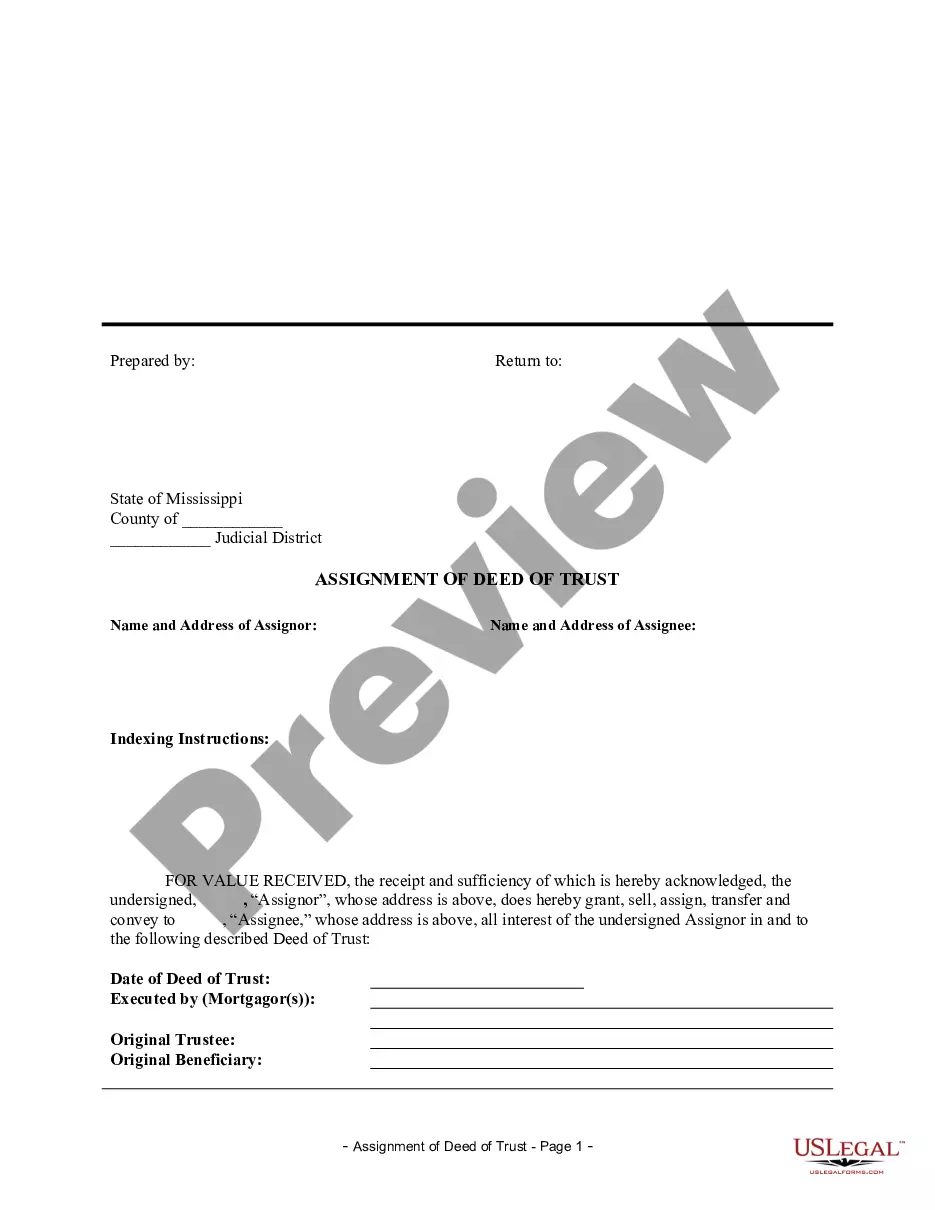

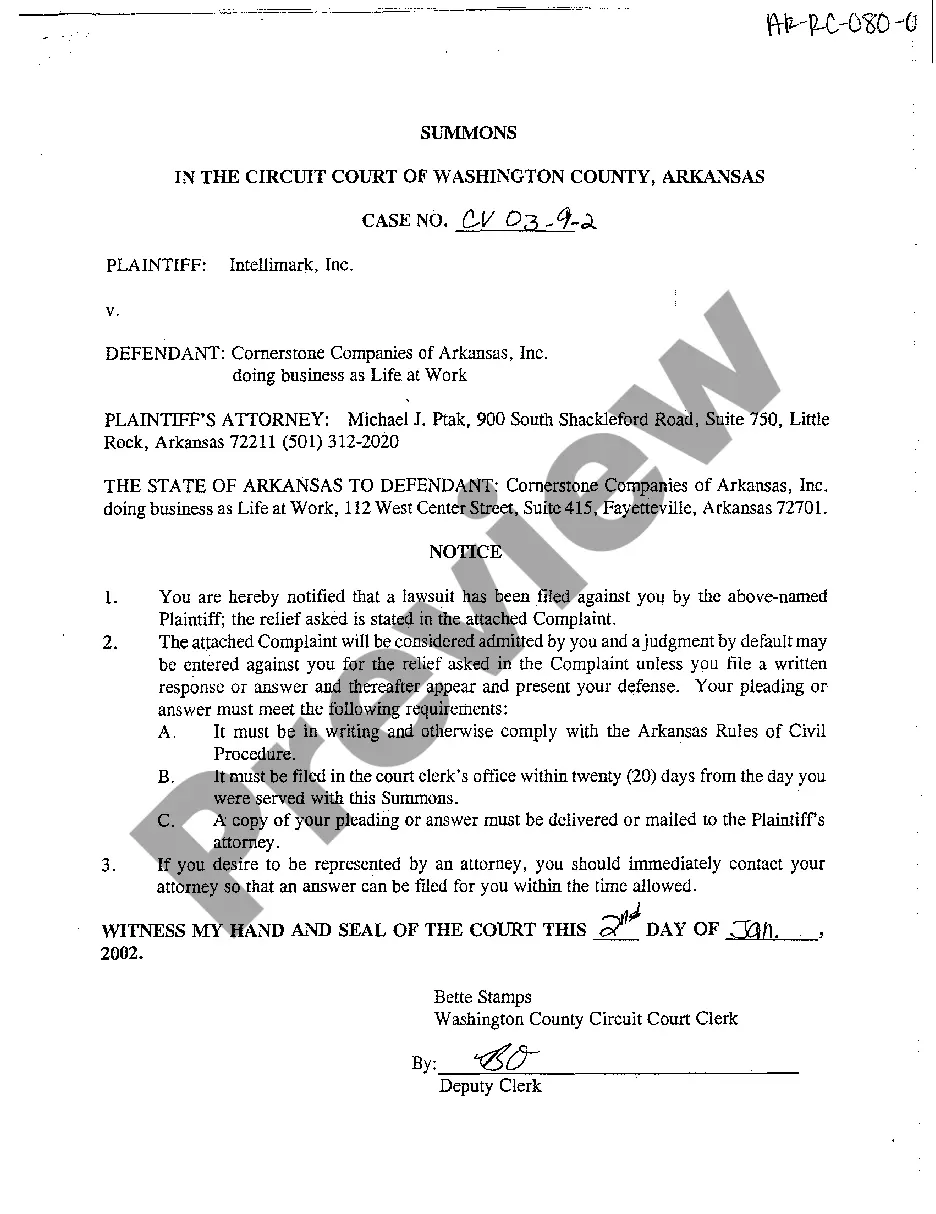

Mississippi