Revocation of Transfer on Death Deed - Beneficiary Deed - Mississippi

Description

Key Concepts & Definitions

Revocation of Transfer on Death Deed Beneficiary: This legal process involves the cancellation or nullification of a designated beneficiary's right to inherit property under a Transfer on Death (TOD) deed. The TOD deed allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing probate.

Step-by-Step Guide to Revoking a TOD Beneficiary

- Review Your Existing TOD Deed: Identify all details about your current TOD arrangement, including the designated beneficiary and property details.

- Consult with a Legal Professional: Discuss your intent to revoke the beneficiary with an attorney specializing in estate planning or real estate law.

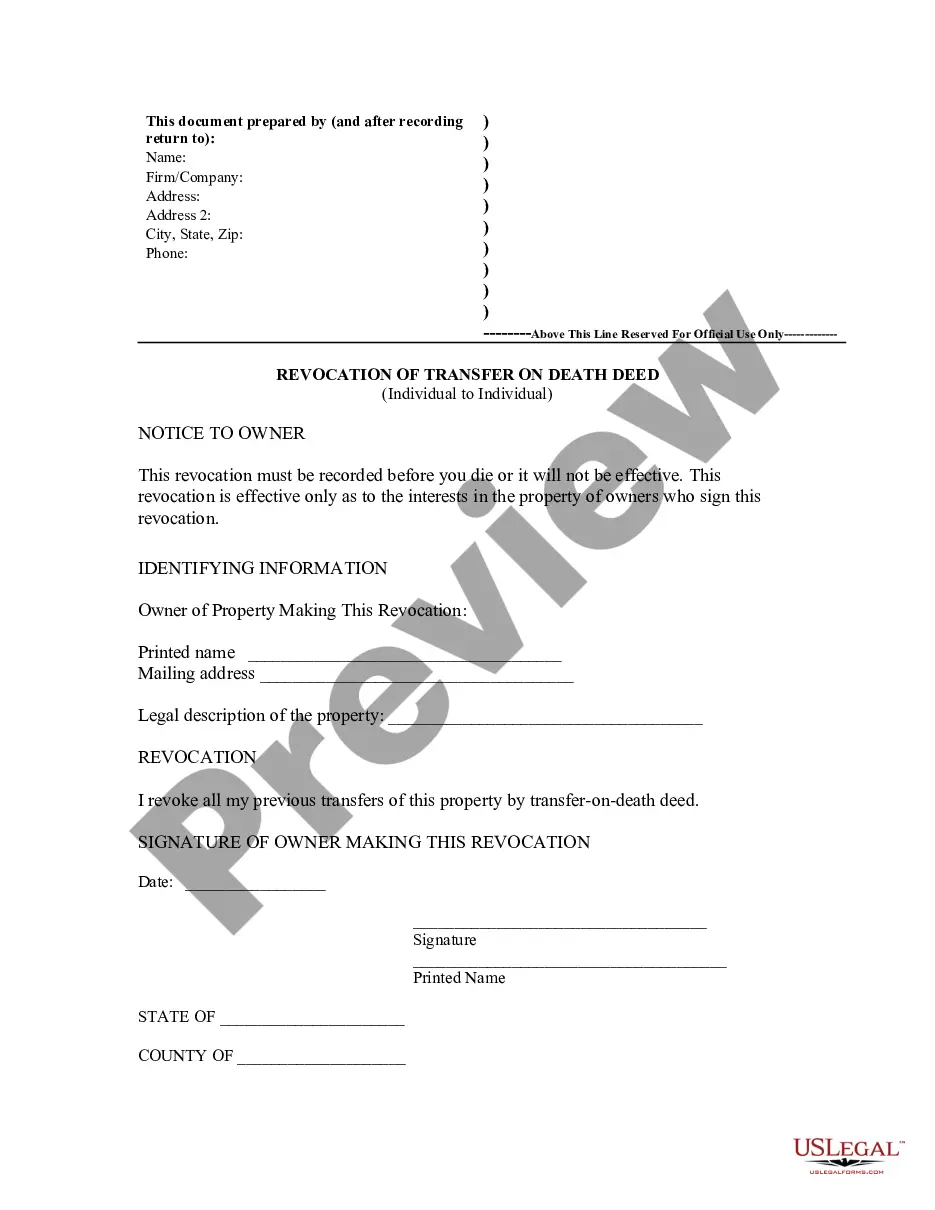

- Execute a Revocation Document: Draft and sign a revocation form that legally cancels the earlier TOD deed in the presence of a notary.

- Record the Revocation: File the signed revocation with the same office where the original TOD deed was recorded to officially nullify the designation.

- Notify the Affected Parties: It's good practice to inform the previously designated beneficiary about the revocation to avoid confusion or legal disputes later.

Risk Analysis

- Legal Risk: Improper revocation can lead to legal challenges or disputes, particularly if the revocation is not properly documented or recorded.

- Financial Risk: Potential for financial implications if disputes lead to legal proceedings, including attorney fees and court costs.

