Mississippi Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

Are you currently situated in a location where you require documents for either business or personal reasons nearly every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms provides a vast selection of form templates, such as the Mississippi Assignment of Partnership Interest, designed to meet state and federal requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and make the payment using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- After that, you will be able to download the Mississippi Assignment of Partnership Interest template.

- If you do not have an account and wish to begin using US Legal Forms, follow these procedures.

- Obtain the form you need and ensure it is for the correct city/state.

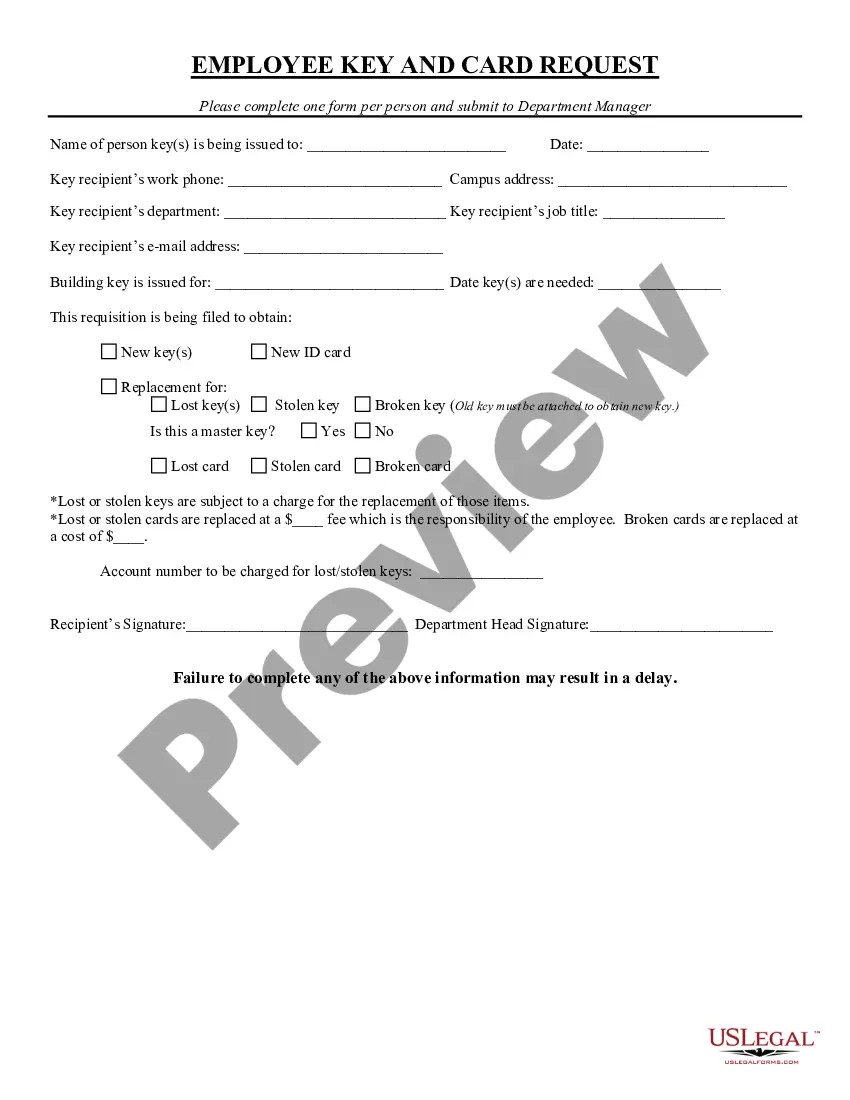

- Use the Preview button to review the document.

- Check the details to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, utilize the Search section to find the form that fits your needs and criteria.

- Once you find the correct form, click Get now.

Form popularity

FAQ

A Section 751 gain occurs when a partner sells their interest in a partnership, which may involve unrealized receivables or inventory. This gain should be reported on the partner’s individual tax return, specifically on IRS Form 8949 and Schedule D. Understanding how a Mississippi Assignment of Partnership Interest relates to reporting requirements is key for compliance. Utilizing platforms like US Legal Forms can provide the needed insights for precise reporting.

Yes, the sale of partnership interest is typically reported on Schedule K-1 of IRS Form 1065. When a partner sells their interest, the transaction may affect the partnership’s capital accounts and allocations of income, deductions, and credits. A Mississippi Assignment of Partnership Interest ensures that all parties are aware of how these sales are recorded. Ensure you have the right documentation and support to accurately report the sale.

Yes, the transfer of partnership interest can have tax implications, including potential capital gains tax. Specifically, a Mississippi Assignment of Partnership Interest may trigger taxable events depending on the situation. It’s essential to consult a tax professional to understand how the transfer could impact your tax obligations. Tools and resources on platforms like US Legal Forms can help guide you through the financial considerations.

The assignment of interest refers to the legal process of transferring a partner's interest in a partnership to another individual or entity. Within the context of a Mississippi Assignment of Partnership Interest, this document details what is being transferred, including any share of profits, losses, and decision-making power. Understanding this process is crucial for maintaining partnership dynamics and ensuring compliance. Using reliable resources can help clarify any complexities associated with the assignment.

Transferring ownership interest in a partnership typically involves an assignment document that clearly states the details of the transfer. The Mississippi Assignment of Partnership Interest should outline the rights and obligations of the new partner. Both the existing partners and the new partner usually must agree to the transfer, ensuring a smooth transition. For a formal approach, using a service like US Legal Forms simplifies the process, providing you with templates and guidance.

The conflict of interest rule in Mississippi requires professionals to disclose any potential conflicts that could impact their objectivity. This rule is designed to protect the integrity of partnerships and uphold trust among partners. When dealing with Mississippi Assignment of Partnership Interest, understanding and adhering to this rule is essential for responsible governance and decision-making.

The 1.15 rule of professional conduct in Mississippi requires attorneys to safeguard client funds and property. It emphasizes the importance of maintaining clear boundaries between personal and client interests. This rule is particularly relevant when handling transactions involved in Mississippi Assignment of Partnership Interest, as it helps ensure that clients' rights and interests are prioritized.

Mississippi Code 25 4 105 pertains to the ethical standards governing public officials, particularly regarding conflicts of interest. This law aims to prevent situations where personal financial interests may conflict with official responsibilities. Understanding this code is essential for individuals involved in Mississippi Assignment of Partnership Interest to ensure compliance and maintain ethical practices.

A typical conflict of interest policy outlines guidelines for identifying and managing conflicts when they arise. Such policies often mandate that partners disclose any potential conflicts before engaging in transactions related to Mississippi Assignment of Partnership Interest. Implementing a clear policy can help promote transparency and foster trust among partners.

The standard for conflict of interest revolves around a situation where personal interests might interfere with professional duties. In the context of Mississippi Assignment of Partnership Interest, it is crucial to avoid any actions that could compromise the decision-making process or the duty owed to the partnership. Adhering to these standards ensures that all partners act in the best interest of the partnership as a whole.