"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Mississippi Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

It is possible to invest several hours on the web searching for the lawful file template which fits the state and federal specifications you will need. US Legal Forms offers a huge number of lawful types which are examined by pros. You can easily down load or print the Mississippi Form of Mortgage Deed of Trust and Variations from your service.

If you have a US Legal Forms account, you are able to log in and then click the Obtain key. After that, you are able to full, change, print, or sign the Mississippi Form of Mortgage Deed of Trust and Variations. Each and every lawful file template you buy is your own for a long time. To have one more backup associated with a obtained form, check out the My Forms tab and then click the related key.

Should you use the US Legal Forms internet site initially, adhere to the straightforward instructions listed below:

- Initial, make certain you have chosen the correct file template for the region/metropolis that you pick. Look at the form outline to make sure you have picked out the right form. If available, take advantage of the Preview key to appear from the file template at the same time.

- If you would like discover one more variation from the form, take advantage of the Lookup industry to obtain the template that suits you and specifications.

- Upon having identified the template you desire, just click Buy now to continue.

- Find the prices plan you desire, type in your qualifications, and sign up for your account on US Legal Forms.

- Full the transaction. You can utilize your bank card or PayPal account to fund the lawful form.

- Find the structure from the file and down load it for your device.

- Make changes for your file if possible. It is possible to full, change and sign and print Mississippi Form of Mortgage Deed of Trust and Variations.

Obtain and print a huge number of file templates while using US Legal Forms site, that provides the biggest selection of lawful types. Use expert and status-specific templates to handle your organization or specific needs.

Form popularity

FAQ

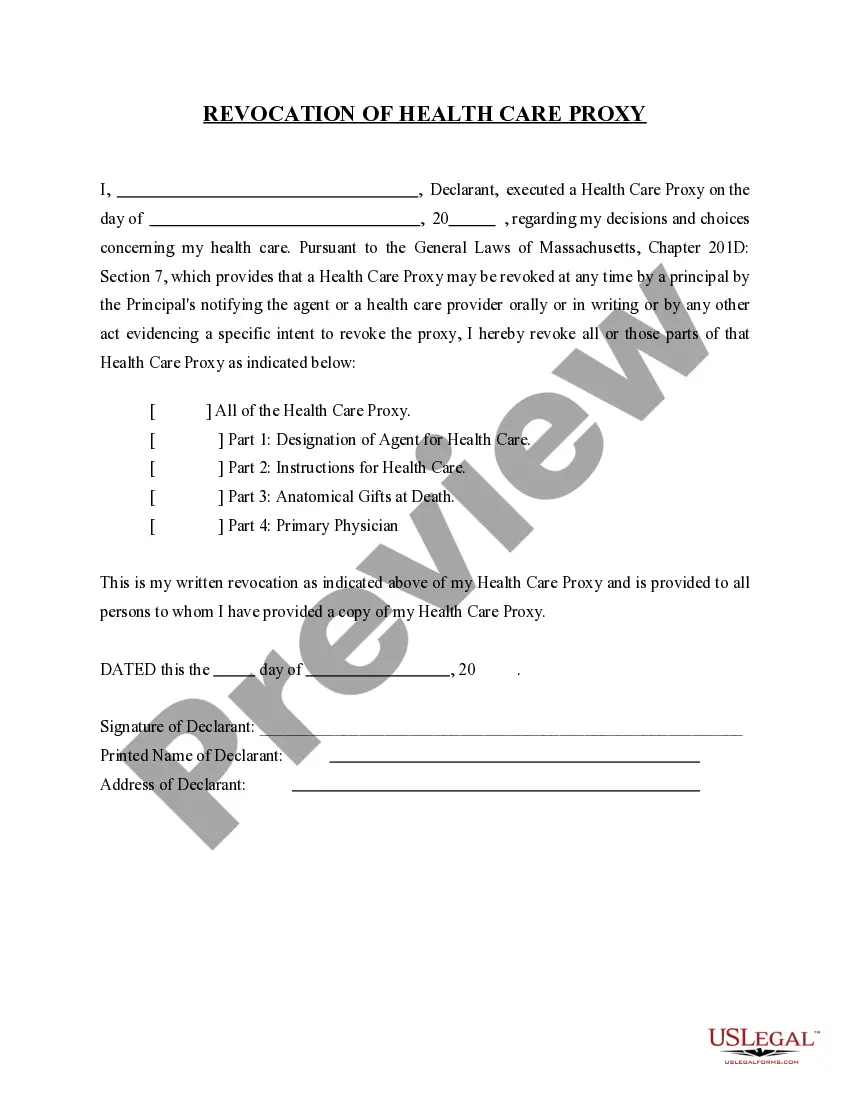

A deed of variation is a legal document that is used to change the details of an existing trust. In most circumstances, in order to properly execute a Deed of Variation, it is important that the Appointor (sometimes referred to as a Principal or Guardian) along with Trustee consents to the proposed change.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

The deed of trust is what secures the promissory note. The promissory note includes the interest rate, the payment amounts and terms, and the buyer's promise to pay the lender the amount borrowed plus interest.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

Notes: Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

(2) Notwithstanding the form of conveyance, any deed of trust or mortgage which has been made or shall hereafter be made may confer on the trustee or mortgagee and their successors, assignees and agents the power of sale.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateMassachusettsYMichiganYYMinnesotaYMississippiY47 more rows

A deed of variation is a legal document which can be utilised where a person has received an asset via a Will or the intestacy rules, but the person would like to vary how they benefit or redirect who benefits from the asset.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.