Mississippi Sample Letter for Explanation of Insurance Rate Increase

Description

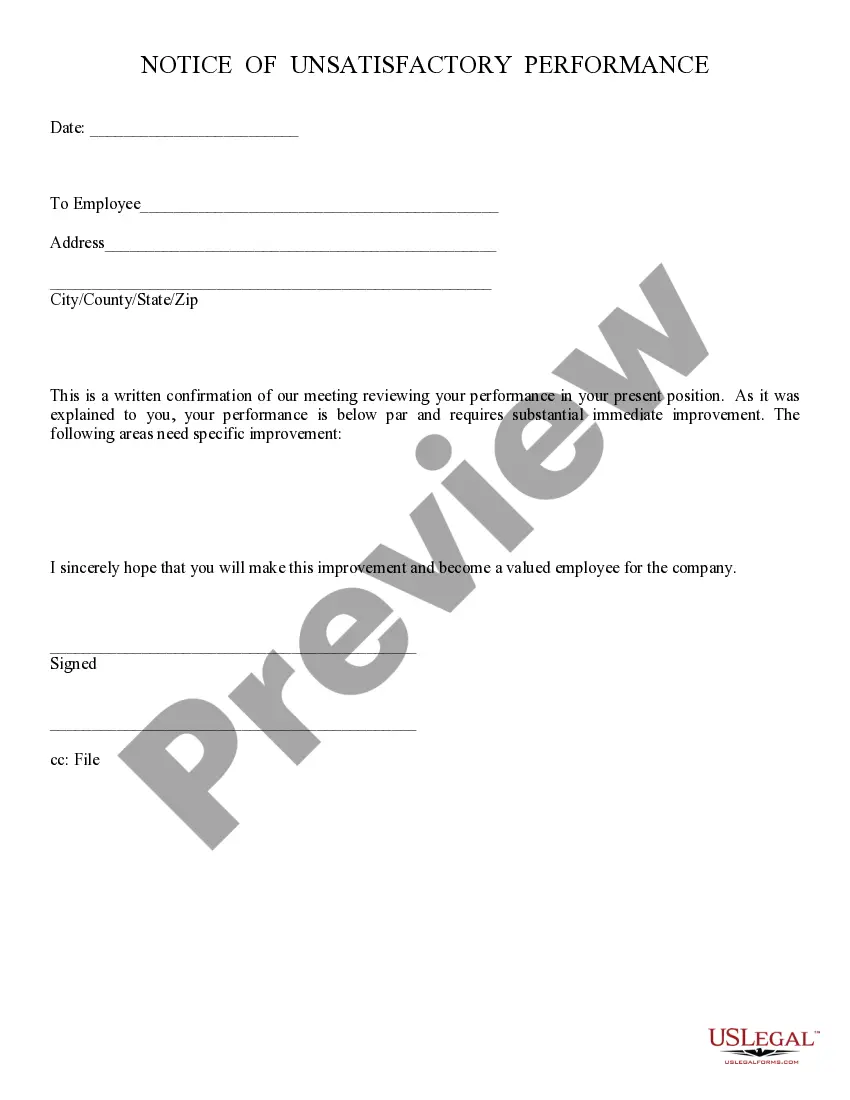

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

If you want to finalize, acquire, or produce authentic document templates, utilize US Legal Forms, the most extensive collection of authentic forms available online.

Employ the site’s straightforward and convenient search feature to locate the documents you require.

Numerous templates for commercial and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have located the form you desire, click on the Purchase now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may utilize your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Mississippi Sample Letter for Explanation of Insurance Rate Increase in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Mississippi Sample Letter for Explanation of Insurance Rate Increase.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the guidelines provided below.

- Step 1. Ensure you have picked the form for your correct city/state.

- Step 2. Use the Review option to browse through the form’s details. Don’t forget to review the specifics.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other forms in the legal document format.

Form popularity

FAQ

Mississippi's high homeowners insurance costs arise primarily from natural disaster risks, including storms and flooding. Insurers factor in these risks when determining overall rates, leading to increased costs for homeowners. If you need help managing these expenses or addressing an increase, the Mississippi Sample Letter for Explanation of Insurance Rate Increase serves as a useful tool in seeking a better understanding of your insurance situation.

Car insurance in Mississippi is often more costly due to high accident rates and a larger number of uninsured drivers on the road. These factors create a riskier environment for insurance companies, which in turn raises premiums. If you need to address a recent spike in your premium, consider utilizing the Mississippi Sample Letter for Explanation of Insurance Rate Increase to seek clarification or potentially lower your rate.

Homeowners insurance rates in Mississippi tend to be high due to various factors, including the state's susceptibility to severe weather events such as hurricanes and floods. Additionally, higher rebuilding costs contribute to these elevated rates. If you find yourself facing a rate increase, using the Mississippi Sample Letter for Explanation of Insurance Rate Increase can help you communicate effectively with your insurer about your concerns.

5 Things That Can Affect Your Auto Insurance RatesCar type. Different types of cars cost differing amounts to insure.Change of residence.New driver on the policy.Vehicle's age.Accidents and violations.01-Nov-2019

Your letter should include:Letter date.Your full name and contact information.Injury date and location.Brief description of the incident, such as car accident or slip and fallThe at-fault party's name and contact information.The at-fault party's insurance policy number, if available.

An insurance company's rates are based upon the claims they pay, operating expenses and profit. The rates you pay as an individual driver/owner are usually based on: The amount of coverage purchased. The amount of the deductible chosen.

Open the main section of the letter with a salutation that includes the name of the insurance company's representative, followed by a colon. Then, skip one line. Write the purpose of your letter in the first paragraph. Use short, clear sentences, and get to the point as quickly as possible.

California law requires insurers to file and justify any proposed health insurance rate change for individual or small group (100 or fewer employees) health insurance policies. The law also requires the California Department of Insurance (CDI) to review those rate changes and publish them on our web site.

7 Tips for Writing a Demand Letter To the Insurance CompanyStep 1 of 2. 50%Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

To summarize, do not forget to include the following:Your first and last name.Contact details.Date.Name of the insurance company.Name of the contact person, if available.The subject of the letter.The parts listed in the table above.Enclosed copies of supporting documentation.