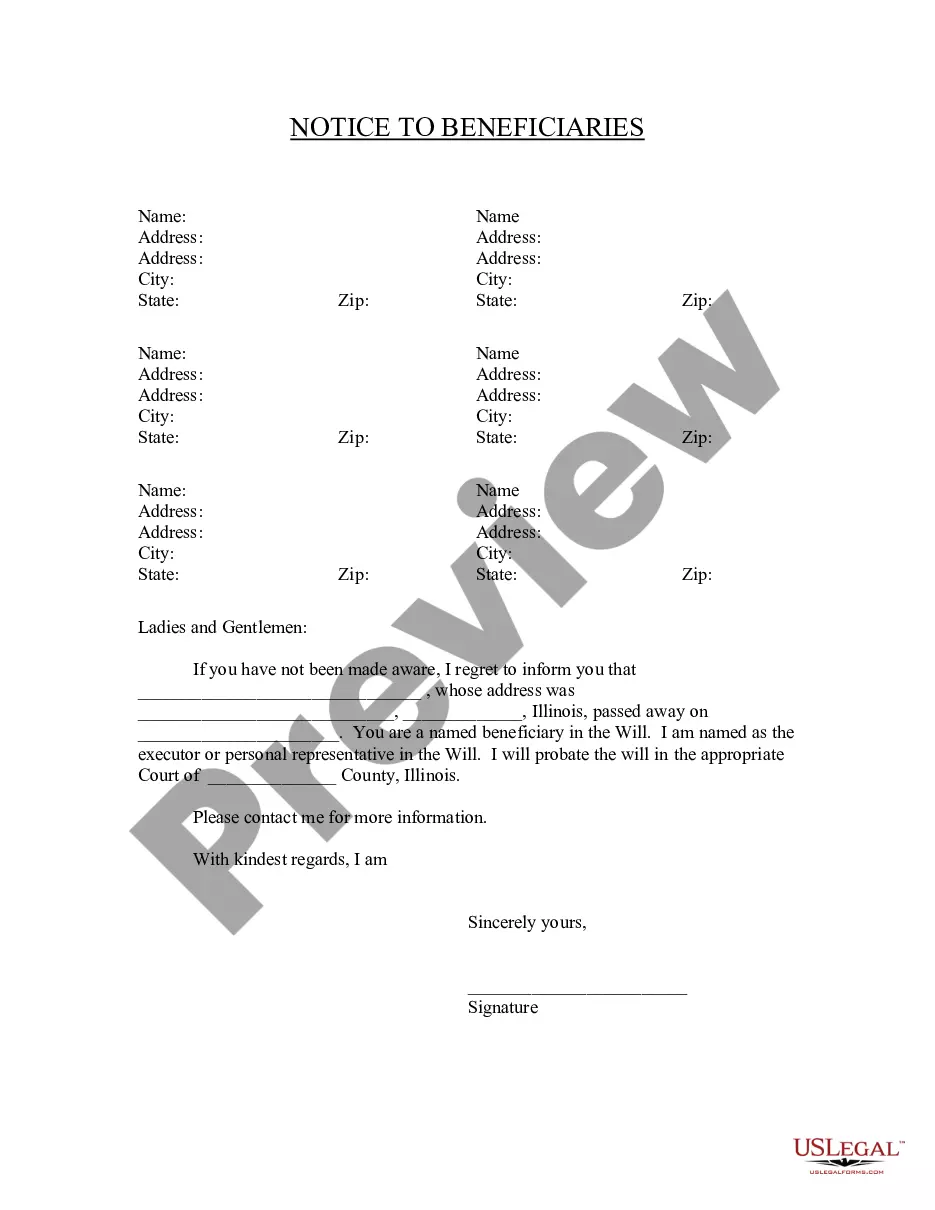

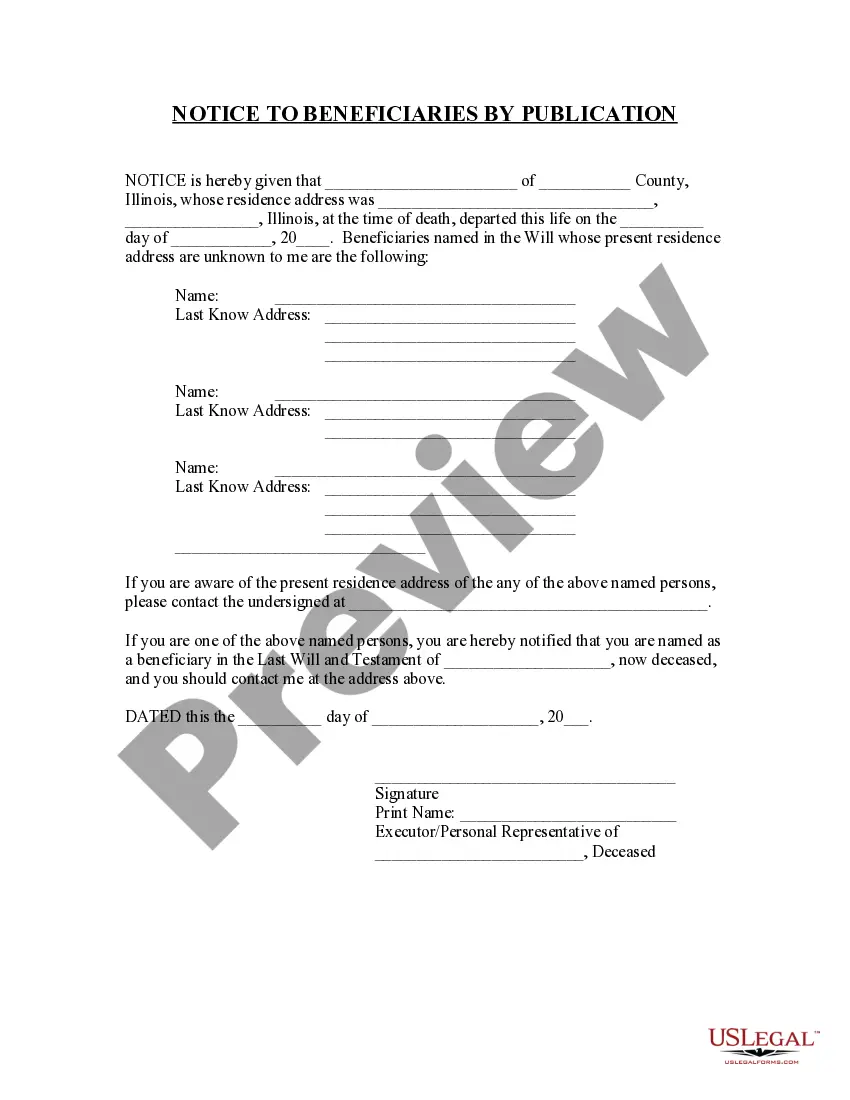

Illinois Notice to Beneficiaries of being Named in Will

Description

How to fill out Illinois Notice To Beneficiaries Of Being Named In Will?

Looking for Illinois Notice to Beneficiaries of being Named in Will template and filling them out can be rather challenging.

To conserve a significant amount of time, expenses, and effort, utilize US Legal Forms and select the appropriate example specifically for your state in just a few clicks.

Our legal experts prepare all documents, so you only have to complete them. It really is that easy.

- Log in to your account and return to the form's page to download the document.

- All your downloaded templates are stored in My documents and are readily available at all times for future use.

- If you haven’t subscribed yet, you ought to register.

- Review our detailed instructions on how to obtain the Illinois Notice to Beneficiaries of being Named in Will sample in moments.

- To acquire an authorized form, verify its compatibility with your state.