Assignment of Deed of Trust by Individual Mortgage Holder

Description

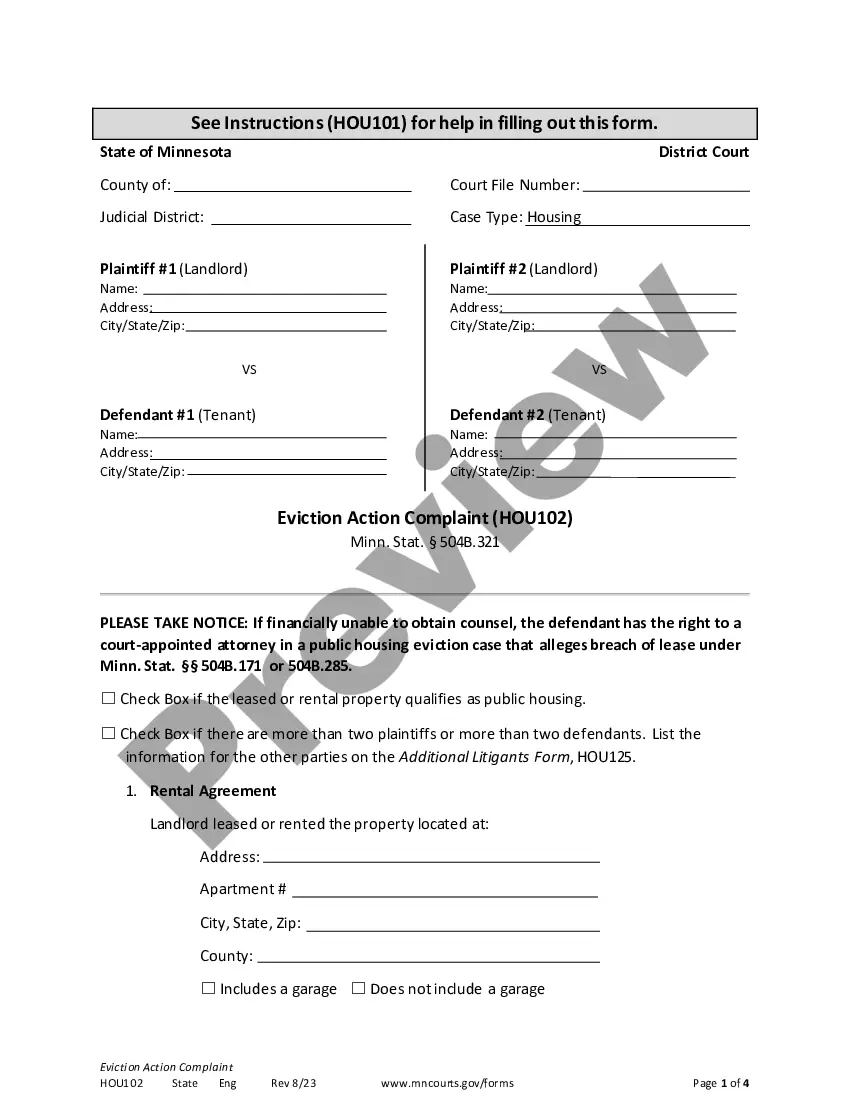

How to fill out Mississippi Assignment Of Deed Of Trust By Individual Mortgage Holder?

