Montana Bond to Secure against Defects in Construction

Description

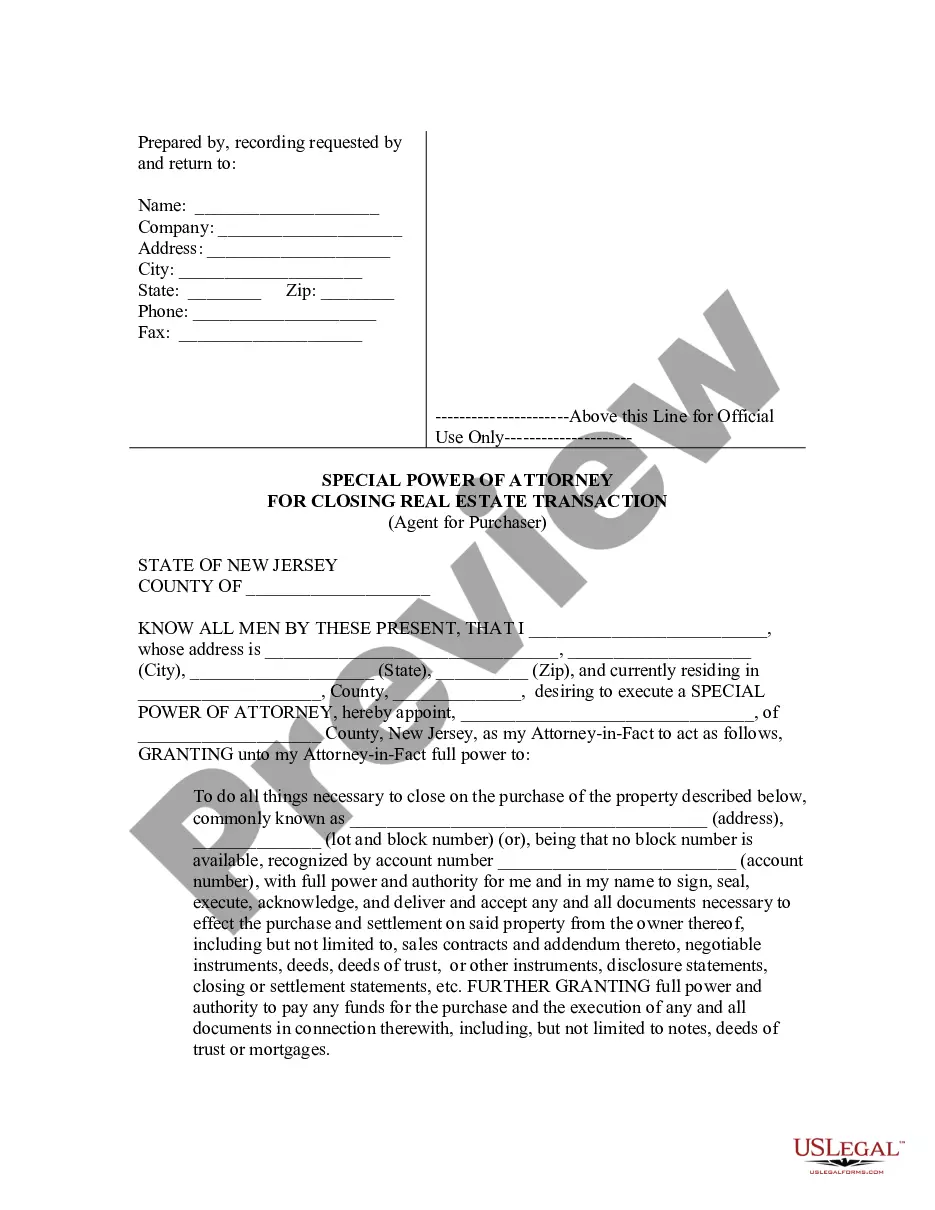

How to fill out Bond To Secure Against Defects In Construction?

US Legal Forms - one of many greatest libraries of legitimate forms in the United States - provides a wide array of legitimate papers themes you can acquire or print. While using website, you can find a large number of forms for enterprise and specific purposes, sorted by categories, suggests, or search phrases.You will find the most recent variations of forms like the Montana Bond to Secure against Defects in Construction within minutes.

If you already have a registration, log in and acquire Montana Bond to Secure against Defects in Construction from the US Legal Forms catalogue. The Obtain option will show up on each and every develop you perspective. You have access to all formerly saved forms from the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, listed below are straightforward instructions to help you started out:

- Ensure you have chosen the best develop for the city/area. Click the Review option to analyze the form`s information. See the develop description to ensure that you have chosen the proper develop.

- In the event the develop does not match your needs, take advantage of the Research field towards the top of the display screen to find the the one that does.

- If you are content with the shape, confirm your selection by clicking on the Get now option. Then, select the pricing prepare you want and supply your references to sign up to have an profile.

- Process the deal. Make use of Visa or Mastercard or PayPal profile to finish the deal.

- Find the file format and acquire the shape on your own product.

- Make modifications. Fill up, modify and print and indicator the saved Montana Bond to Secure against Defects in Construction.

Each and every template you included with your bank account does not have an expiry date and is also your own permanently. So, if you would like acquire or print one more version, just check out the My Forms section and click around the develop you will need.

Obtain access to the Montana Bond to Secure against Defects in Construction with US Legal Forms, by far the most substantial catalogue of legitimate papers themes. Use a large number of professional and express-certain themes that meet up with your company or specific needs and needs.

Form popularity

FAQ

A warranty bond is a financial guarantee made by a builder to protect the owner of a construction project from defects in materials or workmanship that might arise after the project is completed. A warranty bond is also sometimes called a maintenance bond.

When a contractor fails to abide by any of the conditions of the contract, the surety and contractor are both held liable. The three main types of construction bonds are bid, performance, and payment.

Bid bonds ensure that contractors can comply with bid contracts and will fulfill their job responsibilities at agreed prices. Most public construction contracts require contractors or subcontractors to secure their bids by providing bonds that serve as a means of legal and financial protection to the client.

Montana has a ten year statute of repose for construction defects. MCA § 27-2-208. However, if the injury occurred in the tenth year, the claim may be brought within one year of the injury occurring.

A performance bond guarantees that a contractor will perform the work ing to the conditions and requirements of the construction contract. These bonds protect the owner from financial loss as a result of a contractor default.

The 4 Main Types of Construction Bonds Explained 1) Bid Bond. ... Example. ... 2) Agreement to Bond (a.k.a. Surety's Consent or Consent of Surety) ... Example. ... 3) Performance Bond. ... Example. ... 4) Labour and Material Payment Bond. ... Example.

A performance bond is a financial guarantee to one party in a contract against the failure of the other party to meet its obligations. It is also referred to as a contract bond. A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

Performance Bond: Provides an owner with a guarantee that, in the event of a contractor's default, the surety will complete or cause to be completed the contract. Payment Bond: Ensures that certain subcontractors and suppliers will be paid for labor and materials incorporated into a construction contract.