Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond

Description

How to fill out Mississippi Renunciation And Disclaimer Of Property - IRA, Annuity Or Bond?

Obtain a printable Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond in just a few clicks from the most extensive collection of legal electronic documents.

Locate, download and print expertly crafted and certified templates on the US Legal Forms site. Since 1997, US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online.

After downloading your Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond, you can either fill it out using any online editor or print it and complete it by hand. Utilize US Legal Forms to access 85,000 professionally prepared, state-specific documents.

- Clients who already possess a subscription must sign in to their US Legal Forms account to access the Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond and find it stored in the My documents section.

- Subscribers without an account should adhere to the following instructions.

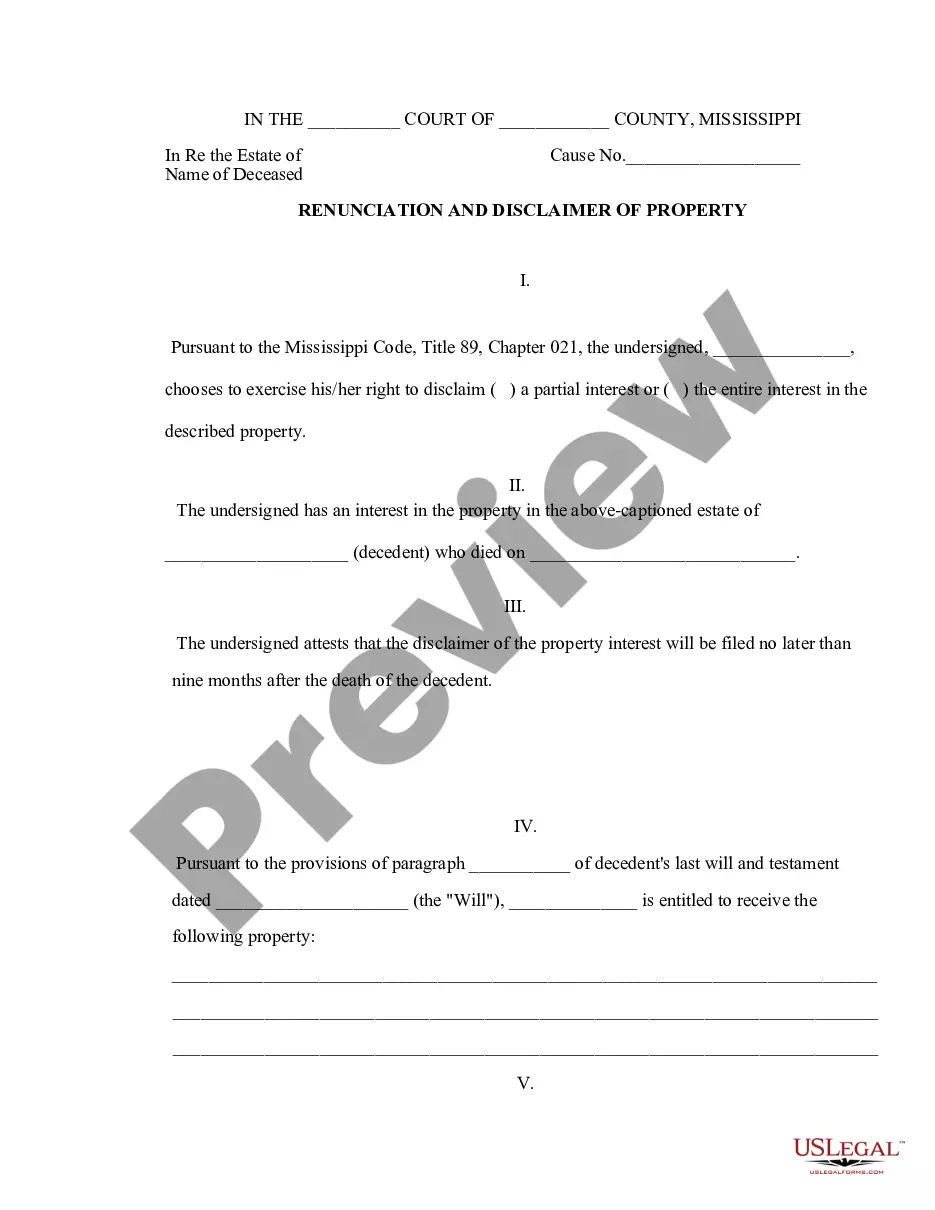

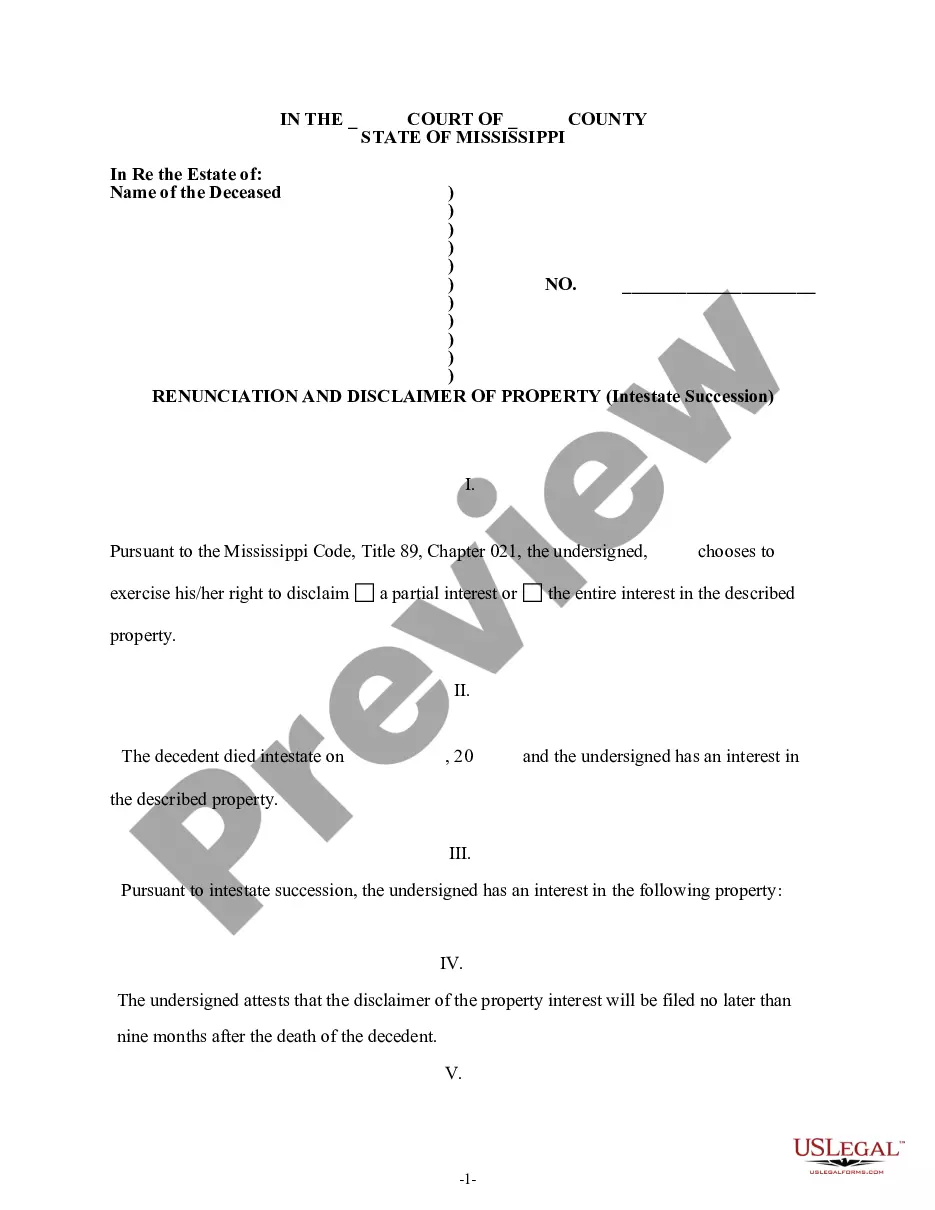

- Ensure your form complies with your state's regulations.