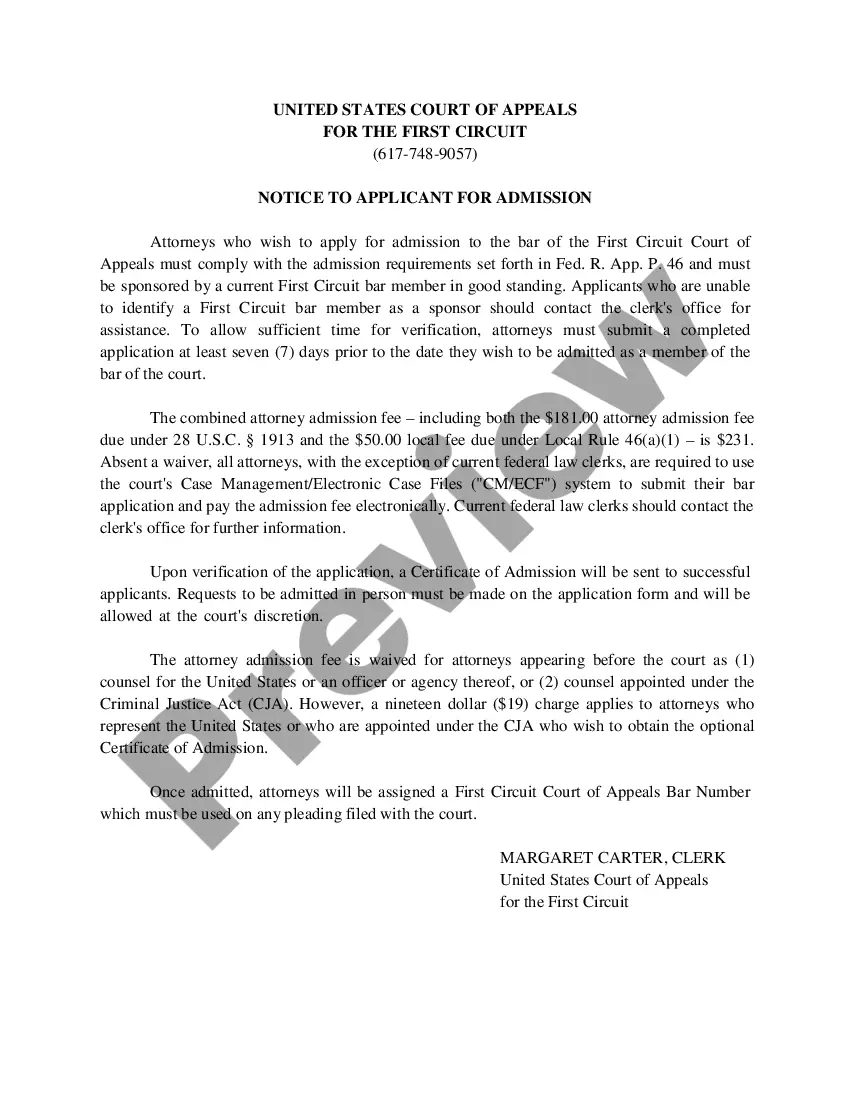

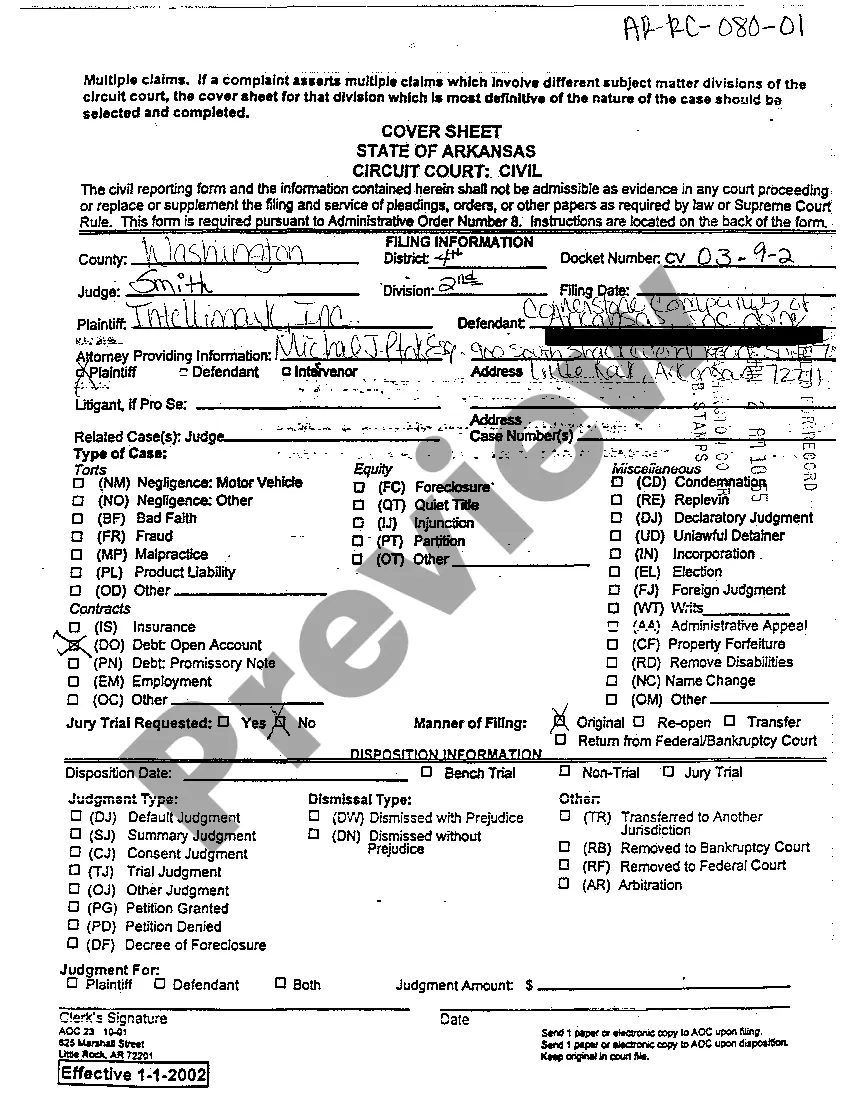

Acquire a printable Mississippi Assignment of Deed of Trust by Individual Mortgage Holder with just a few clicks in the largest collection of legal electronic documents.

Discover, download, and print expertly crafted and certified samples on the US Legal Forms platform. US Legal Forms has been the leading provider of cost-effective legal and tax templates for US citizens and residents online since 1997.

After downloading your Mississippi Assignment of Deed of Trust by Individual Mortgage Holder, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

