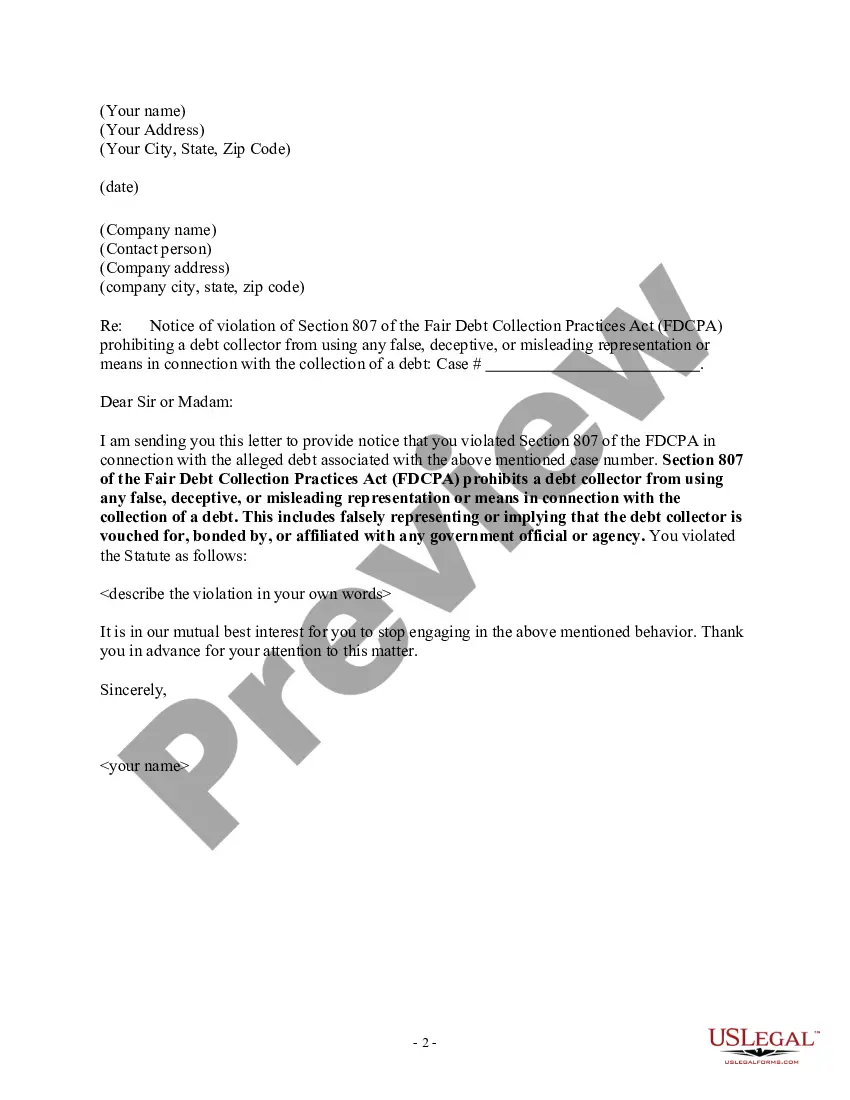

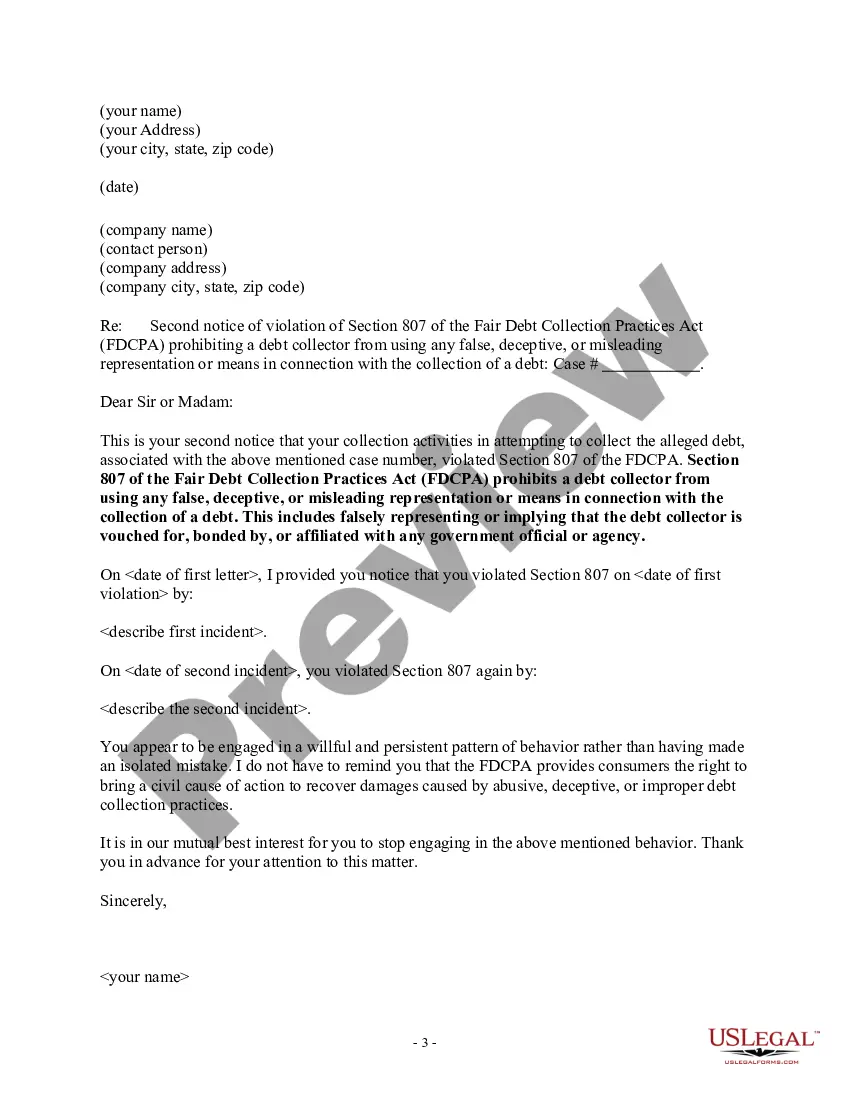

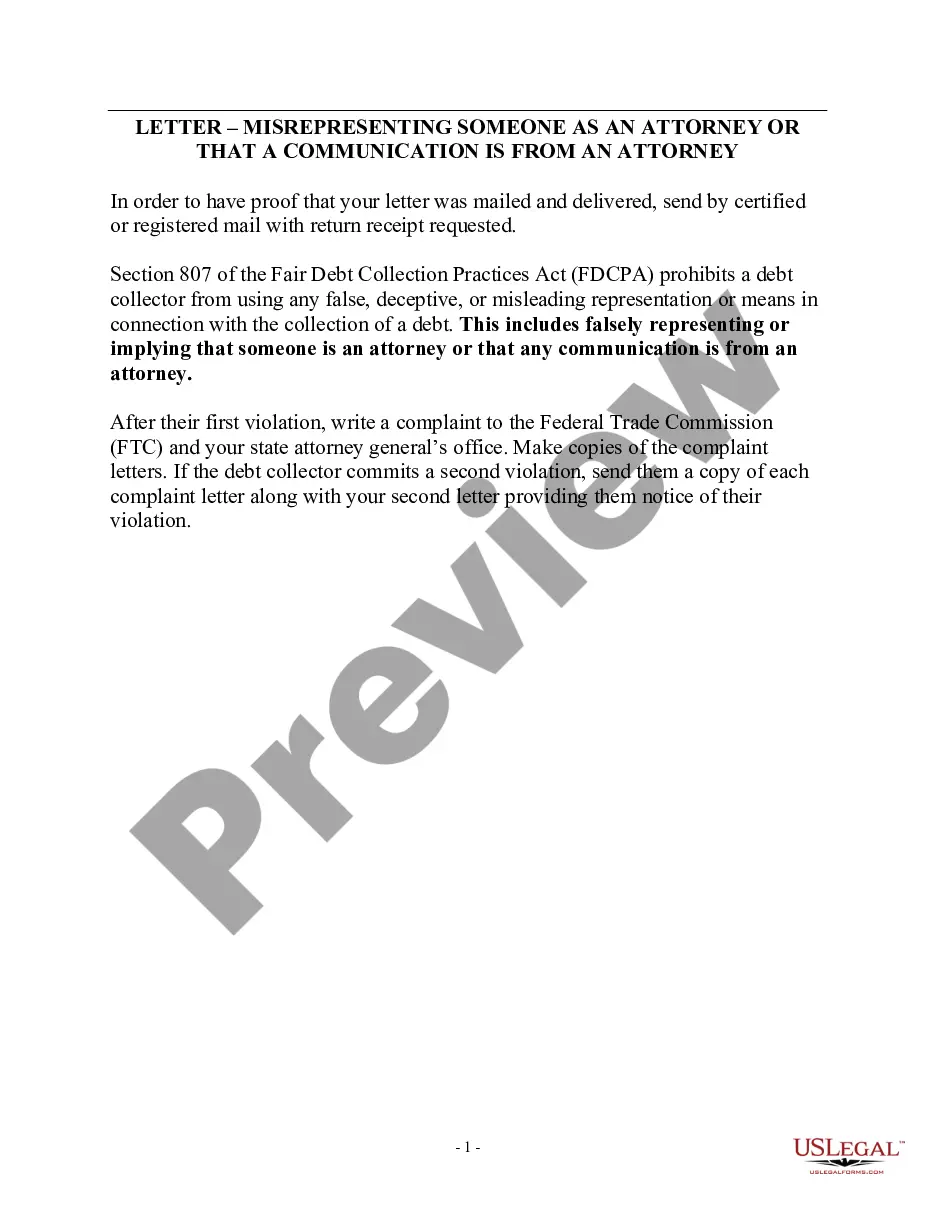

Montana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

Are you presently in a location where you require documents for either business or specific objectives nearly every working day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Montana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, which can be tailored to meet federal and state requirements.

Once you find the correct document, click Purchase now.

Select the pricing plan you want, fill in the required information to create your account, and purchase the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Montana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the right area/region.

- Use the Preview option to examine the form.

- Read through the description to confirm you have selected the correct document.

- If the document isn’t what you are looking for, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.