Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

US Legal Forms - one of the few largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the most current forms such as the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form in just minutes.

If you already possess a monthly subscription, Log In and download the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Every template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form with US Legal Forms, the most extensive collection of legal document templates. Make use of thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you want to utilize US Legal Forms for the first time, here are straightforward instructions to begin.

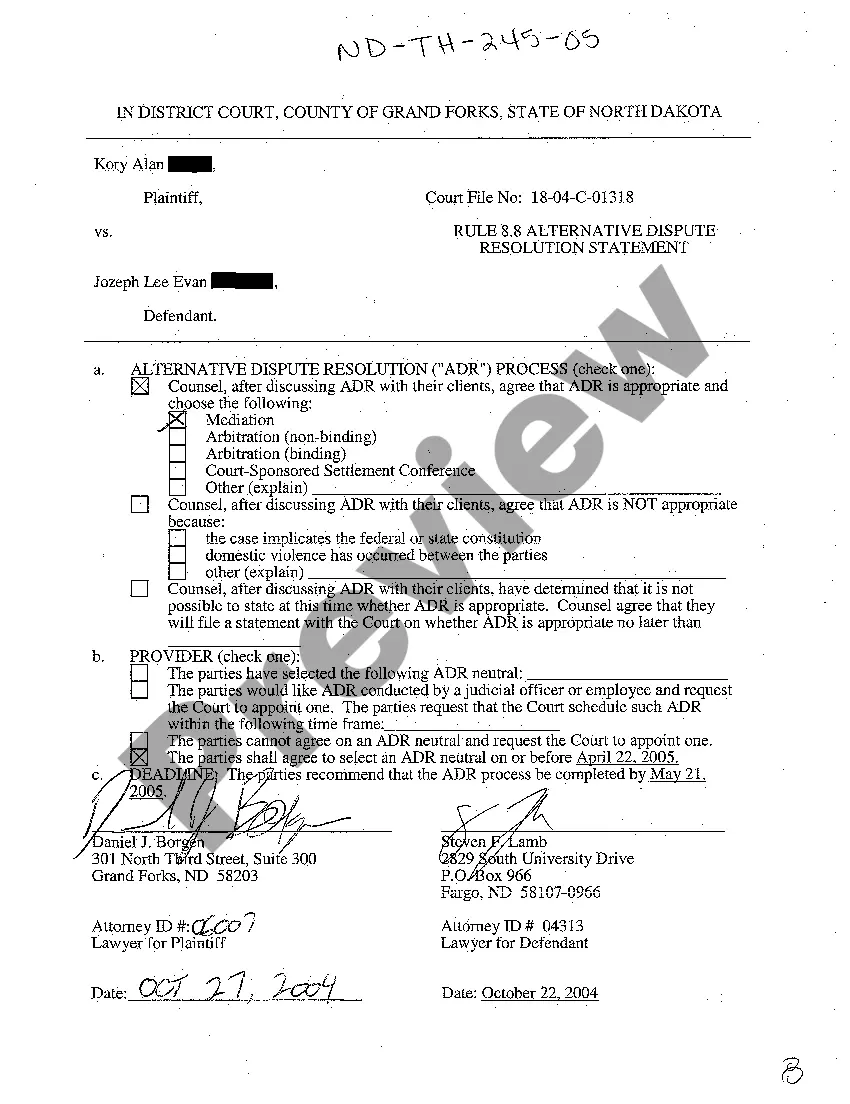

- Ensure you have selected the correct form for your specific city/county.

- Click on the Preview button to review the form's details. Check the form information to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are content with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Various factors can disqualify you from receiving a loan modification. Key reasons include insufficient income to support modified payments and failure to demonstrate financial hardship. Understanding these disqualifications can help you prepare better when seeking assistance. For detailed assistance, consider consulting the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form, as it offers vital insights into enhancing your eligibility.

The full form of RMA is Request for Loan Modification Affidavit. This form is pivotal in initiating the process of loan modification, as it provides essential details about your financial situation. To effectively complete this form, refer to the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form for guidance. This resource ensures you gather the correct information and submit everything accurately.

To file a small estate affidavit in Iowa, first confirm that your estate qualifies under the state's small estate law. Then, complete the necessary forms accurately, including the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form, if applicable. Once completed, you will need to submit your affidavit to the county clerk where the deceased resided. It’s advisable to consult with a legal professional if you encounter any complexities.