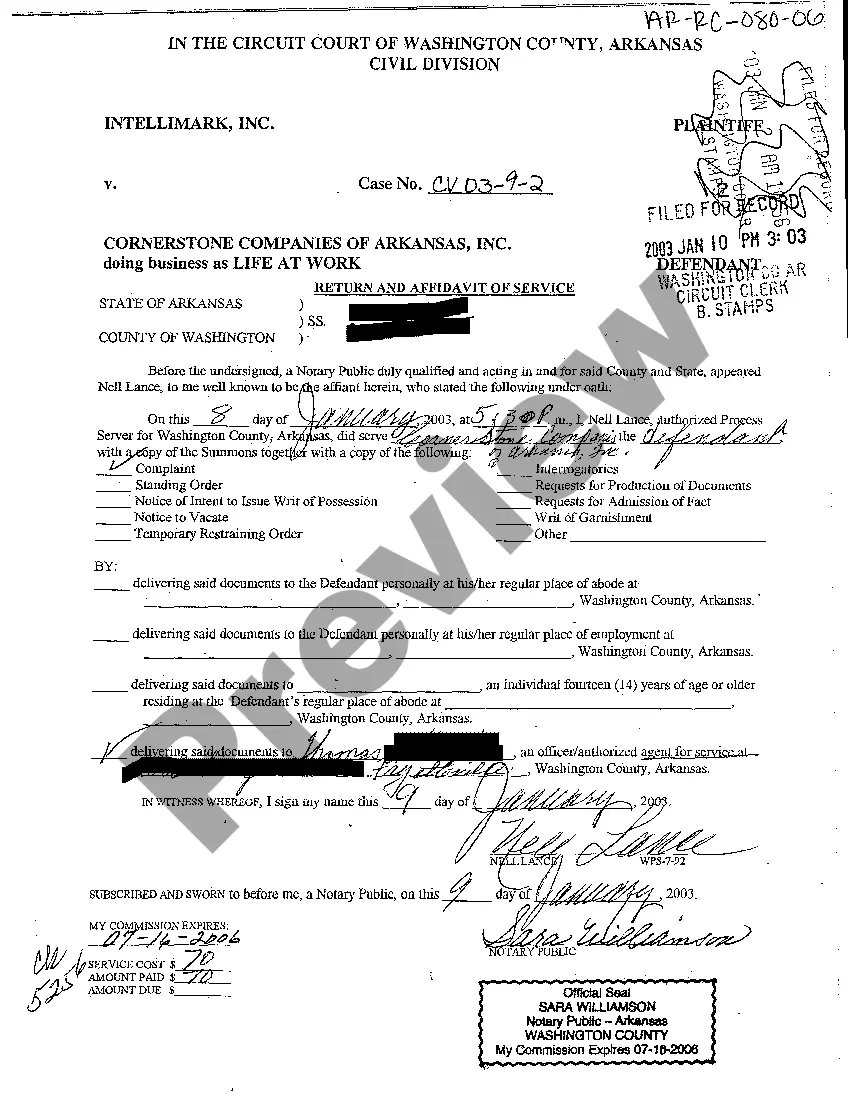

- Users with an existing subscription need to Log In directly to their US Legal Forms account to download the Mississippi Assignment of Deed of Trust by Individual Mortgage Holder and find it saved in the My documents section.

- Individuals without a subscription must follow the instructions listed below.

- Ensure that your template complies with your state's regulations.

- If available, review the form's description to gather additional information.

- If provided, examine the form to uncover more details.

- Once you are confident that the template fulfills your needs, simply click Buy Now.

- Establish a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.