- If available, examine the form's description for additional information.

- If accessible, review the form to uncover more details.

- Once confident that the template is suitable, click Buy Now.

- Create a personal profile.

- Select a subscription plan.

- Complete the payment via PayPal or credit card.

- Download the template in either Word or PDF format.

Form popularity

FAQ

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

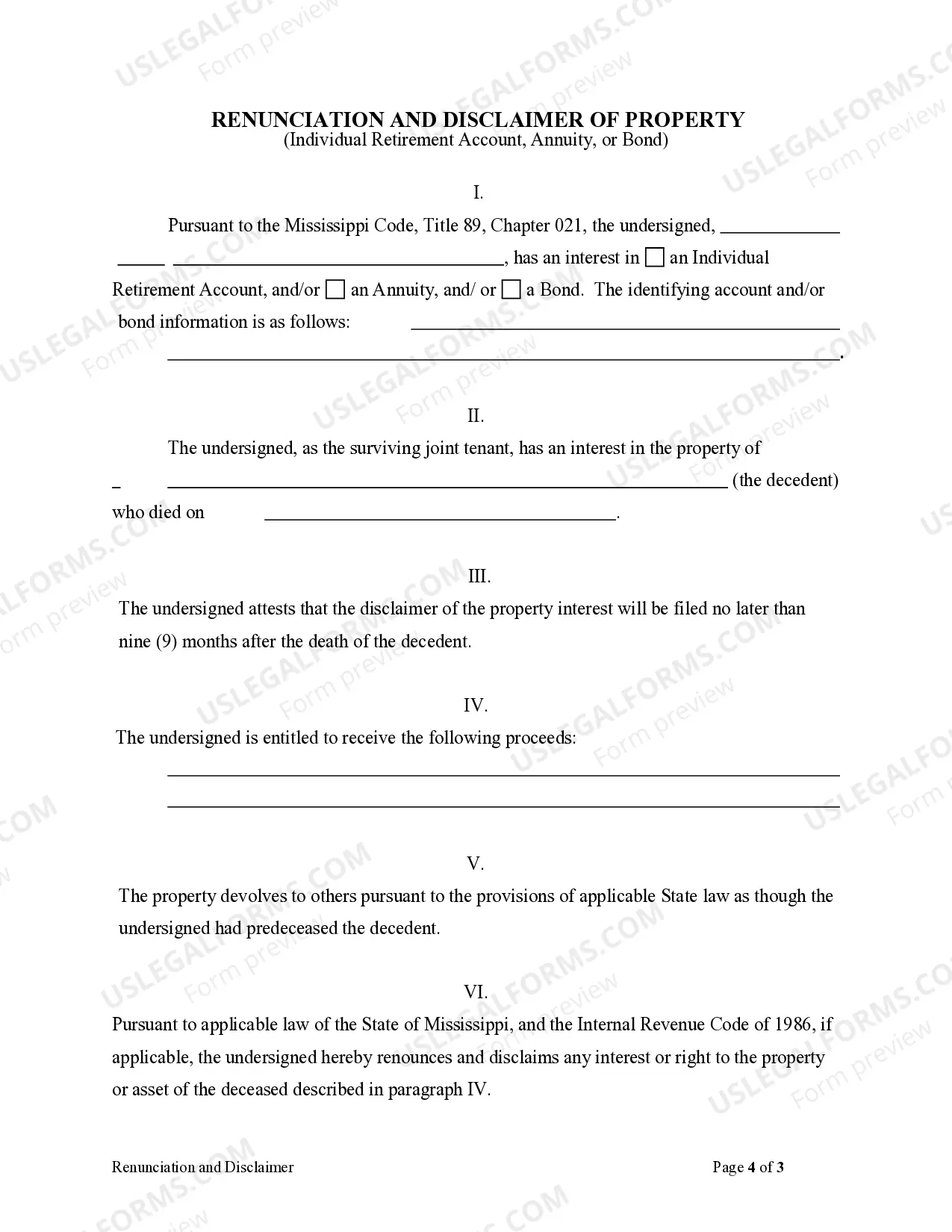