- Relationship Risk: Revoking a beneficiary might affect personal relationships, especially if not communicated effectively or perceived as unfair.

Key Takeaways

- Ensure correct and legal proceedings by consulting with a legal expert before revocation.

- Proper documentation and recording of the revocation are crucial to prevent future disputes.

- Transparent communication with affected parties can help maintain relationships after changes in the designation.

Best Practices

- Maintaining Copies: Always keep copies of the original and revoked TOD deed.

- Leverage Legal Help: Consult legal services to ensure adherence to state laws and regulations.

- Regular Reviews: Periodically review your estate plan and TOD deeds to ensure they reflect your current wishes.

Common Mistakes & How to Avoid Them

- Not Using a Notary: Failing to notarize the revocation can invalidate the document. Always use a notary.

- Lack of Clarity: Ambiguities in the revocation document can cause legal issues. Ensure the language is clear and concise.

- Failure to Record Revocation: Not recording the revocation leads to it not being officially recognized. Always properly file and record documents.

How to fill out Revocation Of Transfer On Death Deed - Beneficiary Deed - Mississippi?

Obtain a printable Revocation of Transfer on Death Deed - Beneficiary Deed - Mississippi in just several clicks in the most complete catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of reasonably priced legal and tax templates for US citizens and residents on-line starting from 1997.

Users who already have a subscription, need to log in straight into their US Legal Forms account, down load the Revocation of Transfer on Death Deed - Beneficiary Deed - Mississippi and find it saved in the My Forms tab. Customers who do not have a subscription are required to follow the tips listed below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If available, review the shape to view more content.

- When you are sure the form is right for you, click on Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Revocation of Transfer on Death Deed - Beneficiary Deed - Mississippi, it is possible to fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

A beneficiary deed is generally used for avoidance of probate, although it may be used to remove a particular property from a probate estate.

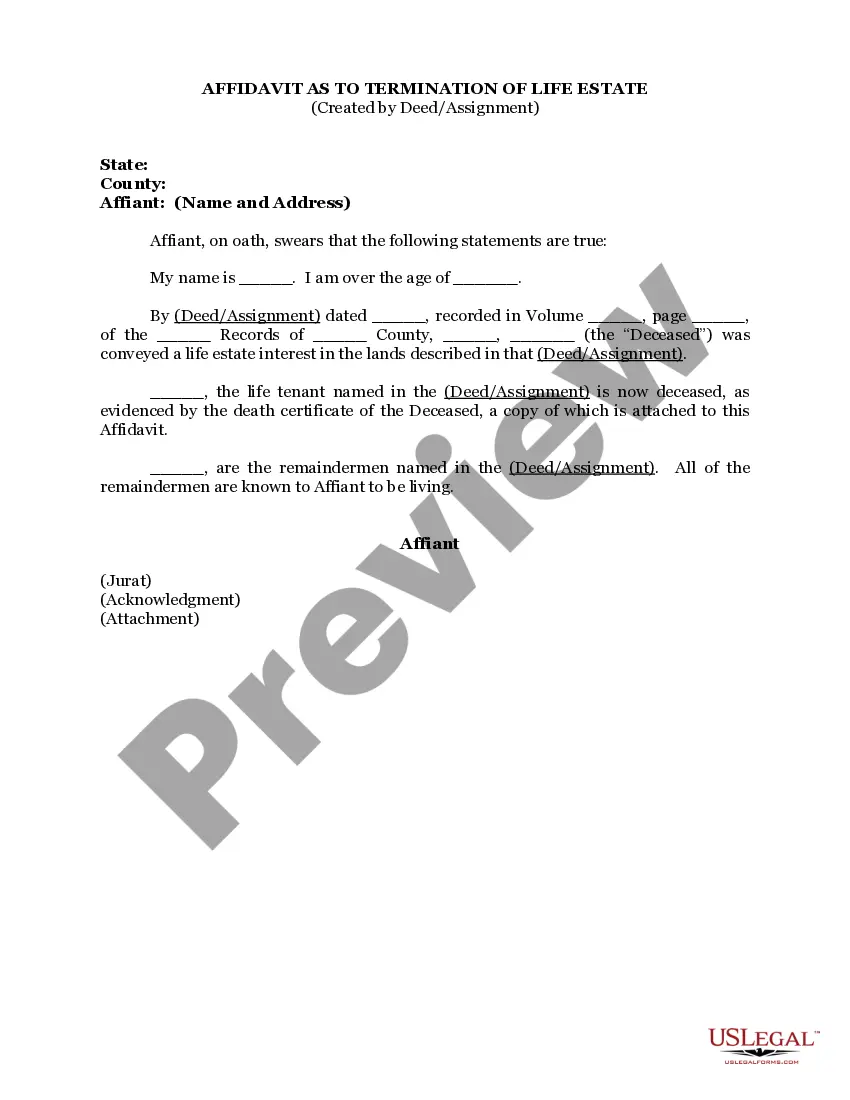

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.