Iowa How to Request a Home Affordable Modification Guide

Description

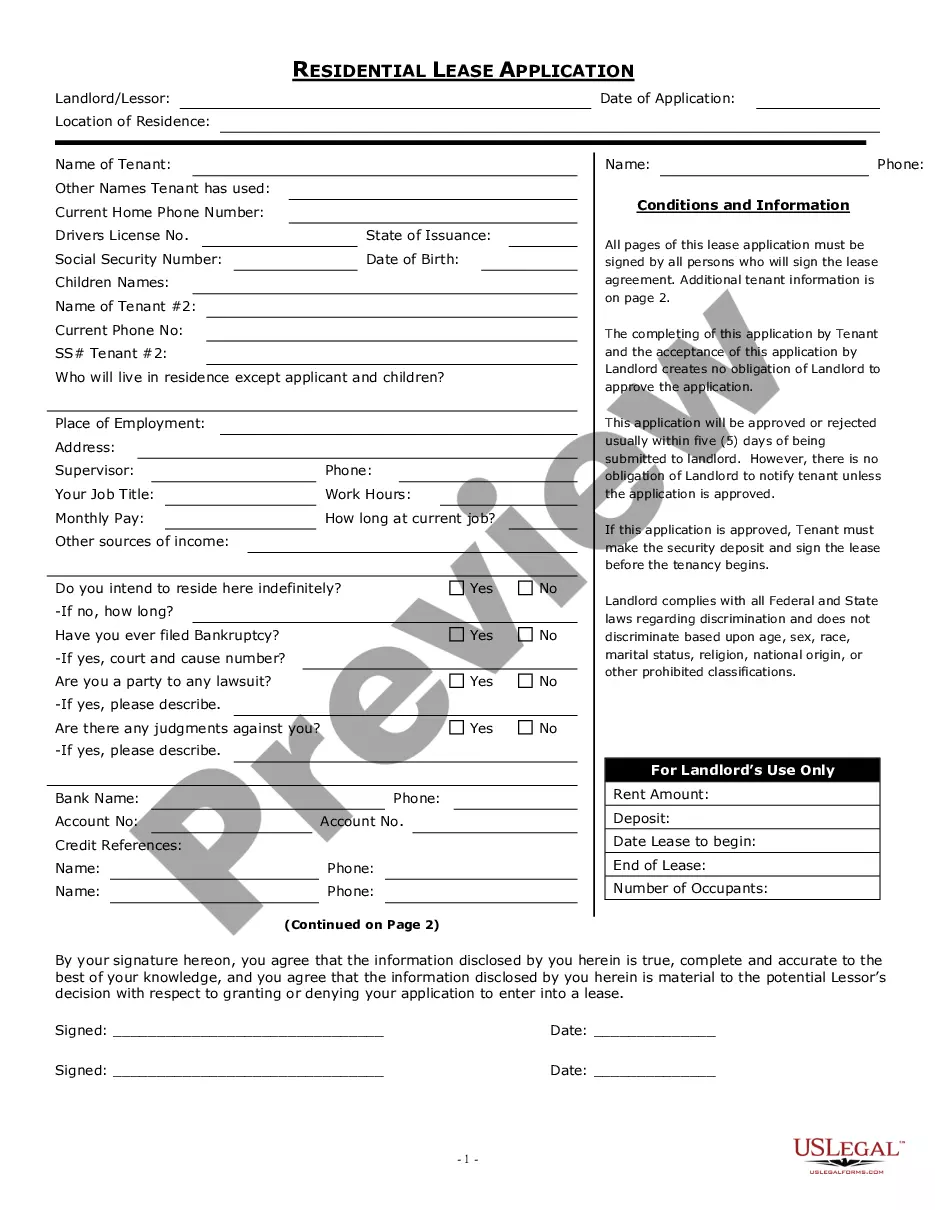

How to fill out How To Request A Home Affordable Modification Guide?

