This form is an official Montana form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

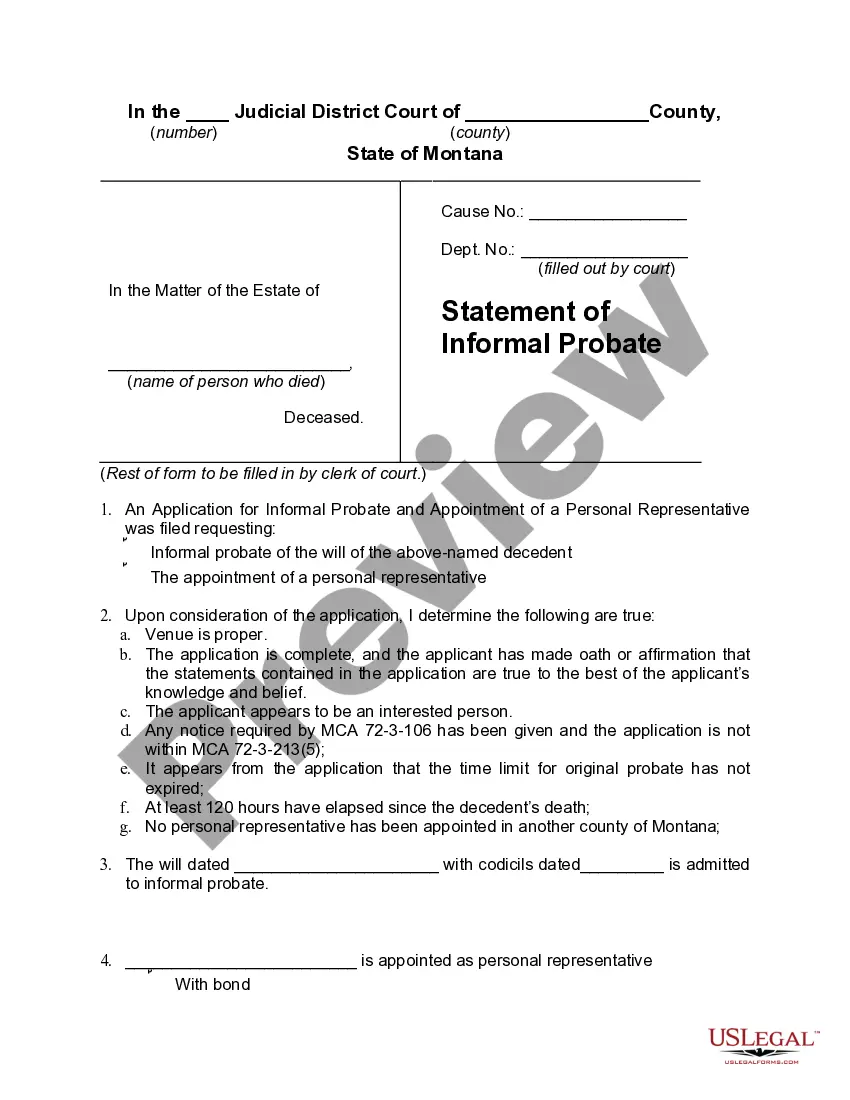

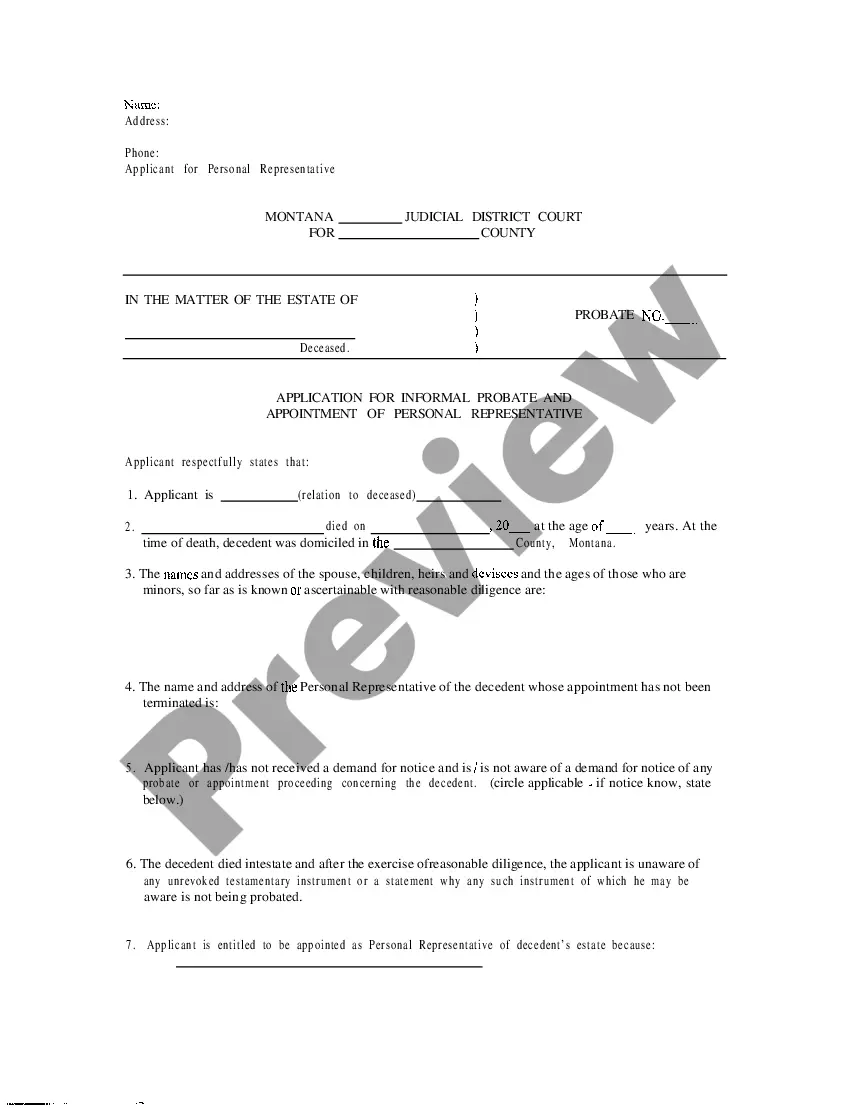

Montana Order of Informal Probate of Will and Appointment of Personal Representative