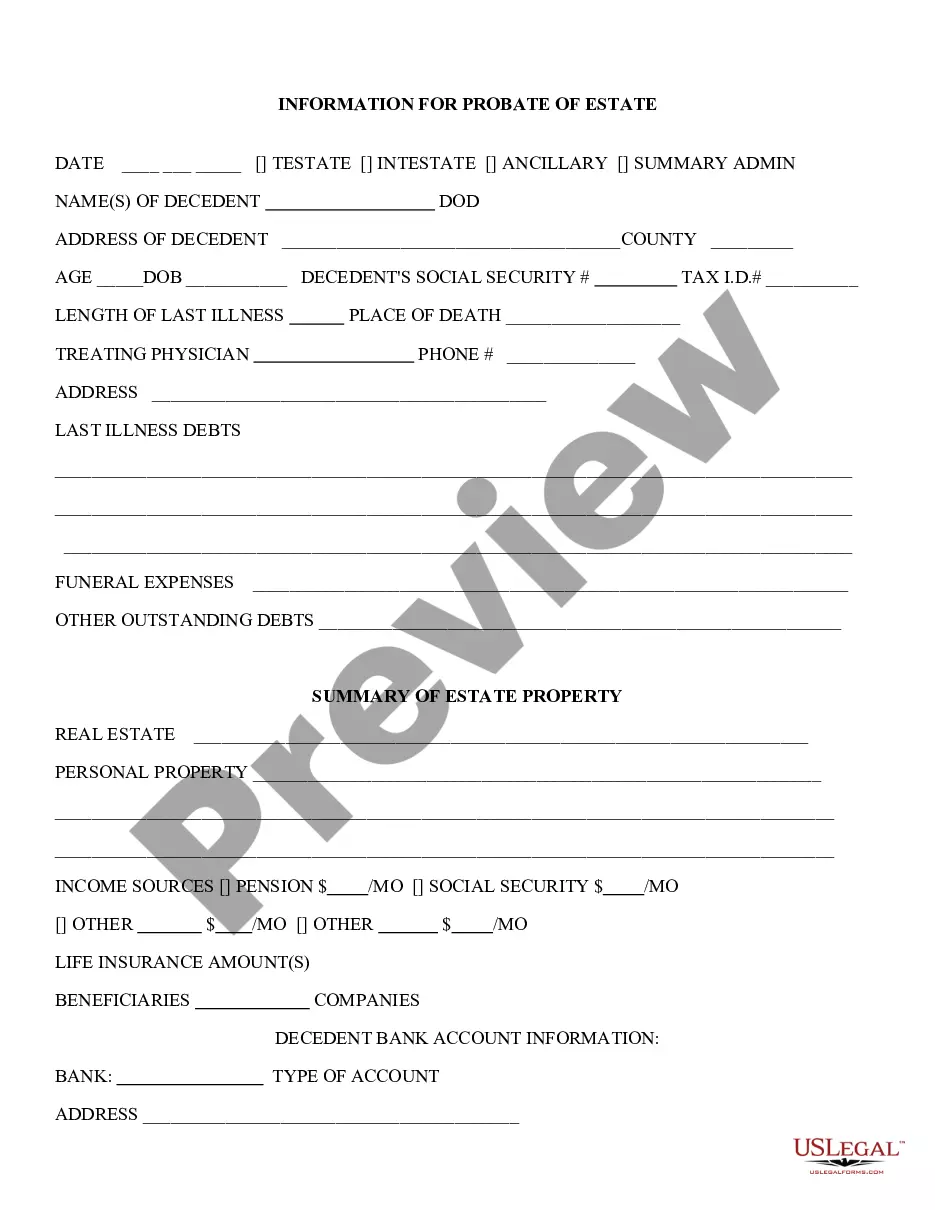

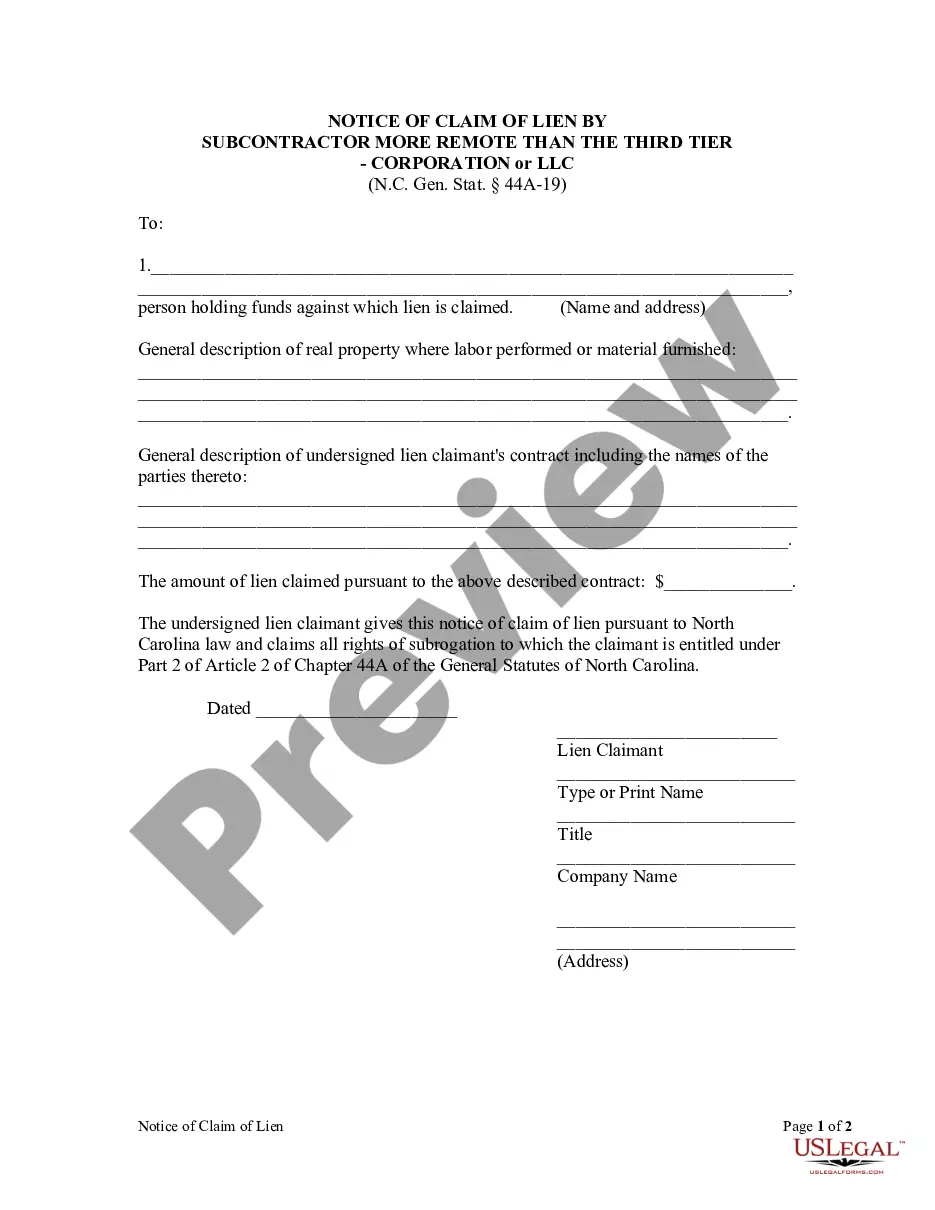

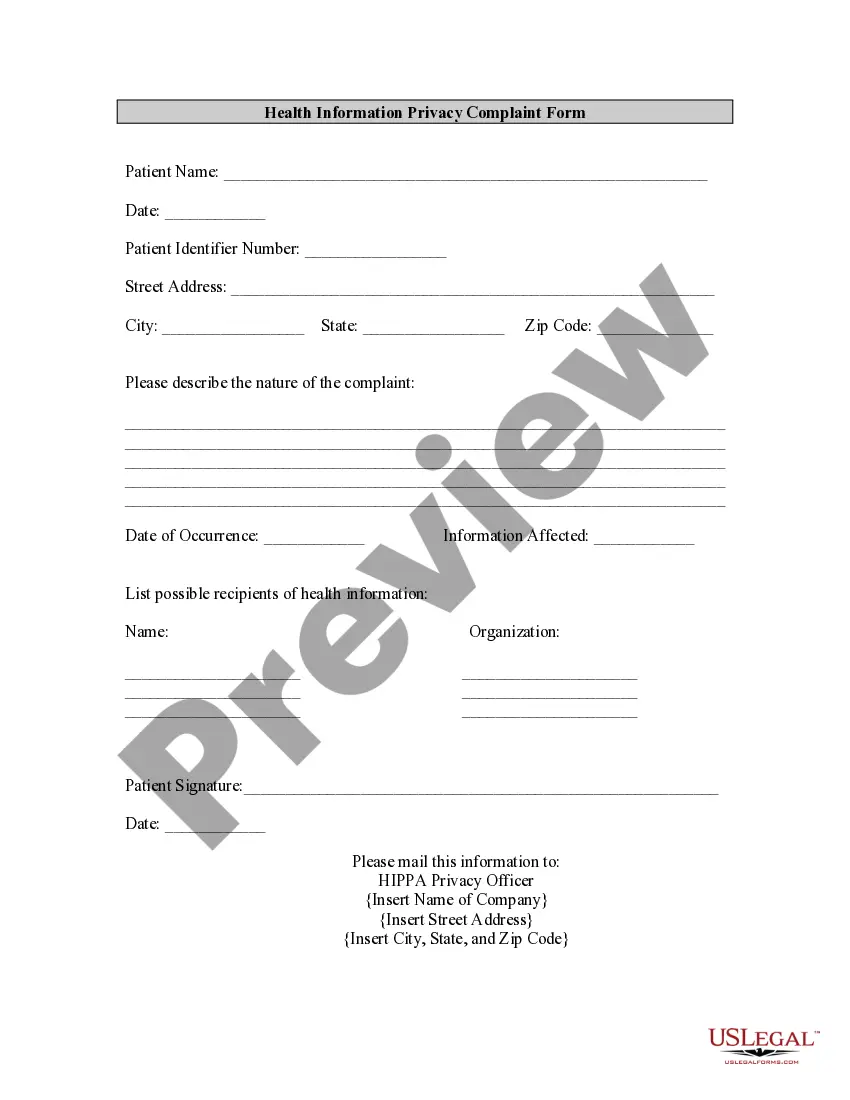

- Examine the sample using the Preview feature (if available).

- If there's a description, go through it to understand the specifics.

- Click Buy Now if you found what you're looking for.

- Pick your plan on the pricing page and create an account.

- Choose to pay with a card or via PayPal.

- Save the document in the desired format.

- You can print the Illinois Notice to Beneficiaries of being Named in Will form or fill it out using any online editor.

- Don’t worry about making errors because your template can be used and sent, and printed as many times as you wish.

- Try US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

Form popularity

FAQ

If beneficiaries are not communicating with the executor, it can create challenges in the estate administration. The executor is responsible for managing the estate and distributing assets, and clear communication is vital for this process. An Illinois Notice to Beneficiaries of being Named in Will can help bridge any communication gaps, as it officially notifies them of their rights and responsibilities. Encouraging open dialogue can foster understanding and improve the estate administration experience.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

What are my rights as a beneficiary?A beneficiary is entitled to be told if they are named in a person's will. They are also entitled to be told what, if any, property/possessions have been left to them, and the full amount of inheritance they will receive.

