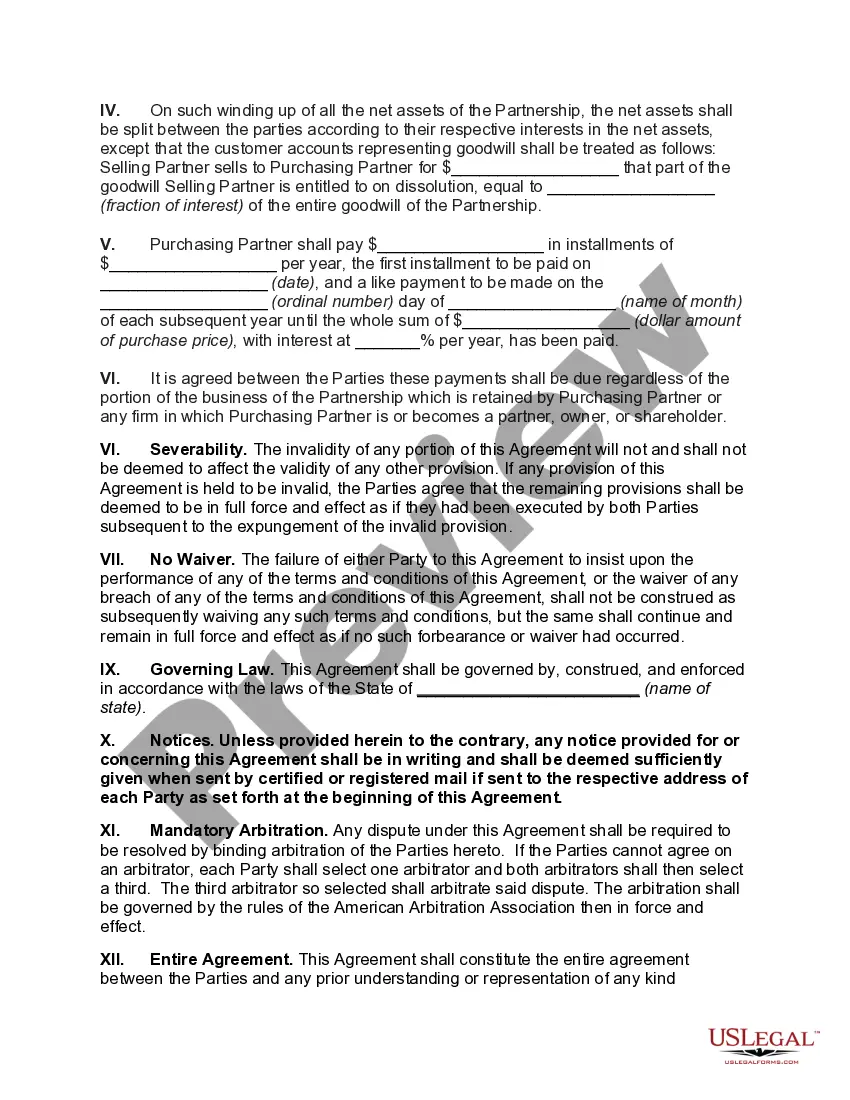

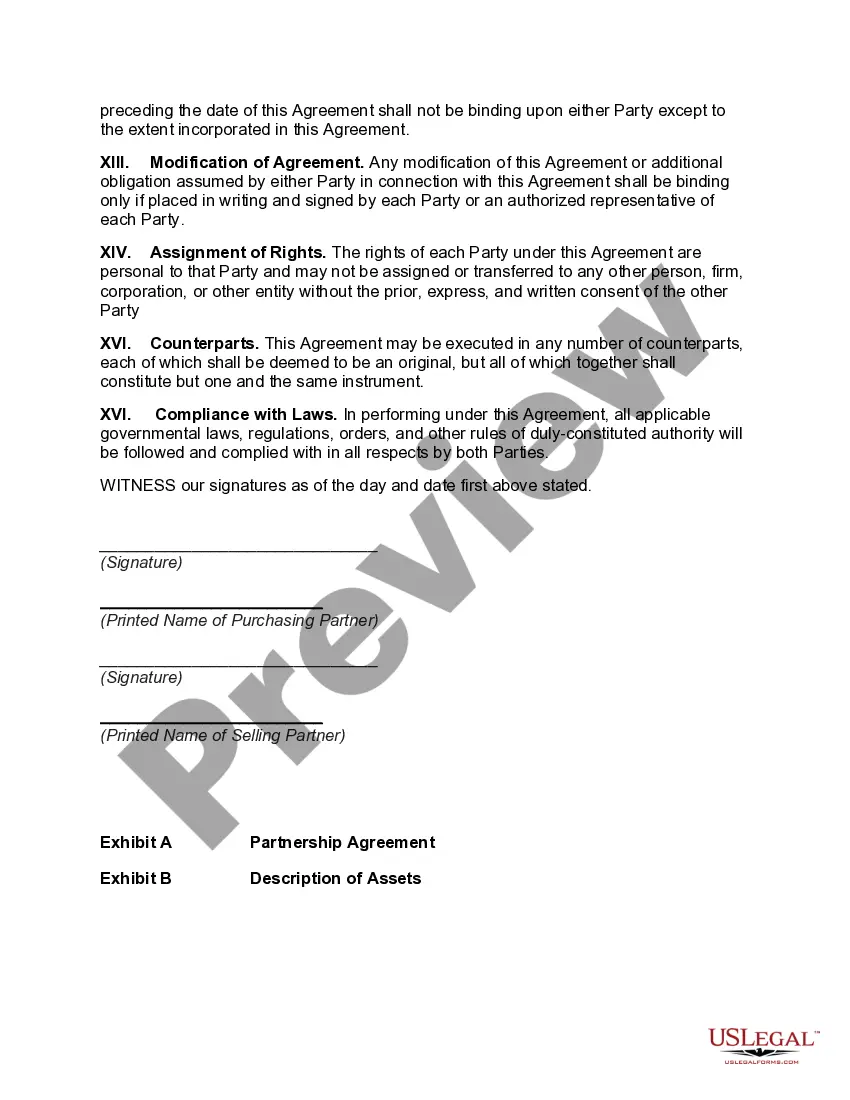

Mississippi Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Have you ever been in a location requiring documentation for perhaps an organization or individual utilized almost every day.

There is a multitude of official document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms provides a vast array of form templates, including the Mississippi Agreement to Dissolve and Liquidate Partnership with Sale to Partner and Unequal Distribution of Assets, which can be tailored to fulfill federal and state requirements.

Once you have the appropriate document, click Buy now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Afterwards, you can download the Mississippi Agreement to Dissolve and Liquidate Partnership with Sale to Partner and Unequal Distribution of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/region.

- Utilize the Preview feature to view the form.

- Review the description to confirm you have chosen the proper document.

- If the document is not what you are looking for, use the Search field to find the document that suits your requirements.

Form popularity

FAQ

If a partner other than the suing partner becomes incapable of performing his duties, then partnership can be dissolved. ADVERTISEMENTS: (iv) Breach of Agreement: When a partner wilfully commits breach of agreement relating to business, it becomes a ground for getting the firm dissolved.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

The dissolution of a partnership firm is said to be dissolved when the relationship between the partners is terminated. In case of dissolution, the firm ceases to exist. The process of dissolution includes disposing of the assets and the liabilities are paid off.

Dissolution by Notice: In case of partnership at will, the firm may be dissolved by any partner giving notice in writing to all other partners of his intention to dissolve the firm. Compulsory Dissolution: A firm is compulsory dissolved if : All the partners except one are insolvent or all,partners are insolvent.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

The partnership can be dissolved if the partner has breached the agreements that are related to the management of business affairs. The dissolution of partnership also can be done when a partner indulges in any other illegal or unethical business activities.

Section 39 of the Indian Partnership Act 1932 states that the dissolution of partnership firm among all the partners of the partnership firm is the Dissolution of the Partnership Firm. The dissolution of partnership firm ceases the existence of the organization.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.