Mississippi Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Chapter 13 Plan?

Obtain a printable Mississippi Chapter 13 Plan in just a few clicks from the most extensive collection of legal electronic documents.

Locate, download, and print expertly crafted and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of economical legal and tax templates for US citizens and residents online since 1997.

After downloading your Mississippi Chapter 13 Plan, you can complete it in any online editor or print it out and fill it out manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Clients who already possess a subscription must sign in to their US Legal Forms account, retrieve the Mississippi Chapter 13 Plan, and view it saved in the My documents section.

- Individuals without a subscription must adhere to the instructions outlined below.

- Ensure your document complies with your state's regulations.

- If accessible, review the form's description for further information.

- If available, preview the form to uncover more details.

- Once you are assured the form is appropriate for you, click on Buy Now.

- Establish a personal account.

- Choose a plan.

- Make a payment via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

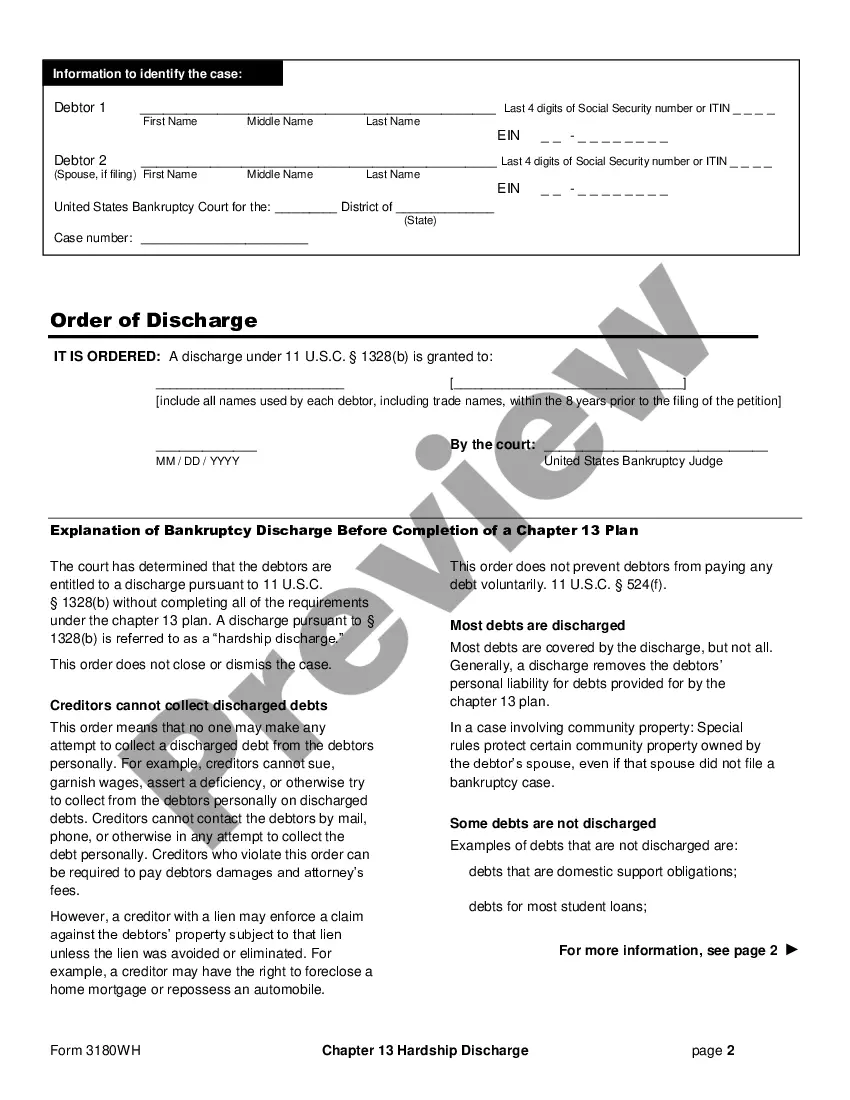

Debts dischargeable in a chapter 13, but not in chapter 7, include debts for willful and malicious injury to property (as opposed to a person), debts incurred to pay nondischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

