Mississippi Application for Certificate of Discharge of IRS Lien

Description

How to fill out Mississippi Application For Certificate Of Discharge Of IRS Lien?

Acquire a printable Mississippi Application for Certificate of Discharge of IRS Lien with just a few clicks in the most extensive collection of legal electronic documents.

Locate, download, and print professionally prepared and verified samples on the US Legal Forms website. US Legal Forms has been the top provider of affordable legal and tax templates for US citizens and residents online since 1997.

After downloading your Mississippi Application for Certificate of Discharge of IRS Lien, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- Users with a subscription must Log In to their US Legal Forms account, download the Mississippi Application for Certificate of Discharge of IRS Lien, and find it stored in the My documents tab.

- Clients without a subscription need to follow the guidelines listed below.

- Ensure your document fulfills your state's criteria.

- If available, read the form’s description for more details.

- If accessible, examine the form for additional content.

- Once you are certain the form satisfies your needs, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay using PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

An IRS tax lien lasts for 10 years, or until the statute of limitations on your tax debt expires. You can take other steps to get the lien removed, such as repaying the debt or entering into a payment plan.

Help Resources. Centralized Lien Operation To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

How Can a Taxpayer Request a Federal Tax Lien Subordination? Apply for a certificate of subordination of federal tax lien by following the instructions in Publication 784. You will need to complete Form 14134. It is also a smart idea to watch this self-help IRS video.

Form 668 (Z): Certificate of Release of Federal Tax Lien Section 6325(a) of the Internal Revenue Code enables us to negotiate for a release of Federal Tax Lien after a liability becomes fully paid or legally unenforceable.

The general rule is that a Federal tax lien attaches to all of your property.Yes, you can sell the car, and keep the proceeds, even though the IRS has filed a tax lien against you. (Of course, the IRS can levy the proceeds of the sale if you have cash on hand.)

