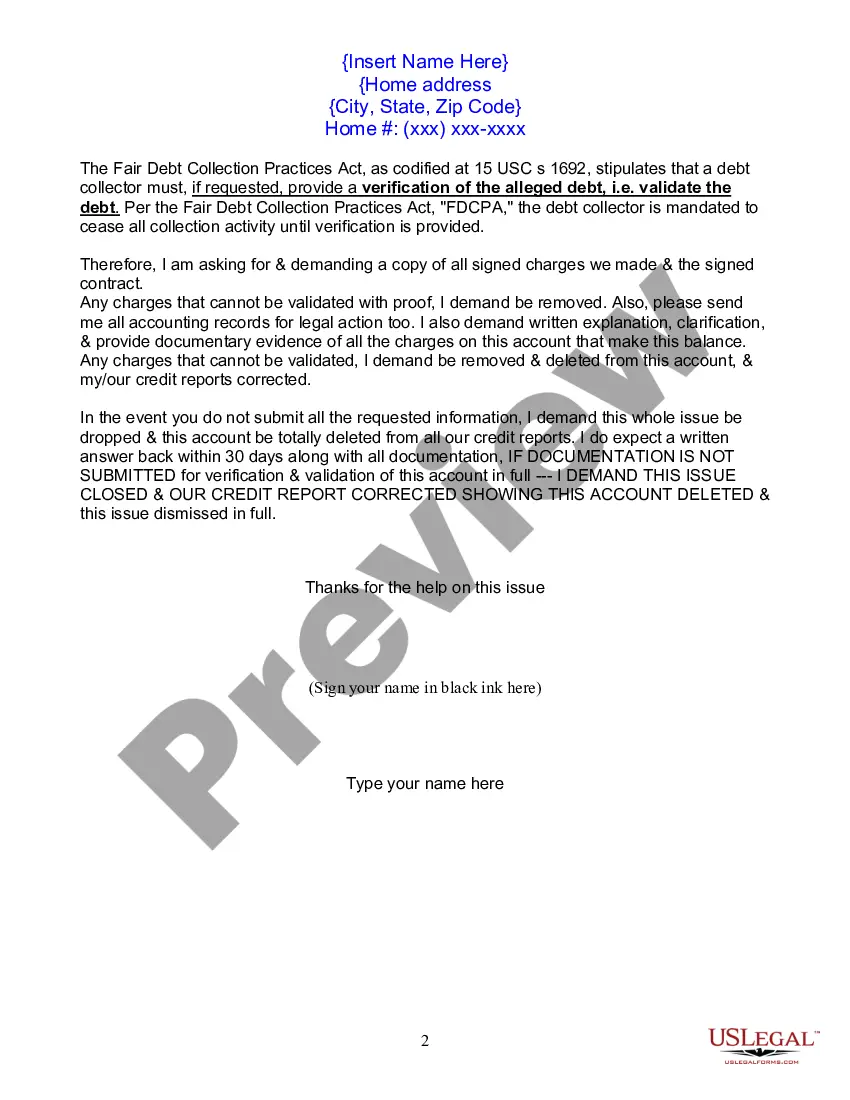

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Montana Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

Have you been in a position where you need to have papers for both company or individual purposes virtually every working day? There are a lot of lawful file web templates available on the Internet, but getting ones you can rely isn`t straightforward. US Legal Forms provides a large number of kind web templates, much like the Montana Letter of Dispute - Complete Balance, that are composed to fulfill state and federal demands.

If you are presently informed about US Legal Forms site and also have a merchant account, merely log in. After that, you are able to down load the Montana Letter of Dispute - Complete Balance design.

Unless you have an account and want to begin to use US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is for that proper town/area.

