Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

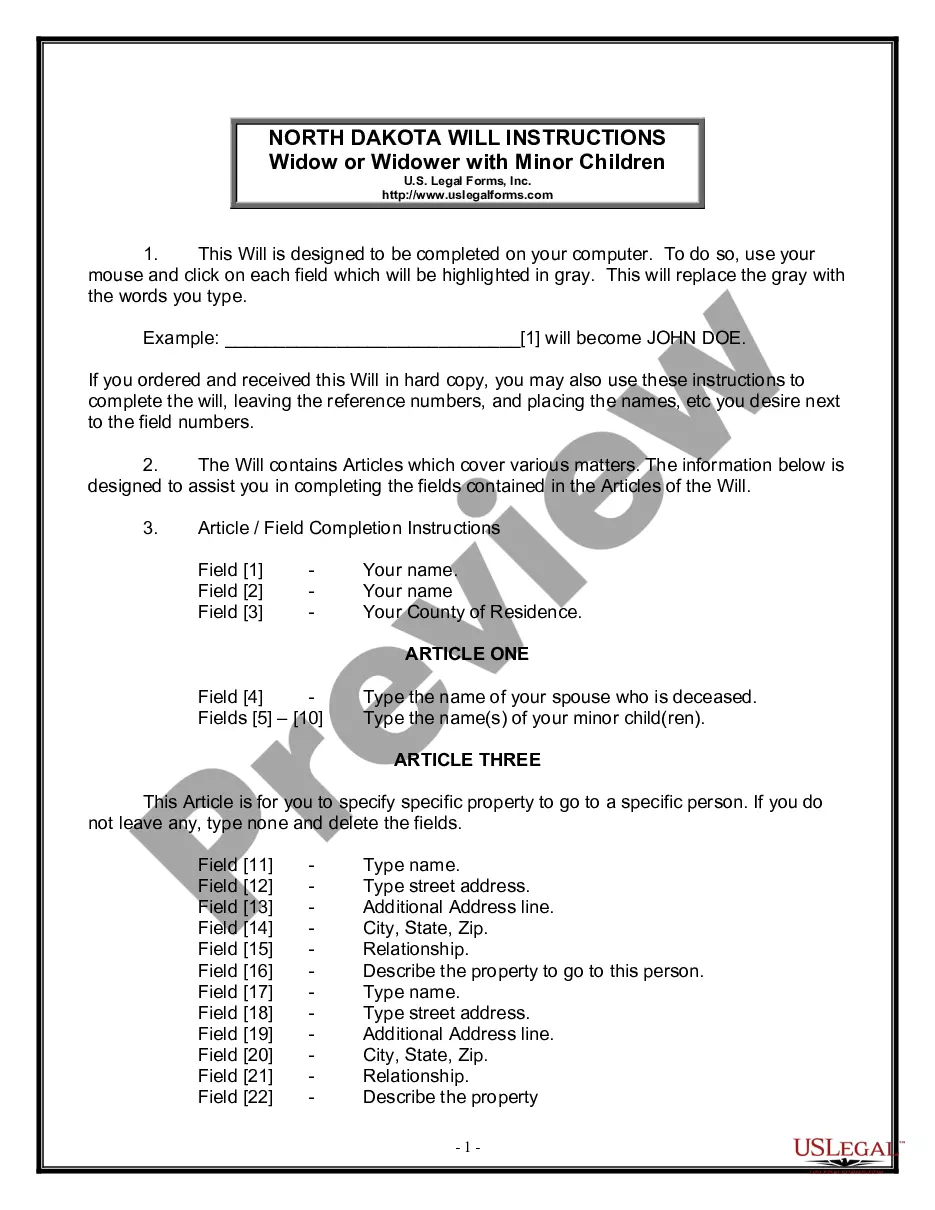

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

Finding the correct authentic document template can be a challenge.

Of course, there is a variety of templates accessible online, but how can you locate the authentic form you need.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your region/county. You can browse the form using the Review button and check the form details to confirm this is the right one for you.

- The service provides numerous templates, such as the Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, which can be used for both business and personal purposes.

- All templates are verified by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

- Use your account to review the legal documents you have previously ordered.

- Visit the My documents tab in your account to source another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

Form popularity

FAQ

The transfer of partnership interest to another partner involves one partner relinquishing their share, which is then taken over by another existing partner. This process is often governed by partnership agreements and may require consent from other partners. A Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment serves as a vital tool in documenting this transfer, thus ensuring that all parties are aware of their updated rights and responsibilities within the partnership.

A silent partnership agreement involves a partner who invests capital into the business but does not participate in its daily operations or management. These silent partners typically receive a share of the profits while limiting their involvement in decision-making processes. Drafting a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can help clarify the roles of silent partners and ensure everyone understands their rights and responsibilities, promoting a balanced partnership.

A limited partnership agreement governs the relationships between general partners and limited partners, which includes specific roles and liability limitations. In contrast, a shareholder agreement pertains to relationships among shareholders in a corporation, focusing on stock ownership and transfer. Both agreements play critical roles in partnership operations, but a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment is specific to partnership contexts, ensuring clarity in ownership transfer.

sell agreement, or restriction agreement, is specifically designed to prevent a partner from selling their interest without the other partners' consent. This type of agreement promotes harmony among partners and protects business interests. By implementing a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, partners can define their roles and establish clear guidelines prior to needing to sell or transfer interests.

