Puerto Rico Letter regarding trust money

Description

How to fill out Letter Regarding Trust Money?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print.

By using the website, you can access countless forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of forms like the Puerto Rico Letter regarding trust funds in minutes.

If you already have a monthly membership, Log In and acquire the Puerto Rico Letter regarding trust funds from your US Legal Forms library. The Download button will appear on each document you view. You have access to all previously downloaded documents in the My documents tab of your profile.

Make edits. Complete, modify and print, and sign the downloaded Puerto Rico Letter regarding trust funds.

Each template added to your account does not have an expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you require. Gain access to the Puerto Rico Letter regarding trust funds with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

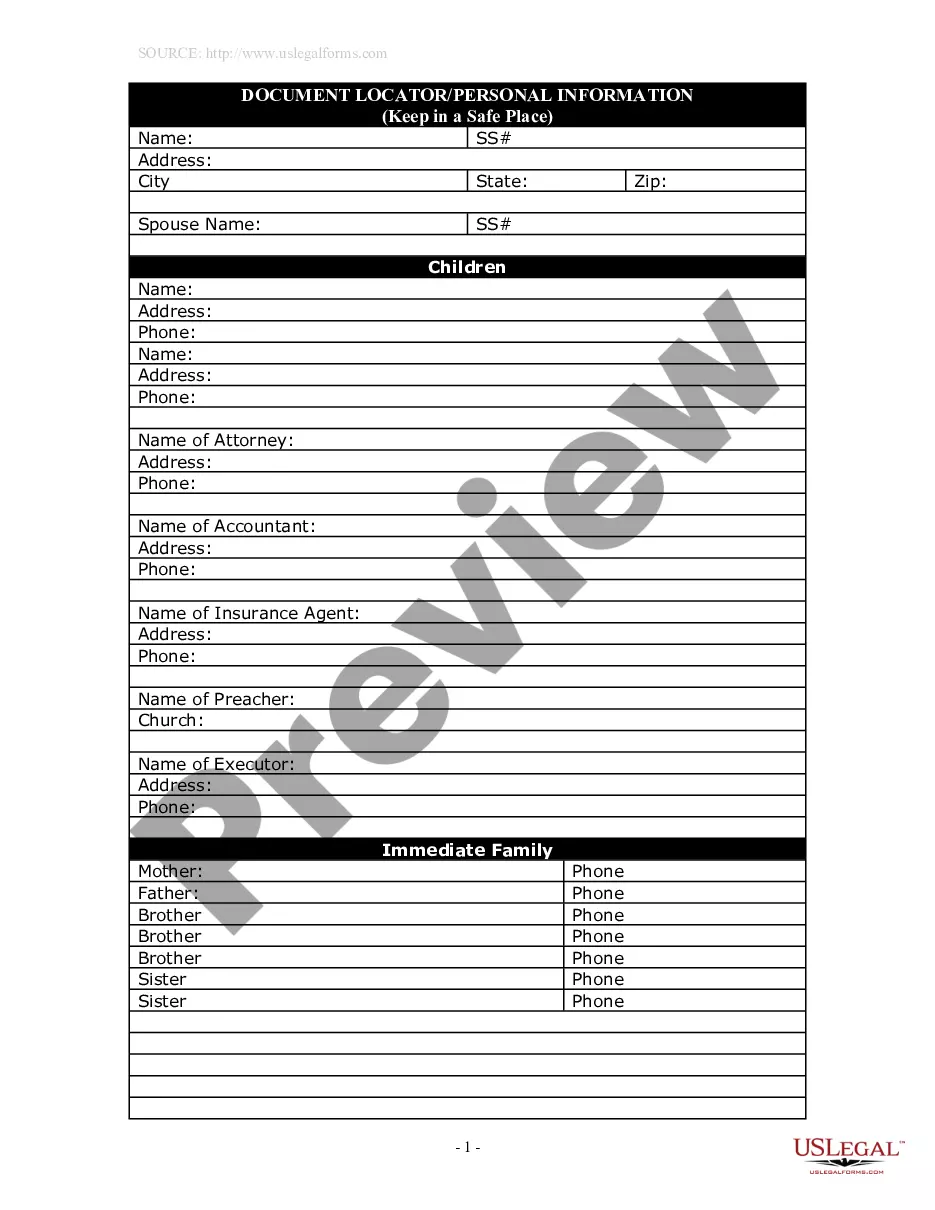

- Ensure you have selected the correct form for your state/region. Click on the Preview button to review the contents of the form. Check the description of the form to confirm that you have selected the correct one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use a credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Schedule K-1 is an IRS tax form that reports a beneficiary's income, credits, and deductions from a trust or estate. For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

Income from a foreign grantor trust is generally taxed to the trust's individual grantor, rather than to the trust itself or to the trust's beneficiaries. For a U.S. owner, this means that the trust's worldwide income would be subject to U.S. tax as if the owner himself earned such income.

Income of a trust that has a tax identification number is reported to that tax identification number with a Form 1099, and a trust reports its income and deductions for federal income tax purposes annually on Form 1041.

Beneficiaries of a trust typically pay taxes on distributions they receive from the trust's income. However, they are not subject to taxes on distributions from the trust's principal.

If a foreign trust has a U.S. owner or beneficiary, U.S. tax reporting will be required. Transfers to, distributions from and annual income and expenses of foreign trusts must be reported on Forms 3520 and 3520-A as appropriate. These are filed annually, and reporting is based on US accounting principles.

You may be required to file Form 8938, Statement of Specified Foreign Financial Assets, to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than certain reporting thresholds.

As a trust domiciled in Puerto Rico, the IRS is, without a doubt, a federal government subcontractor that is subject to this Act.