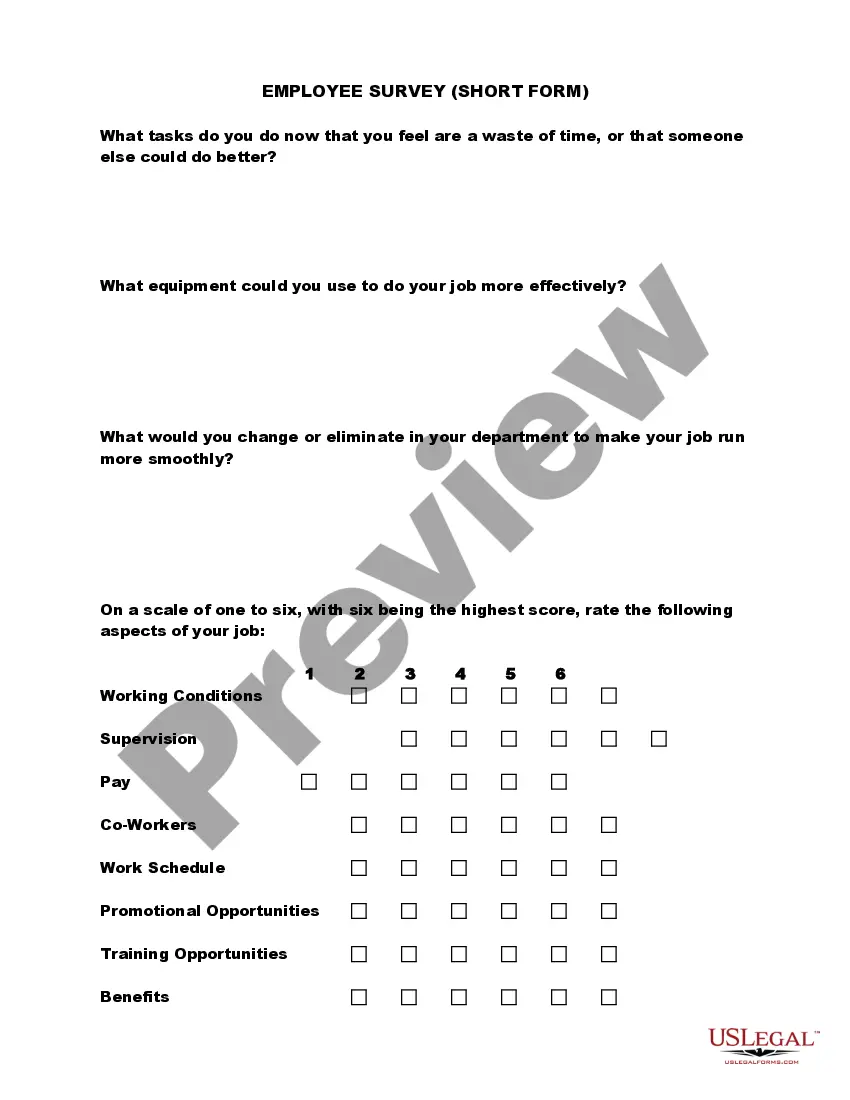

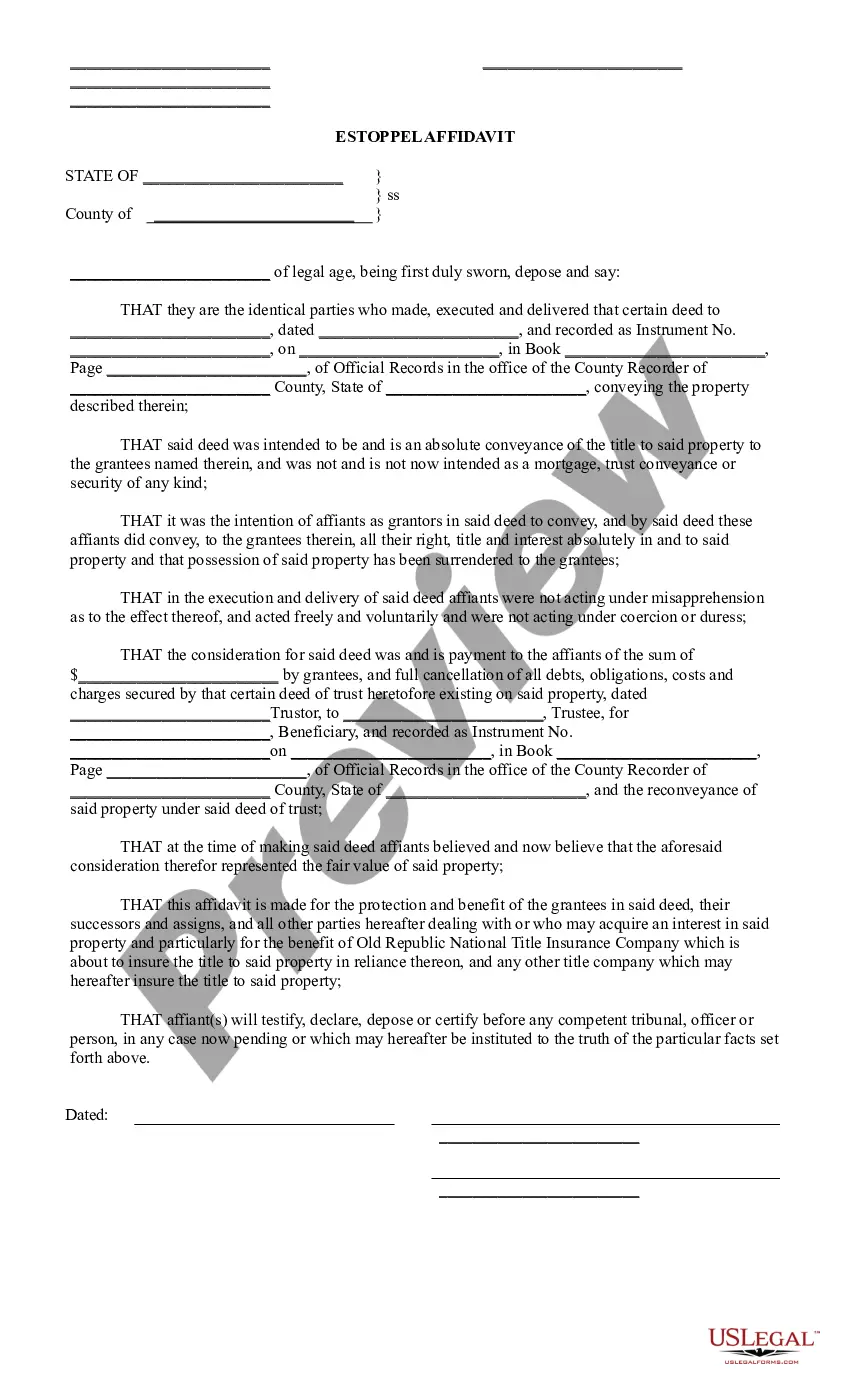

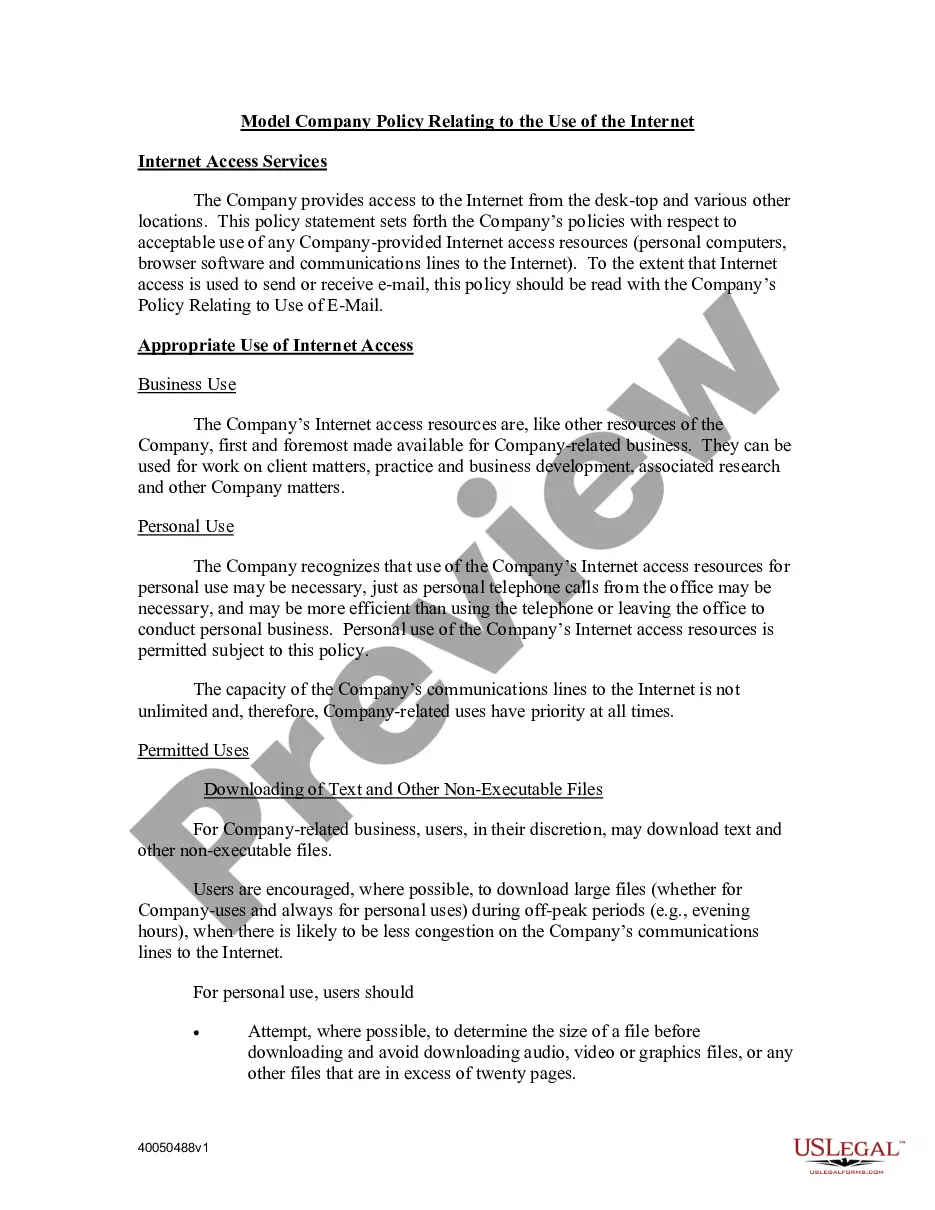

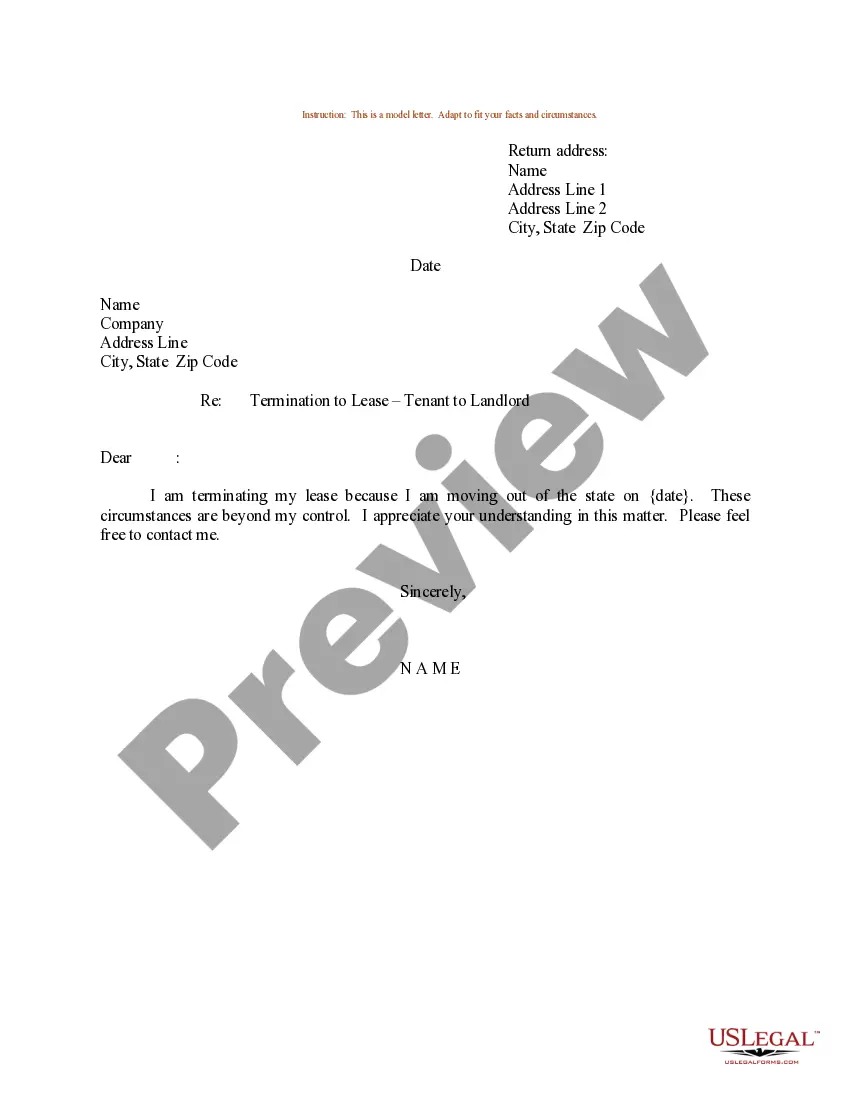

- Take advantage of the Review switch to check the form.

- Look at the description to actually have chosen the correct kind.

- In the event the kind isn`t what you are trying to find, use the Search area to discover the kind that fits your needs and demands.

- Whenever you discover the proper kind, click Purchase now.

- Select the costs plan you desire, fill in the specified details to generate your money, and buy the transaction making use of your PayPal or charge card.

- Choose a hassle-free paper structure and down load your version.

Get all of the file web templates you may have purchased in the My Forms menu. You can obtain a extra version of Montana Letter of Dispute - Complete Balance whenever, if required. Just click on the required kind to down load or print the file design.

