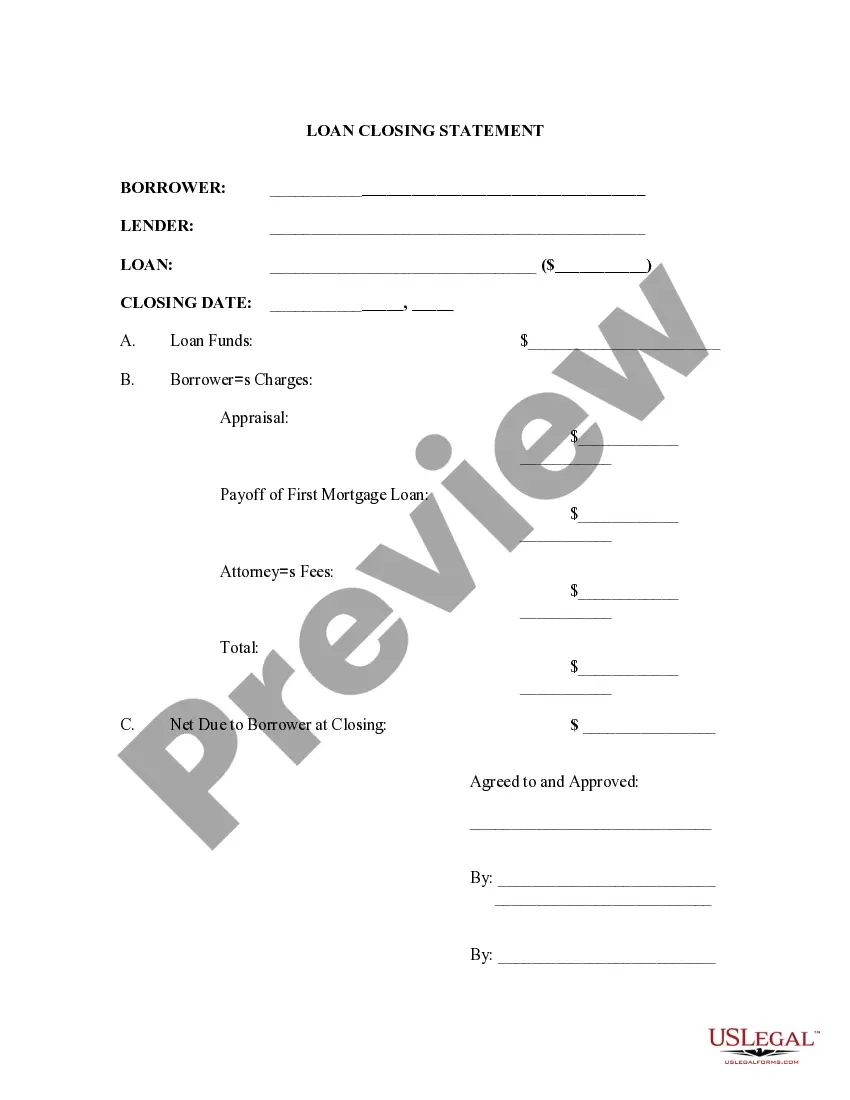

This form is a simple loan closing statement for real estate loans within the State of Mississippi.

Mississippi Simple Loan Closing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Simple Loan Closing Statement?

Obtain a printable Mississippi Simple Loan Closing Statement in just a few clicks from the most extensive collection of legal electronic documents. Locate, download, and print expertly created and certified templates on the US Legal Forms site. US Legal Forms has been the leading provider of cost-effective legal and tax documents for US citizens and residents online since 1997.

Users with a subscription must Log In directly to their US Legal Forms account, access the Mississippi Simple Loan Closing Statement, and find it stored in the My documents section. Users without a subscription need to follow the steps outlined below.

After downloading your Mississippi Simple Loan Closing Statement, you can complete it in any online editor or print it out to fill it in manually. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Ensure your template complies with your state's regulations.

- If applicable, read the form's description for additional information.

- If available, examine the form to see more details.

- When you are certain the form satisfies your criteria, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

A mortgage closing statement lists all of the costs and fees associated with the loan as well as the total amount and payment schedule.A seller's closing disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

While it's rare, the short answer is yes. After your loan has been deemed clear to close, your lender will update your credit and check your employment status one more time.Even if you left your job for another job with equal pay, your loan could still be denied, or delayed, depending on the type of loan you have.

It outlines the final terms and costs of the mortgage. It's one of the most important pieces of paperwork you'll receive, so check it over carefully. In August 2015, under the direction of the Consumer Financial Protection Bureau (CFPB), the Closing Disclosure Form replaced the HUD-1 settlement statement.

A loan settlement statement provides full disclosure of a loan's terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan's interest.Generally, loan settlement statements can also be referred to as closing statements.

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

In your case, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your settlement documents.