Montana Notice of Disputed Account

Description

How to fill out Notice Of Disputed Account?

Selecting the appropriate legal document template can be quite a challenge.

It goes without saying that there are numerous templates accessible online, but how can you obtain the legal document you need.

Utilize the US Legal Forms platform. The service offers thousands of templates, such as the Montana Notice of Disputed Account, which can be utilized for business and personal purposes.

If the form does not satisfy your requirements, use the Search field to locate the right form. Once you are confident that the form is correct, click the Buy now button to acquire the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Fill out, modify, print, and sign the obtained Montana Notice of Disputed Account. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to obtain professionally-crafted documents that adhere to state regulations.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the Montana Notice of Disputed Account.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

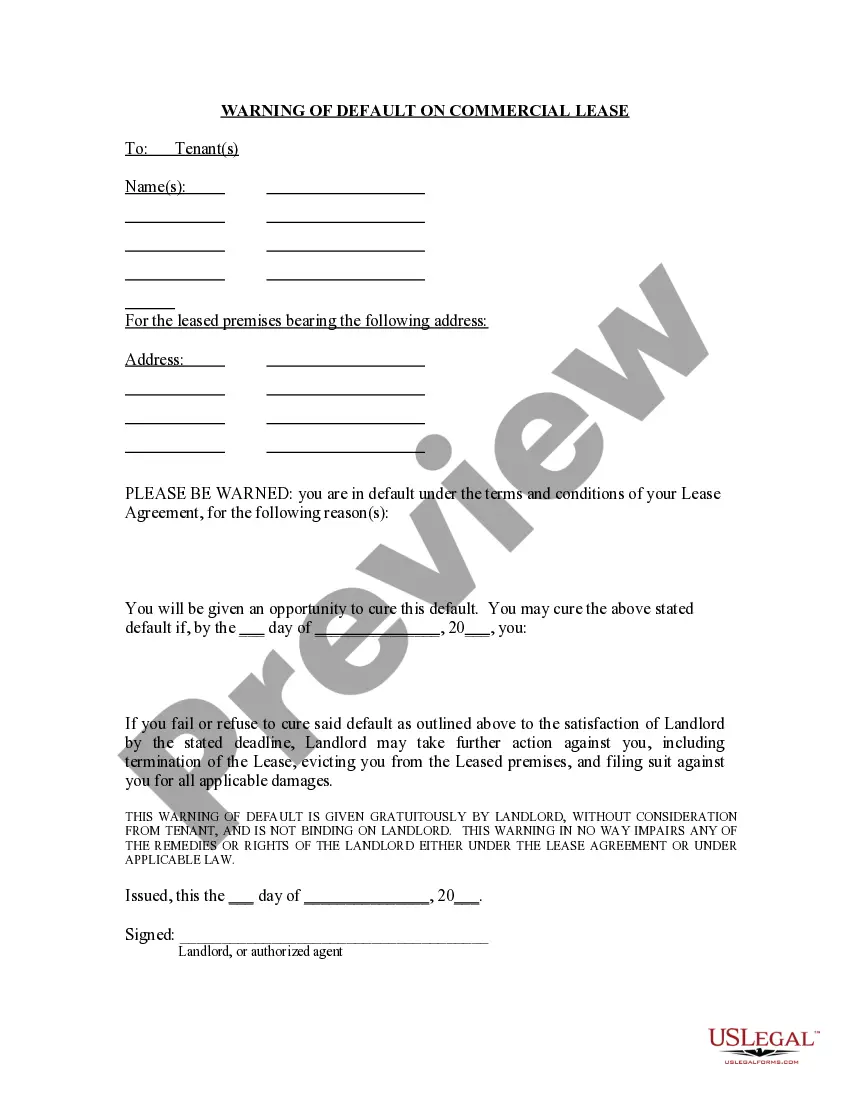

- First, ensure you have selected the appropriate form for your city/region. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

The best approach when disputing a collection is to clearly state the reason for your dispute, such as claiming the debt is inaccurate or not yours. Include a Montana Notice of Disputed Account with your statement to enhance your case's authority. This strategy not only provides clarity but also prompts a thorough review of the collection efforts. Timely communication can significantly improve the outcome of your dispute.

To get debt disputed, start by gathering all related documents and identifying any errors on your credit report. Submit a Montana Notice of Disputed Account to the credit bureaus, detailing the discrepancies you’ve found. This signed document serves as your official request for investigation and correction. The more clear and organized your submission is, the smoother the dispute process will be.

When disputing a collection, the best reason to include is evidence of prior payment or a lack of proper validation of the debt. Utilizing a Montana Notice of Disputed Account allows you to formally present your stance and request comprehensive details from the collector. This comprehensive approach enhances the chances of resolving the dispute in your favor. Always ensure your records are organized and ready to support your challenge.

An effective excuse to dispute a credit report is if the entry is outdated or reflects inaccurate payment history. By submitting a Montana Notice of Disputed Account, you communicate clearly with credit agencies, providing them the specific inaccuracies you've noticed. This documentation streamlines the investigation process, so your credit report can be corrected swiftly. Your financial reputation deserves to be accurate and transparent.

A compelling reason to dispute a collection account is if the debt is not yours or if the amount is incorrect. Filing a Montana Notice of Disputed Account helps you formally present your case to creditors and credit bureaus. This method not only supports your claim but also puts a hold on collection actions while your dispute is investigated. It's essential to stay proactive in safeguarding your credit health.

The best option is to use a Montana Notice of Disputed Account to formally challenge any inaccuracies on your credit report. This document clearly outlines your dispute and provides a record of your communication with credit bureaus. By using this notice, you ensure that your rights are protected, and the errors are addressed promptly. Always keep copies for your records to follow up if needed.

Writing a successful dispute letter requires a structured approach. Begin with a clear statement of your dispute, referencing your account information and the Montana Notice of Disputed Account. Be specific about your reasons for disputing the debt and include supporting documentation. Lastly, maintain a polite tone, and request a timely response to ensure the issue is resolved promptly.

To write a letter to settle a debt, start by referencing the debt and your account number. Clearly state your intention to settle the debt for a lesser amount and propose a specific sum. Use the Montana Notice of Disputed Account to frame your rationale and ensure to request a written confirmation of any agreement. This letter serves as a record of your attempt to resolve the debt amicably.

An example of a debt dispute letter includes a header with your name and address, followed by the creditor’s information. Start with a salutation, then express your dispute clearly, referencing the Montana Notice of Disputed Account. Include any relevant account numbers, a statement of the reasons for your dispute, and request confirmation from the creditor that the debt status will be investigated.

Writing a letter of debt dispute involves clear and concise communication. Begin by stating your account details, followed by a clear declaration of your dispute regarding the debt. Next, use the Montana Notice of Disputed Account format to outline your reasons for disputing the debt and attach any supporting documentation. Finally, make sure to include your contact information for follow-up.