Mississippi Shipping Reimbursement

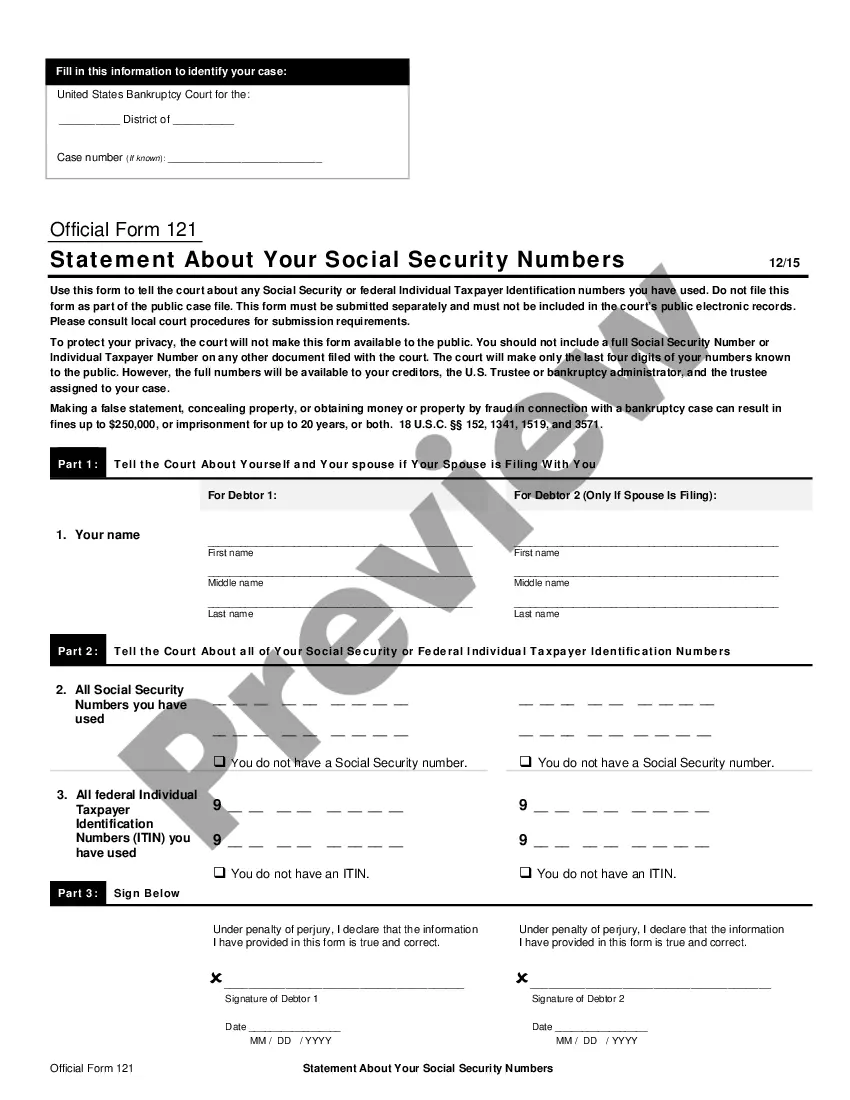

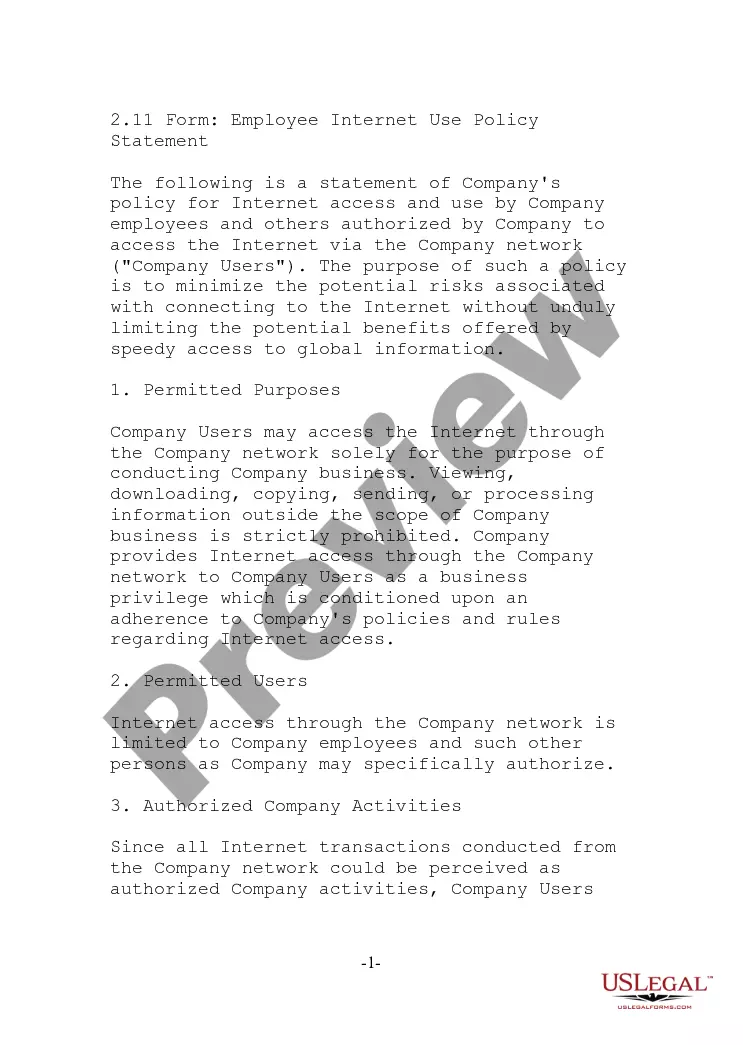

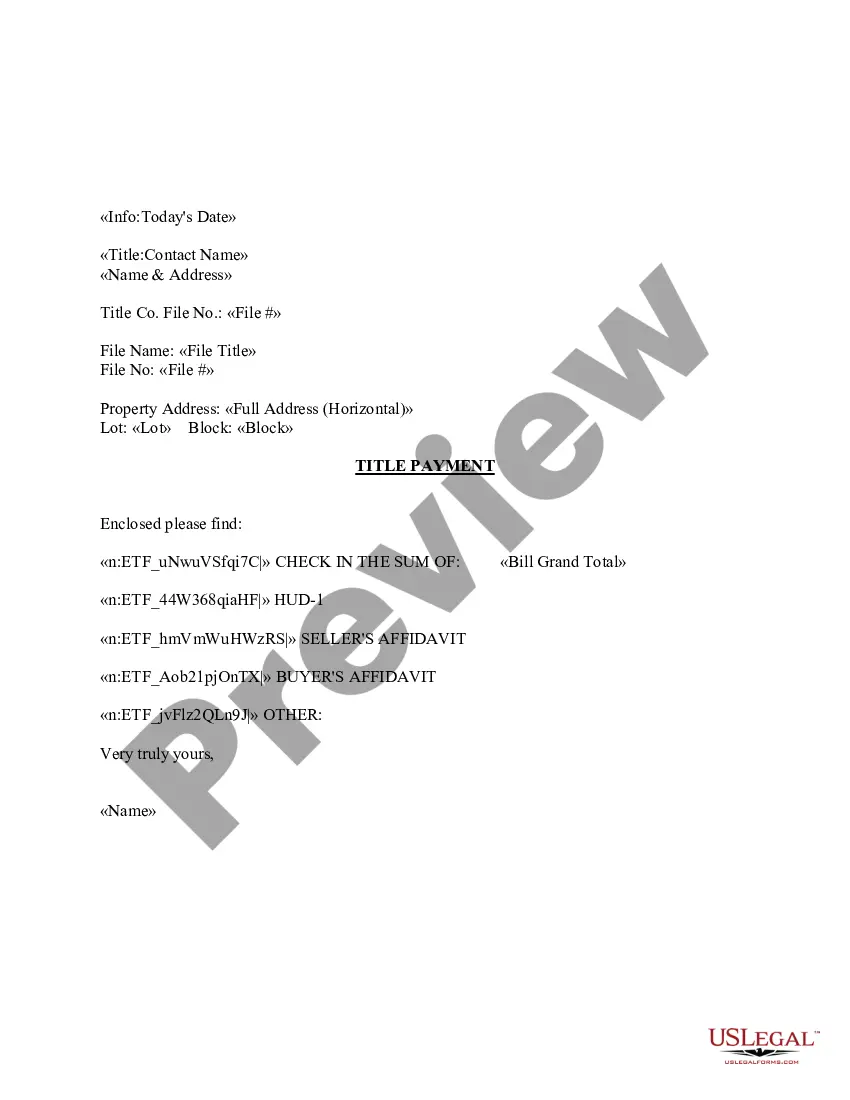

Description

How to fill out Shipping Reimbursement?

You have the ability to allocate time online trying to locate the legal document template that matches the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that are reviewed by professionals.

You can download or print the Mississippi Shipping Reimbursement from the service.

Review the form description to ensure you have selected the right document. If available, take advantage of the Review option to verify the document template too.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can fill out, modify, print, or sign the Mississippi Shipping Reimbursement.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have chosen the correct document template for your state/region that you select.

Form popularity

FAQ

Taxable and exempt shipping charges Charges for shipping, handling, delivery, freight, and postage are generally taxable in Mississippi. If the sale is tax exempt, the shipping charges are generally exempt as well.

Handling charges can be combined with shipping charges; if stated separately, shipping and handling charges are exempt. However, shipping charges that exceed the actual cost of delivery are generally taxable.

Some online retailers, including Amazon, have been voluntarily paying the state. Mississippi levies a 7 percent sales tax on goods purchased in-state. It also has a 7 percent use tax on the books, and individuals and companies that buy from out-of-state sellers are supposed to pay the use tax.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. The tax is based on gross proceeds of sales or gross income, depending on the type of business.

The majority of states (Arkansas, Connecticut, Georgia, Illinois, Kansas, Kentucky, Michigan, Mississippi, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, West Virginia and

Are services taxable? Certain types of labor performed in connection with the sale and installation of tangible personal property are taxable....TaxableRepairs of tangible personal property.Rental or lease of personal property like motor vehicles or equipment.Charges for admission to an amusement, sport, or recreation.More items...

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

Goods that are subject to sales tax in Mississippi include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine and gasoline are both tax-exempt.

Mississippi tax-free weekend 2021 The Mississippi Department of Revenue defines clothing as pants, shirts, blouses, dresses, coats, jackets, belts, hats and undergarments, while footwear includes any shoes except for skis, swim fins, roller blades and skates.