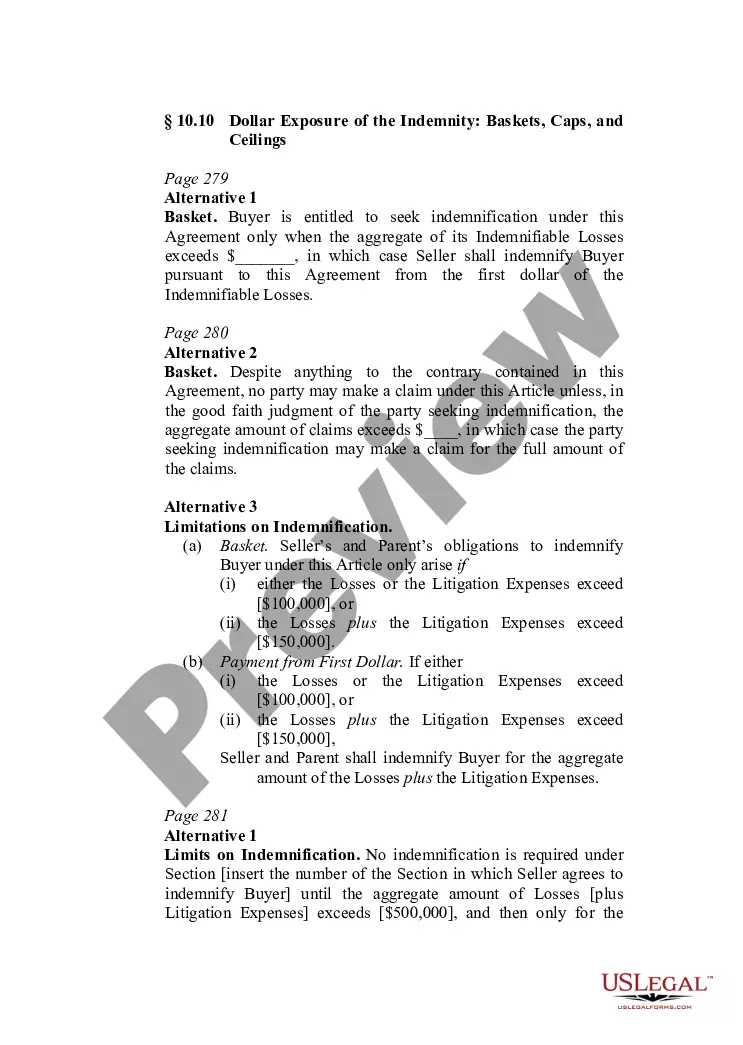

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Mississippi Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