Description

How to fill out Montana Order Of Informal Probate Of Will And Appointment Of Personal Representative?

Steer clear of costly attorneys and locate the Montana Order of Informal Probate of Will and Appointment of Personal Representative you desire at an affordable rate on the US Legal Forms website.

Utilize our straightforward categories feature to search for and obtain legal and tax documents. Review their summaries and preview them before downloading.

After downloading, you can complete the Montana Order of Informal Probate of Will and Appointment of Personal Representative by hand or using editing software. Print it out and reuse the document multiple times. Accomplish more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed guidance on how to download and complete each form.

- Clients of US Legal Forms only need to Log In and access the particular form they require in their My documents section.

- Those who haven’t yet acquired a subscription should adhere to the instructions outlined below.

- Ensure the Montana Order of Informal Probate of Will and Appointment of Personal Representative is valid for use in your jurisdiction.

- If possible, review the summary and utilize the Preview feature before downloading the template.

- If you believe the document meets your needs, click Buy Now.

- If the document is incorrect, utilize the search tool to find the appropriate one.

- Then, create your account and select a subscription package.

- Make payment via credit card or PayPal.

- Choose to receive the document in PDF or DOCX format.

- Click Download and locate your document in the My documents section. You can save the document to your device or print it.

Form popularity

FAQ

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

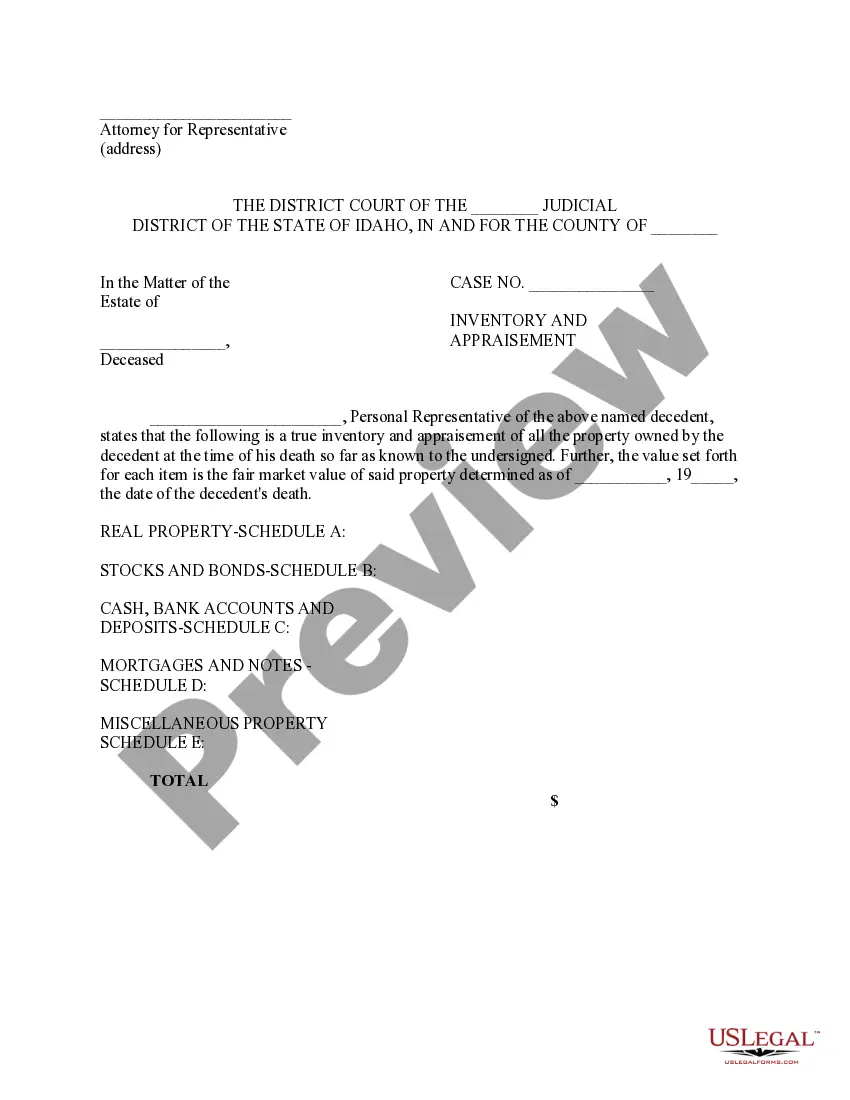

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

An administrator is the person appointed by the court to administer the deceased person's estate where the deceased did not have a Will, no executor is appointed, or the appointed executors do not or cannot act. Executors and administrators are both commonly referred to as a legal personal representative (LPR).

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

To be appointed executor or personal representative, file a petition at the probate court in the county where your loved one was living before they died. In the absence of a will, heirs must petition the court to be appointed administrator of the estate.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.