Mississippi Account Stated Between Partners and Termination of Partnership

Description

How to fill out Account Stated Between Partners And Termination Of Partnership?

Choosing the best legitimate record format might be a struggle. Naturally, there are tons of layouts available online, but how will you get the legitimate kind you will need? Utilize the US Legal Forms website. The support offers a large number of layouts, for example the Mississippi Account Stated Between Partners and Termination of Partnership, that can be used for organization and private demands. Each of the varieties are checked by experts and meet up with state and federal needs.

When you are previously listed, log in to your account and click on the Obtain key to find the Mississippi Account Stated Between Partners and Termination of Partnership. Make use of your account to appear from the legitimate varieties you have acquired previously. Go to the My Forms tab of the account and get another duplicate in the record you will need.

When you are a brand new consumer of US Legal Forms, here are easy directions so that you can follow:

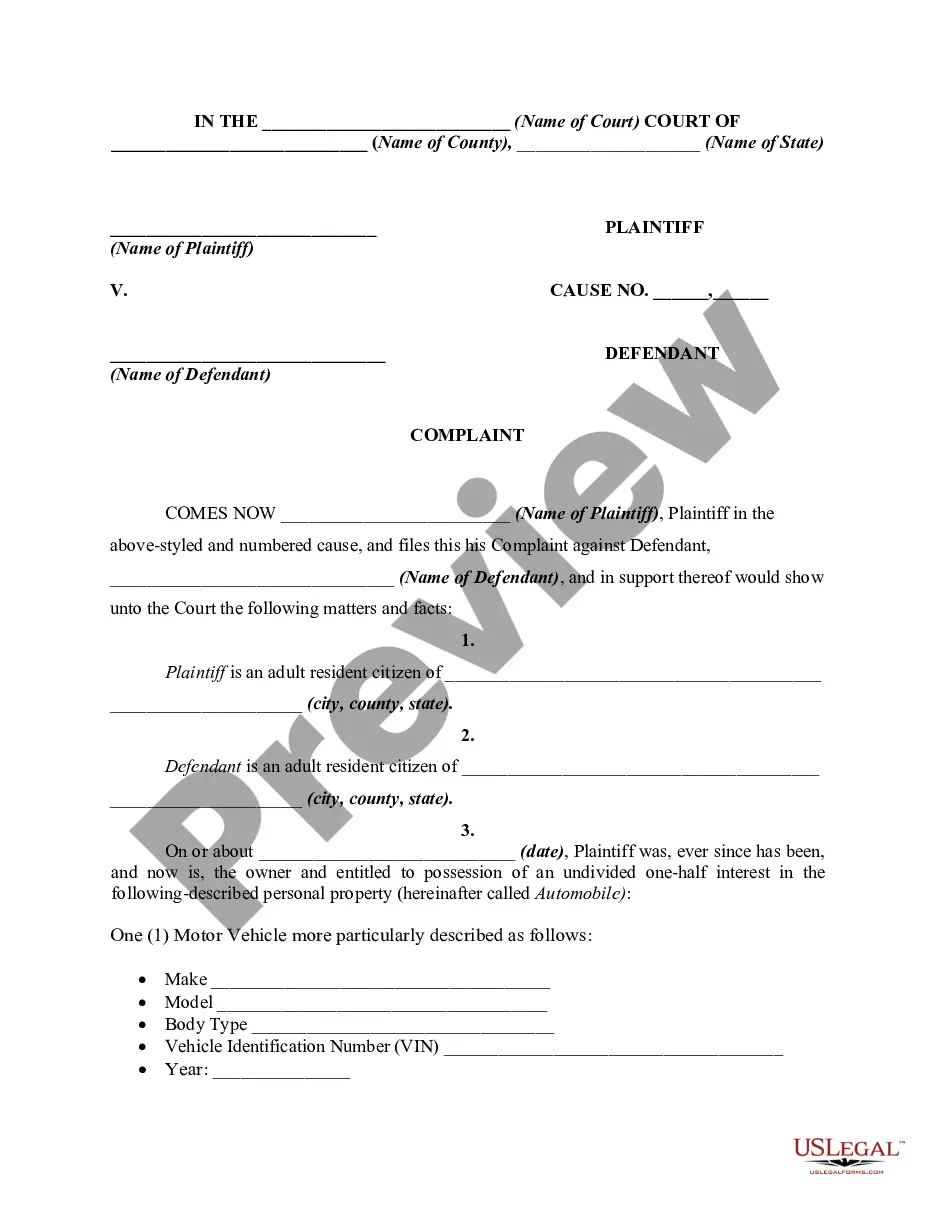

- Very first, make certain you have selected the correct kind for your metropolis/state. It is possible to check out the form while using Preview key and study the form description to guarantee it is the right one for you.

- In the event the kind fails to meet up with your needs, use the Seach area to obtain the correct kind.

- When you are certain the form is proper, click the Purchase now key to find the kind.

- Pick the costs plan you desire and type in the required information and facts. Create your account and purchase your order making use of your PayPal account or bank card.

- Opt for the submit file format and down load the legitimate record format to your gadget.

- Total, revise and print and indication the acquired Mississippi Account Stated Between Partners and Termination of Partnership.

US Legal Forms will be the largest library of legitimate varieties where you will find various record layouts. Utilize the service to down load expertly-produced papers that follow condition needs.

Form popularity

FAQ

How is cash paid out? All payments from the Partnership to Partners are a form of cash transfer, whether you chose to transfer the money via check, ACH, bill pay or Zelle. The method does not matter, as long as it is going from the business Partnership bank account to a Partner or their personal bank account.

Section 708(b)(1)(A) and § 1.708-1(b)(1) of the Income Tax Regulations provide that a partnership shall terminate when the operations of the partnership are discontinued and no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership.

You must file Form 1065, U.S. Return of Partnership Income, for the year you close your business. When you file, you must: Report capital gains and losses on Schedule D (Form 1065).

When a partnership is terminated, each partner must pay taxes on the positive difference between the money distributed to a partner at the termination of the partnership and their basis in the partnership interest just prior to the termination.

In addition to income tax, each individual may need to file IRS forms for self-employment tax, estimated tax and international tax. Are partnership distributions taxable? Because each individual partner pays taxes on their share of the partnership income, they are not taxed on any withdrawals or distributions.

The partnership tax return is generally due by the 15th day of the third month following the end of the tax year. See the Instructions for Form 1065, U.S. Return of Partnership Income.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

When a partnership business is terminated, partners are expected to pay taxes on the taxable gain distributed to them upon liquidation of current and fixed assets.