Use US Legal Forms, probably the most comprehensive selection of lawful forms, in order to save time as well as avoid errors. The support provides professionally manufactured lawful file web templates that can be used for a range of purposes. Produce a merchant account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

To write a dispute letter to a debt collector, start by addressing the letter formally to the collector. Clearly outline your reasons for disputing the debt, including any inaccuracies and your request for validation. Utilizing a Montana Letter of Dispute - Complete Balance can simplify the process, ensuring you cover all necessary points while presenting your case in a professional manner.

When writing a dispute letter to a debt collector, begin with your contact information and the date, followed by the collector's information. Clearly state that you are disputing the debt, referencing the specific amount and account number. A Montana Letter of Dispute - Complete Balance can serve as a helpful template, guiding you through the necessary details to include and ensuring that your letter is both comprehensive and effective.

To write a successful dispute letter, start by clearly stating your intent to dispute the debt in question. Include essential details such as your account number, the amount you believe is incorrect, and any supporting evidence. Using a Montana Letter of Dispute - Complete Balance not only provides a structured format but also ensures you include all necessary components, making it easier for the debt collector to understand your position.

In Montana, the statute of limitations on most debts is eight years. This means that creditors have eight years to file a lawsuit to collect a debt, but after that, the debt becomes legally unenforceable. Understanding this timeframe can help you navigate your financial obligations more effectively. If you believe a debt is beyond this limit, a Montana Letter of Dispute - Complete Balance can help you formally contest the validity of that debt.

To dispute a debt successfully, gather all supporting documents and clearly outline your reasons for the dispute in your letter. Be sure to send your letter using certified mail to ensure it is received. By following the guidelines in the Montana Letter of Dispute - Complete Balance, you can present a compelling argument and increase your chances of a favorable resolution.

When writing a letter to dispute a debt, begin with your contact information and the date at the top. Next, address the letter to the creditor and specify the debt you are disputing, along with your reasons for disputing it. Utilizing the Montana Letter of Dispute - Complete Balance can help you format your letter correctly and include all relevant details, making your case stronger.

To write a debt dispute letter effectively, start by clearly stating your intention to dispute the debt. Include essential details such as your account number, the amount in question, and a brief explanation of why you believe the debt is inaccurate. Using the Montana Letter of Dispute - Complete Balance template can streamline this process, ensuring you include all necessary information and maintain a professional tone.