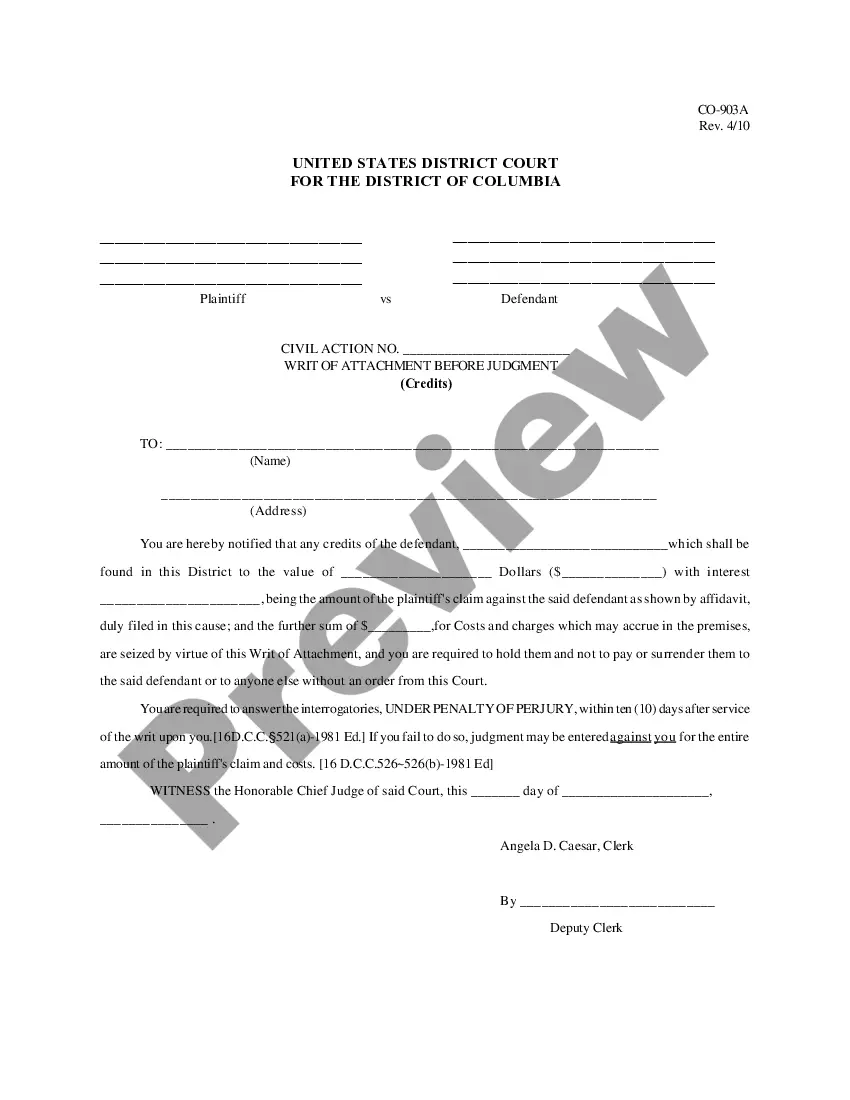

This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

Mississippi Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates you can download or print.

By using the site, you can discover countless forms for business and personal purposes, categorized by types, states, or keywords. You can access the most recent versions of forms such as the Mississippi Form of Accounting Index within minutes.

If you already have a monthly subscription, Log In and download the Mississippi Form of Accounting Index from the US Legal Forms library. The Download button will appear on every form you examine. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your Visa or MasterCard or PayPal account to finalize the transaction.

Choose the format and download the form onto your system. Make modifications. Fill out, edit, print, and sign the saved Mississippi Form of Accounting Index. Every template you added to your account has no expiration date and is yours permanently. So, to download or print another copy, simply visit the My documents section and click on the form you need. Gain access to the Mississippi Form of Accounting Index with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have chosen the correct form for the city/county.

- Select the Preview button to review the contents of the form.

- Read the form summary to make sure you have selected the appropriate form.

- If the form does not meet your needs, use the Search field located at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To obtain a state tax ID number in Mississippi, visit the Mississippi Department of Revenue’s website to fill out the necessary application. The process requires your business details, including your Federal EIN, if applicable. By reviewing the Mississippi Form of Accounting Index, you can ensure that you meet all necessary tax registration requirements. Acquiring your state tax ID number is a crucial step in establishing your business legally.

To find a CPA in Mississippi, start by searching the state’s Board of Public Accountancy website for licensed professionals. You can also consider speaking with local business owners for their recommendations. A CPA can help you understand the Mississippi Form of Accounting Index, guiding you through essential tax obligations and financial reporting. Connecting with a certified public accountant is vital for your business’s financial health.

To file an annual report for your LLC in Mississippi, you need to complete the report form available on the Mississippi Secretary of State's website. Ensure all your company details are accurate, and attach the necessary fees. Utilizing the Mississippi Form of Accounting Index can streamline your filing, ensuring all financial records align with state requirements. It is important to file your report on time to maintain your LLC's good standing.

Filling out an employee withholding exemption requires you to acquire the appropriate forms and provide personal details, including your Social Security number. Carefully state your exemptions based on your tax situation, ensuring compliance with Mississippi tax regulations. Utilizing the Mississippi Form of Accounting Index as a tool will help you navigate this process effectively and reduce potential errors.

When answering whether you are exempt from withholding, consider your financial situation carefully. If you meet specific criteria, such as having no tax liability in the previous year and expecting none for the current year, you may be eligible for exemption. To clarify your status, reference the Mississippi Form of Accounting Index to support your claims, ensuring an informed response.

When filling out the Mississippi employee's withholding exemption certificate, start with obtaining the latest version of the form from the state revenue website. Provide your complete details, including personal identification and exemption claims. The Mississippi Form of Accounting Index can guide you through filling out each section to ensure accuracy and compliance.

For Mississippi, the standard deduction varies based on your filing status. For individuals, it is generally set at a fixed dollar amount each year, and understanding this can help streamline your tax filing process. Utilizing the Mississippi Form of Accounting Index can assist you in keeping track of these details, making sure you claim your standard deduction correctly.

To calculate penalty and interest on Mississippi sales tax, first determine the amount of tax you owe and how late your payment is. Mississippi imposes penalties for late payments, usually a percentage of the unpaid tax. For exact calculations, refer to the Mississippi Form of Accounting Index and any guidelines provided by the Mississippi Department of Revenue, ensuring accurate data and calculations.

On your employee withholding certificate, include your name, Social Security number, and address to ensure proper identification. Also, indicate your filing status and any exemptions you are claiming. By referencing the Mississippi Form of Accounting Index, you can confirm that you have filled in all required information, helping to prevent delays in processing your withholding information.

To complete a Mississippi employee withholding exemption certificate, first obtain the correct form from the Mississippi Department of Revenue website. Provide your personal information, including your name, Social Security number, and address. Use the Mississippi Form of Accounting Index as a reference to ensure that you fill out all necessary sections accurately, thereby avoiding any potential withholding issues.