Montana Memorandum to Stop Direct Deposit

Description

How to fill out Memorandum To Stop Direct Deposit?

Are you facing a scenario where you need documents for potentially corporate or particular purposes on a daily basis.

There are numerous authentic document templates available online, but locating ones you can trust can be challenging.

US Legal Forms offers thousands of form templates, including the Montana Memorandum to Stop Direct Deposit, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Get now.

Choose the payment plan you want, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Montana Memorandum to Stop Direct Deposit at any time, if needed. Just click on the necessary form to download or print the document template. Use US Legal Forms, the most comprehensive collection of authentic forms, to save time and prevent errors. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you may download the Montana Memorandum to Stop Direct Deposit template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

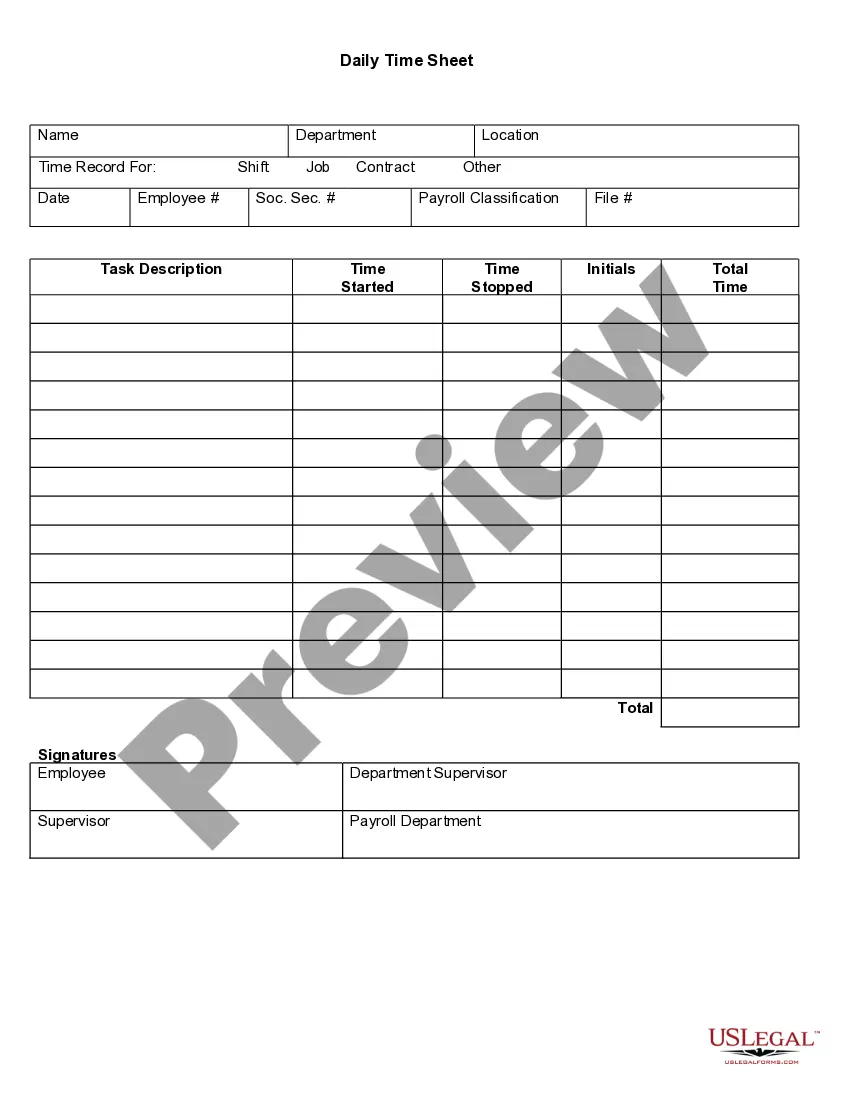

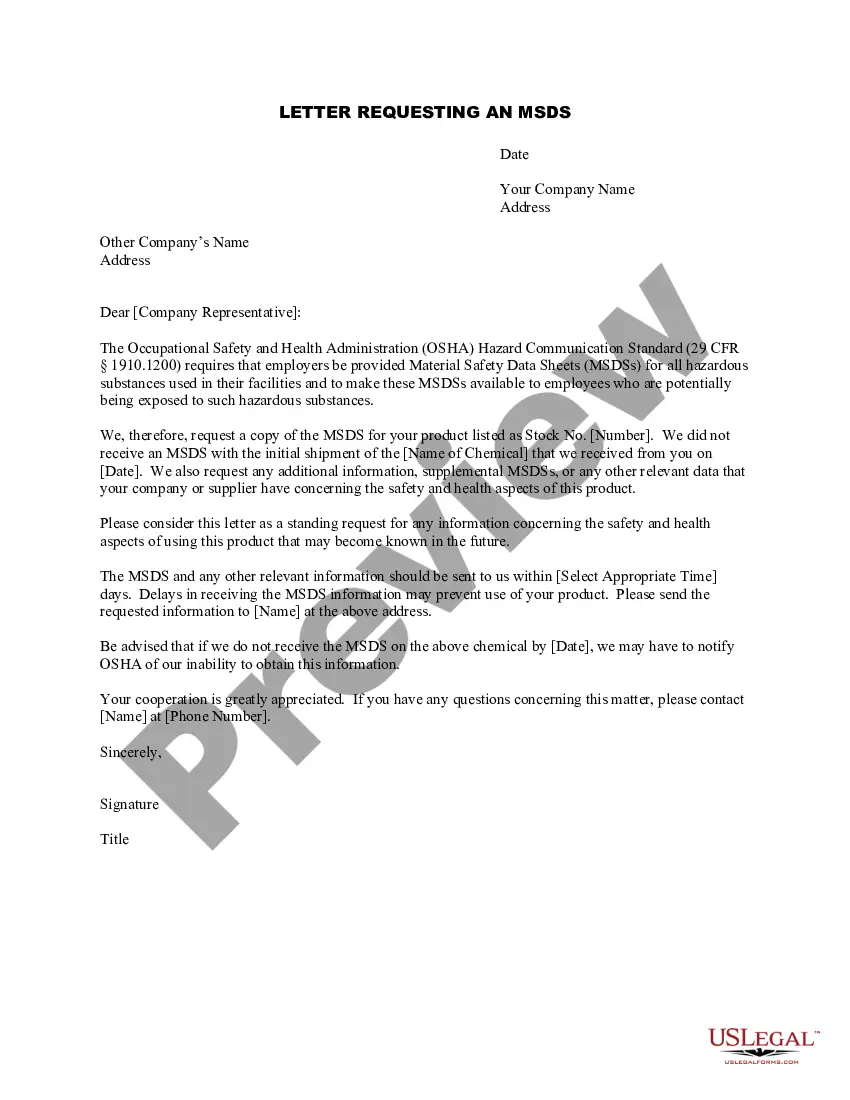

- Utilize the Review button to examine the form.

- Check the details to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

Direct deposits are most commonly made by businesses in the payment of salaries and wages and for the payment of suppliers' accounts, but the facility can be used for payments for any purpose, such as payment of bills, taxes, and other government charges.

Be prepared to provide your U.S. Bank deposit account type (checking or savings), account number and routing number, your Social Security Number, and other required information.

Sometimes when your direct deposit doesn't show up as planned, the reason is simply that it has just taken a few extra days to process. This might be due to holidays or because the request to transfer money accidentally went out after business hours. Give it at least 24 hours before you start worrying.

Usually, a bank places a hold on a check or deposit you make into your account. The bank will do this to ensure the funds clear before they are made available in your account. A hold is put in place to protect you as much as it protects the bank.

Employee Requests Direct Deposit be Stopped Depending on the situation, they may instruct the employee to reopen their account or contact the bank for assistance. If they determine the payment should be stopped, the payroll office can complete the stop pending form.

The scoring formulas take into account multiple data points for each financial product and service. If you receive Social Security or other federal benefits, it's legally required to get them through direct deposit or a Direct Express prepaid debit card.

The Direct Deposit Program allows for the automatic deposit of your net earnings in to a checking or savings account at the financial institution of your choice. Only one account at a single financial institution may be used for direct deposit enrollees.

The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.

To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. You can give the order in person, over the phone or in writing. To stop future payments, you might have to send your bank the stop payment order in writing.

With respect to payroll checks, the DoD has mandated participation in the Direct Deposit Program (DD/EFT) for all newly enlisted, reenlisted, appointed, or retired military personnel and all newly hired civilian personnel.