Mississippi Pledge of Stock Agreement

Description

How to fill out Mississippi Pledge Of Stock Agreement?

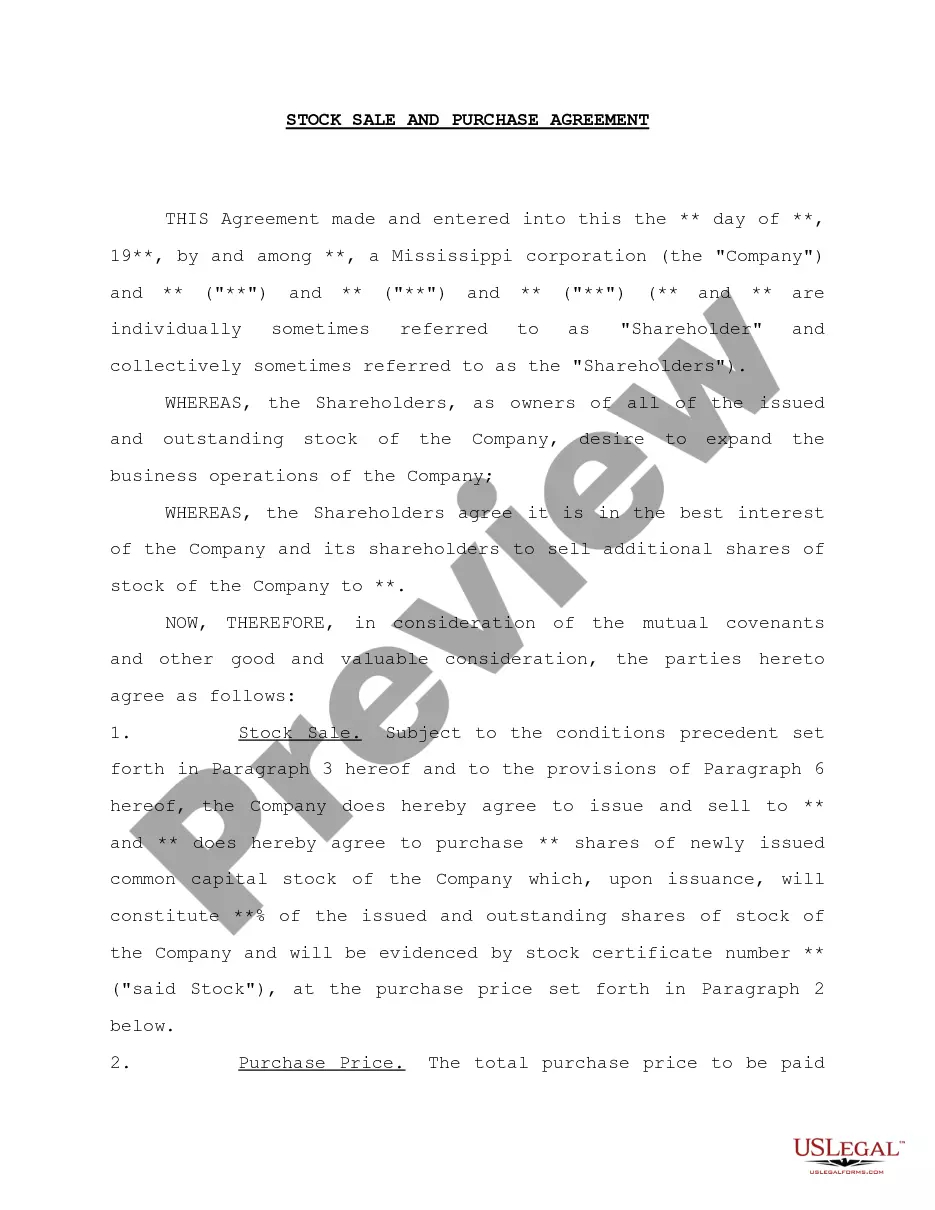

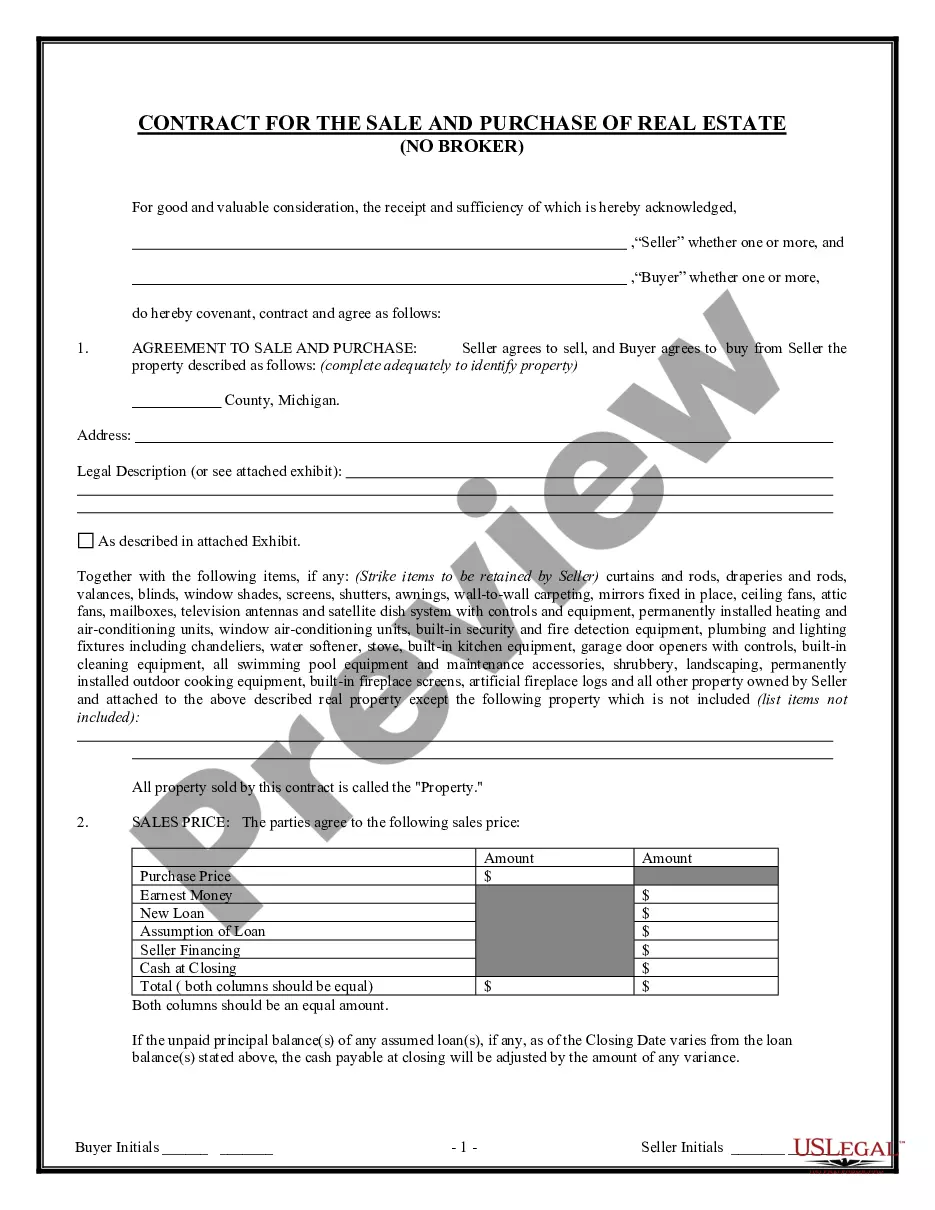

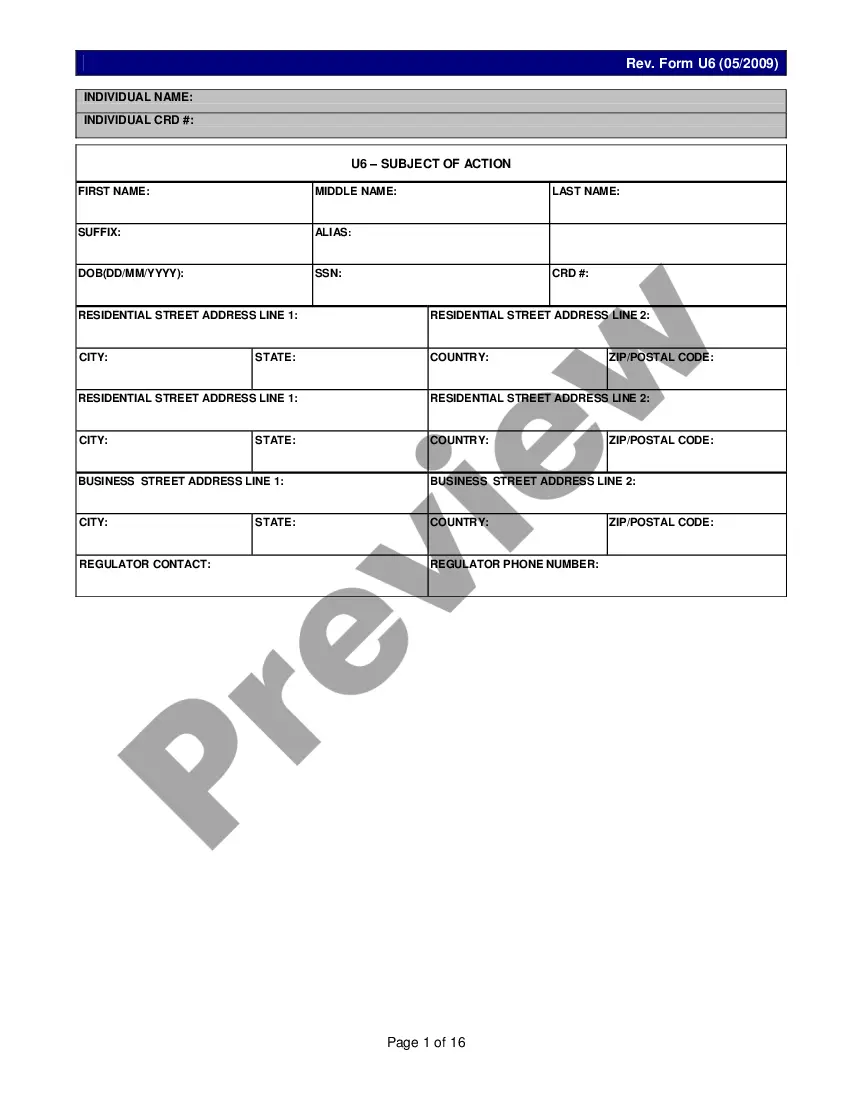

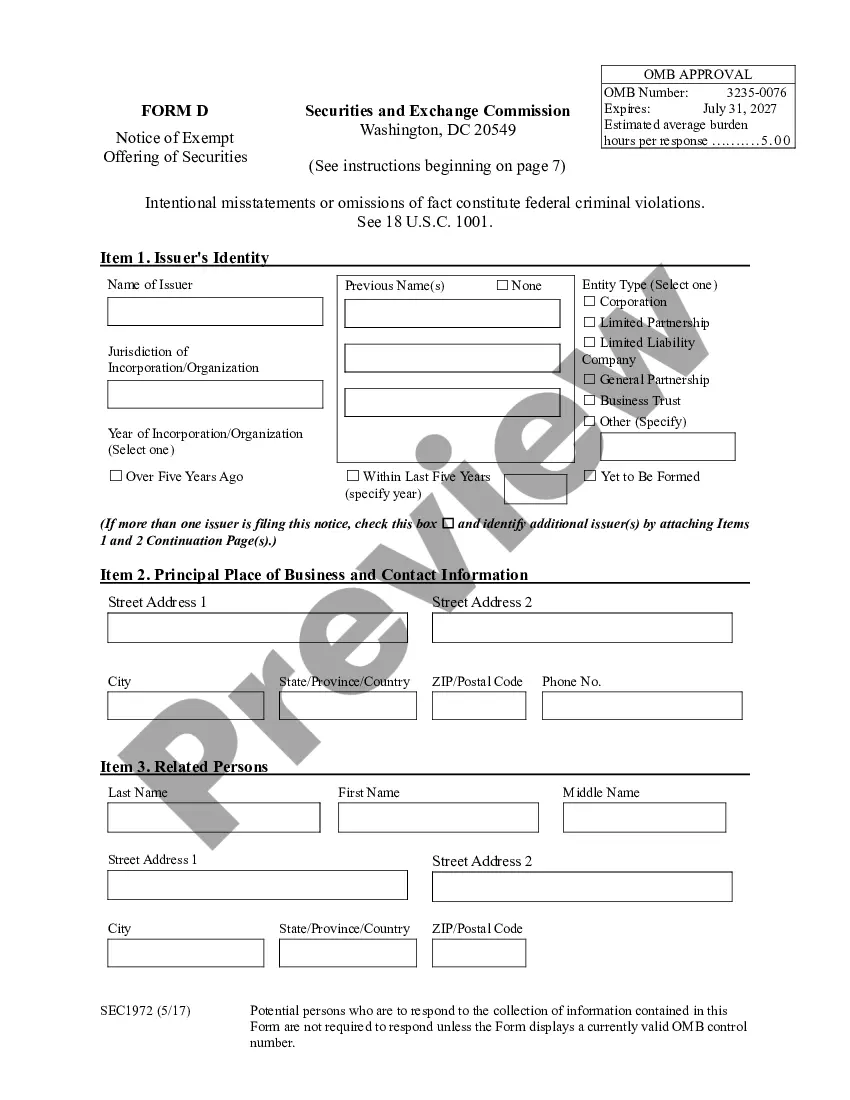

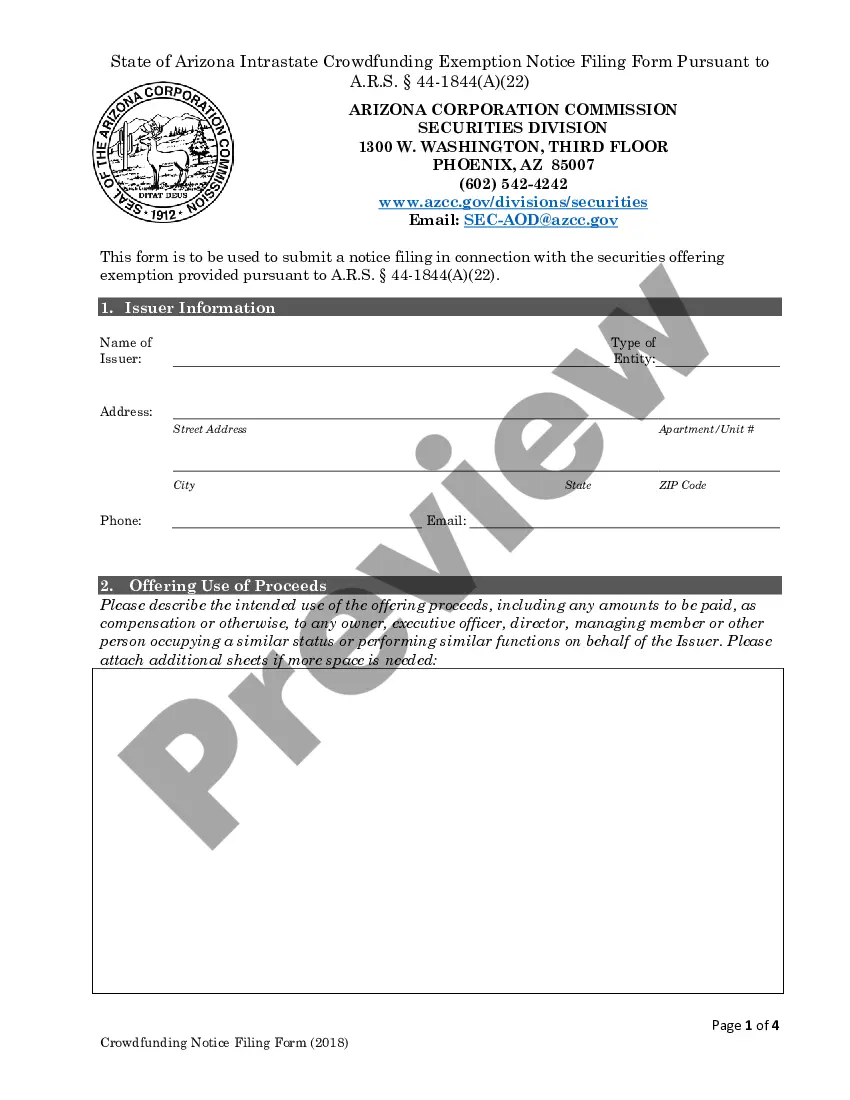

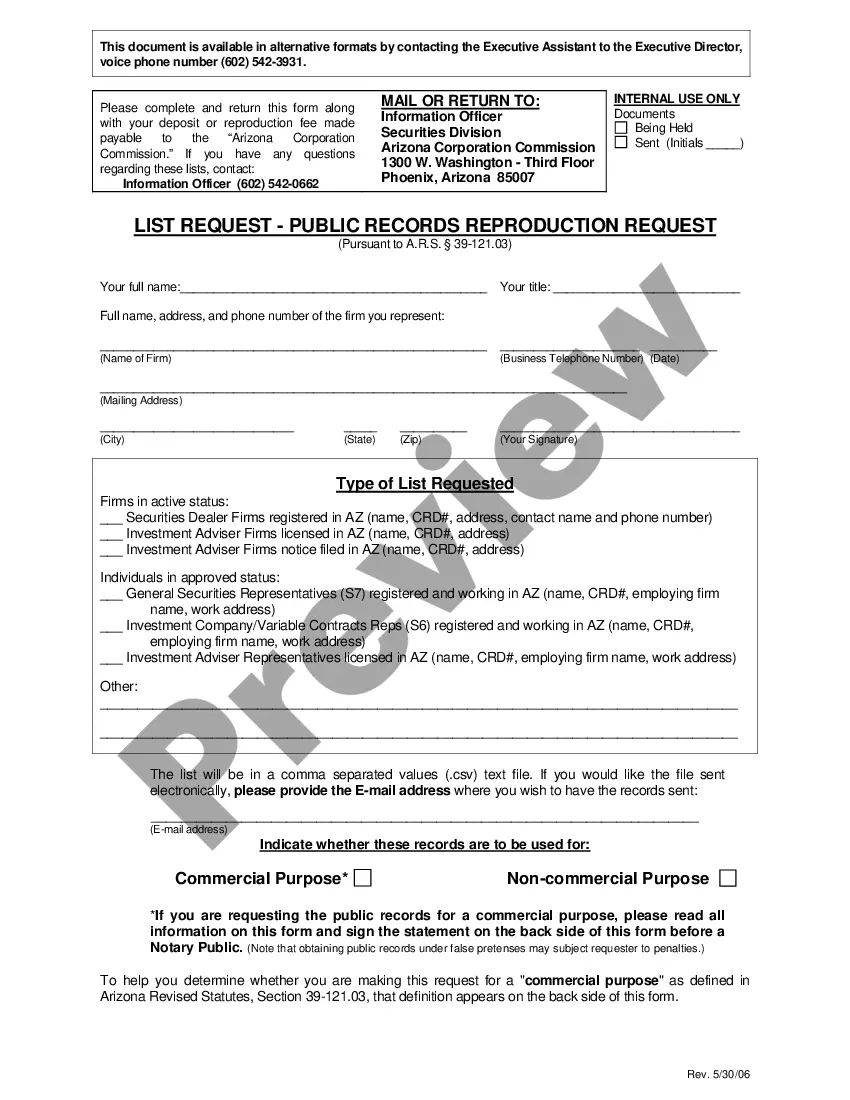

Obtain a printable Mississippi Pledge of Stock Agreement within just several mouse clicks in the most complete library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of affordable legal and tax templates for US citizens and residents on-line since 1997.

Users who have a subscription, need to log in into their US Legal Forms account, get the Mississippi Pledge of Stock Agreement and find it saved in the My Forms tab. Users who never have a subscription must follow the tips listed below:

- Ensure your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If readily available, review the shape to see more content.

- As soon as you’re sure the template is right for you, click on Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Pledge of Stock Agreement, it is possible to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Remember, the pledging of promoter's shares is not necessarily bad. Even if a company has a high percentage of promoter's shares being pledged, if its operating cash flow is constantly increasing and the company has good prospects, it can be worth investing in.

Shares to be pledged. The customer can access the demat account to view the shareholdings and their respective haircut percentage and amount available as margin. Pledge request. Authorising pledge request. Charges for pledging. Point to note.

In the holdings table, hover the cursor on the stock you want to pledge and click on 'options' and select pledge for margins. Once you do, you will get a pop-up, which will show how much margins you will be eligible for. The cost of pledging will be 20b930 + GST irrespective of the quantity pledged.

