Mississippi Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer

Description

How to fill out Notice Of Election To Exercise Stock Purchase Right And Record Of Stock Transfer?

Are you in the place the place you will need paperwork for either business or personal purposes almost every day time? There are plenty of legitimate record themes available on the Internet, but getting ones you can rely isn`t simple. US Legal Forms offers a huge number of kind themes, such as the Mississippi Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer, which can be composed to satisfy state and federal demands.

In case you are previously informed about US Legal Forms internet site and also have a merchant account, just log in. Following that, you are able to download the Mississippi Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer design.

Unless you come with an bank account and want to start using US Legal Forms, adopt these measures:

- Discover the kind you need and ensure it is to the appropriate town/county.

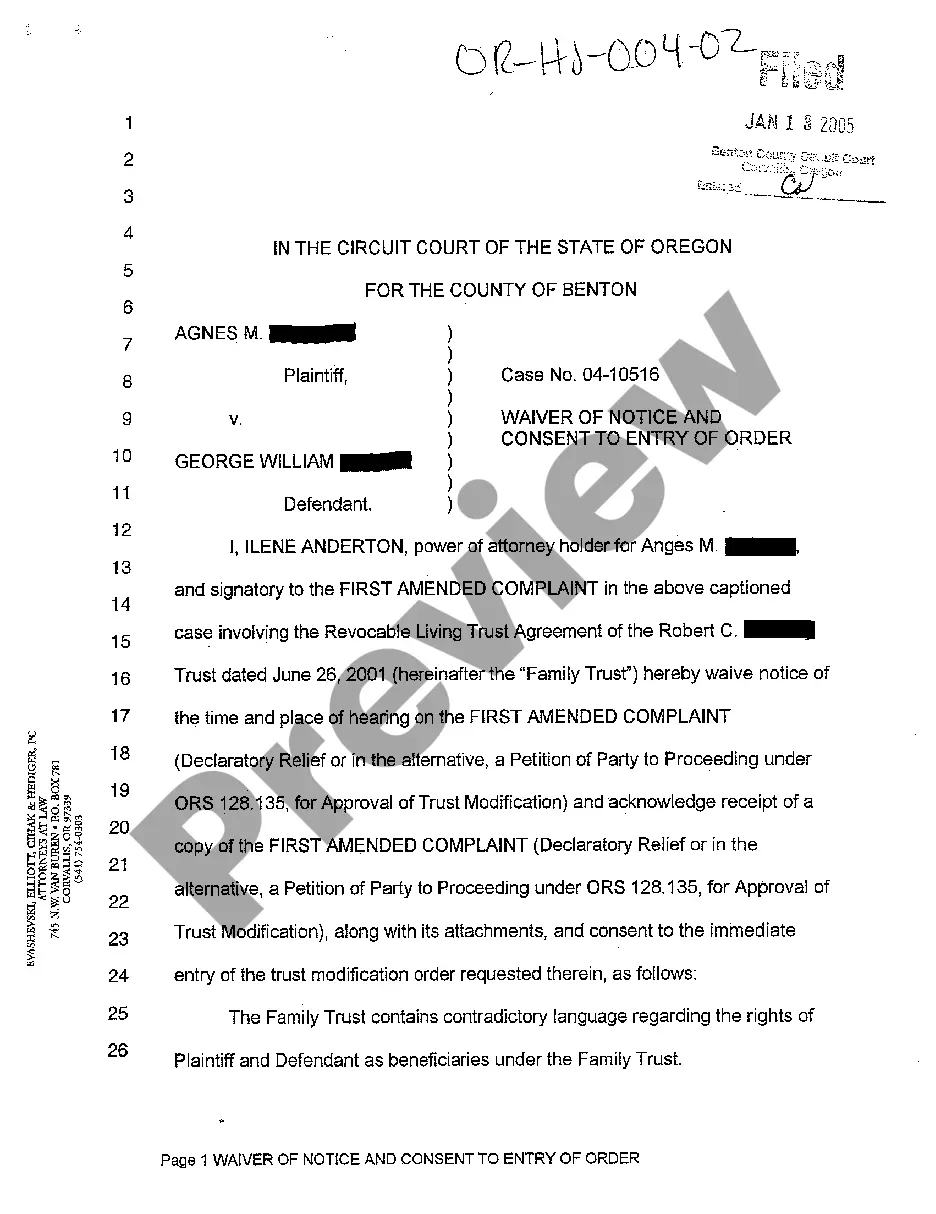

- Utilize the Review key to examine the shape.

- Read the description to actually have selected the right kind.

- In the event the kind isn`t what you are searching for, take advantage of the Search area to discover the kind that fits your needs and demands.

- Once you obtain the appropriate kind, click Acquire now.

- Opt for the costs plan you would like, fill out the desired info to produce your money, and pay for an order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free file format and download your copy.

Discover all of the record themes you possess purchased in the My Forms menus. You can obtain a more copy of Mississippi Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer any time, if needed. Just click on the necessary kind to download or print the record design.

Use US Legal Forms, probably the most considerable variety of legitimate types, to save lots of efforts and avoid blunders. The service offers expertly produced legitimate record themes which you can use for a selection of purposes. Produce a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Form 4 is a two-page document, which covers any buy-and-sell orders, as well as the exercise of company stock options. Options are contracts that give the holder the right, but not the obligation to buy or sell a stock at a certain price, and by a specific date.

When an employee exercises stock options, you'll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x the exercise price, then debit Additional Paid-In Capital for the difference, representing the increase in value of the shares during the service period.

Usually, you have several choices when you exercise your vested stock options: Hold Your Stock Options. Initiate an Exercise-and-Hold Transaction (cash for stock) Initiate an Exercise-and-Sell-to-Cover Transaction. Initiate an Exercise-and-Sell Transaction (cashless)

What is Form 3921? Form 3921 is an IRS form that must be filed by a company when an employee has exercised an incentive stock option (ISO) in the last tax year. Form 3921 informs the IRS which shareholders received ISO compensation. You must file one form per ISO exercise.

Form 3921 informs the IRS which shareholders received ISO compensation. You must file one form per ISO exercise. If you miss the deadline, fail to file, or make significant mistakes on the forms, your company could end up paying fines?up to millions of dollars in the worst-case scenario?for tax year 2023.

Form 3921 is a form that companies have to file with the IRS when an existing or former employee exercises an ISO. One form needs to be filed for each transfer of stock that occurs pursuant to an ISO exercise during the applicable calendar year.

Since you'll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the income will be included when you file your tax return.

Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost, taxes, and brokerage commissions and fees. The proceeds you receive from an exercise-and-sell-to-cover transaction will be shares of stock.