Under the Fair Credit Reporting Act, whenever credit or insurance for personal, family, or household purposes, or employment involving a consumer is denied, or the charge for such credit or insurance is increased, either wholly or partly because of information contained in a consumer report from a consumer reporting agency, the user of the consumer report must:

notify the consumer of the adverse action,

identify the consumer reporting agency making the report, and

notify the consumer of the consumer's right to obtain a free copy of a consumer report on the consumer from the consumer reporting agency and to dispute with the reporting agency the accuracy or completeness of any information in the consumer report furnished by the agency.

Mississippi Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

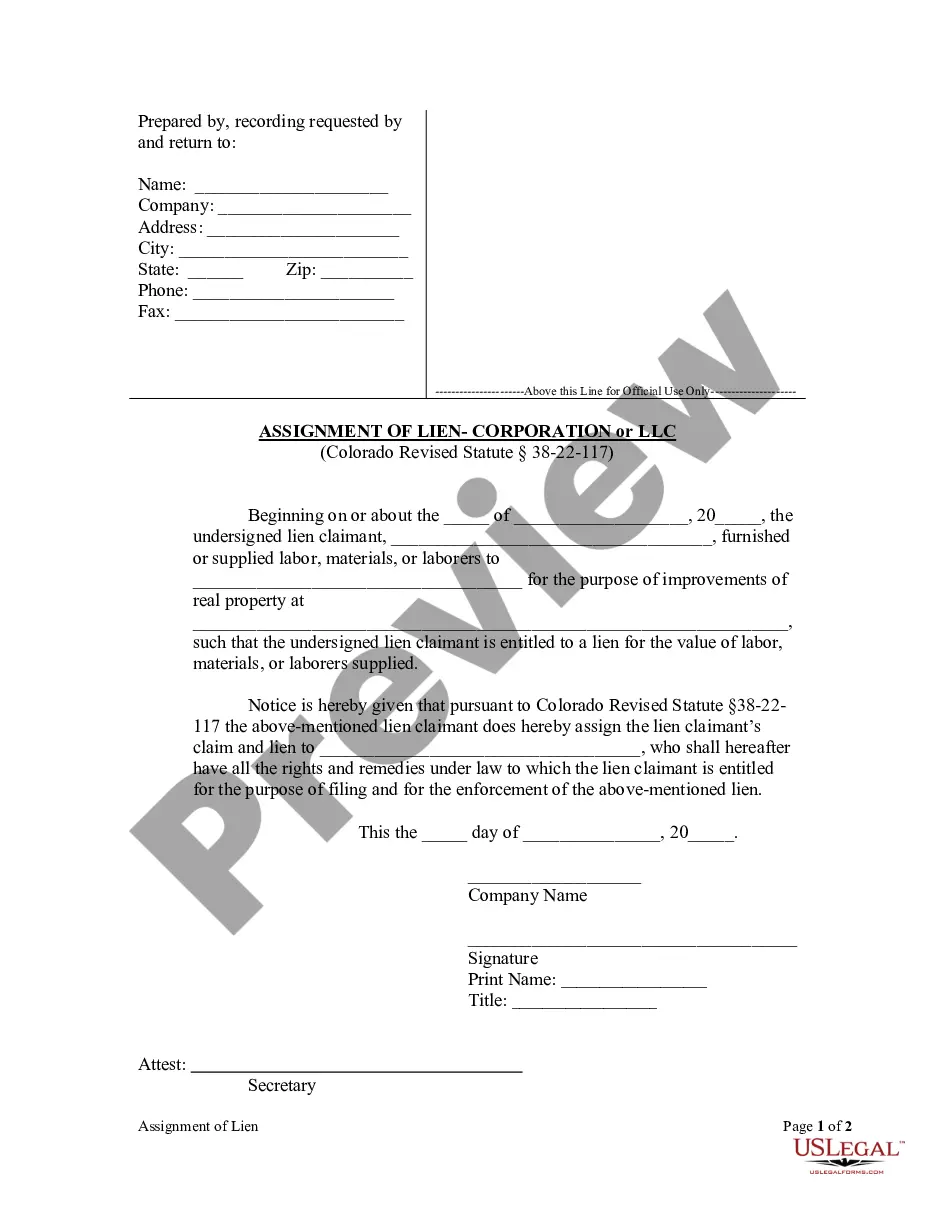

Choosing the right legal papers format could be a have a problem. Of course, there are a variety of web templates available online, but how would you get the legal type you need? Make use of the US Legal Forms website. The support gives a large number of web templates, for example the Mississippi Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency, which can be used for company and personal requirements. All of the kinds are examined by professionals and meet federal and state specifications.

Should you be currently signed up, log in for your account and click on the Acquire button to have the Mississippi Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency. Use your account to appear throughout the legal kinds you possess purchased formerly. Go to the My Forms tab of your account and have one more duplicate in the papers you need.

Should you be a new end user of US Legal Forms, listed here are basic instructions that you can follow:

- Very first, be sure you have chosen the right type to your area/region. It is possible to check out the form utilizing the Review button and look at the form description to make sure it will be the best for you.

- In the event the type does not meet your requirements, utilize the Seach discipline to obtain the appropriate type.

- When you are certain that the form is acceptable, click the Buy now button to have the type.

- Choose the prices program you want and enter the needed details. Make your account and purchase the transaction with your PayPal account or Visa or Mastercard.

- Opt for the submit file format and acquire the legal papers format for your system.

- Full, revise and printing and indication the received Mississippi Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency.

US Legal Forms is definitely the most significant local library of legal kinds where you can discover numerous papers web templates. Make use of the company to acquire expertly-created documents that follow express specifications.

Form popularity

FAQ

An insurer shall deliver to the insured either (1) an offer of renewal of the policy 45 days before the policy expiration contingent upon payment of premium as stated in the offer, and which states any reduction of limits or elimination of coverage, or (2) a notice of nonrenewal 75 days prior to the expiration that ...

Section 603(d) defines a consumer report to include information about a consumer such as that which bears on a consumer's creditworthiness, character, and capacity among other factors. Communication of this information may cause a person, including a financial institution, to become a consumer reporting agency.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

Section 623(a)(1)(B). If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information reported by the furnisher, the furnisher may not subsequently report that information to a CRA without providing notice of the dispute.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

As of January 1, 2014, most U.S. citizens and legal residents are required by law to have qualifying health care coverage or pay an annual tax penalty for every month they go without insurance.

Section 623 (a)(3) of the FCRA states that ?if the completeness or accuracy of any information furnished by any person to any consumer reporting agency is disputed to such person by a consumer, the person may not furnish the information to any consumer reporting agency without notice that such information is disputed ...

Section 628 - Properly dispose of consumer information to protect the confidentiality of the information -- go to Section 628. Section 629 - Prevents consumer reporting agencies from circumventing the law -- Section 629.