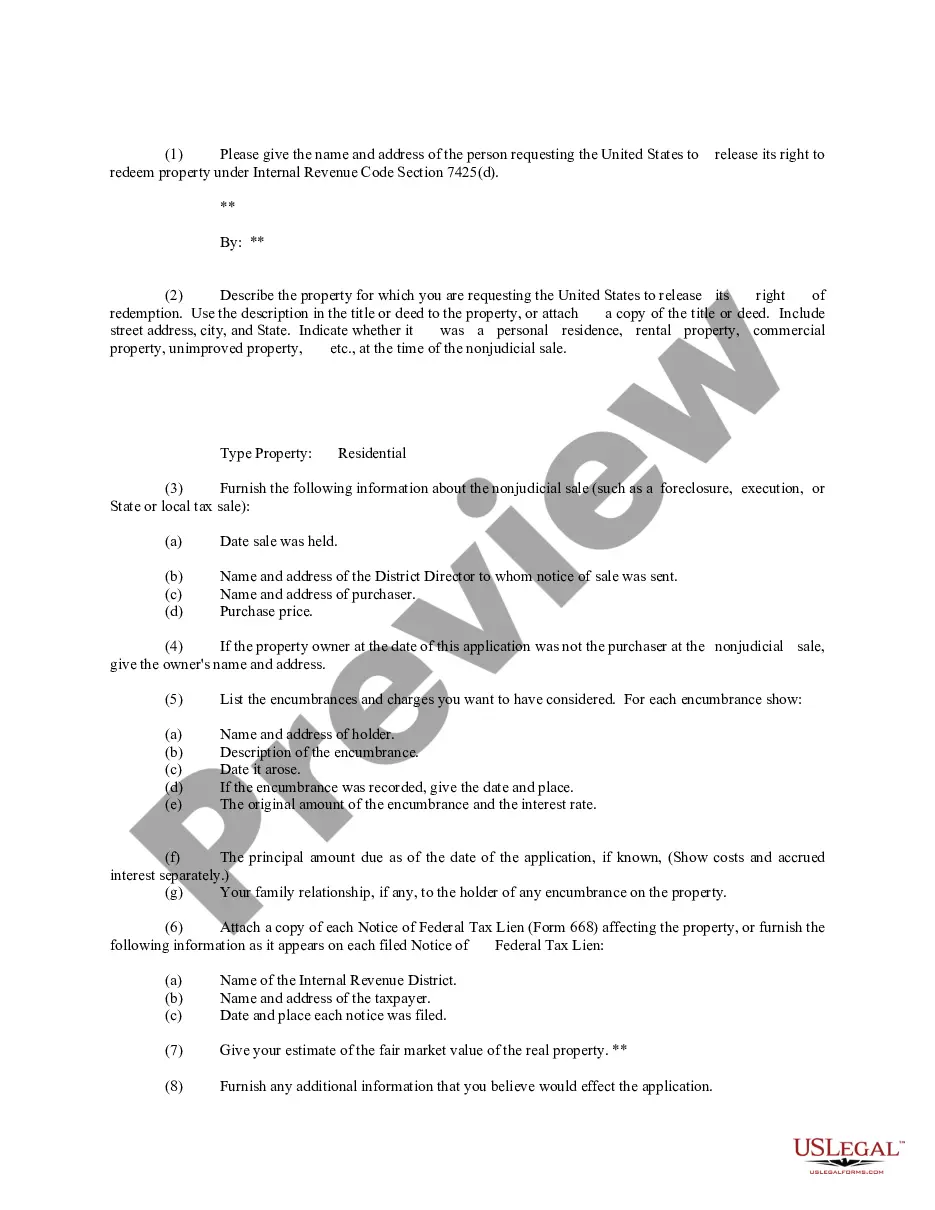

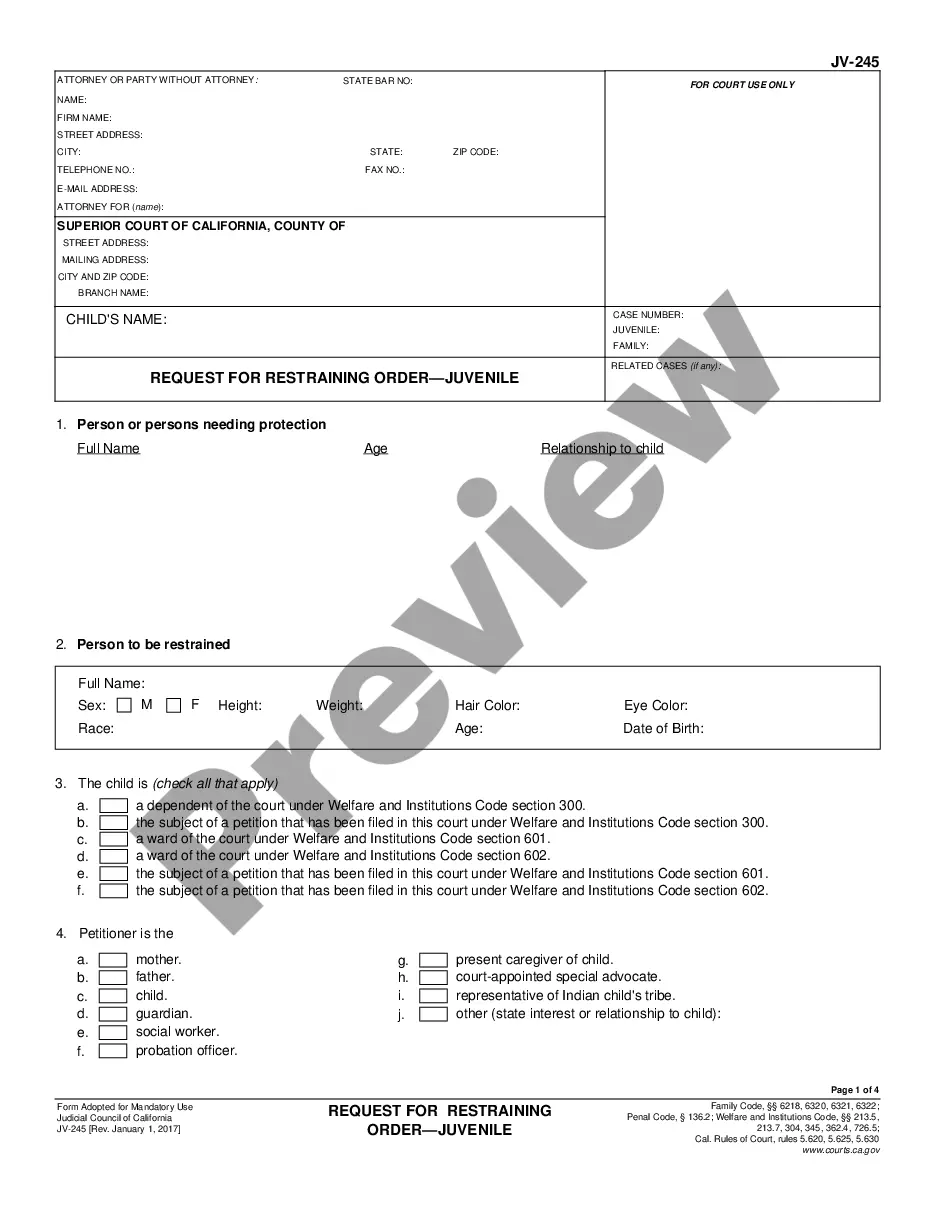

You need to submit form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien at least 45 days before the sale or settlement meeting. Publication 783 provides the instructions for completing form 14135. You will need to describe the property, its appraised value, and other information.

A tax lien recorded on the State Tax Lien Registry covers all property in Mississippi. To avoid having a tax lien filed against your property, send the Department of Revenue full payment before the due date as set forth in your Assessment Notice.

If you do happen to find a paid tax lien on your report, and it's been more than seven years since satisfied the debt, you just need to dispute the item with the credit bureaus. Once they verify the date and status, they will typically remove it within 30 days.