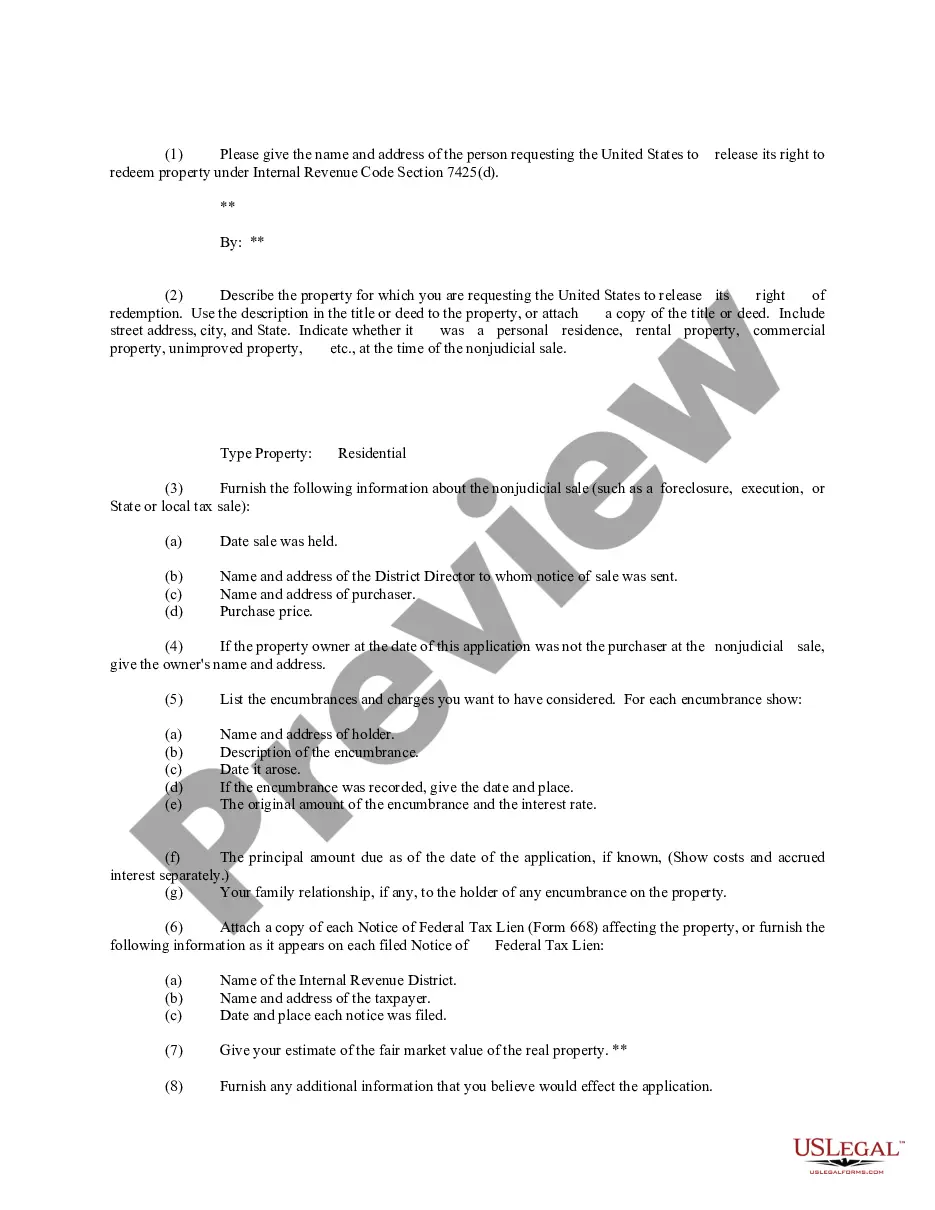

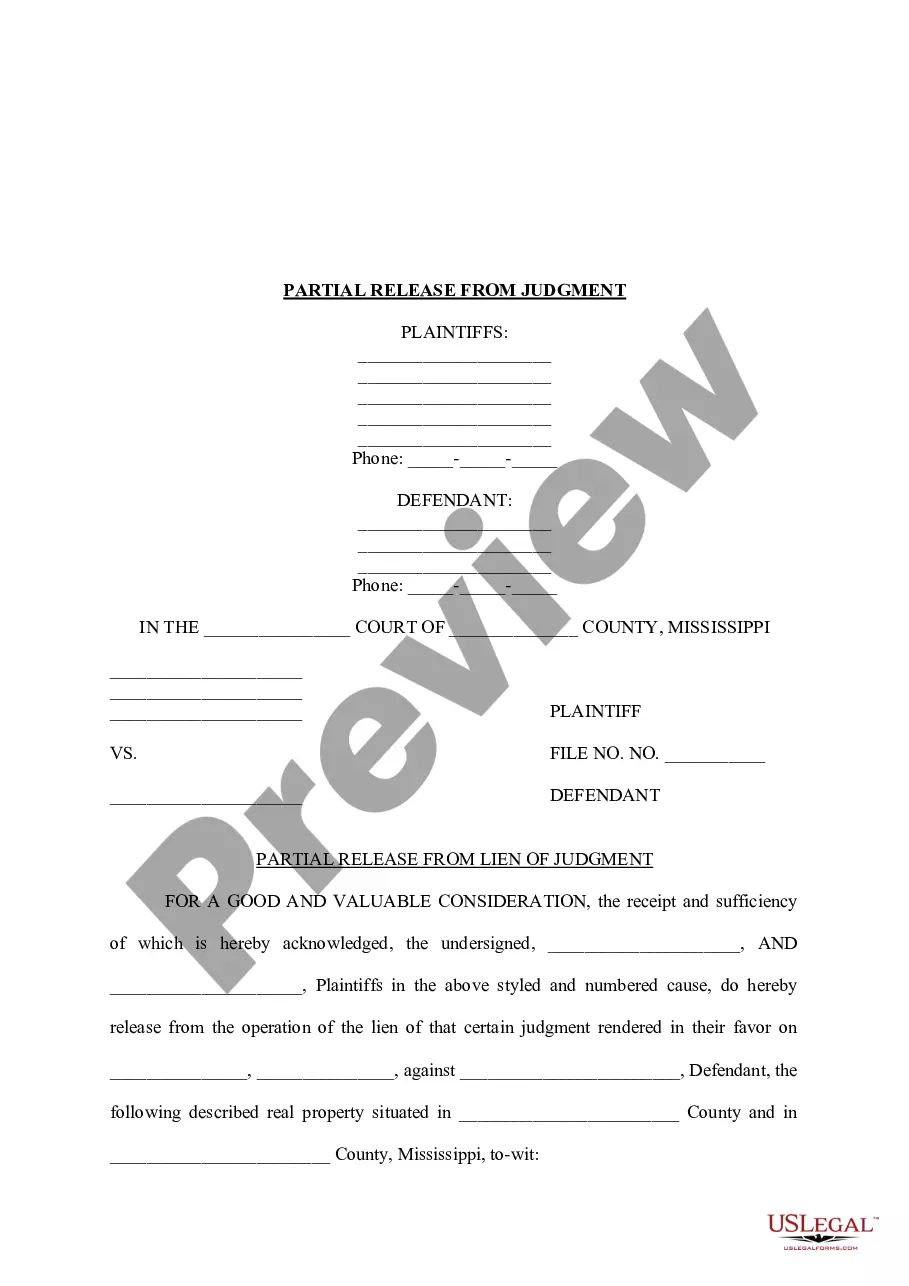

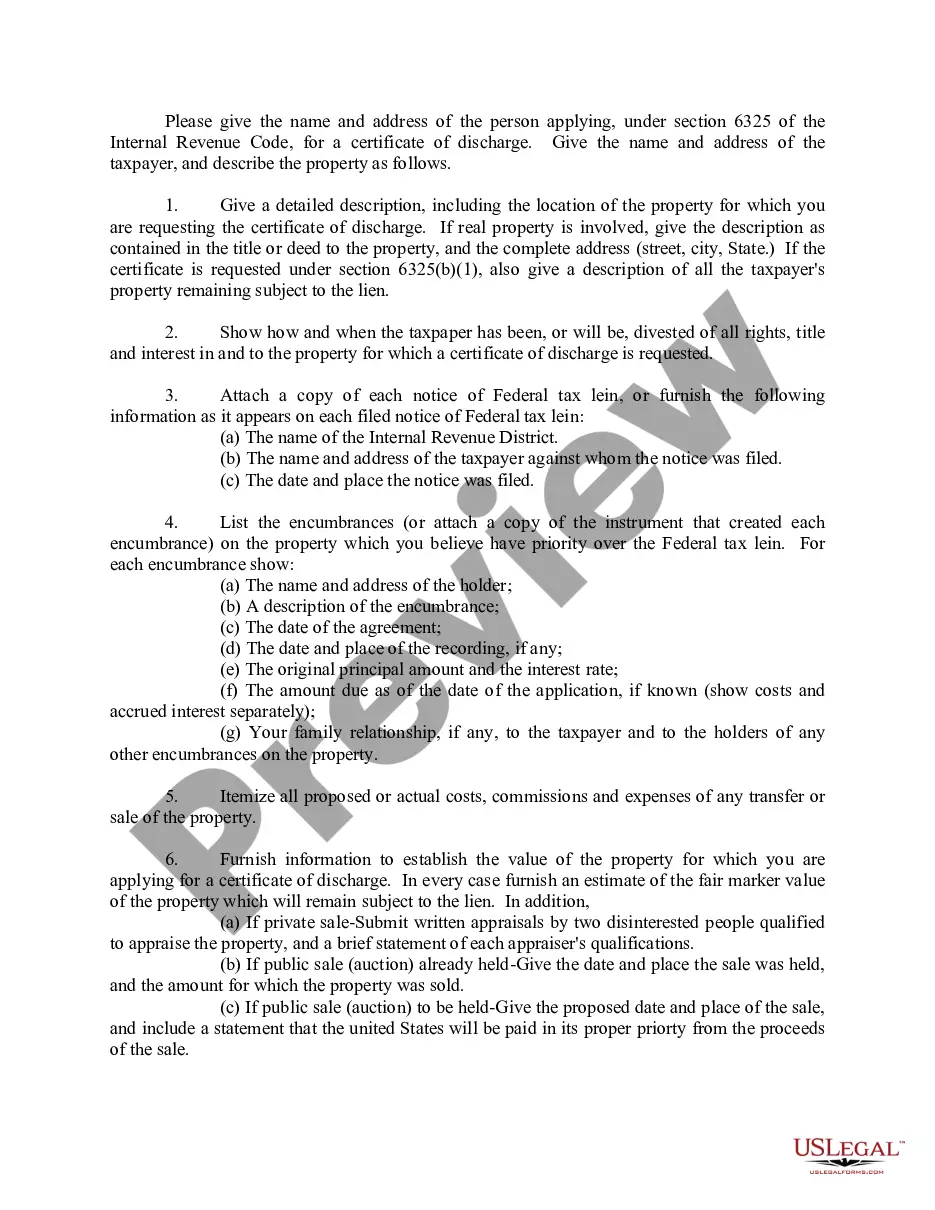

Mississippi Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

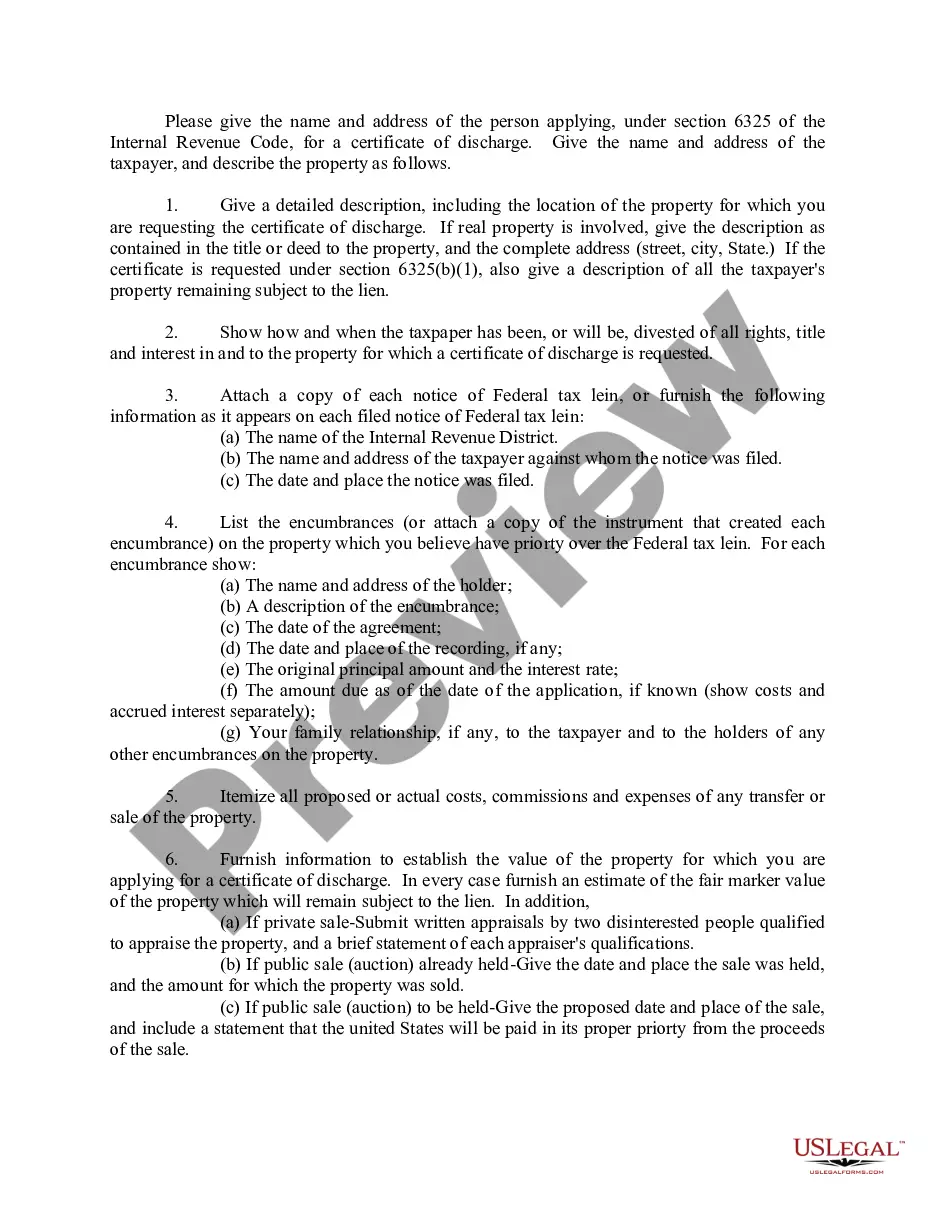

How to fill out Mississippi Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Acquire a printable Mississippi Application for Release of Right to Redeem Property from IRS After Foreclosure within a few clicks from the largest collection of legal e-documents. Locate, download, and print professionally prepared and certified examples on the US Legal Forms site. US Legal Forms has been the leading provider of economical legal and tax templates for US citizens and residents online since 1997.

