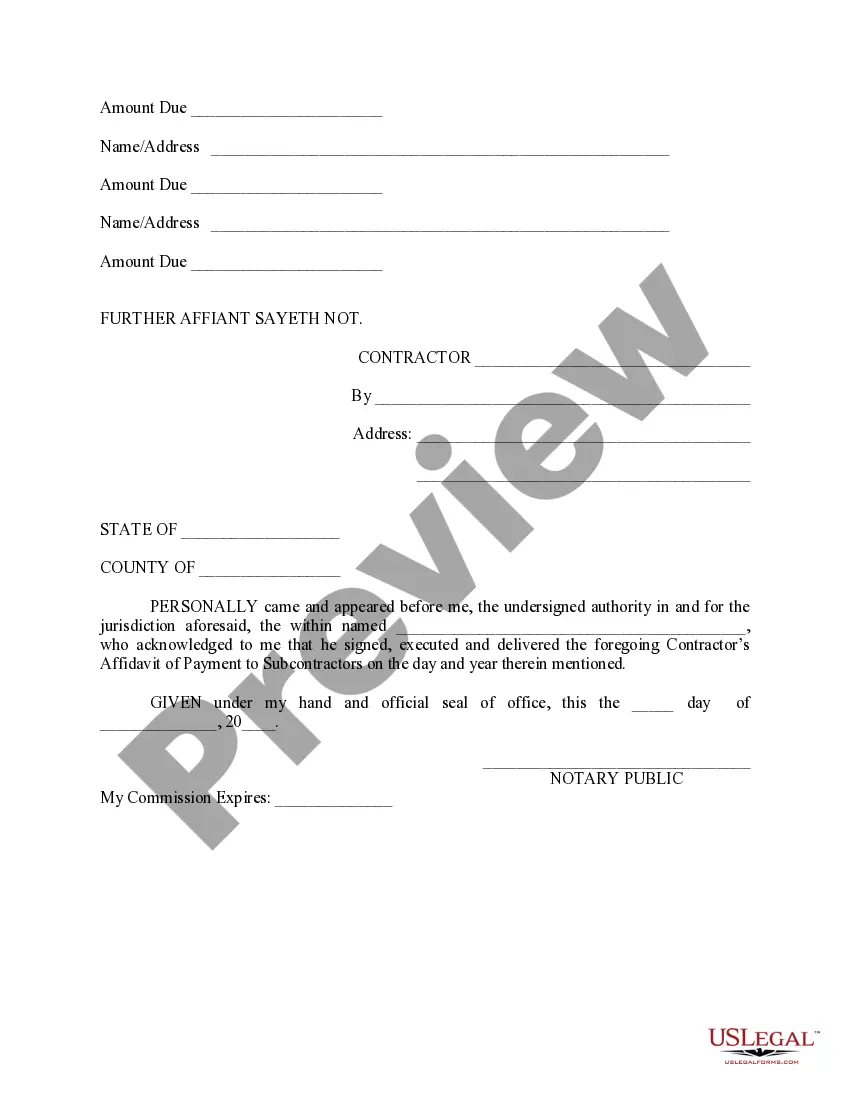

Mississippi Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

Have you ever found yourself in a situation where you require documents for both professional or personal purposes almost every day.

There are numerous legitimate document templates available online, but locating versions you can rely on is not straightforward.

US Legal Forms offers thousands of document templates, including the Mississippi Contractor's Affidavit of Payment to Subs, which are designed to satisfy state and federal requirements.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Mississippi Contractor's Affidavit of Payment to Subs at any time if needed; just select the necessary form to download or print the document format.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Mississippi Contractor's Affidavit of Payment to Subs template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the appropriate city/county.

- Utilize the Review button to examine the document.

- Verify the details to ensure you have selected the correct form.

- If the form is not what you're seeking, use the Search field to find the one that suits your requirements.

- Once you find the right form, click Buy now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

Subcontracting and TaxesSubcontractors may qualify for certain tax deductions that can be claimed on their business expenses. These expenses have to be ordinary and necessary for the operation of a self-employed business.

You can claim:Fuel costs.Repairs and servicing costs.Maintenance costs.Interest owed on the vehicle loan.Insurance premiums related to the vehicle.Payments on any lease agreements for the vehicle.Registration costs.Depreciation.

6 Tips for Dealing With Subcontractor DefaultPrequalify Your Subs. Before you take pricing or solicit bids from subcontractors you need to make sure they are capable of completing the work, both physically and financially.Know the Signs.Craft a Plan.Put It in a Contract.Protect Yourself.Termination of Contract.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

6 Tips for Dealing With Subcontractor DefaultPrequalify Your Subs. Before you take pricing or solicit bids from subcontractors you need to make sure they are capable of completing the work, both physically and financially.Know the Signs.Craft a Plan.Put It in a Contract.Protect Yourself.Termination of Contract.

Subcontractor Costs means all costs incurred by subcontractors for the project, including labor and non-labor costs.

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

Independent subcontractors regularly purchase materials and equipment related to their specific projects. Expenses for materials necessary for completion of a job may be directly deducted from taxable income on your tax return.

A subcontractor is a person who works for a contractor. A contractor is a person or company who works with businesses on a contract basis and is paid for completing projects. Like contractors, subcontractors are self-employed, and they can help contractors on projects that require additional help or skills to complete.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.