It is not uncommon to encounter a situation where a mineral owner owns all the mineral estate in a tract of land, but the royalty interest in that tract has been divided and conveyed to a number of parties; i.e., the royalty ownership is not common in the entire tract. If a lease is granted by the mineral owner on the entire tract, and the lessee intends to develop the entire tract as a producing unit, the royalty owners may desire to enter into an agreement providing for all royalty owners in the tract to participate in production royalty, regardless of where the well is actually located on the tract. This form of agreement accomplishes this objective.

Montana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common

Description

How to fill out Commingling And Entirety Agreement By Royalty Owners Where The Royalty Ownership Is Not Common?

You are able to spend hrs on the Internet searching for the legitimate document format that meets the state and federal requirements you need. US Legal Forms provides a large number of legitimate kinds that happen to be analyzed by experts. You can actually acquire or printing the Montana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common from our assistance.

If you already possess a US Legal Forms account, you can log in and click the Acquire switch. Following that, you can full, change, printing, or indicator the Montana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common. Each and every legitimate document format you buy is your own property for a long time. To obtain one more backup of the obtained type, proceed to the My Forms tab and click the related switch.

Should you use the US Legal Forms site initially, adhere to the simple guidelines beneath:

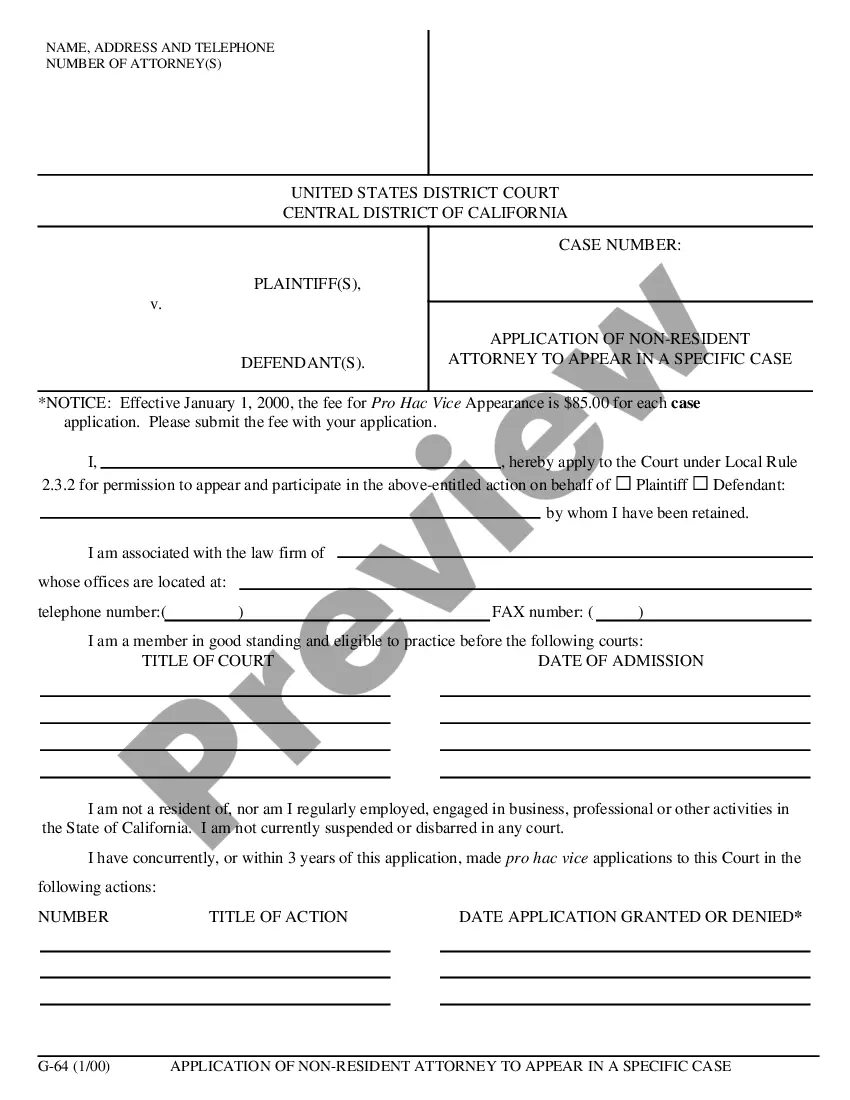

- Initial, make sure that you have selected the proper document format to the area/area of your liking. Look at the type outline to ensure you have picked the proper type. If readily available, use the Review switch to check through the document format too.

- If you would like get one more model from the type, use the Lookup area to find the format that suits you and requirements.

- Once you have identified the format you need, just click Buy now to carry on.

- Choose the costs plan you need, type in your references, and register for an account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal account to cover the legitimate type.

- Choose the format from the document and acquire it to the system.

- Make changes to the document if required. You are able to full, change and indicator and printing Montana Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common.

Acquire and printing a large number of document layouts utilizing the US Legal Forms Internet site, that offers the biggest assortment of legitimate kinds. Use specialist and state-distinct layouts to tackle your organization or specific demands.