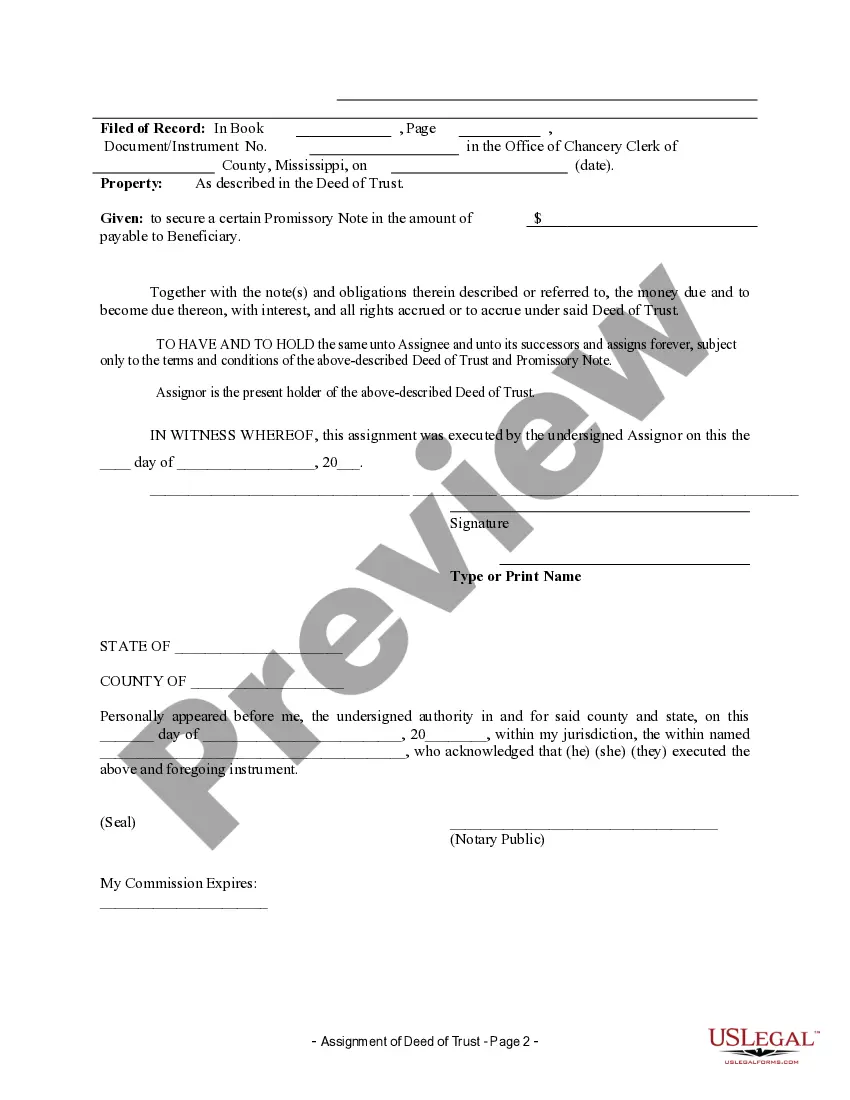

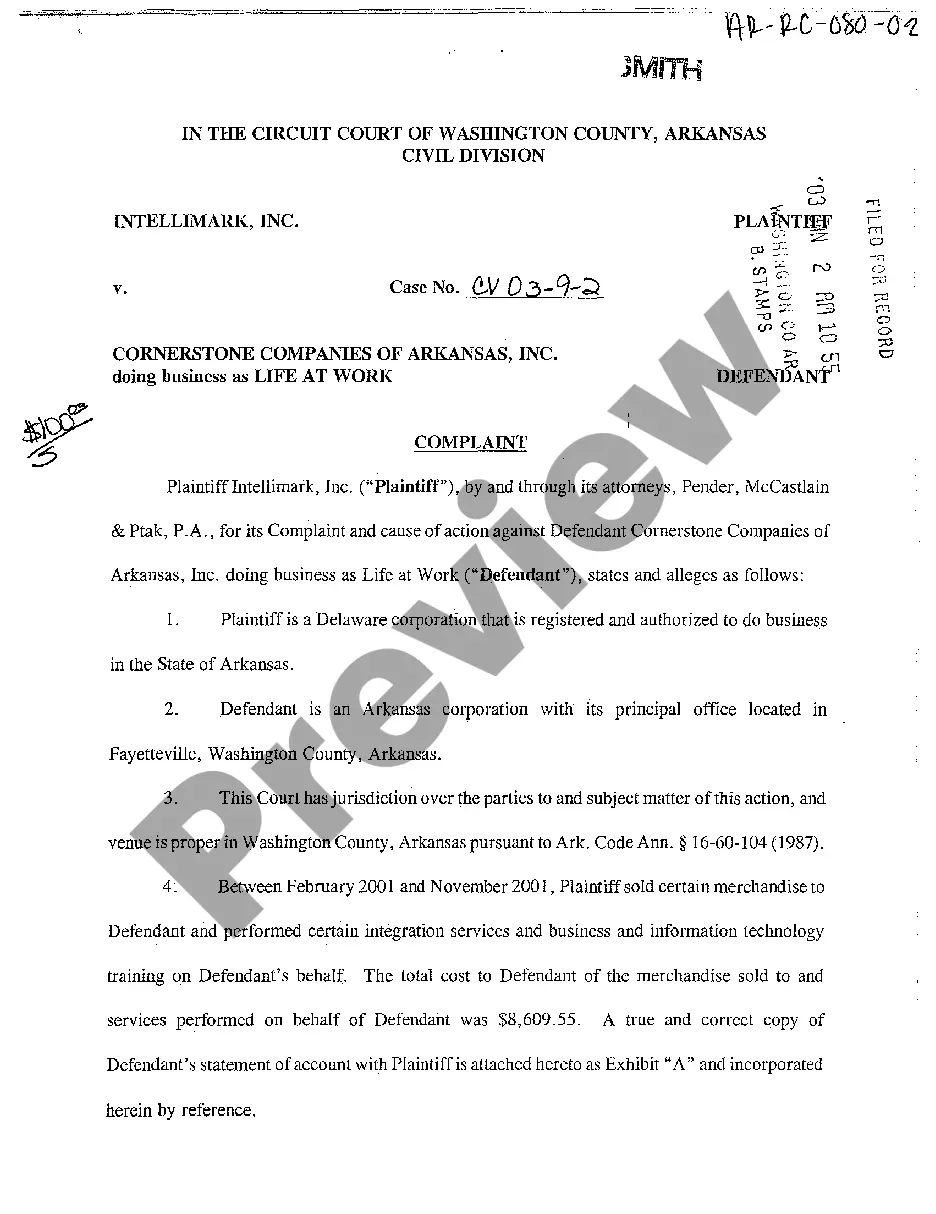

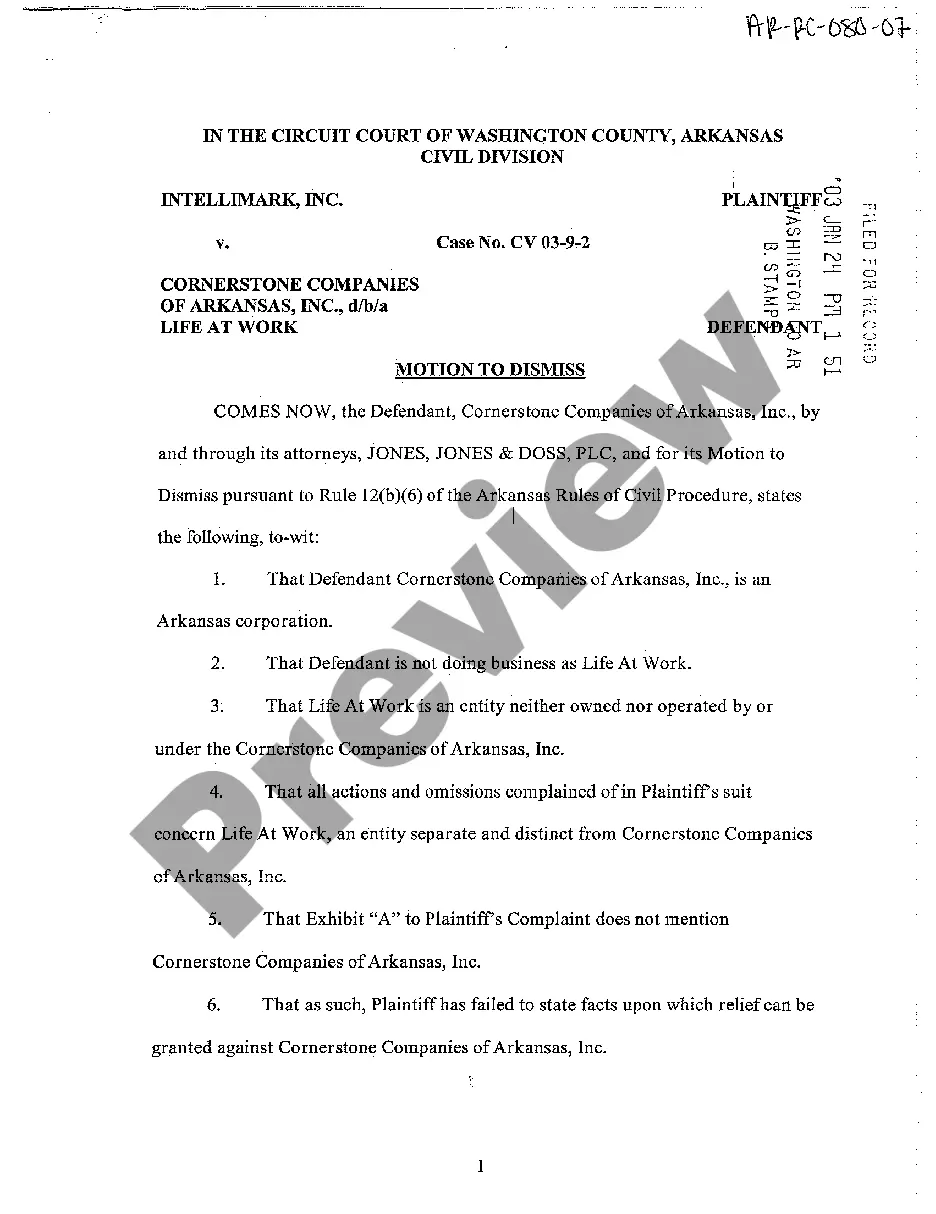

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Deed: This is the document that proves ownership of a property. It transfers ownership of the property to the grantee, also known as the buyer.Mortgage: This is the document that gives the lender a security interest in the property until the Note is paid in full.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Name of the trust. Address of the trust. Objects of the trust (Charitable or Religious) One settlor of the trust. Two trustees of the trust (minimum)