Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

You can dedicate hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

It is easy to access or print the Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans through the service.

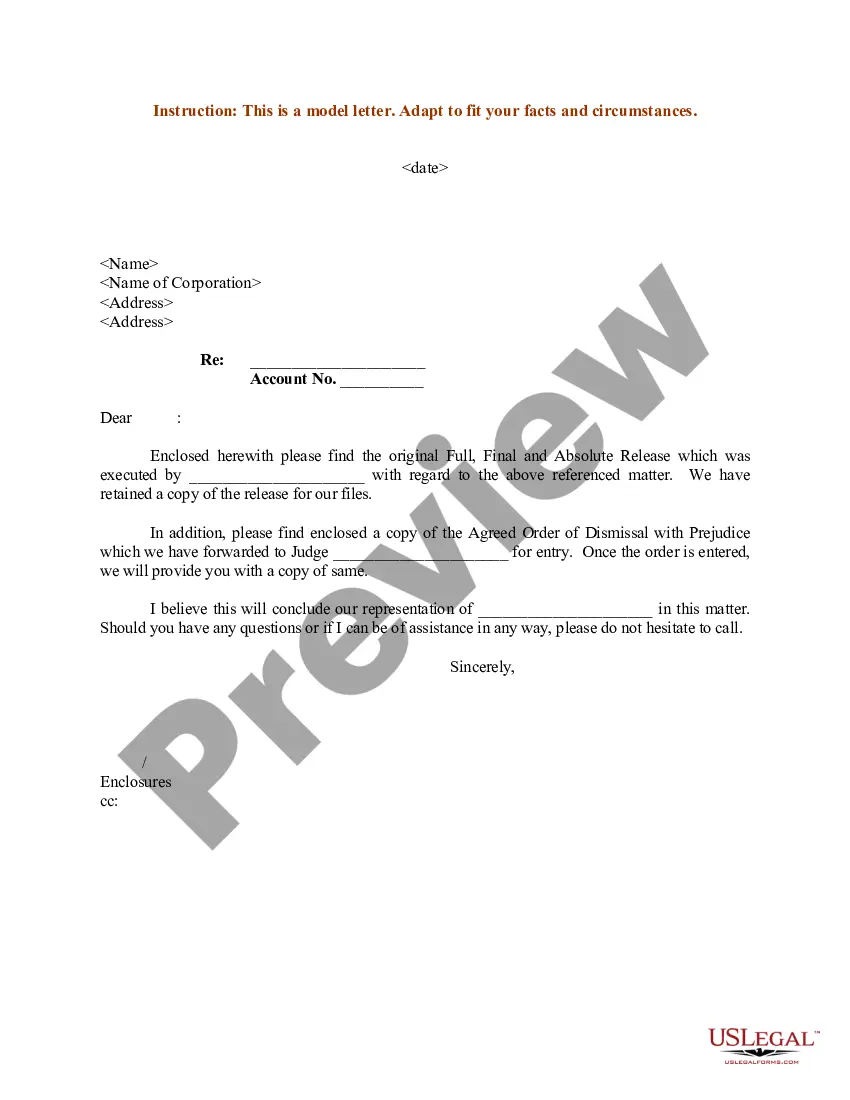

If available, use the Review button to look through the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can fill out, modify, print, or sign the Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, visit the My documents tab and click the relevant button.

- For first-time users of the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city that you choose.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

RFC accounts (Resident Foreign Currency) are bank accounts that can be maintained by resident Indians in foreign currency. These accounts are especially useful for Non Resident Indians (NRI) who return to India and would like to bring back foreign currency from their overseas bank accounts.

Commercial banks are what most people think of when they hear the term "bank." Commercial banks are for-profit institutions that accept deposits, make loans, safeguard assets, and work with many different types of clients, including the general public and businesses.

First-loss Loans or Other GuaranteesIf the project fails to generate sufficient revenue to cover loan payments, a first-loss loan absorbs the loss and leaves other investors protected.

FLDG or 'first loan default guarantee' is an extremely popular term in fintech parlance. Every new-age technology player who wants to partner with large banks or NBFCs offers this guarantee to lenders.

FLDG or 'first loan default guarantee' is an extremely popular term in fintech parlance. Every new-age technology player who wants to partner with large banks or NBFCs offers this guarantee to lenders.

FLDG is an arrangement whereby a third party compensates a lender if the borrower defaults. In an FLDG setup, the credit risk is borne by the loan service provider (LSP) without maintaining any regulatory capital.

A bank is a financial institution licensed to receive deposits and make loans. Banks may also provide financial services such as wealth management, currency exchange, and safe deposit boxes. There are several different kinds of banks including retail banks, commercial or corporate banks, and investment banks.

FLDG is an arrangement whereby a third party compensates a lender if the borrower defaults. In an FLDG setup, the credit risk is borne by the loan service provider (LSP) without maintaining any regulatory capital.

Those that accept deposits from customersdepository institutionsinclude commercial banks, savings banks, and credit unions; those that don'tnondepository institutionsinclude finance companies, insurance companies, and brokerage firms.

Process of NBFC Collaboration between NBFCs and FinTech'sA co-origination scheme agreement needs to be signed by between NBFCF and the FinTech Firm.The FinTech's must sign an Intercorporate deposit agreement with Fund Manager.A separate escrow account must be opened for repayment and disbursement of funds.More items...