Montana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

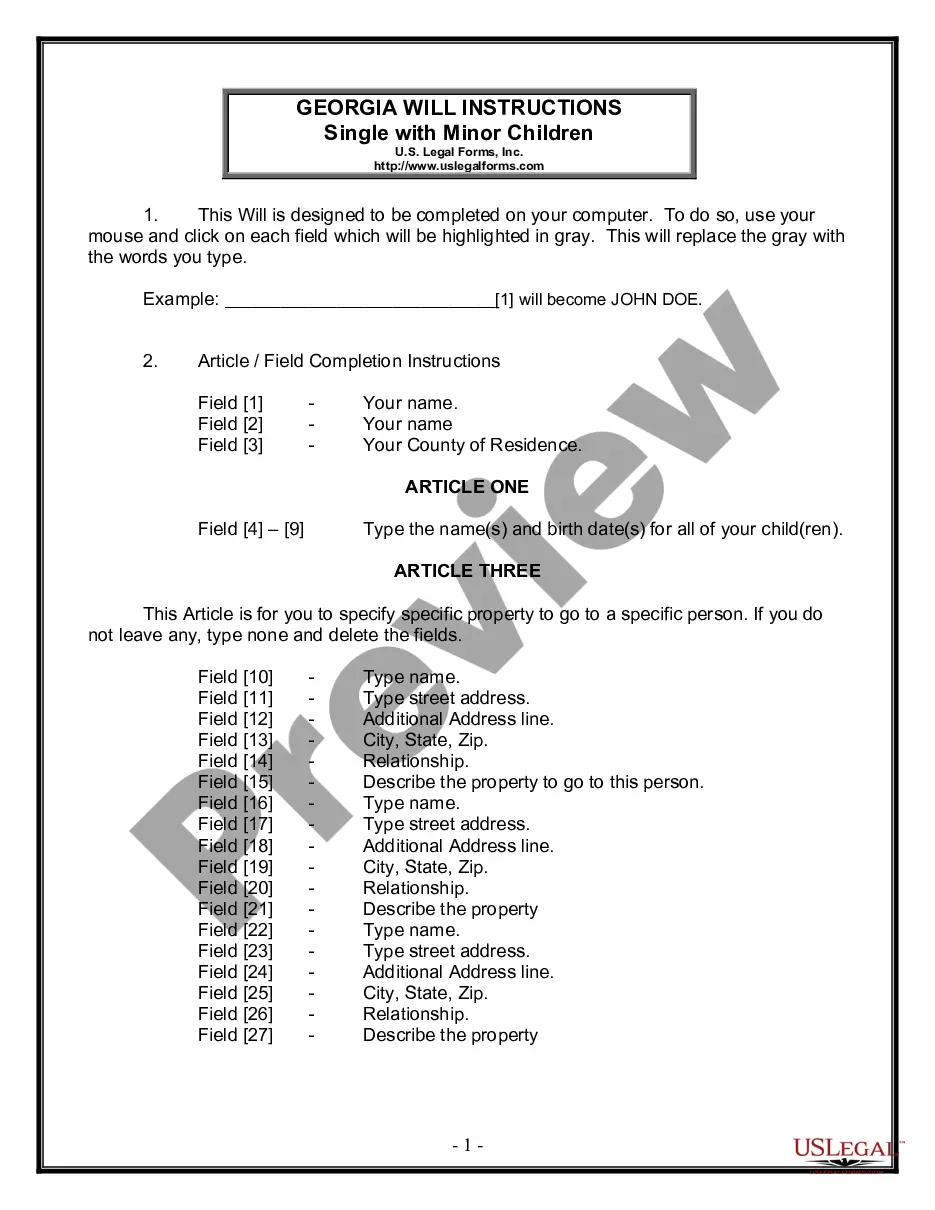

How to fill out Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

Are you currently inside a placement that you will need paperwork for sometimes enterprise or specific reasons virtually every working day? There are plenty of authorized document templates available on the net, but discovering kinds you can rely on is not easy. US Legal Forms delivers 1000s of form templates, such as the Montana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease, that are created in order to meet state and federal requirements.

If you are already familiar with US Legal Forms site and have your account, merely log in. Following that, it is possible to obtain the Montana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease web template.

If you do not offer an bank account and want to begin to use US Legal Forms, follow these steps:

- Get the form you will need and ensure it is to the proper town/area.

- Take advantage of the Preview switch to examine the form.

- Browse the outline to actually have chosen the appropriate form.

- When the form is not what you are searching for, utilize the Research discipline to obtain the form that suits you and requirements.

- Once you find the proper form, click on Buy now.

- Pick the pricing strategy you desire, submit the specified info to generate your money, and purchase an order with your PayPal or credit card.

- Decide on a handy data file formatting and obtain your duplicate.

Find every one of the document templates you may have purchased in the My Forms food list. You can get a additional duplicate of Montana Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease whenever, if possible. Just click on the necessary form to obtain or produce the document web template.

Use US Legal Forms, the most substantial collection of authorized types, to save lots of efforts and prevent faults. The support delivers expertly manufactured authorized document templates which you can use for an array of reasons. Produce your account on US Legal Forms and commence generating your way of life easier.