Users who already possess a subscription must Log In to their US Legal Forms account, download the Mississippi Application for Release of Right to Redeem Property from IRS After Foreclosure, and find it saved in the My documents section. Users who do not have a subscription should follow the steps listed below.

Once you have downloaded your Mississippi Application for Release of Right to Redeem Property from IRS After Foreclosure, you can complete it in any online editor or print it out and fill it in manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Ensure your form complies with your state’s regulations.

- If available, review the form’s description for additional details.

- If possible, preview the form to see more content.

- When you are certain the template suits your requirements, click Buy Now.

- Create a personal account.

- Select a plan.

- Make a payment via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

What happens during the redemption period? During the redemption period, you or your tenant may continue to live in the property and are not required to make any mortgage payments. You also have the right to sell the property to another person or re-purchase the property.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

In most states, you can get your home back after foreclosure within a certain period of time. This is called the right of redemption. In order to reedem your home, you usually must reimburse the person who bought the home at the foreclosure sale for the full purchase price, plus other costs.

Yes you can waive your right to redemption. Mortgage companies often will pay you for a waiver of your redemption rights in certain circumstances.

Which of these reasons for foreclosure would allow a former homeowner to access a two-year right of redemption period? Homeowners whose homes were foreclosed on for unpaid ad valorem taxes get a two-year right of redemption period in Texas. The Federal Reserve recently raised the discount rate.

The party who bought the home at the foreclosure sale and. the court or other party that held the foreclosure sale.

Right of redemption is a legal process that allows a delinquent mortgage borrower to reclaim their home or other property subject to foreclosure if they are able to repay their obligations in time.

The best way to qualify for a home loan with a foreclosure on your credit report is to immediately begin rebuilding your credit. Sub-prime lenders would approve mortgages for credit scores as low as 580 in this past, but this is no longer the case.