Montana Sample Letter for Organization Audit Form

Description

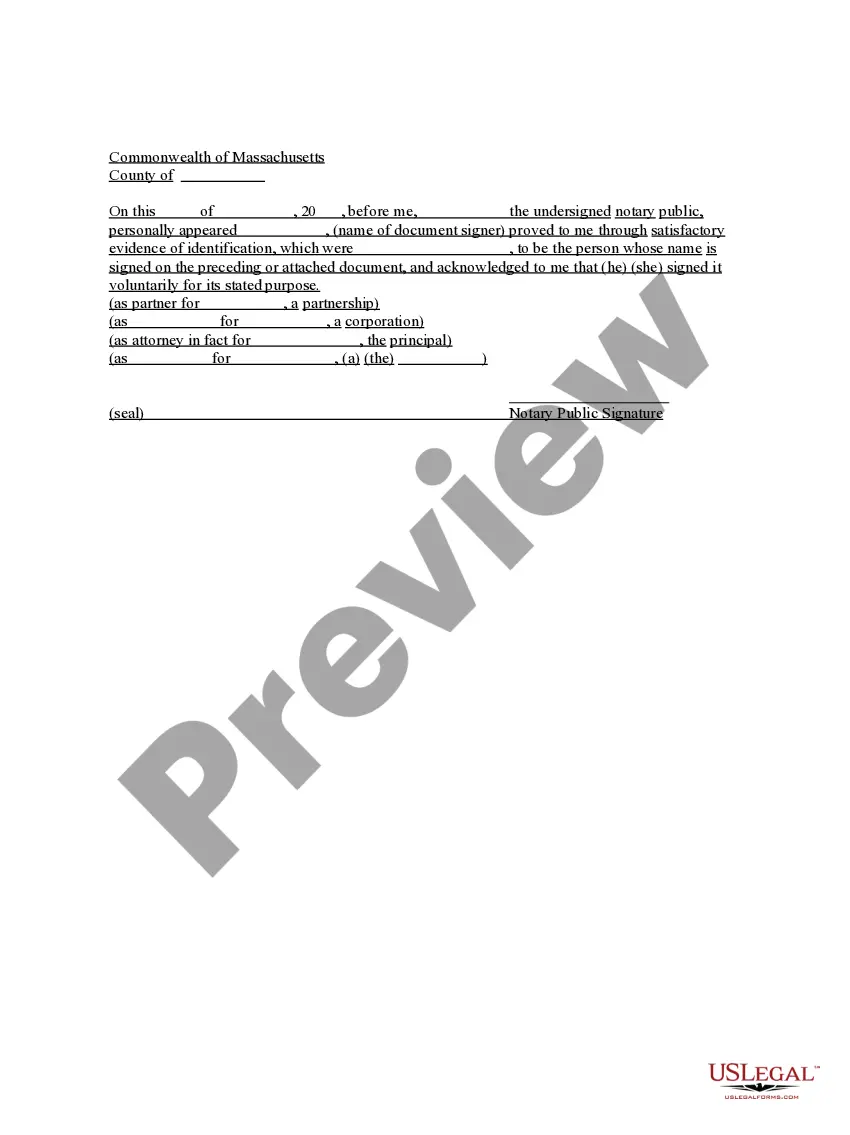

How to fill out Sample Letter For Organization Audit Form?

You are able to commit time on the Internet searching for the authorized file format that fits the federal and state demands you want. US Legal Forms gives a large number of authorized kinds which are examined by experts. It is simple to obtain or produce the Montana Sample Letter for Organization Audit Form from our assistance.

If you currently have a US Legal Forms profile, you may log in and then click the Down load switch. Afterward, you may complete, modify, produce, or sign the Montana Sample Letter for Organization Audit Form. Each authorized file format you purchase is yours permanently. To get yet another copy for any obtained kind, check out the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site the very first time, keep to the straightforward recommendations under:

- First, ensure that you have chosen the right file format to the region/city of your choosing. See the kind outline to make sure you have chosen the appropriate kind. If offered, utilize the Preview switch to search from the file format at the same time.

- In order to find yet another version of the kind, utilize the Lookup area to get the format that fits your needs and demands.

- Once you have located the format you desire, just click Buy now to proceed.

- Choose the prices program you desire, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your credit card or PayPal profile to purchase the authorized kind.

- Choose the file format of the file and obtain it in your device.

- Make alterations in your file if required. You are able to complete, modify and sign and produce Montana Sample Letter for Organization Audit Form.

Down load and produce a large number of file themes making use of the US Legal Forms Internet site, which offers the greatest collection of authorized kinds. Use specialist and condition-specific themes to take on your small business or personal requirements.

Form popularity

FAQ

A ?rep? letter is the audit teams' formal evidence that management understands their responsibilities and that management has performed all of their responsibilities.

If the IRS decides to audit, or ?examine? a taxpayer's return, that taxpayer will receive written notification from the IRS. The IRS sends written notification to the taxpayer's or business's last known address of record. Alternatively, IRS correspondence may be sent to the taxpayer's tax preparer.

August 06 2023 ? Jacob Dayan. IRS Help. 20. Certified IRS audit letters are notices sent by the IRS to inform taxpayers that their tax returns are being audited.

Does the IRS Send Letters Using Certified Mail? The IRS audit letter will arrive via certified mail and list your full name, taxpayer ID or social security number, the form number, and the Information they are reviewing.

An audit engagement letter should list the auditor's responsibilities, such as. performing the audit for the financial statements per auditing standards and expressing an opinion on the financial statements. performing procedures to obtain audit evidence about the amounts and disclosures in financial statements.

Management Letter means a letter prepared by the auditor which discusses findings and recommendations for improvements in internal control, that were identified during the audit and were not required to be included in the auditor's report on internal control, and other management issues.

The IRS audit letter will outline the reasons for the audit and the documents they need from you. It will usually list the documents they need from you, such as receipts and bank statements, and it will also list the timeframe they expect you to respond. This is where your organizational skills will come in handy.

An audit confirmation letter is an inquiry sent by the auditor to a third party to establish the contents of the accounting records of the entity that is being audited.