A Scots law share pledge requires that the pledged shares are legally transferred to the lender (or more often a nominee company of the lender), with a stock transfer form being signed, share certificate issued and the lender or their nominee company being entered in the company's Register of Members (being the

Pledging of shares is an arrangement in which the promoters of a company use their shares as collateral to fulfil their financial requirements. Pledging of shares is common for companies that have high shares owned by investors.

An investor can keep extra cash/pledge other holdings for the stipulated margin required. In addition, the shares bought one day cannot be sold the next day. So, if an investor bought shares on, say, Monday, then he can only sell them after receiving the delivery of shares. So, in T+2, they can sell these on Wednesday.

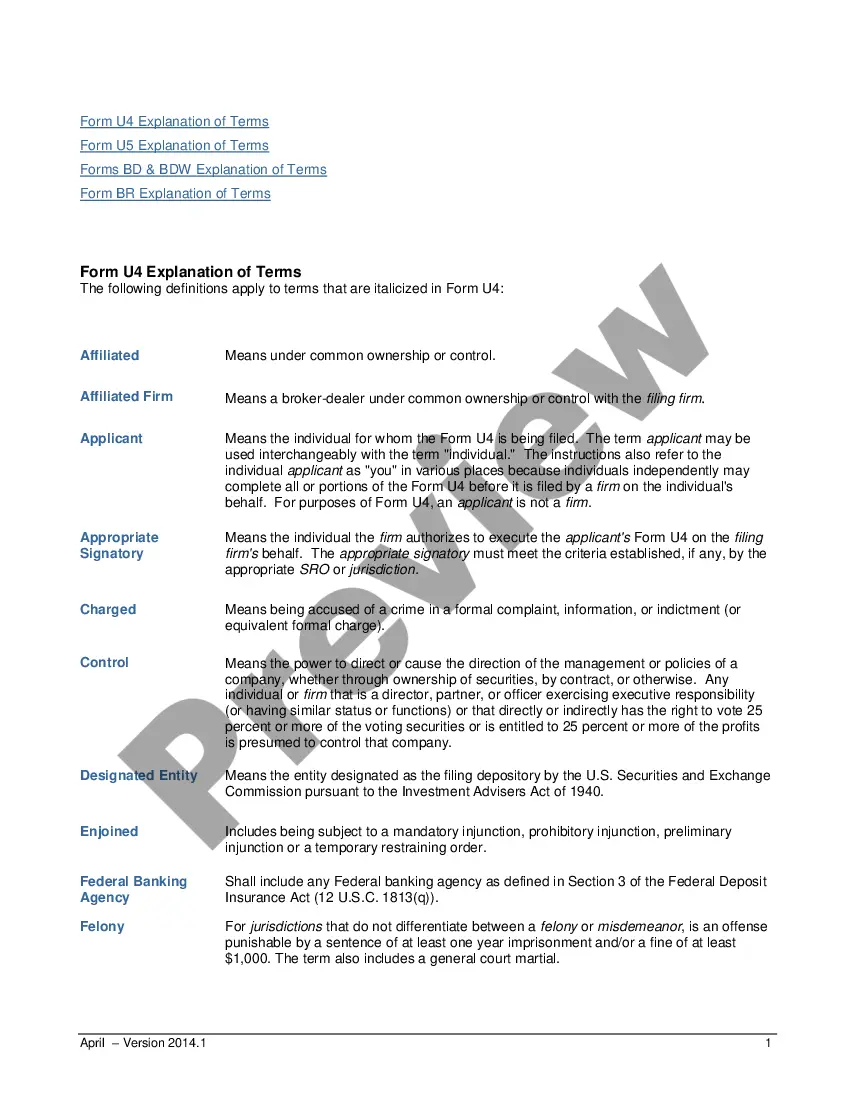

Under English law a pledge is effectively the delivery of possession of an asset by one party (the pledgor) to the creditor (the pledgee) by way of security but with ownership of the asset remaining with the pledgor.

A Stock Pledge is the transfer of stocks against a debt.The debtor pledges the stocks as an asset against the amount of money taken from a lender and promises to return the amount. The debtor pledges the stocks as a security against the debt.

If you put up a share pledge or stock pledge agreement, you're committing shares of stock that you own as collateral for a debt. You can pledge your stocks orally, but a written pledge agreement is safer: That way if anyone gets confused or forgets the terms, it's easy to determine the facts.