Montana Sample Letter for Review of Form 1210

Description

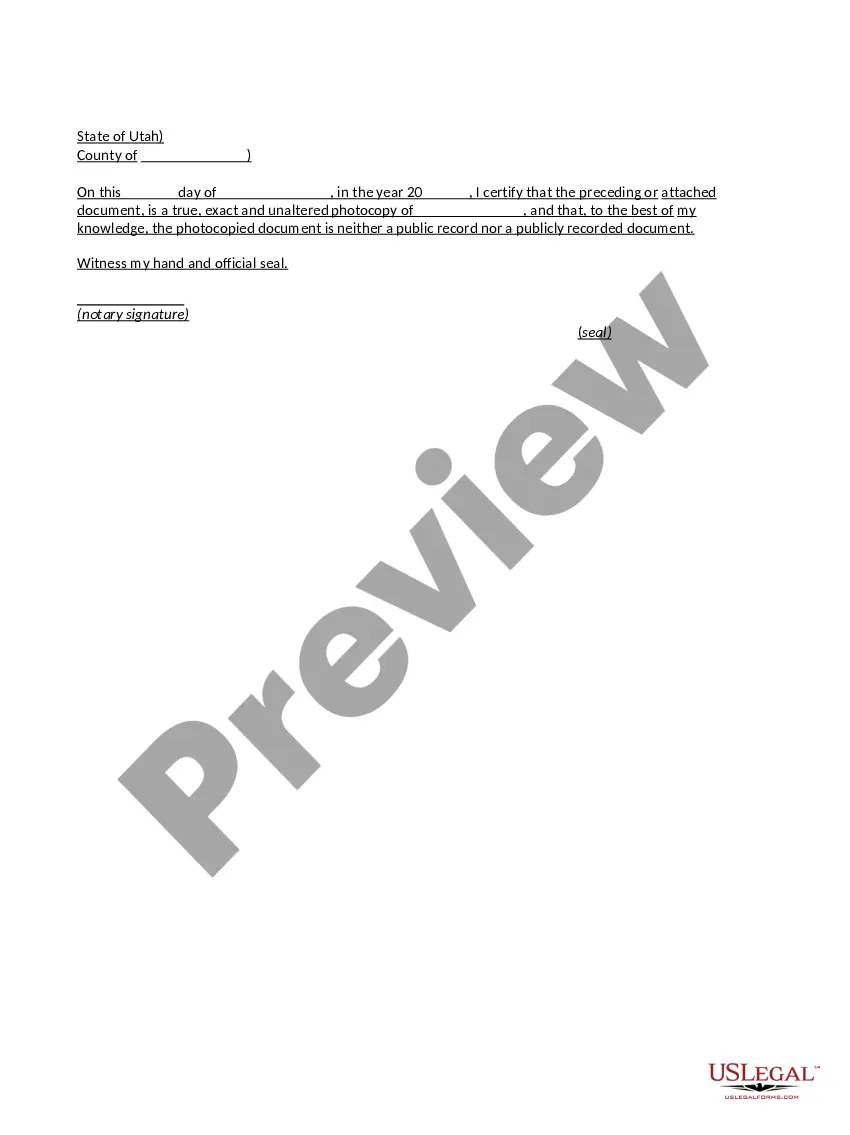

How to fill out Sample Letter For Review Of Form 1210?

US Legal Forms - one of the greatest libraries of authorized kinds in America - gives an array of authorized record templates you can acquire or produce. Utilizing the web site, you can get a large number of kinds for enterprise and individual reasons, sorted by classes, suggests, or key phrases.You can get the newest versions of kinds like the Montana Sample Letter for Review of Form 1210 in seconds.

If you already possess a registration, log in and acquire Montana Sample Letter for Review of Form 1210 in the US Legal Forms catalogue. The Acquire button can look on each and every kind you look at. You have access to all formerly delivered electronically kinds inside the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, listed here are straightforward recommendations to obtain started out:

- Ensure you have picked the right kind to your town/county. Click on the Preview button to analyze the form`s content material. Browse the kind information to actually have selected the right kind.

- When the kind doesn`t suit your needs, make use of the Research field towards the top of the screen to discover the the one that does.

- Should you be happy with the form, verify your decision by visiting the Get now button. Then, pick the costs prepare you prefer and offer your credentials to register on an bank account.

- Method the financial transaction. Make use of charge card or PayPal bank account to finish the financial transaction.

- Pick the format and acquire the form on your product.

- Make changes. Complete, revise and produce and indication the delivered electronically Montana Sample Letter for Review of Form 1210.

Every design you put into your account does not have an expiry date which is yours eternally. So, if you would like acquire or produce an additional copy, just go to the My Forms section and then click around the kind you require.

Gain access to the Montana Sample Letter for Review of Form 1210 with US Legal Forms, probably the most extensive catalogue of authorized record templates. Use a large number of specialist and condition-distinct templates that fulfill your small business or individual requirements and needs.

Form popularity

FAQ

For Montanans who turned 62 or older in 2021, the Elderly Homeowner/Renter Tax Credit can bring up to $1,000.

The property tax rebates, up to $675 per homeowner, were authorized by this year's Montana Legislature and Gov. Greg Gianforte, a Republican. Lawmakers, who also authorized a similar round of rebates for next year, allocated about $350 million from the state's budget surplus to pay for both years of the program.

Property Tax Assistance Program (PTAP) will reduce your tax obligation if you meet the following income guidelines: $24,607 or less for a single person or $32,810 or less for a married couple (2021 FAGI).

A property's taxable value is the market value multiplied by the tax (or assessment) rate. For residential property, the tax rate is 1.35% and for commercial property, the tax rate is 1.89%.

A property's taxable value is the market value multiplied by the tax (or assessment) rate. For residential property, the tax rate is 1.35% and for commercial property, the tax rate is 1.89%.

Taxpayers must have owned and lived in a home in Montana for at least seven months last year to qualify. They will receive a rebate for their 2022 property taxes on their primary residence, up to a maximum of $675.