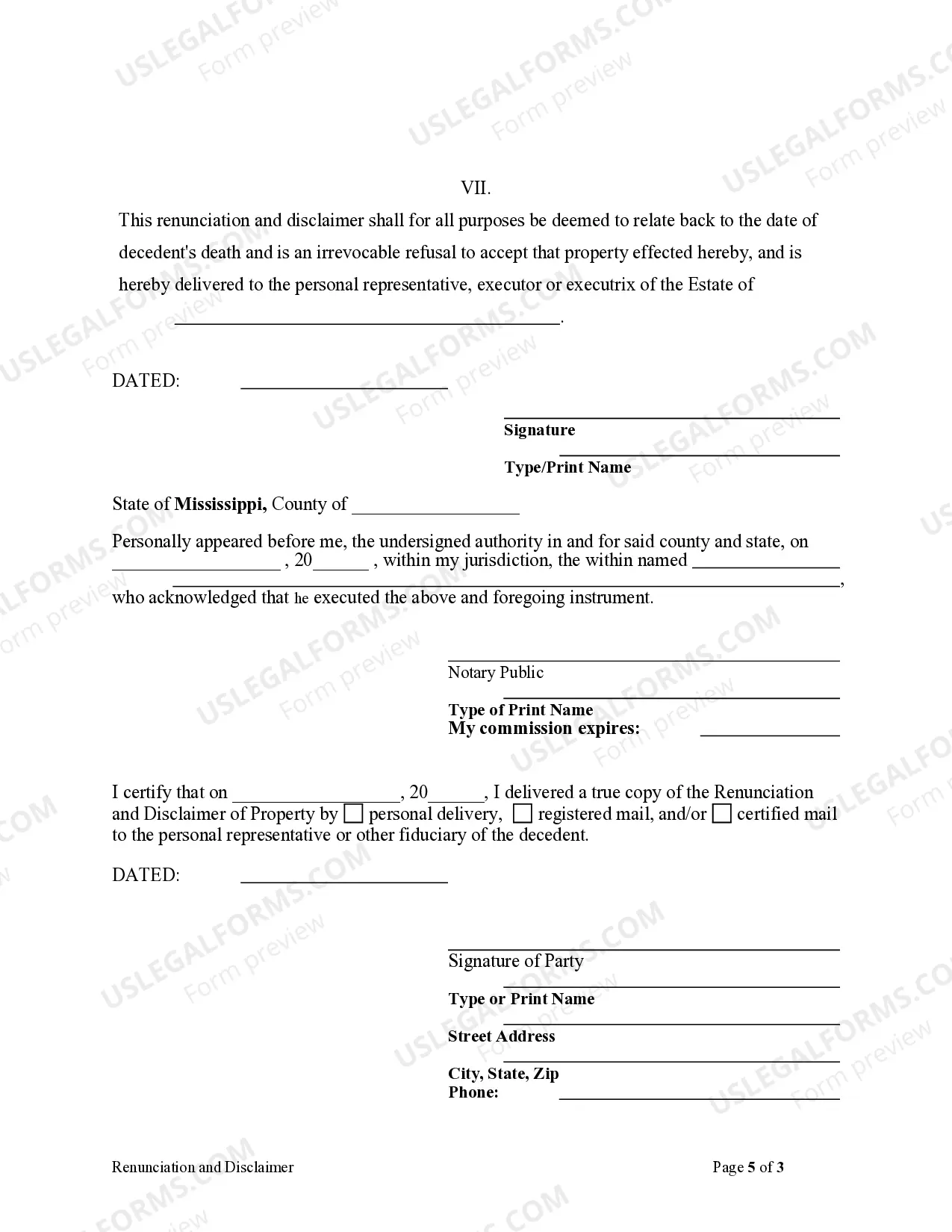

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Inherited assets can be disclaimed.When one disclaims an asset, the asset passes as though the beneficiary had died prior to the date of the benefactor's passing. For instance, in the case of an IRA it is pretty simple. If you disclaim all or a part of the IRA, the funds pass on based on the beneficiary designation.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

