Mississippi Charitable Contribution Payroll Deduction Form

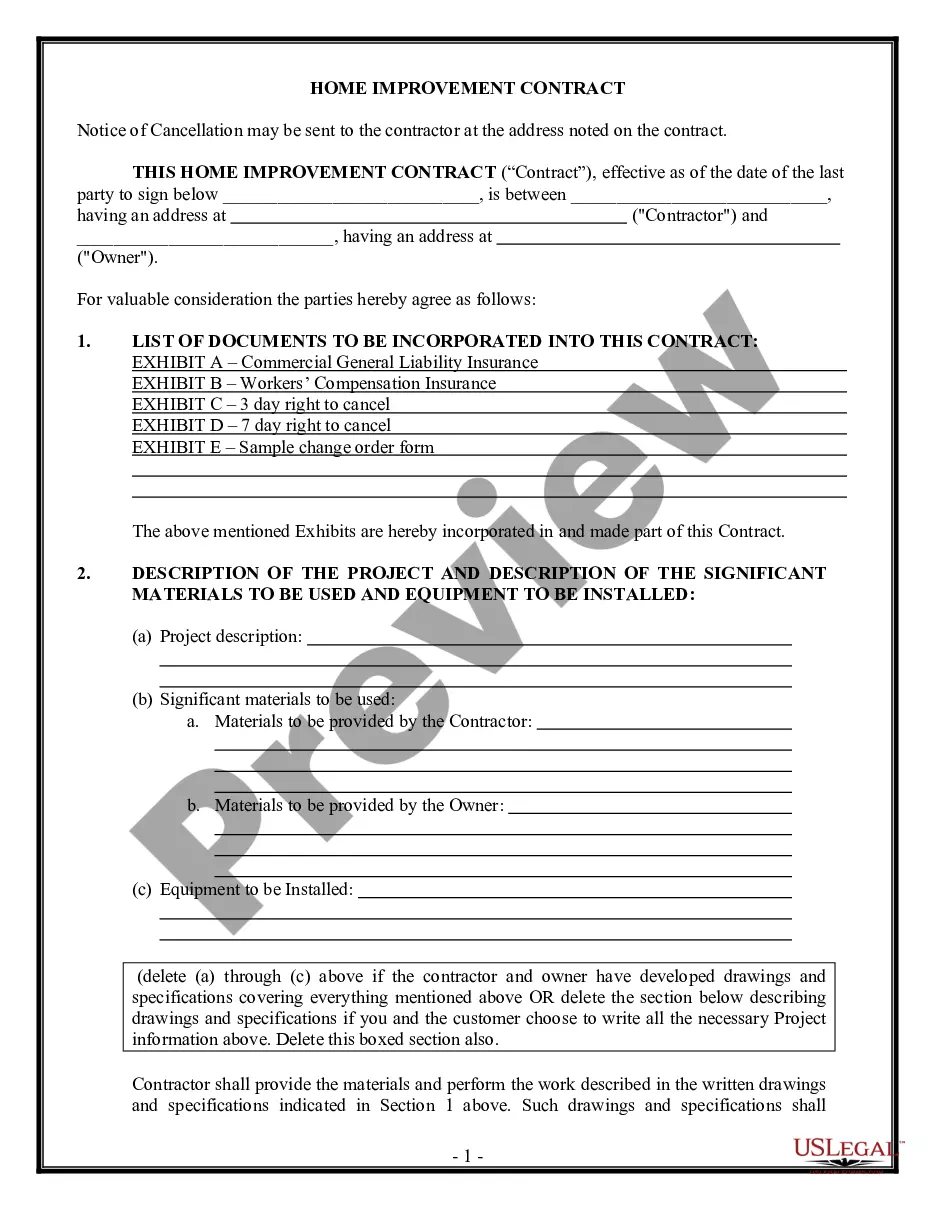

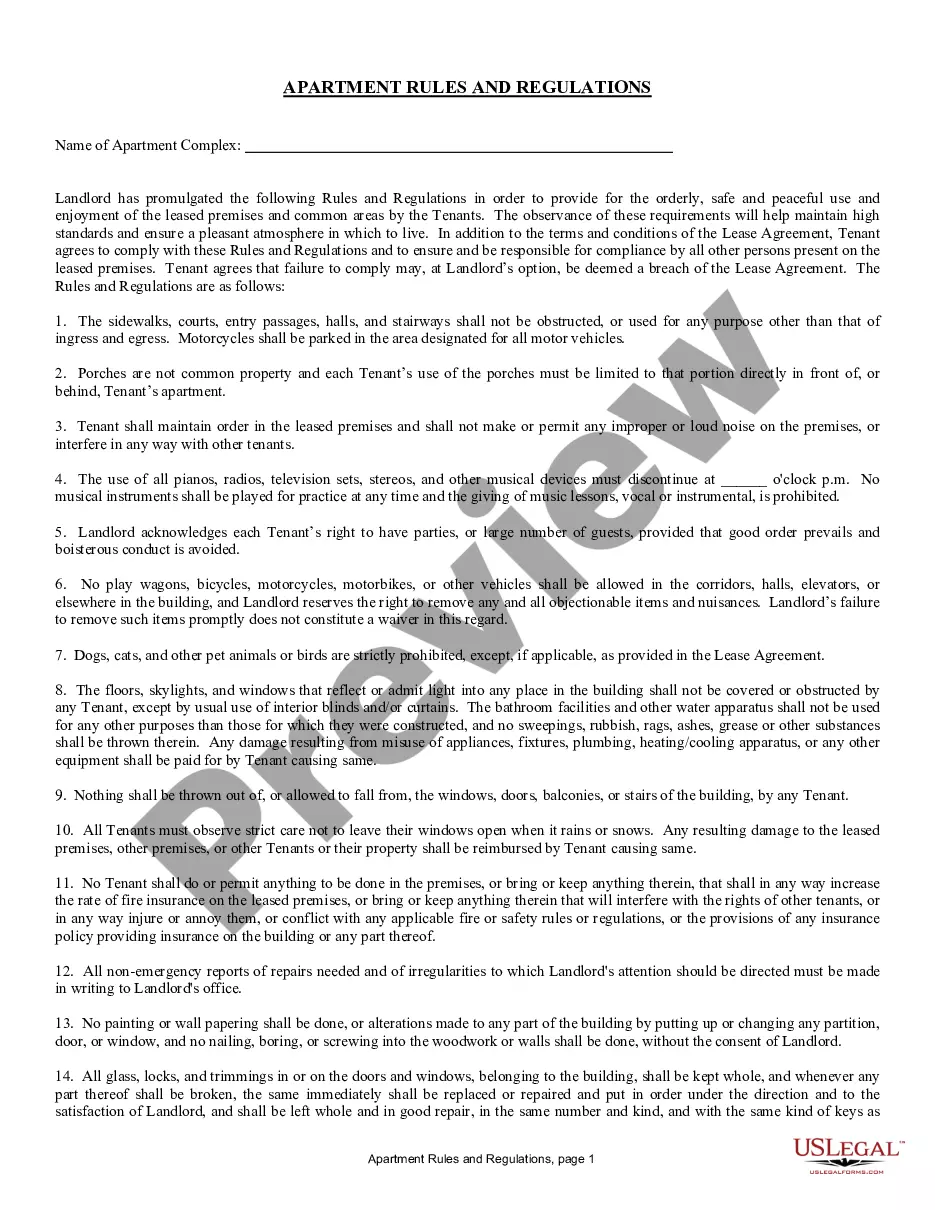

Description

How to fill out Charitable Contribution Payroll Deduction Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal record templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Mississippi Charitable Contribution Payroll Deduction Form in moments.

If you already possess a registration, Log In and download the Mississippi Charitable Contribution Payroll Deduction Form from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

When you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, choose your preferred pricing plan and provide your details to sign up for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the file format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Mississippi Charitable Contribution Payroll Deduction Form.

Every document you add to your account does not expire and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Mississippi Charitable Contribution Payroll Deduction Form with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your area/county.

- Click on the Review button to examine the details of the form.

- Read the form summary to confirm you have chosen the correct document.

- If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

Form popularity

FAQ

The state of Mississippi offers a tax credit for donations made to an eligible Qualified Charitable Organization. Your donation to Canopy can be a DOLLAR-FOR-DOLLAR TAX CREDIT on your Mississippi taxes up to $1,800.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

Claim your charitable donations on Form 1040, Schedule A. Your donations must go to an organization that's one of these: Nonprofit religious group....Your deductions can't be more than 50% of your adjusted gross income (AGI) if the donations are to:Public charities.Colleges.Religious organizations.

Charitable donations go on line 40 of your Form 1040 tax return along with all your other itemized deductions. That's the easy part.

You can deduct donations you make to qualified charities. This can reduce your taxable income, but to claim the donations, you have to itemize your deductions. Claim your charitable donations on Form 1040, Schedule A....Non-cash donations more than $500 but less than $5,000Created.Produced.Manufactured.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

The charitable contributions entered in the tax program on the following Line 13, Codes A through G. that are allowed contribution on Schedule A - Itemized Deductions will automatically reduce the Qualified Business Income from that partnership.

Single taxpayers can claim a tax write-off for cash charitable gifts up to $300 and married couples filing together may get up to $600 for 2021. The tax break is available even if you claim the standard deduction and don't itemize.

If you itemize deductions, you will be able to use the amount in Box 14 as a charitable deduction. Depending on the code you enter, the program may enter it automatically. Enter the Box 14 description/code from your Form W-2 in the first field in the row for Box 14 (e.g. NONTX PK).