Mississippi Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.

Description

How to fill out Restricted Stock Bonus Plan Of McDonald And Company Investments, Inc.?

US Legal Forms - one of several largest libraries of lawful types in the USA - gives a wide array of lawful papers themes you can down load or print out. Using the site, you can find a huge number of types for business and specific reasons, categorized by classes, says, or key phrases.You can get the most recent versions of types just like the Mississippi Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. in seconds.

If you currently have a registration, log in and down load Mississippi Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. from the US Legal Forms collection. The Download switch can look on each and every develop you perspective. You have access to all in the past saved types within the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, listed here are straightforward guidelines to obtain started out:

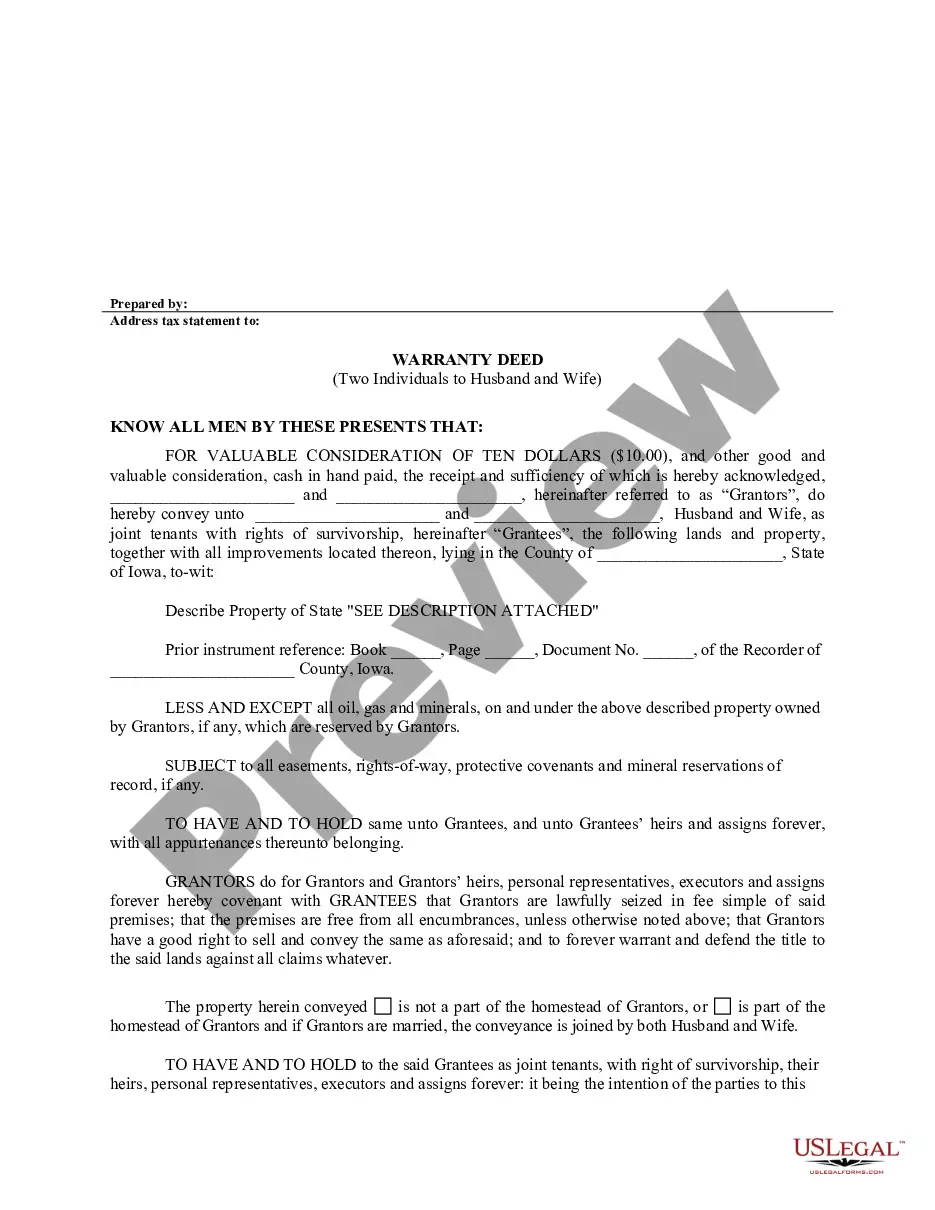

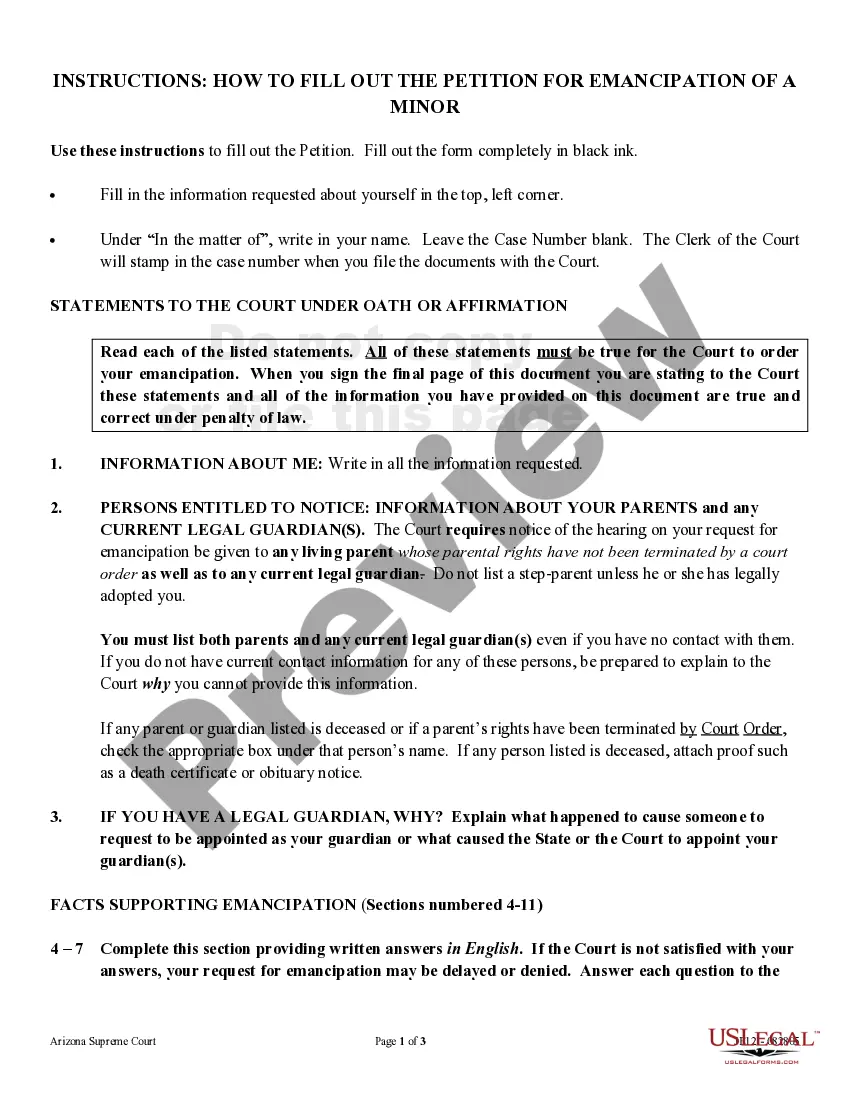

- Make sure you have chosen the correct develop to your metropolis/state. Click the Preview switch to review the form`s information. Read the develop explanation to actually have chosen the proper develop.

- In case the develop doesn`t suit your needs, take advantage of the Search discipline at the top of the display screen to get the one who does.

- Should you be satisfied with the shape, validate your choice by clicking the Acquire now switch. Then, opt for the prices plan you want and supply your references to register for an profile.

- Method the financial transaction. Use your charge card or PayPal profile to perform the financial transaction.

- Pick the structure and down load the shape on your device.

