partnership Agreement in a couple of mouse clicks.

When you are currently a US Legal Forms client, log in in your bank account and click on the Download option to get the Montana Amended Equity Fund Partnership Agreement. You may also entry types you earlier saved inside the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the right town/region.

- Step 2. Make use of the Review solution to examine the form`s content material. Never forget to read through the description.

- Step 3. When you are not happy with all the kind, utilize the Lookup field near the top of the monitor to discover other models of your legitimate kind template.

- Step 4. Once you have found the shape you want, click on the Purchase now option. Opt for the costs plan you favor and put your credentials to sign up on an bank account.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Pick the format of your legitimate kind and download it on your own device.

- Step 7. Full, change and print or indication the Montana Amended Equity Fund Partnership Agreement.

Every legitimate file template you get is your own property permanently. You possess acces to every kind you saved within your acccount. Click on the My Forms area and choose a kind to print or download yet again.

Compete and download, and print the Montana Amended Equity Fund Partnership Agreement with US Legal Forms. There are many skilled and status-certain types you may use for the company or specific demands.

Form popularity

FAQ

A Partnership Amendment is used whenever there is a change to the original Partnership Agreement or new provisions must be added to the original Agreement. Often, this is used when: A partner leaves the partnership. A new partner is added to the partnership.

Any slight changes made in the relationship between partners in a partnership firm would result in the reconstitution of the firm itself. Thus, whenever a new partner is introduced or when an existing partner is being removed, a partnership firm is bound to be reconstituted.

Any change in the existing agreement is known as reconstitution of the partnership firm. Thus, the existing agreement ends and a new agreement is formed with the changed relationship among the members of the partnership firm and its composition.

Types of Withdrawal from a Partnership Firm The partner is guilty of a breach of trust or is in breach of the partnership agreement. The partner has been declared as a person of unsound mind by a competent court. The partner is permanently incapacitated.

A limited partnership agreement helps protect your business into the future by outlining each partner's roles and responsibilities, as well as how they share in the business profits. You should use a limited partnership agreement if you want to form a limited partnership or formalize an existing limited partnership.

Drafting and Filing An amendment to a partnership agreement is a legal document that includes specific information about the action, such as a statement that the amendment is made by unanimous consent, a statement that the undersigned agree to the amendment and an explanation of the amendment.