Montana Miller Trust Forms for Assisted Living

Description

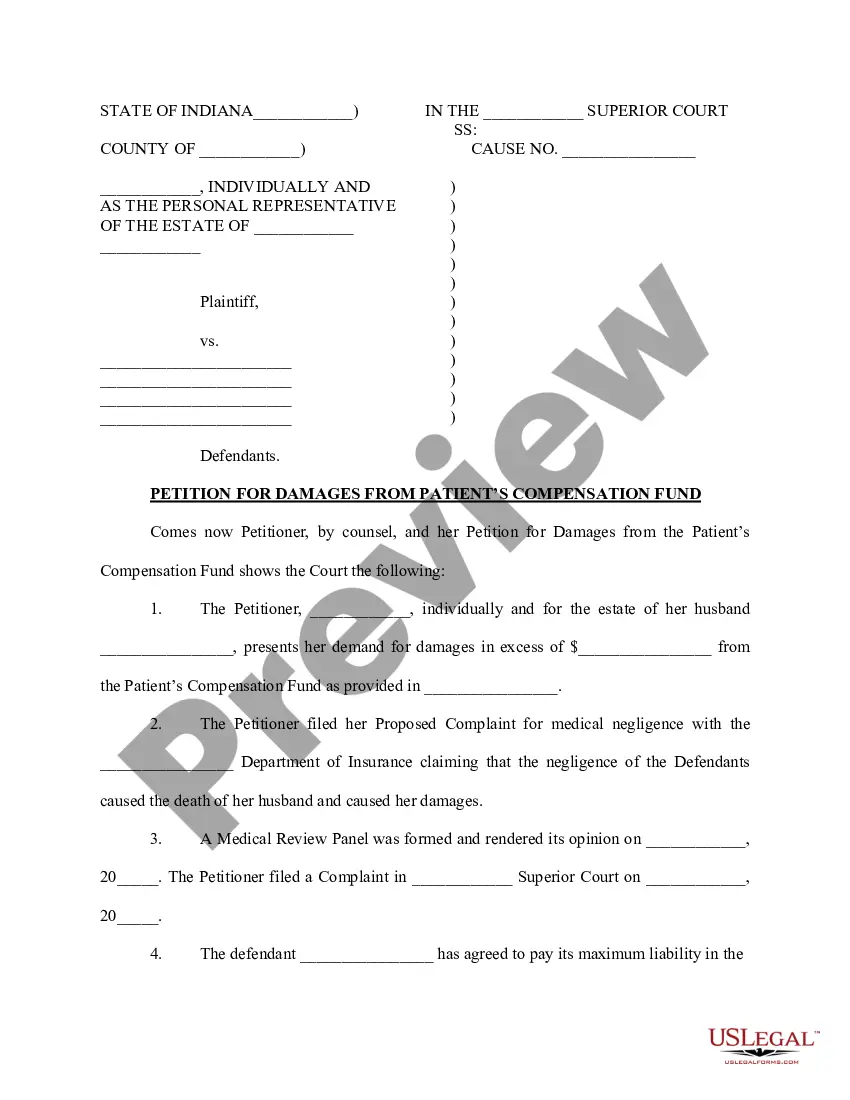

How to fill out Miller Trust Forms For Assisted Living?

You can invest hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers numerous legal forms that are reviewed by experts.

It is easy to obtain or print the Montana Miller Trust Forms for Assisted Living from our service.

If available, utilize the Review button to look at the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Montana Miller Trust Forms for Assisted Living.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area you choose.

- Read the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

An income trust is designed to allow individuals to retain their income while still qualifying for assistance programs. This type of trust can be particularly beneficial for those looking to cover costs in assisted living facilities. Montana Miller Trust Forms for Assisted Living simplify the setup process, making it easier for you to maintain your financial stability.

One of the disadvantages of a Medicaid trust is that it can be complex and may require legal assistance to set up properly. Additionally, if not managed correctly, you might face delays in receiving benefits. However, the benefits of utilizing Montana Miller Trust Forms for Assisted Living often outweigh these challenges, especially for those needing long-term care.

The purpose of a Medicaid trust is to manage and protect your assets while qualifying for Medicaid benefits. By setting up a Montana Miller Trust, individuals can help secure funding for assisted living without losing their resources. This trust allows you to receive the care you need while ensuring that your belongings are safeguarded for your loved ones.

A QIT, or Qualified Income Trust, is a financial tool that helps individuals qualify for Medicaid while maintaining a certain income level. It allows individuals to place their income in this trust, thereby reducing the countable income for Medicaid purposes. If you're interested in how the Montana Miller Trust Forms for Assisted Living can integrate with a QIT, consider exploring more about your options.

If you have a properly structured trust, nursing homes cannot directly access those assets to cover your care costs. However, it's crucial to establish the trust correctly and comply with Medicaid rules. The Montana Miller Trust Forms for Assisted Living are designed to assist you in this complex area of asset protection.

Using a trust, like the Montana Miller Trust Forms for Assisted Living, can help protect specific assets from being counted for Medicaid eligibility. However, this often depends on the type of trust and its provisions. Consulting with a legal expert will give you insights into how a trust can effectively safeguard your assets while planning for assisted living.

Certain assets, such as retirement accounts, life insurance policies with named beneficiaries, and assets jointly owned with rights of survivorship, typically cannot be placed in a trust. These assets pass directly to the beneficiaries and do not go through the trust. It is important to understand how your estate is structured to ensure the Montana Miller Trust Forms for Assisted Living serve your goals.

Montana Medicaid does provide coverage for some assisted living services, but it varies based on individual circumstances. Typically, eligibility requires meeting specific income and asset criteria. Using Montana Miller Trust Forms for Assisted Living can help you navigate these requirements, ensuring you meet Medicaid standards while protecting your financial resources. Always check current policies for the most accurate information.

Not everyone meets the requirements for assisted living, which often includes health assessments and income limitations. Individuals who are deemed too independent or do not require sufficient assistance may not qualify. Furthermore, if you exceed certain financial thresholds, these limits may disqualify you. Using Montana Miller Trust Forms for Assisted Living can help manage your assets effectively to improve your eligibility.

While it is not legally required to hire a lawyer to establish a Miller trust, having professional assistance can simplify the process. Understanding Montana Miller Trust Forms for Assisted Living ensures that you comply with state regulations and address your unique needs. This can also prevent complications down the road. Websites like USLegalForms provide user-friendly templates to guide you through the process.