Montana Acknowledgment of Satisfaction of Lien - Corporation

About this form

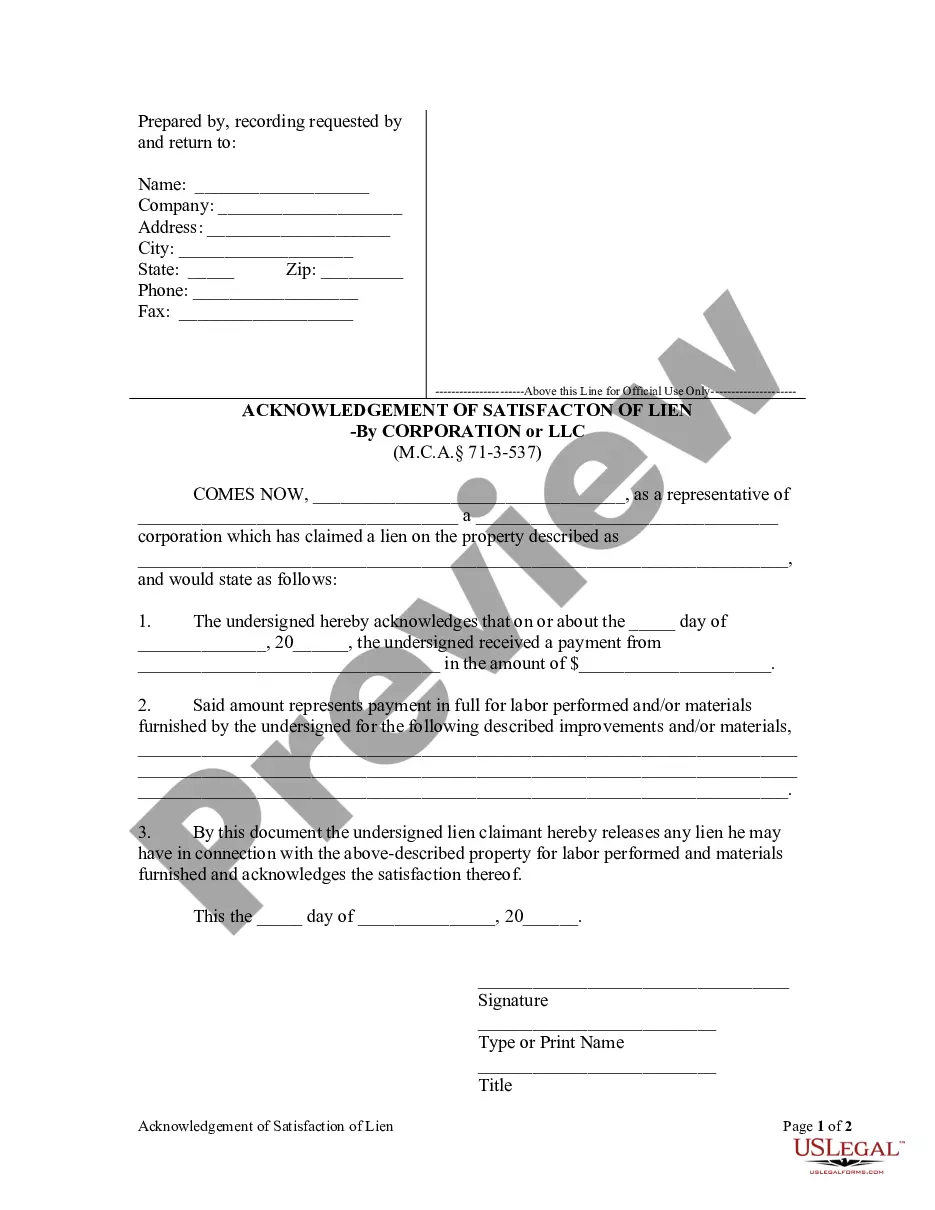

The Acknowledgment of Satisfaction of Lien - Corporation is a legal document used to confirm that a lien has been fully paid and satisfied. According to Montana statutes, the lien holder must acknowledge this satisfaction to avoid liability for any damages caused by failing to do so. This form distinctly serves as official recognition of payment, differentiating it from other lien-related documents by focusing on the release of the lien itself.