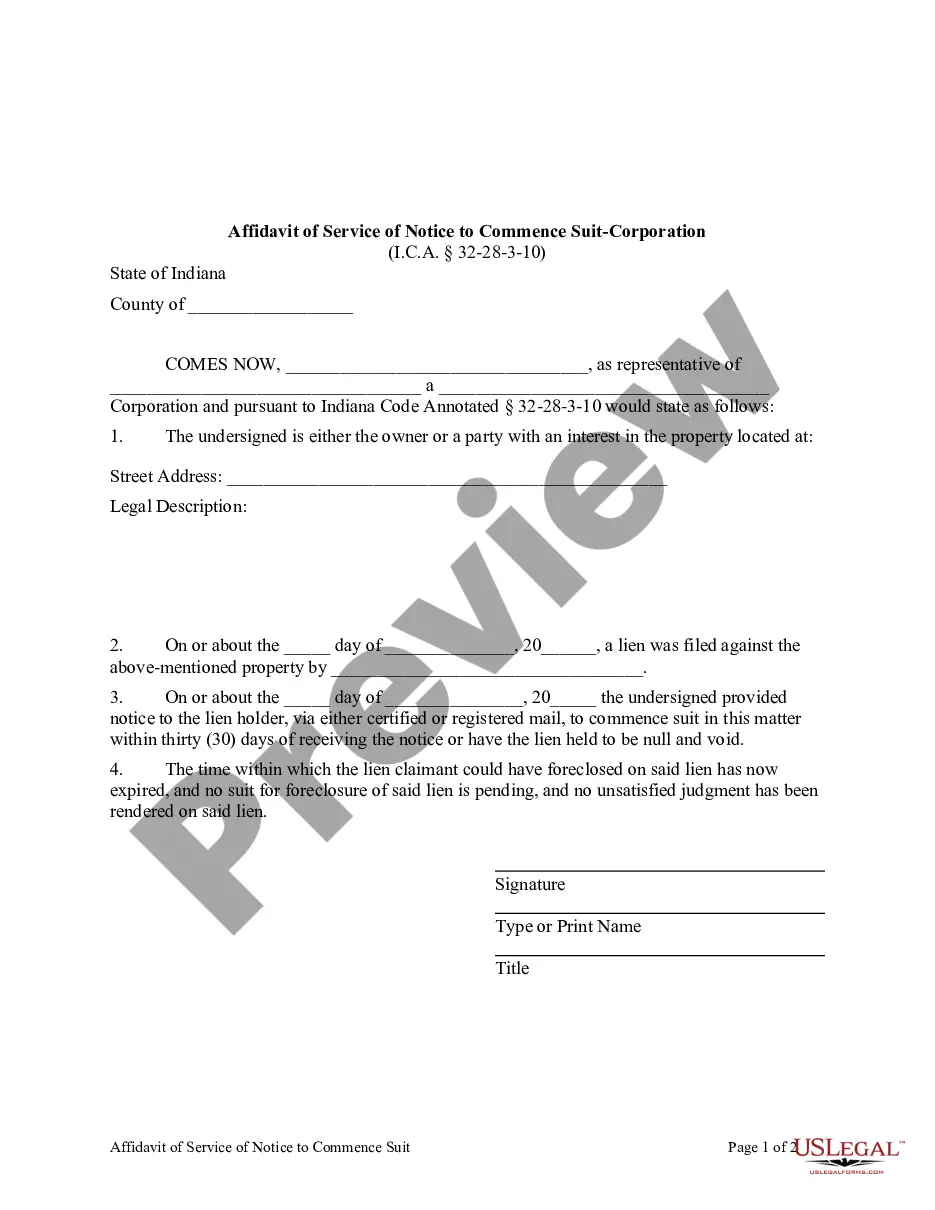

A person may file under Chapter 13 repeatedly unless prohibited by the court, while filings under Chapter 7 may occur only every six years.

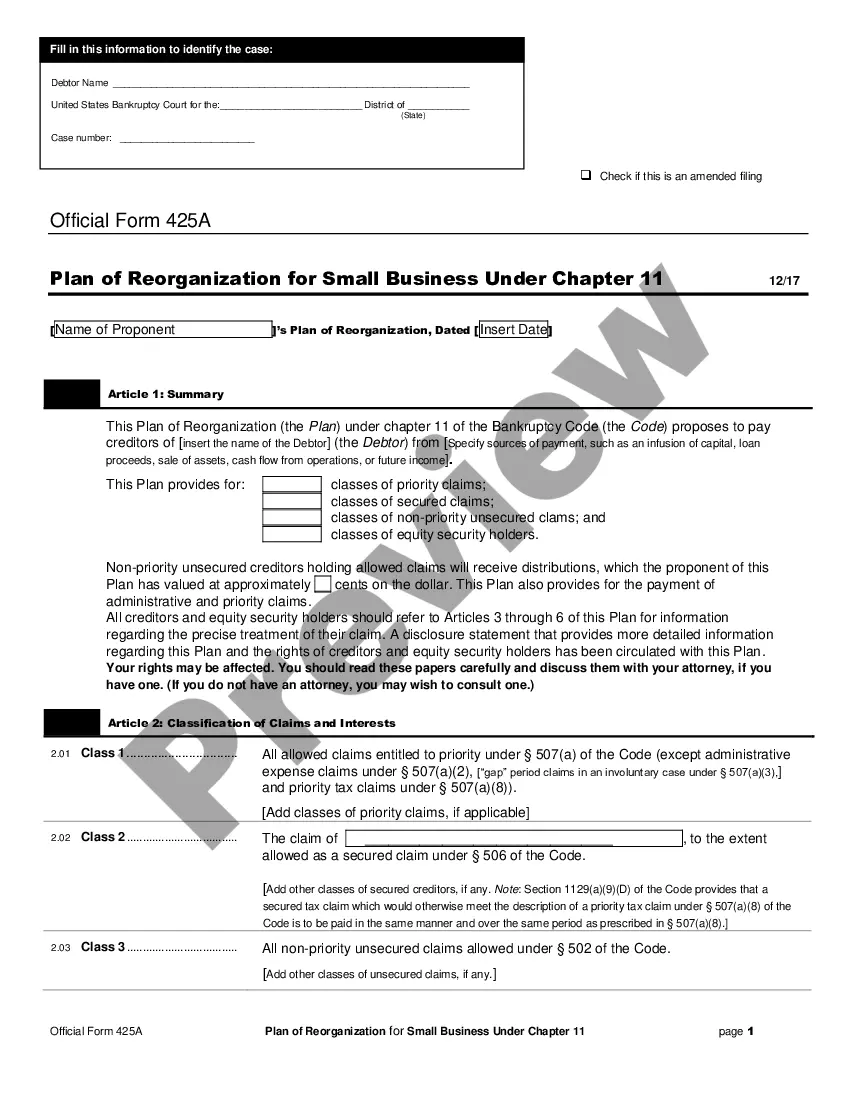

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.

Debts arising out of willful and malicious damage to property. debts used to pay nondischargeable tax obligations.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

The Section 109(e) Chapter 13 unsecured debt limit of $419,275 includes the total of all amounts owed by an individual on credit cards, medical bills, lines of credit, unsecured taxes, and other debts not secured by collateral.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.