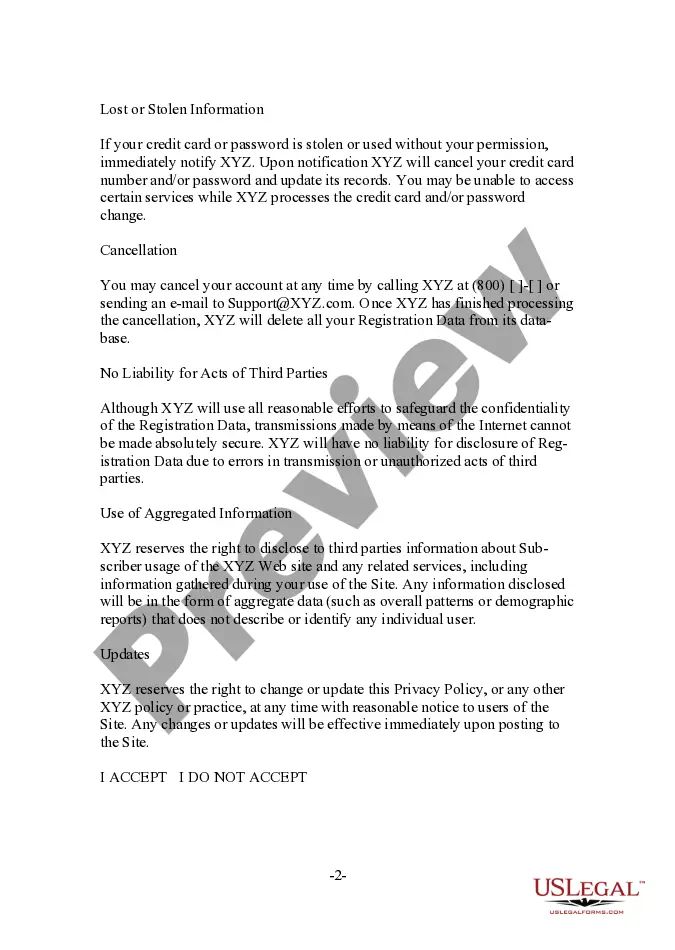

Mississippi Form - Web Site Data Collection Policy

Description

How to fill out Form - Web Site Data Collection Policy?

If you want to complete, acquire, or print authorized document web templates, use US Legal Forms, the biggest assortment of authorized forms, which can be found on the Internet. Take advantage of the site`s basic and practical look for to find the documents you require. Various web templates for business and individual uses are categorized by groups and suggests, or keywords. Use US Legal Forms to find the Mississippi Form - Web Site Data Collection Policy in just a handful of clicks.

If you are previously a US Legal Forms customer, log in for your profile and then click the Down load button to have the Mississippi Form - Web Site Data Collection Policy. You can even accessibility forms you in the past saved within the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape to the proper metropolis/region.

- Step 2. Make use of the Preview option to examine the form`s articles. Never neglect to see the description.

- Step 3. If you are not happy using the type, take advantage of the Look for industry at the top of the display screen to get other versions of your authorized type template.

- Step 4. When you have identified the shape you require, click on the Purchase now button. Choose the costs strategy you favor and include your qualifications to sign up for the profile.

- Step 5. Approach the deal. You should use your charge card or PayPal profile to perform the deal.

- Step 6. Pick the formatting of your authorized type and acquire it on your gadget.

- Step 7. Complete, edit and print or indicator the Mississippi Form - Web Site Data Collection Policy.

Every authorized document template you get is yours forever. You might have acces to every type you saved inside your acccount. Click on the My Forms area and pick a type to print or acquire again.

Contend and acquire, and print the Mississippi Form - Web Site Data Collection Policy with US Legal Forms. There are millions of skilled and condition-certain forms you can utilize for the business or individual demands.

Form popularity

FAQ

Mississippi Code 27-65-42 defines the statute of limitations for sales tax assessment as 3 years from the return filing date.

A VDA may be helpful in the following situations: You should have been collecting sales tax, but weren't. You collected the sales tax, but failed to remit it. You could save a substantial amount of money on waived penalties and interest by engaging in a voluntary disclosure agreement program.

As such, the applicant may be asked to complete a nexus questionnaire as a part of their application process. The VDA Program has a standard three year look-back period for income and franchise taxes and consists of the three tax years which are past due based on when the Department received the initial contact.

The State of Mississippi Enterprise Security Policy establishes the minimum requirements for preserving the confidentiality, integrity, and availability of State data and information technology (IT) resources from unauthorized use, access, disclosure, modification, or destruction.

In most cases, OTR will agree to limit the look-back period to the lesser of three years or the date when the taxpayer established nexus in the District of Columbia. In egregious situations, however, OTR may require a five-year look-back period.

If you had a sales tax permit in the last three years before the lookback period (the standard lookback period for sales tax in Mississippi is thirty-six months), you are not eligible for a Sales Tax Voluntary Disclosure Agreement (VDA) in Mississippi.