Hawaii How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

Utilizing the website, you will access thousands of forms for both business and personal needs, organized by categories, states, or keywords. You can find the latest forms such as the Hawaii How to Request a Home Affordable Modification Guide in just minutes.

If you already have a membership, Log In and download the Hawaii How to Request a Home Affordable Modification Guide from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms under the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Hawaii How to Request a Home Affordable Modification Guide. Every template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Access the Hawaii How to Request a Home Affordable Modification Guide with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast assortment of professional and state-specific templates that meet your business or personal requirements and standards.

- Make sure you have selected the correct form for your city/county.

- Click the Review button to look over the content of the form.

- Examine the form description to confirm that you have picked the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

HAMP stands for the Home Affordable Modification Program, which is designed to aid struggling homeowners. It provides opportunities to adjust mortgage terms to lower monthly payments, making homeownership more sustainable. For those interested in knowing how to leverage this program effectively, the 'Hawaii How to Request a Home Affordable Modification Guide' offers clarity and resources for a smooth application process.

Affordable housing in Hawaii is generally accessible to individuals and families with low to moderate incomes. Eligibility often depends on income limits set by local housing authorities, as well as residency status. Whether you are seeking affordable housing or need to modify your mortgage, resources like the 'Hawaii How to Request a Home Affordable Modification Guide' can provide valuable information tailored to your needs.

While this question specifically pertains to Virginia, it's important to note that relief programs vary by state. Typically, homeowners demonstrating financial hardship and who are at risk of foreclosure may qualify. If you're a resident of Hawaii, understanding your local options and utilizing resources like the 'Hawaii How to Request a Home Affordable Modification Guide' can ensure you find the right support tailored to your situation.

The Home Affordable Modification Program (HAMP) is designed to help homeowners modify their mortgage loans to make them more affordable. This program allows borrowers in financial hardship to potentially lower their monthly payments, thereby making their homes more sustainable. If you're interested in learning more about this, our 'Hawaii How to Request a Home Affordable Modification Guide' provides step-by-step instructions. Utilizing the resources available at USLegalForms can help simplify the application process and guide you toward successful modification.

Unlike the Making Home Affordable HAMP program, FHA-HAMP is still an active program. Borrowers do not need to be reviewed for FHA forbearances and FHA Loan Modification options first before applying for FHA-HAMP.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score.

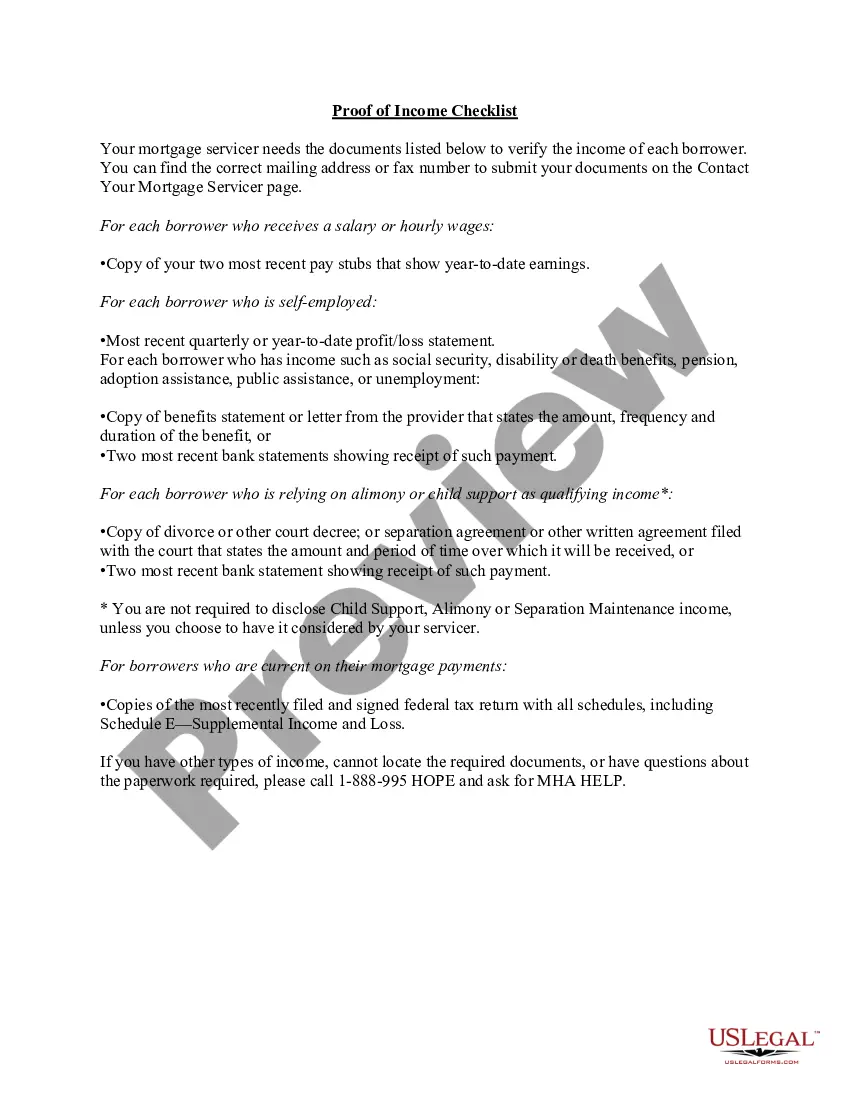

Eligibility requirements for mortgage modifications vary from lender to lender, but you typically must: Be at least one regular mortgage payment behind or show that missing a payment is imminent.

To qualify for a loan modification under federal laws, the borrower's surplus income must total at least $300 and must constitute at least 15 percent of his or her monthly income.

A property became eligible if the analysis showed a lender or investor currently holding the loan would make more money by modifying the loan rather than foreclosing. Other than the requirement that a homeowner prove financial hardship, the home had to be habitable and have an unpaid principal balance under $729,750.

The loan modification process can be complicated and difficult. Most homeowners are denied a few times before they are finally approved. Often, the denials are legitimate--because the process is confusing, many homeowners don't do it correctly.