Mississippi Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

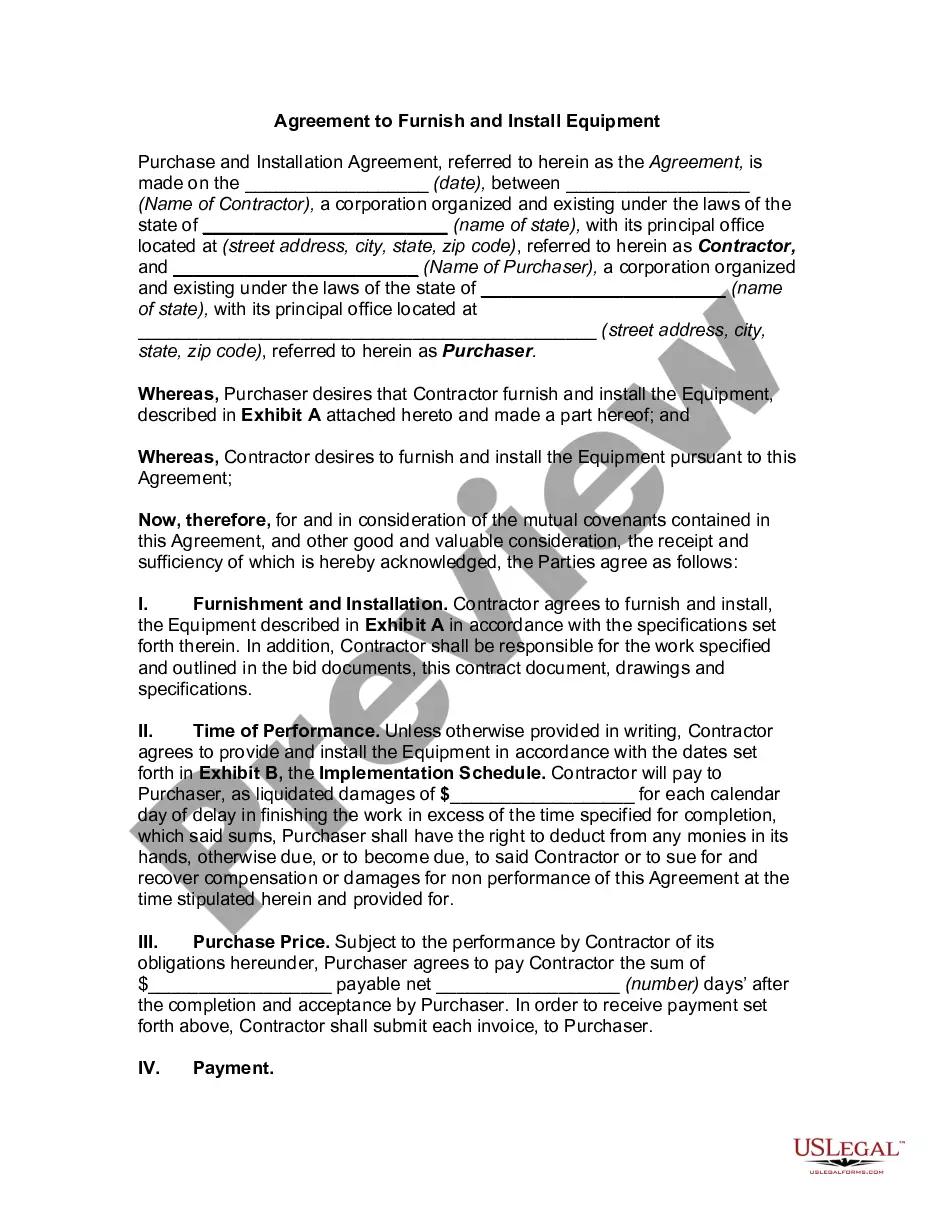

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Locating the correct format for legal documents can be quite a challenge.

Certainly, numerous templates are accessible online, but how do you secure the legal form you need.

Make use of the US Legal Forms website. The platform offers thousands of templates, such as the Mississippi Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, which can be utilized for both business and personal purposes.

You can review the form by clicking the Review button and reading the description to confirm it’s suitable for your needs.

- All templates are reviewed by professionals and meet federal and state requirements.

- If you are already a member, Log In to your account and click the Download button to retrieve the Mississippi Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- You can use your account to access the legal forms you've previously purchased.

- Go to the My documents section of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

Liability for partnership debtsPartners are 'jointly and severally liable' for the firm's debts. This means that the firm's creditors can take action against any partner. Also, they can take action against more than one partner at the same time.

Liability of partners shall be limited except in case of unauthorized acts, fraud and negligence. But a partner shall not be personally liable for the wrongful acts or omission of any other partner.

Successor General Partner . Any Person who is admitted to the Partnership as substitute General Partner pursuant to this Agreement.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Limited Partnership (LP) FAQsOne party (the general partner) has control over the assets and management responsibilities, but also are personally liable. The other party (limited partners) are generally investors whose personal liability is limited to their investment.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

Partners are personally liable for the business obligations of the partnership. This means that if the partnership can't afford to pay creditors or the business fails, the partners are individually responsible to pay for the debts and creditors can go after personal assets such as bank accounts, cars, and even homes.

How to sell your share of a partnership?Step 1: Review the partnership agreement which outlines how partners would address certain business situations, such as selling.Step 2: Meet with your partner(s) in order to take a vote on how to dissolve the partnership and sell your assets.More items...

What is Partnership Liability? Partnership liability is the division of responsibility with regards to any debts or losses of a business partnership. For example, if the partnership is experiencing a loss of profits, the partners may want to understand how the losses are occurring and who should be responsible.