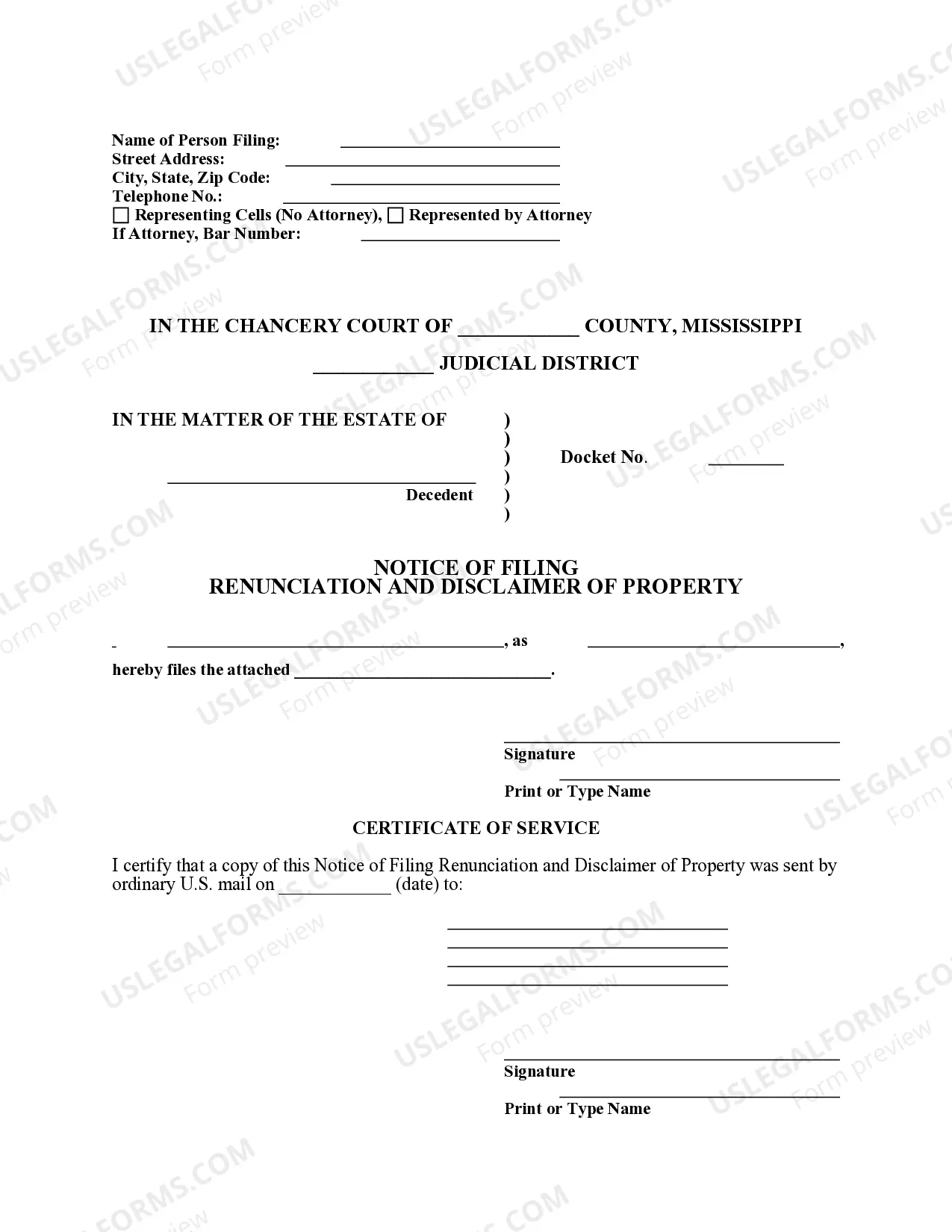

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.