- Make adjustments. Complete, revise and print out and indication the saved Mississippi Restricted Stock Bonus Plan of McDonald and Company Investments, Inc..

Each and every format you put into your money lacks an expiration date which is your own eternally. So, if you want to down load or print out another version, just visit the My Forms segment and click on about the develop you require.

Gain access to the Mississippi Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. with US Legal Forms, by far the most considerable collection of lawful papers themes. Use a huge number of specialist and status-specific themes that meet your small business or specific requires and needs.

Form popularity

FAQ

McDirect Shares is a McDonald's stock purchase plan through which you are eligible to build your share ownership and reinvest dividends. You can purchase stock through convenient payroll deductions and a minimal start up fee. It's more important than ever to save for retirement.

A stock bonus plan is a defined-contribution profit sharing plan, to which employers contribute company stock. These are considered to be qualified retirement plans, and as such, they're governed by the Employee Retirement Income Security Act (ERISA).

Profit-sharing Vs. So, let's look at some of the differences below. Profit-sharing can be a part of the employee's retirement plan. Bonuses are a part of the employee's annual compensation. Employees receive the amount at the time of retirement if it is merged with their 401(k) plan.

Whereas a stock bonus plan is not required to invest in employer securities, an ESOP must invest primarily in employer securities, to the extent that employer stock is available. The employer can contribute company stock directly to the plan.