Louisiana Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp

Description

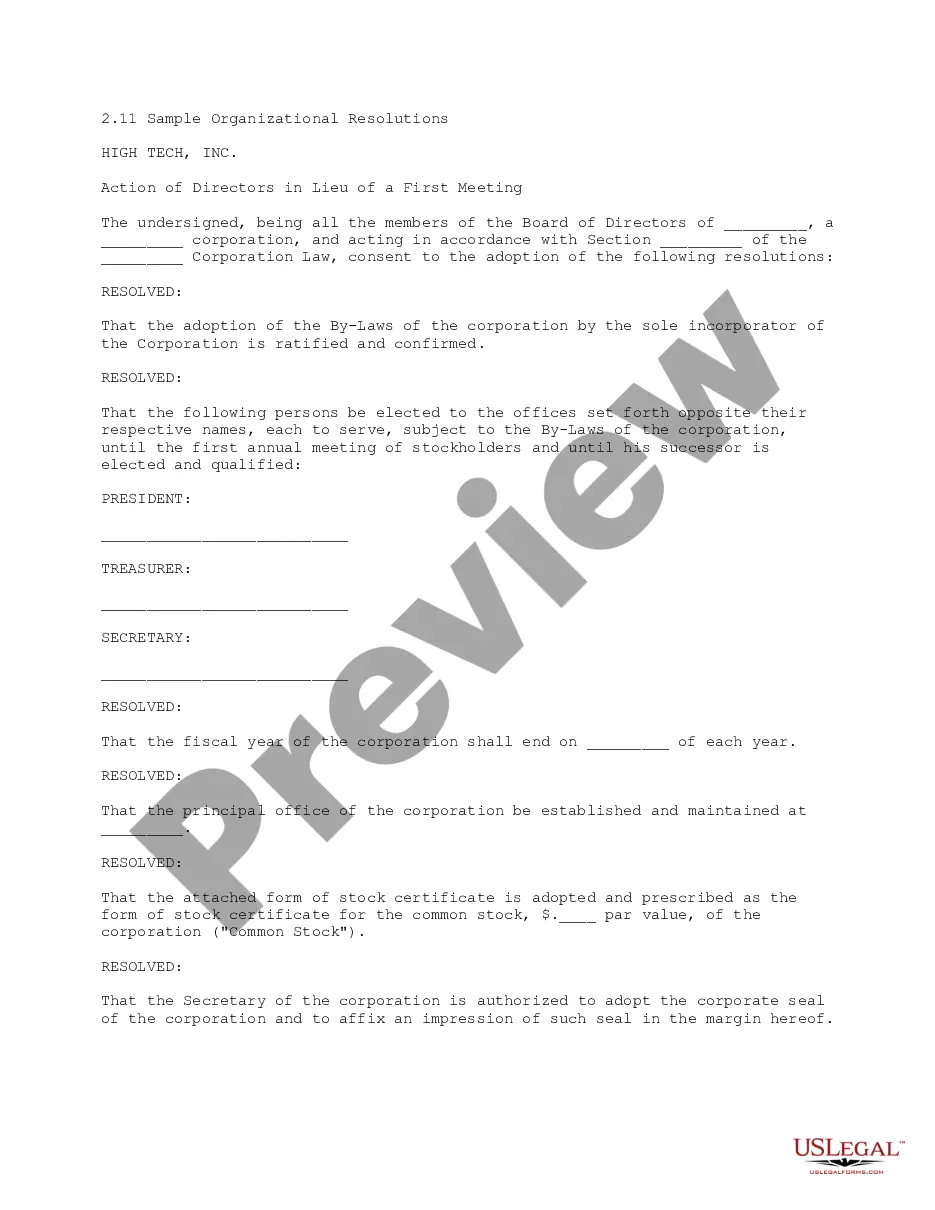

How to fill out Credit Agreement Between Unilab Corp, Various Lending Institutions, Bankers Trust Co And Merrill Lynch Capital Corp?

Are you presently in the place the place you will need documents for possibly business or person purposes almost every time? There are tons of legal file web templates available on the Internet, but finding kinds you can trust isn`t simple. US Legal Forms provides 1000s of kind web templates, just like the Louisiana Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp, that are composed to satisfy federal and state demands.

If you are presently acquainted with US Legal Forms web site and also have a free account, simply log in. Afterward, it is possible to obtain the Louisiana Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp design.

If you do not offer an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is to the right metropolis/area.

- Take advantage of the Review button to analyze the form.

- Read the description to actually have chosen the proper kind.

- When the kind isn`t what you are searching for, use the Look for discipline to discover the kind that meets your needs and demands.

- Once you find the right kind, click on Buy now.

- Opt for the prices plan you want, fill in the specified details to produce your money, and buy your order using your PayPal or bank card.

- Choose a convenient document structure and obtain your duplicate.

Get all of the file web templates you may have purchased in the My Forms menu. You can aquire a additional duplicate of Louisiana Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp at any time, if possible. Just select the required kind to obtain or produce the file design.

Use US Legal Forms, one of the most substantial assortment of legal varieties, to conserve time as well as stay away from faults. The services provides professionally created legal file web templates that you can use for a variety of purposes. Create a free account on US Legal Forms and initiate creating your way of life easier.