Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

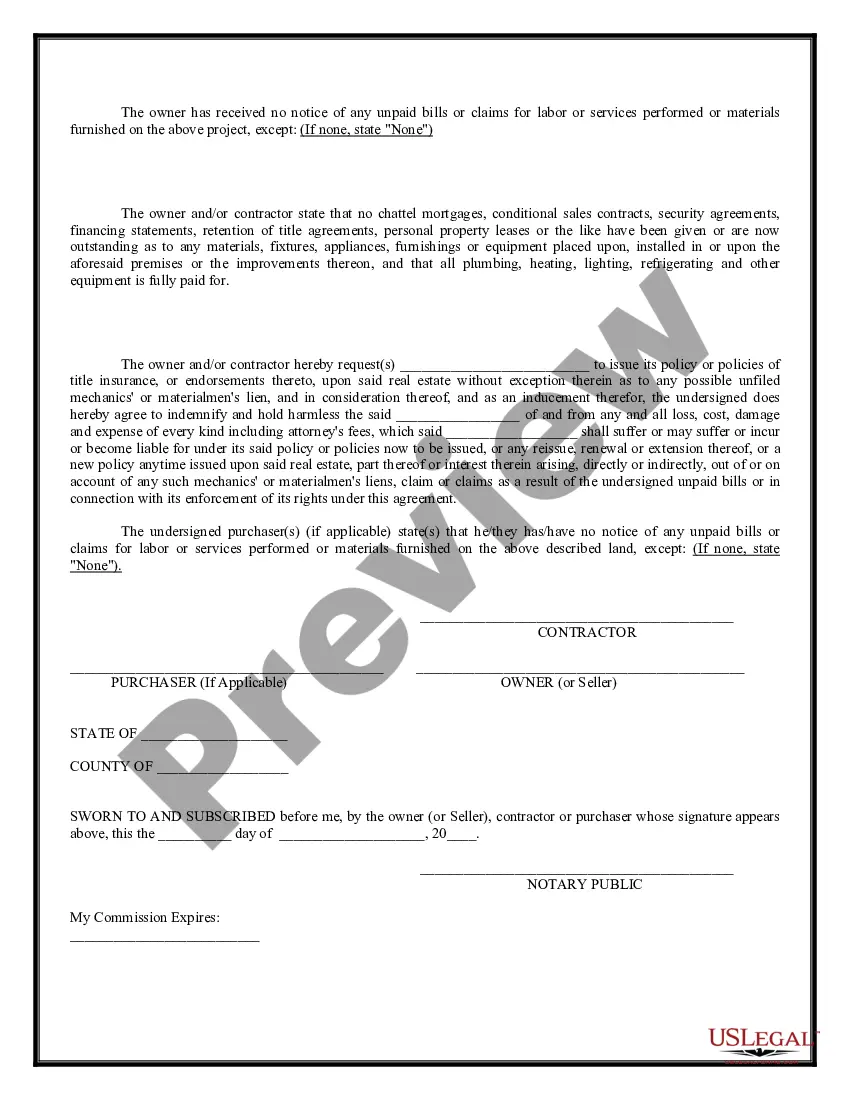

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

You can spend hours online searching for the authentic legal document template that accommodates the federal and state regulations you need. US Legal Forms offers an extensive collection of legal forms that are examined by experts.

You can obtain or print the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors from this service.

If you already possess a US Legal Forms account, you may Log In and select the Obtain option. Subsequently, you can fill out, modify, print, or sign the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. Every legal document template you purchase is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Select the format of the document and download it to your device. Make any necessary changes to your document. You can complete, modify, sign, and print the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. Obtain and print a vast array of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire another copy of a purchased form, navigate to the My documents tab and select the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure that you have selected the correct document template for your desired area/city. Review the form description to confirm you have chosen the right type.

- If available, utilize the Review option to examine the document template as well.

- If you wish to find another version of the form, use the Lookup field to locate the template that meets your needs and specifications.

- Once you have found the template required, click on Acquire now to proceed.

- Choose the pricing plan you need, fill in your credentials, and register for an account on US Legal Forms.

Form popularity

FAQ

The individual income tax rate in Mississippi varies based on income level and ranges from 0% to 5%. This rate influences the financial decisions of both residents and contractors alike. As contractors complete projects, they must also consider how the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors impacts their overall tax obligations. This awareness helps in better financial planning for the future.

In Mississippi, an MPC refers to a Master Project Completion document that outlines a contractor's completion of a project. This document plays a vital role when filing the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. It serves as proof that all parties met their obligations, including payments to subcontractors. Familiarizing yourself with the MPC process can streamline project completion.

An MPC number is a unique identifier assigned to contractors in Mississippi for tracking purposes. When contractors file the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, they use this number to ensure accurate documentation. This number aids in verifying that all subcontractors receive their payments on time. It's essential for maintaining organized and compliant project records.

The MPC tax refers to the Mississippi Project Completion tax, which is a tax implemented for construction projects. When contractors submit the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, they ensure compliance with this tax. This requirement helps maintain transparency in the payment process for subcontractors and protects their rights. Understanding this tax is crucial for contractors operating in Mississippi.

The two-year contractor rule typically refers to the period within which a homeowner can file a claim against the contractor for defects or incomplete work. Understanding this timeframe is crucial for protecting your interests. Having documentation like the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can strengthen your position if disputes arise. Staying informed helps you make timely decisions regarding your contractor relationships.

Avoid making statements that imply a lack of trust or confidence in their work, which can strain the relationship. Refrain from saying things like 'I just need this done quickly' without discussing quality standards, as it may undermine their commitment. It's advisable to communicate concerns constructively and reference agreements, such as the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, to maintain a positive dialogue.

Avoid making vague requests or demands regarding project timelines and costs. Specific details help maintain clear communication. Additionally, refrain from discussing budget limits that could lead to misunderstandings. Instead, focus on the expectations laid out in official documents like the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors to ensure clarity.

Yes, it is common for contractors to request a down payment of 50% before starting work. This helps cover initial costs for materials and labor. However, it is important to ensure that you have a written agreement in place, such as the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, to protect both parties. This document clarifies payment schedules and completion expectations.

An affidavit holds considerable weight in legal matters as it is a sworn statement made under oath. Specifically, the Mississippi Owner's and Contractor Affidavit of Completion and Payment to Subcontractors provides a reliable form of evidence in disputes regarding payments. The strength of an affidavit stems from its ability to be used in court, should any issues arise, making it a crucial document for construction projects.

In Texas, an affidavit of completion is not mandated by law, but it is highly recommended for protecting all parties involved. Unlike in Mississippi, where the Owner's and Contractor Affidavit of Completion and Payment to Subcontractors serves a specific purpose, Texas allows more flexibility. Using such affidavits can still ensure clarity and security in payment practices.