Are you in a situation where you need documents for various organizational or specific reasons almost every business day.

There is an array of legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template designs, like the Iowa How to Request a Home Affordable Modification Guide, that are crafted to comply with state and federal regulations.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient document format and download your copy. Explore all the document templates you have purchased in the My documents menu. You can obtain another version of the Iowa How to Request a Home Affordable Modification Guide whenever needed. Simply choose the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa How to Request a Home Affordable Modification Guide template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct city/county.

- Utilize the Preview feature to review the document.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup area to find the form that meets your needs and requirements.

- Once you have found the correct form, click Acquire now.

Form popularity

FAQ

The Home Affordable Modification Program (HAMP) officially ended in December 2016. However, many homeowners in Iowa can still explore other modification options to help manage their mortgage payments. It is essential to understand the available alternatives, as some programs may provide similar benefits. For detailed guidance, consider using the Iowa How to Request a Home Affordable Modification Guide available on the US Legal Forms platform.

The HUD home affordable modification program is designed to help homeowners facing financial difficulties modify their existing mortgages, making payments more manageable. This program aims to reduce monthly payments and prevent foreclosure, providing a lifeline for those in need. By utilizing the Iowa How to Request a Home Affordable Modification Guide, you can learn more about eligibility requirements and the application process. For further assistance, consider exploring the resources available on the uslegalforms platform.

To apply for a mortgage modification, start by gathering your financial documents, including your income statements and current mortgage details. Next, reach out to your lender to express your intention to modify your mortgage, and request the specific forms needed for the process. Following that, complete the application and submit it along with the required documents. For detailed steps, refer to the Iowa How to Request a Home Affordable Modification Guide, which provides clear instructions and resources to assist you.

The homeowners assistance program in Iowa is designed to help residents facing financial hardships maintain their homes. This program offers resources and potential financial support to assist with mortgage payments, property taxes, and home repairs. To learn more about the program and how you might qualify, refer to the Iowa How to Request a Home Affordable Modification Guide. Additionally, UsLegalForms can provide helpful documents to support your application and navigate the process smoothly.

To get home modifications in Iowa, start by reviewing the Iowa How to Request a Home Affordable Modification Guide. This guide provides essential steps, including gathering necessary documents, assessing your financial situation, and submitting your request to your mortgage lender. Utilizing resources like UsLegalForms can simplify this process by offering templates and forms you need to make your request effectively. Remember, clear communication with your lender is key to successfully obtaining modifications.

Participating in HAMP can significantly reduce your monthly mortgage payments, making homeownership more affordable. By lowering your payments, you can regain financial stability and avoid the stress of foreclosure. Additionally, our Iowa How to Request a Home Affordable Modification Guide explains the process of applying for these modifications, ensuring you have the best chance of success.

The Home Affordable Modification Program (HAMP) is a federal initiative designed to help homeowners facing financial difficulties. This program aims to reduce monthly mortgage payments, making them more affordable. If you are looking for information on Iowa How to Request a Home Affordable Modification Guide, understanding HAMP is crucial. By participating in HAMP, you can potentially avoid foreclosure and stabilize your financial situation.

The Iowa Individual Assistance Grant Program primarily aids residents who have experienced a disaster or significant financial distress. This program targets individuals and families with low to moderate incomes. If you seek assistance, reviewing the Iowa How to Request a Home Affordable Modification Guide can help clarify eligibility and the application process.

Iowa offers several assistance programs for seniors, including home repair grants, weatherization assistance, and property tax relief. These programs aim to help seniors maintain their homes and live independently. For a comprehensive overview of these options, including how to access them, refer to the Iowa How to Request a Home Affordable Modification Guide.

Eligibility for government home improvement grants in Iowa varies based on factors like income, age, and the nature of the repair needed. Generally, these grants target low-income households or specific demographic groups such as seniors. Utilizing the Iowa How to Request a Home Affordable Modification Guide can provide you with detailed information on available grants and how to apply for them.