Mississippi Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

Are you presently in the placement that you require documents for possibly enterprise or specific reasons virtually every day? There are plenty of authorized record templates available on the net, but getting types you can trust is not simple. US Legal Forms provides thousands of kind templates, like the Mississippi Investment Transfer Affidavit and Agreement, that are composed in order to meet federal and state requirements.

Should you be already informed about US Legal Forms website and also have a free account, simply log in. Next, you may acquire the Mississippi Investment Transfer Affidavit and Agreement template.

If you do not have an bank account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is for that appropriate town/region.

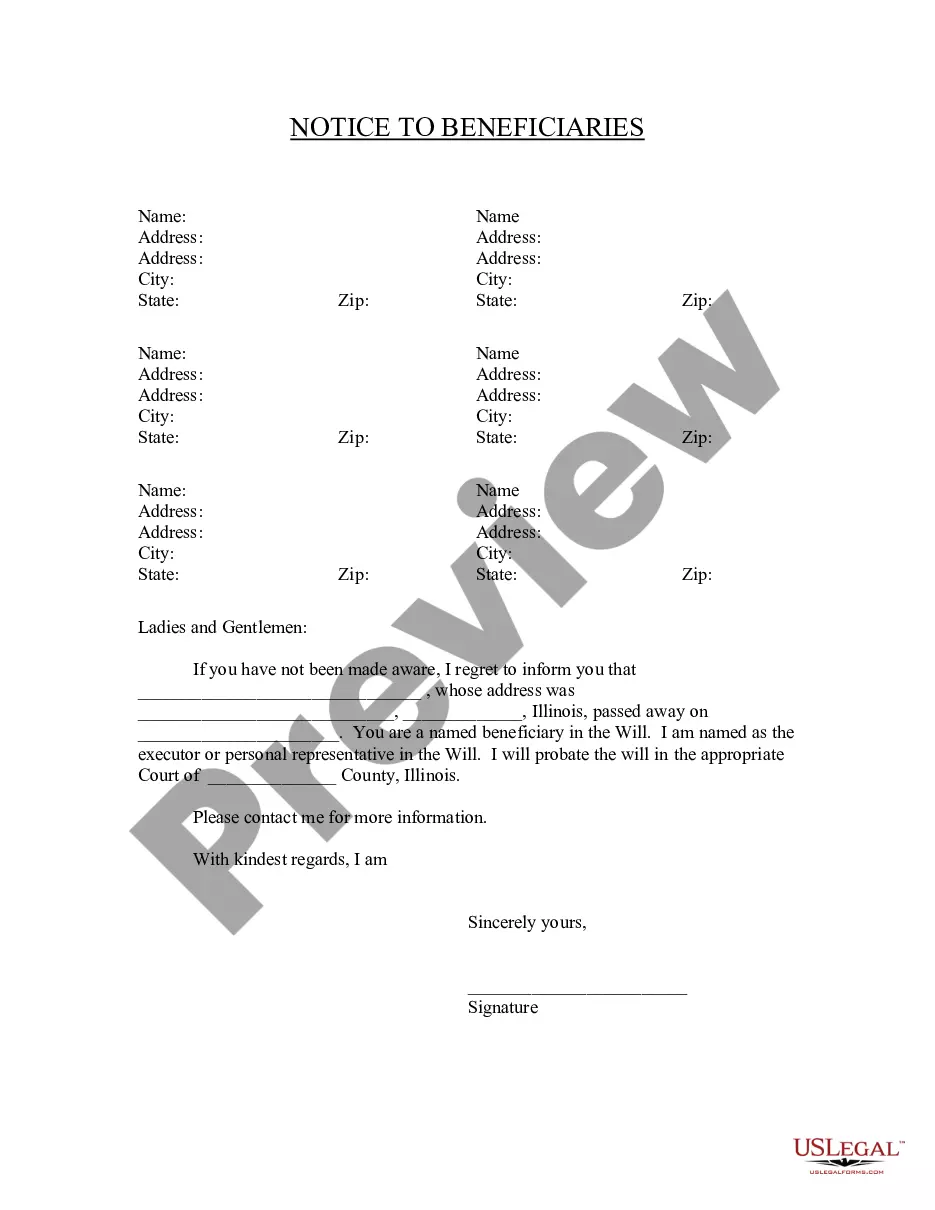

- Use the Preview button to examine the form.

- Browse the outline to ensure that you have selected the correct kind.

- In case the kind is not what you are seeking, make use of the Look for area to get the kind that fits your needs and requirements.

- Whenever you discover the appropriate kind, click Purchase now.

- Choose the prices strategy you need, fill out the specified information to make your bank account, and buy an order with your PayPal or credit card.

- Decide on a hassle-free data file file format and acquire your backup.

Find all of the record templates you possess bought in the My Forms menu. You may get a additional backup of Mississippi Investment Transfer Affidavit and Agreement at any time, if possible. Just go through the needed kind to acquire or printing the record template.

Use US Legal Forms, by far the most extensive assortment of authorized varieties, to conserve time as well as avoid faults. The support provides professionally made authorized record templates which can be used for a range of reasons. Generate a free account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

Income Tax Brackets The standard deduction in Mississippi is $2,300 for single filers and married individuals filing separately, $4,600 for married individuals filing jointly and $3,400 for heads of household. If itemized deductions are less than the standard deduction, taxpayers receive the standard deduction.

MIssissippi has a flast 5% individual income tax rate for 2023. That rate will gradually lower, due to legislation, in subsequent years.

To qualify, a business must invest at least $1 million in buildings and/or equipment. A corporate income tax credit equal to 5% of eligible investment may be awarded to qualifying manufacturers with a maximum available credit of $1 million per project.

Mississippi Tax Rates, Collections, and Burdens Mississippi has a flat 5.00 percent individual income tax. Mississippi also has a 4.00 to 5.00 percent corporate income tax rate.

Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1. (b) Married individuals are allowed a joint exemption of $12,000. If the spouse is not employed, enter $12,000 on Line 2(a).

If you make $70,000 a year living in Mississippi you will be taxed $10,953. Your average tax rate is 11.67% and your marginal tax rate is 22%.