Main sections of this form

- Name of the lien claimant and their corporation

- Description of the property subject to the lien

- Date and amount of payment received

- Statement of release of the lien

- Signature and title of the lien claimant

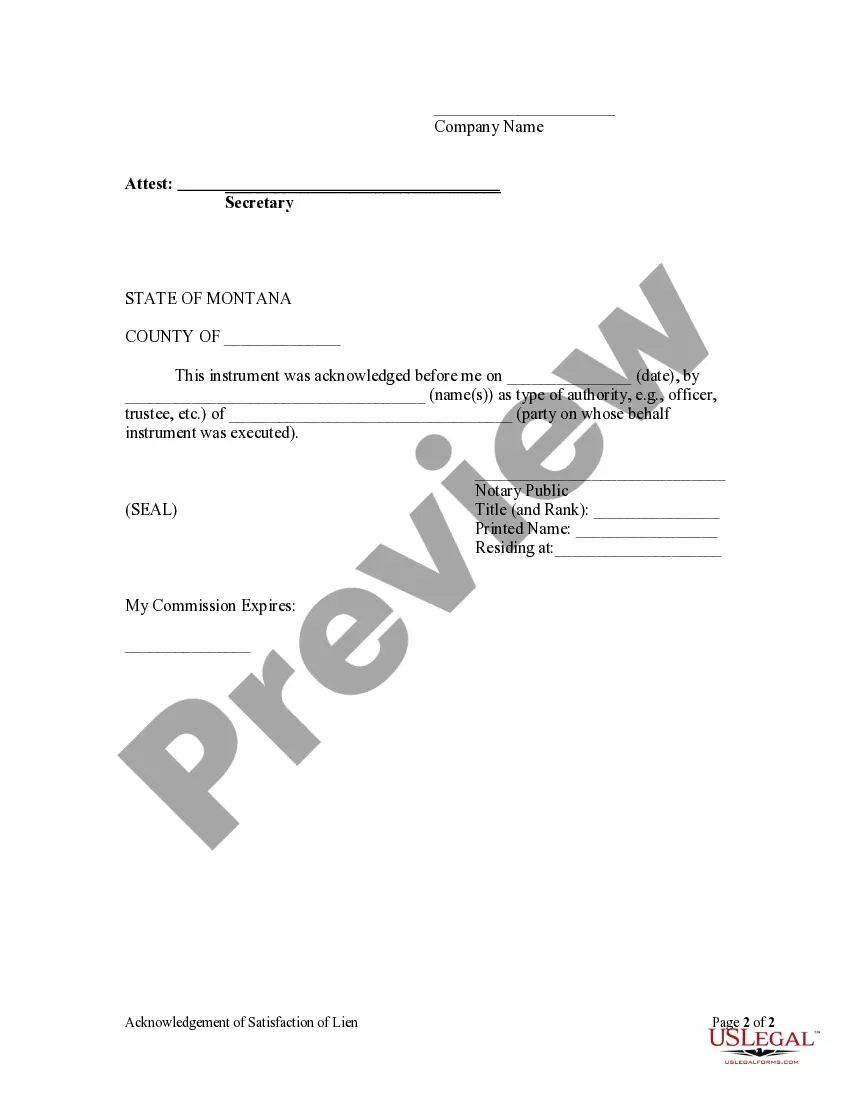

- Notary acknowledgment section

Common use cases

This form is needed when a corporation that has claimed a lien on a property has received full payment for services or materials provided. It is essential to formally acknowledge the satisfaction of the lien to prevent any future disputes or claims regarding the lien. Use this form when the lien holder is ready to release their claim after payment is made.

Who this form is for

- Corporations that have placed a lien on a property

- Representatives or officers of the corporation acting on behalf of the lien claimant

- Individuals or entities that have received payment in full for labor or materials rendered

How to complete this form

- Identify the parties involved by filling in the names of the lien claimant and their corporation.

- Describe the property that is subject to the lien.

- Input the date and the exact amount received for payment.

- Detail the services performed or materials provided in relation to the lien.

- Sign the document, including the title and corporation name, and have it notarized.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to include the correct property description.

- Leaving out the date or incorrect payment amounts.

- Not having the document notarized, if required.

- Neglecting to sign or provide the appropriate title and corporate name.

Why complete this form online

- Convenience of downloading and filling out the form at any time.

- Templates prepared by licensed attorneys ensure legal compliance.

- Editability allows customization to fit specific circumstances.

- Access to legal forms without the need for in-person visits or consultations.

Form popularity

FAQ

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

Local city and county offices provide all business licensing in Montana. The State of Montana provides professional licenses. Visit the Montana Department of Revenue for more information. Contact the Secretary of State's office for any business registration information.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

To form a Montana corporation, you must file articles of incorporation with the Secretary of State and pay a filing fee, at which point a corporation's existence officially begins. At a minimum, the articles must include the following information: Name of the corporation. Names and addresses of incorporators.

How much does it cost to set up an LLC in Montana? Filing the Montana Articles of Organization costs $70 and will take 7-10 business days to processunless you pay an additional $20 (24 hours) or $100 (1 hour) for expedited processing.

STEP 1: Name your Montana LLC. STEP 2: Choose a Registered Agent in Montana. STEP 3: File the Montana LLC Articles of Organization. STEP 4: Create a Montana LLC Operating Agreement. STEP 5: Get an EIN.

The different types of corporations and business structures. When it comes to types of corporations, there are typically four that are brought up: S corps, C corps, non-profit corporations, and LLCs.

If your LLC was formed in the state of Montana and you wish to dissolve (or terminate) your business, you must file the Articles of Termination for a Limited Liability Company with the Secretary of State's office. You can find this form on the Secretary of State's website.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.