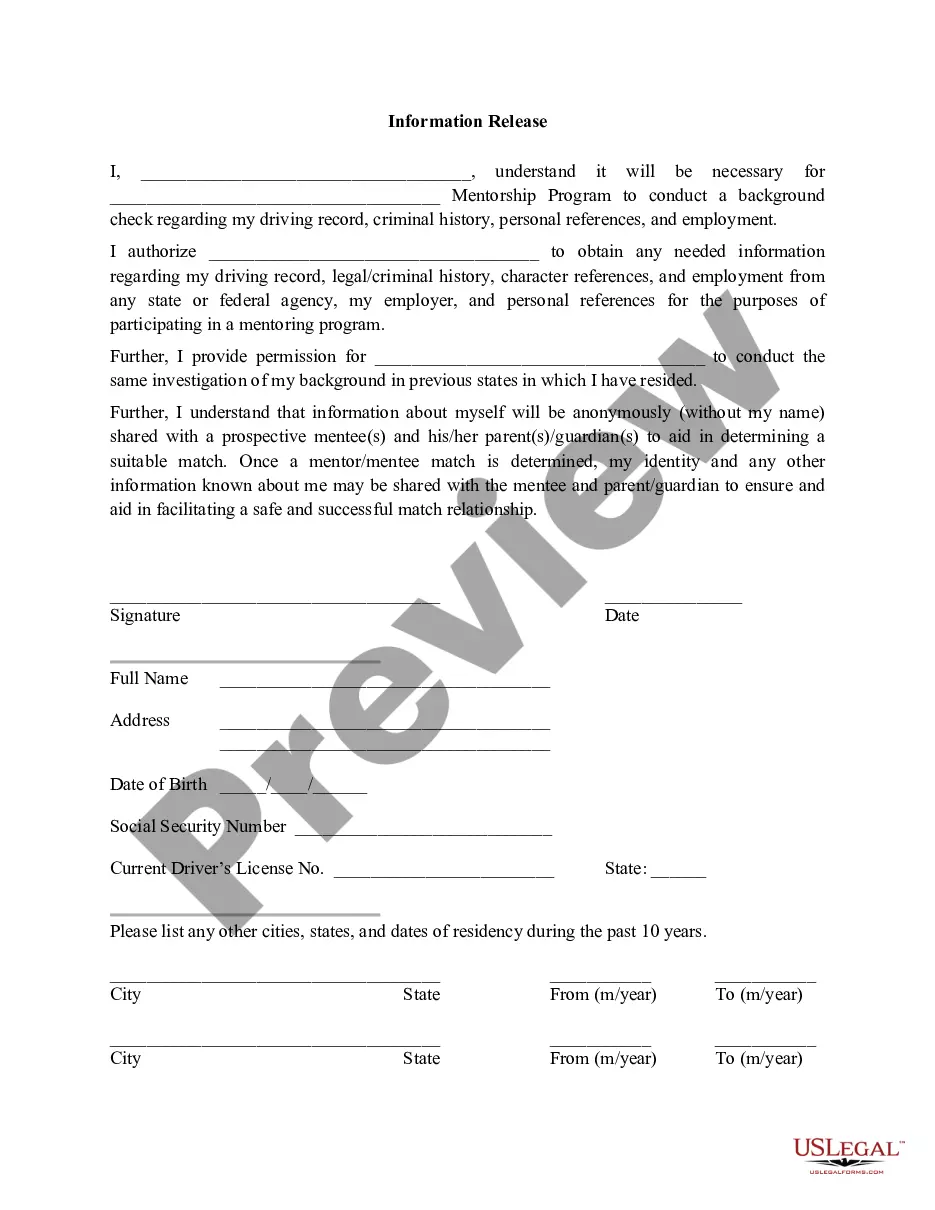

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

You can invest several hours online looking for the legitimate record web template that fits the state and federal needs you want. US Legal Forms offers thousands of legitimate types which can be evaluated by professionals. It is simple to acquire or printing the Mississippi Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations from your assistance.

If you already have a US Legal Forms accounts, you can log in and then click the Download key. Afterward, you can comprehensive, revise, printing, or signal the Mississippi Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations. Every legitimate record web template you purchase is your own property forever. To obtain yet another duplicate of the acquired kind, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms web site initially, keep to the easy instructions beneath:

- First, make sure that you have selected the proper record web template to the state/city that you pick. Browse the kind information to ensure you have selected the appropriate kind. If available, use the Review key to check from the record web template as well.

- If you would like locate yet another variation of your kind, use the Search industry to find the web template that meets your requirements and needs.

- When you have identified the web template you would like, click on Purchase now to move forward.

- Choose the costs program you would like, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You may use your charge card or PayPal accounts to pay for the legitimate kind.

- Choose the structure of your record and acquire it in your product.

- Make changes in your record if necessary. You can comprehensive, revise and signal and printing Mississippi Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Download and printing thousands of record templates utilizing the US Legal Forms site, that offers the largest selection of legitimate types. Use expert and condition-particular templates to tackle your company or individual requires.

Form popularity

FAQ

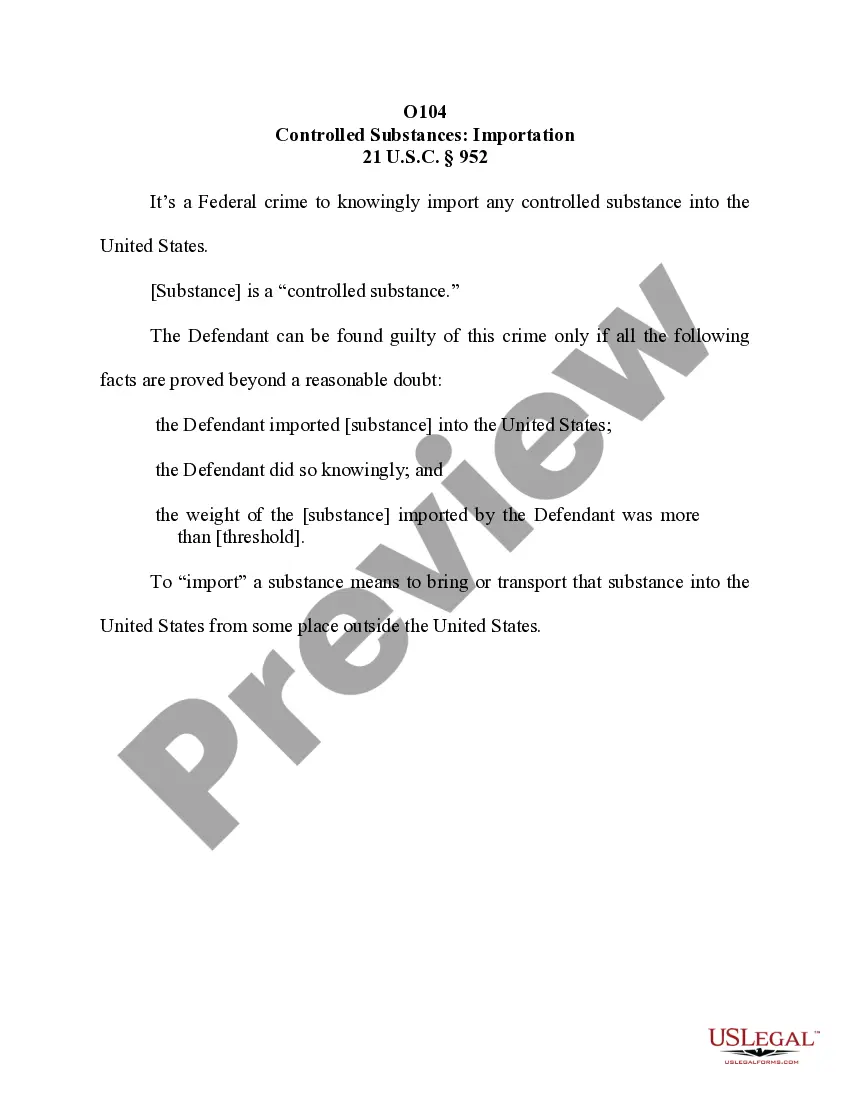

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

The purpose of an indemnity is to provide guaranteed compensation to a buyer on a dollar for dollar basis in circumstances in which a breach of warranty would not necessarily give rise to a claim for damages or to provide a specific remedy that might not otherwise be legally available.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

An LOI must clearly list all of the parties involved (shipper, carrier and when applicable, consignee or recipient) and should include as much detail as possible (i.e. vessel name, ports of origin and destination, description of goods, container number, specifics from the original bill of lading, etc.).

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.