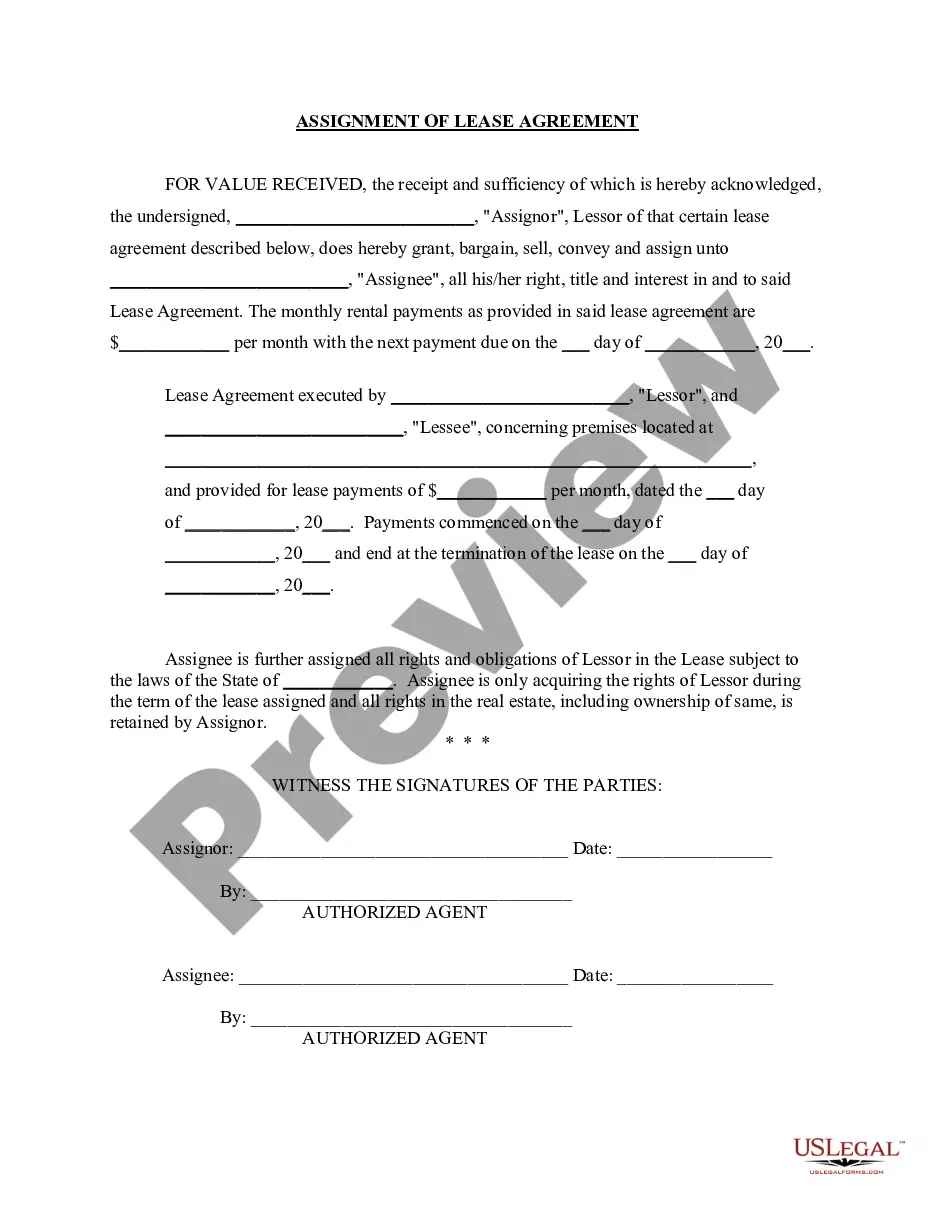

The assignment of partnership interest agreement is a legal document that allows a partner to transfer their stake in the partnership to another individual or entity. This document outlines the terms and conditions of the transfer, including rights and obligations. Utilizing a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment ensures that all parties are informed and protected during this transition. This agreement can lead to smoother operations and enhanced partner relationships.

A partnership can exist without a formal written agreement, commonly known as a general partnership. In this arrangement, partners share profits, losses, and responsibilities based on the default laws of the state. It's important to note that even without an explicit agreement, partnership laws still govern interactions and obligations among partners. Creating a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can provide more clarity and structure.

To transfer a partnership interest effectively, you will need a formal document, commonly referred to as a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. This form contains the details of the transfer, including terms of sale and rights of the new partner. It serves as a vital record for both legal and tax purposes. Consider using uslegalforms to access this template easily and ensure your transfer complies with legal requirements.

The sale of a partnership interest is typically treated as a transfer of ownership. This transaction can have tax implications, depending on the nature of the partnership and local regulations. By preparing a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, you establish a clear record of the sale. Consulting with a tax professional can help you navigate any potential tax impacts.

Selling a limited partnership interest involves drafting a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. This legal document outlines the sale's terms, ensuring all necessary legal standards are met. It is important to notify all partners and possibly obtain their consent, depending on the partnership agreement. Use our platform to facilitate this process, ensuring each step is clear and compliant.

When someone purchases a partnership interest, they generally acquire a share of the partnership's assets, liabilities, and profits. This transition often requires creating a Mississippi Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. The purchasing partner steps into the shoes of the selling partner, gaining rights and responsibilities in line with the partnership agreement. It is crucial to update all partnership documents to reflect this change.