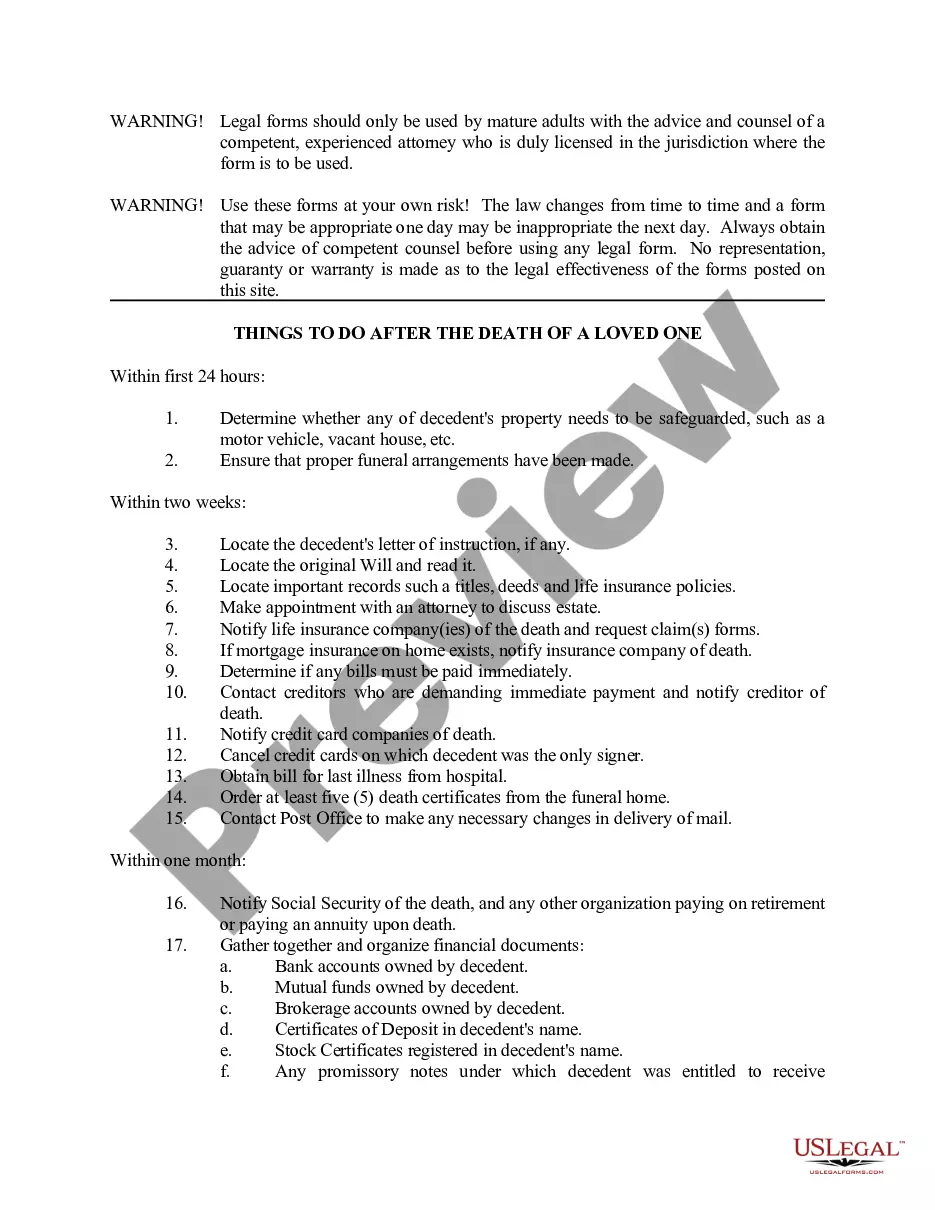

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.