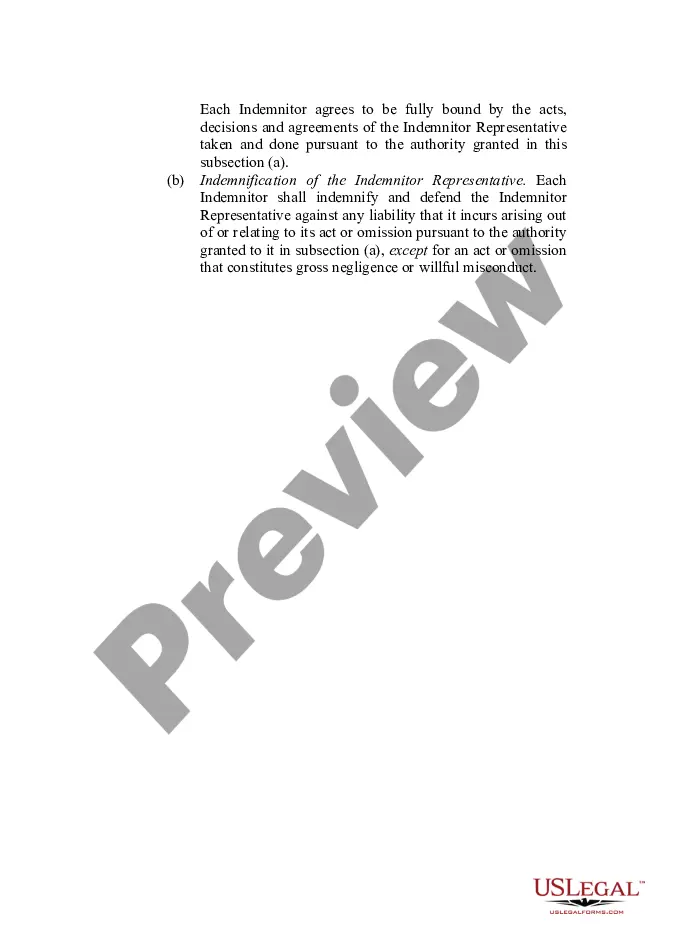

This form provides boilerplate contract clauses that designate the rights of parties to appoint an Indemnitor Representative and outlines such representative's powers and obligations under the contract.

Mississippi Indemnity Provisions - Parties to the Indemnity

Description

How to fill out Indemnity Provisions - Parties To The Indemnity?

If you have to complete, down load, or produce legal record templates, use US Legal Forms, the largest collection of legal kinds, that can be found on the Internet. Take advantage of the site`s easy and practical research to find the paperwork you will need. Various templates for enterprise and person reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to find the Mississippi Indemnity Provisions - Parties to the Indemnity with a handful of clicks.

In case you are presently a US Legal Forms consumer, log in to the profile and click on the Down load switch to obtain the Mississippi Indemnity Provisions - Parties to the Indemnity. You can even gain access to kinds you earlier saved inside the My Forms tab of the profile.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape to the right town/nation.

- Step 2. Make use of the Review method to check out the form`s content material. Don`t forget to see the explanation.

- Step 3. In case you are unhappy using the develop, take advantage of the Lookup industry towards the top of the display screen to discover other models from the legal develop design.

- Step 4. After you have identified the shape you will need, select the Purchase now switch. Opt for the pricing prepare you prefer and add your qualifications to sign up to have an profile.

- Step 5. Process the transaction. You can utilize your bank card or PayPal profile to complete the transaction.

- Step 6. Pick the file format from the legal develop and down load it on the device.

- Step 7. Full, edit and produce or signal the Mississippi Indemnity Provisions - Parties to the Indemnity.

Every single legal record design you get is yours for a long time. You possess acces to each develop you saved in your acccount. Go through the My Forms portion and select a develop to produce or down load once more.

Compete and down load, and produce the Mississippi Indemnity Provisions - Parties to the Indemnity with US Legal Forms. There are many specialist and status-certain kinds you may use for your personal enterprise or person demands.

Form popularity

FAQ

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Example: Third Party Indemnity Clause The service provider shall indemnify the customer against all actions, claims, losses and expenses in respect of loss or damage to third party property arising from the services supplied by the service provider.

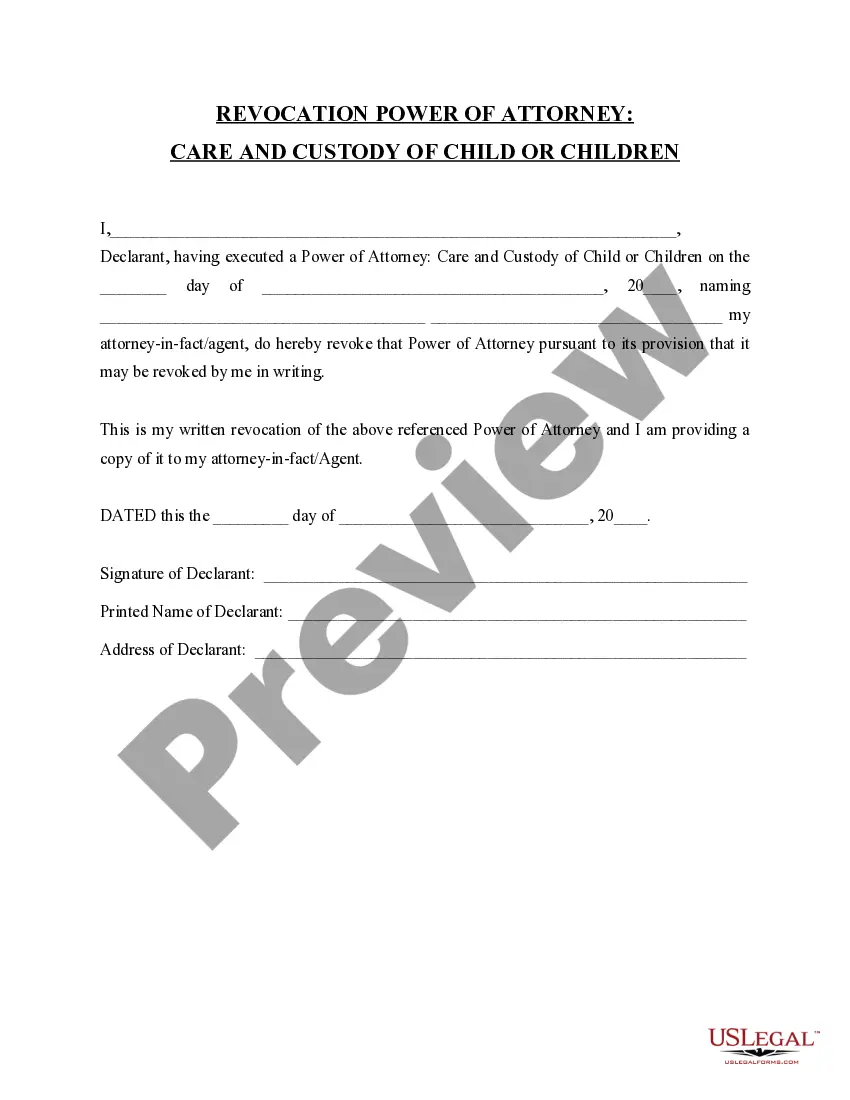

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

An LOI must clearly list all of the parties involved (shipper, carrier and when applicable, consignee or recipient) and should include as much detail as possible (i.e. vessel name, ports of origin and destination, description of goods, container number, specifics from the original bill of lading, etc.).