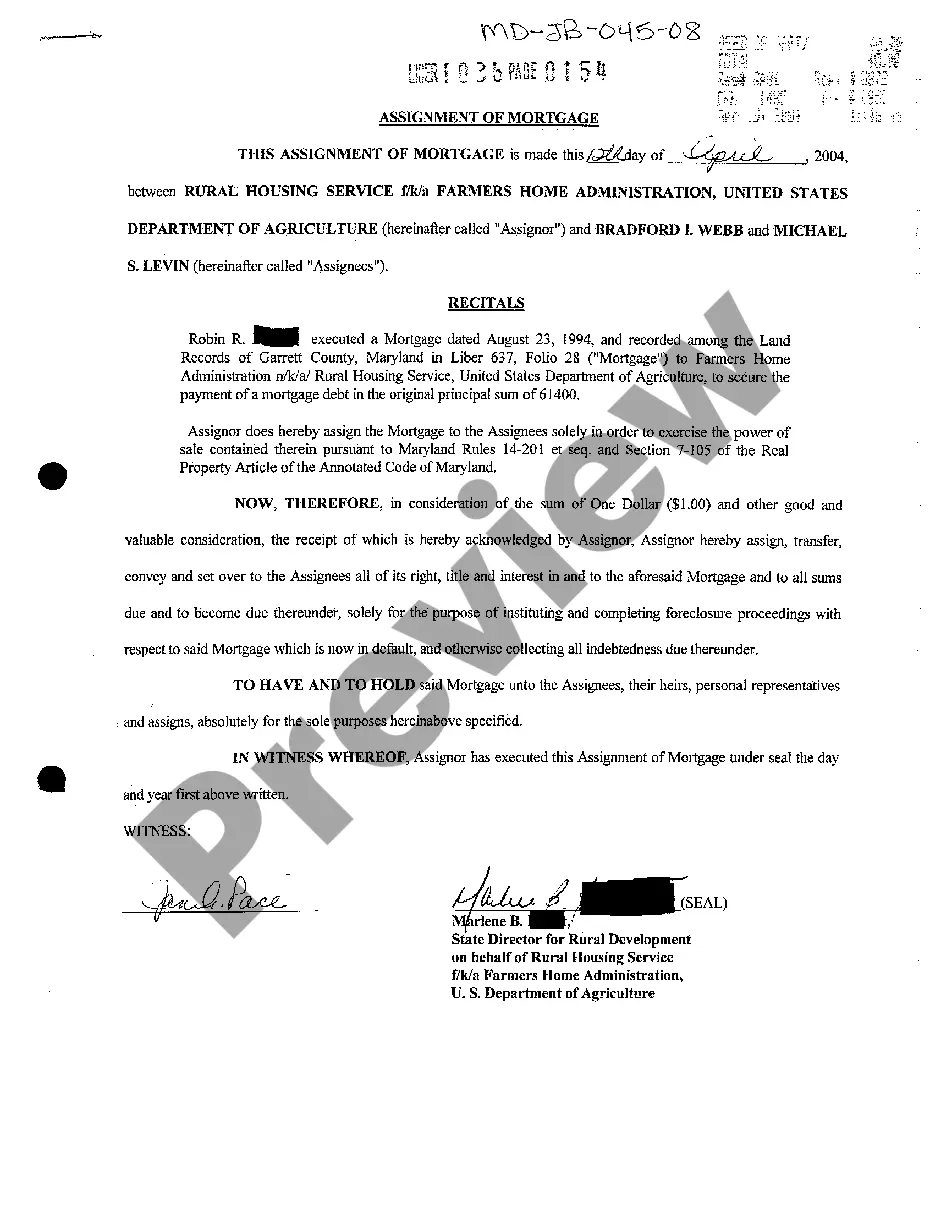

Requirements for a loan modification can differ by lender, but generally, you need proof of income, a valid hardship explanation, and a completed application. Following the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form can help you navigate these requirements efficiently. Additionally, lenders may require other documentation like tax returns or bank statements. Always check with your lender for their specific guidelines.

The loan modification process begins with assessing your financial situation and determining whether modification is a viable option. Once you decide to proceed, complete the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form and submit it along with required documents. Your lender will analyze your application, discuss options, and formalize any changes to your existing loan. It’s essential to stay in touch with your lender for updates.

The process for a loan modification typically involves submitting a formal request to your lender. Start by gathering the necessary documentation and completing the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form. After submission, your lender will review your financial situation and determine eligibility. Communication is crucial during this time, so remain proactive in following up with your lender.

To modify your divorce decree in Iowa, you must file a petition in the court that issued the original decree. It's essential to provide valid reasons for the modification and potentially present supporting evidence. As you navigate this process, consider referring to the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form for additional insights on documentation. Consulting with a lawyer can also simplify this process significantly.

The approval time for a loan modification can vary, but it generally takes anywhere from 30 to 90 days. To ensure a smoother process, follow the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form carefully. Be prepared to provide any requested documentation promptly, as this can help speed up your approval. Keep in mind that the lender's workload may also impact the timeline.

RMA in mortgage terms is the Request for Mortgage Assistance, which is a formal request for loan modification or leniency from your lender. It's important for homeowners experiencing financial challenges. By utilizing resources like the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can effectively present your case and improve your chances of receiving the support you need.

To apply for a loan modification, you'll typically need to provide your recent income statements, tax returns, and the completed RMA form. Additionally, personal information such as your financial hardships, assets, and debts will be necessary. Ensure you have these documents ready as you follow the Iowa Instructions for Completing Request for Loan Modification and Affidavit RMA Form, simplifying the process.