Missouri Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

Have you ever found yourself in a situation where you need documents for both business or personal purposes almost daily.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, like the Missouri Door Contractor Agreement - Self-Employed, which are designed to comply with state and federal regulations.

Select the payment plan you want, fill in the required information to create your account, and complete the order using your PayPal or credit card.

Choose a convenient document format and download your copy. You can access all the document templates you have purchased from the My documents menu. You can obtain another copy of the Missouri Door Contractor Agreement - Self-Employed anytime, if needed. Simply click the desired form to download or print the document format.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Missouri Door Contractor Agreement - Self-Employed template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you require and ensure it corresponds to the correct city/state.

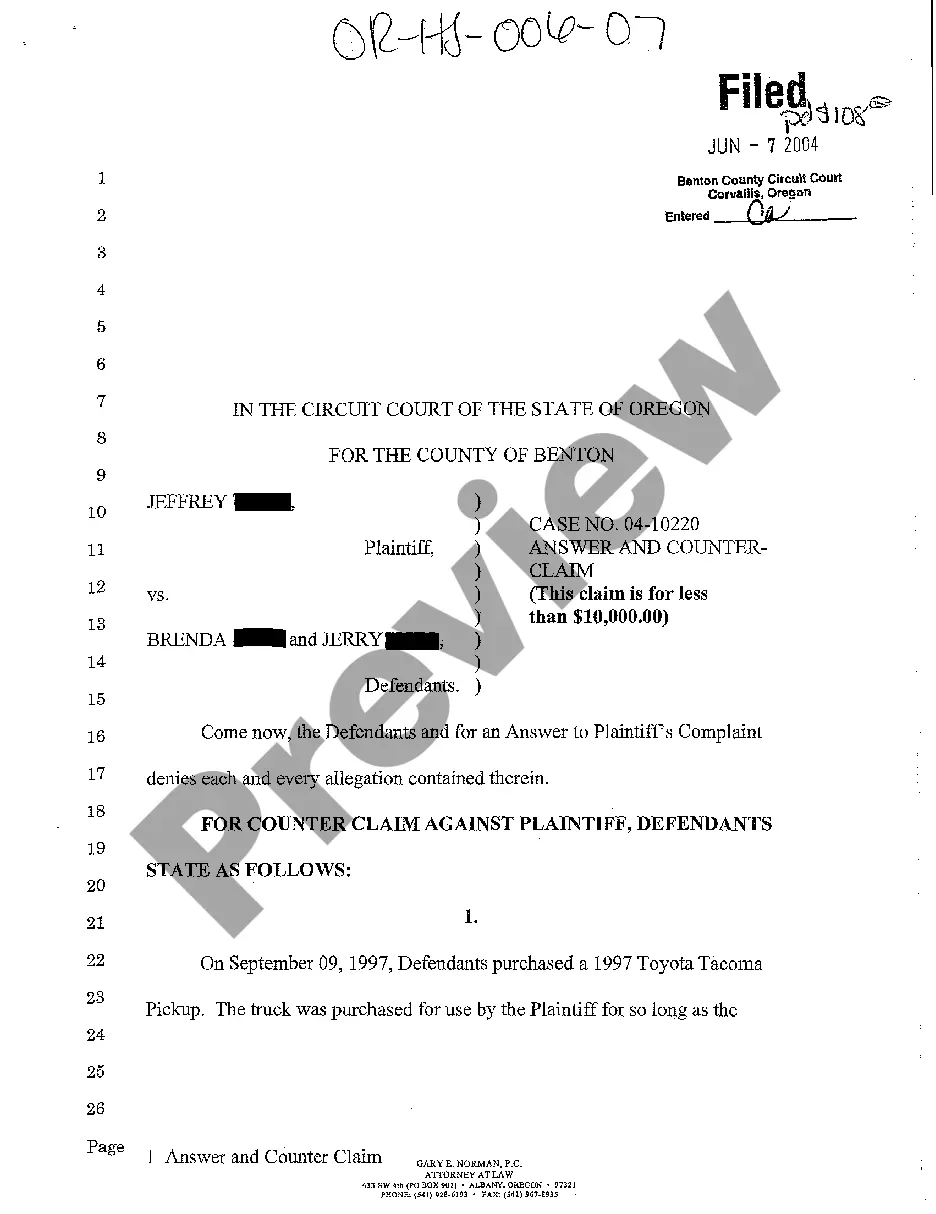

- Utilize the Preview option to review the form.

- Read the description to confirm you have selected the appropriate form.

- If the form isn’t what you need, use the Search field to locate the form that fits your requirements.

- Once you find the right form, click Purchase now.

Form popularity

FAQ

Writing a Missouri Door Contractor Agreement - Self-Employed involves several key steps. Begin by identifying both parties and clearly outlining the services to be performed. Include essential details such as payment schedules, responsibilities, and termination clauses to create a solid foundation. US Legal can help by providing customizable templates to guide you through structuring the agreement properly.

Yes, a contractor is typically considered self-employed because they work independently, providing services to clients without being a staff employee. With a Missouri Door Contractor Agreement - Self-Employed, you establish the legal framework for this relationship. Being self-employed offers flexibility and independence but requires careful attention to the terms of your agreement. Understanding your status can shape your financial and tax obligations.

Filling out an independent contractor form, particularly a Missouri Door Contractor Agreement - Self-Employed, requires you to input contact details for both parties. Make sure to outline the services to be performed, payment methods, and any relevant legal clauses. It is essential to read the form thoroughly, ensuring all aspects of the work relationship are covered. Platforms like US Legal can offer templates to simplify this process.

To fill out a Missouri Door Contractor Agreement - Self-Employed, start by providing your personal information and the contractor's details. Ensure you include the scope of work, payment terms, and the duration of the agreement. Always clarify any specific responsibilities and conditions related to your project. You can also use resources like US Legal to create a comprehensive agreement tailored to your needs.

To create an independent contractor agreement for your Missouri Door Contractor Agreement - Self-Employed, start by clearly outlining the scope of work and services the contractor will provide. Specify payment terms, including rates and deadlines, to ensure both parties understand the compensation structure. Additionally, include clauses related to confidentiality, intellectual property, and termination to safeguard your interests. You can use platforms like US Legal Forms to access templates and guides that make this process simpler and more efficient.

Writing an independent contractor agreement involves clearly outlining the scope of work, payment terms, and deadlines. Include clauses that address confidentiality and dispute resolution to protect both parties. For those in the contracting field, crafting a Missouri Door Contractor Agreement - Self-Employed can provide a solid legal framework to support your professional relationships.

The terms 'self-employed' and 'independent contractor' are often used interchangeably, yet each carries nuances. Self-employed is a broader category that encompasses various business types, while independent contractor specifically refers to those working on a contract basis. Regardless of the term you choose, utilizing a Missouri Door Contractor Agreement - Self-Employed can clarify your role and responsibilities.

In Missouri, while it is not legally mandated for LLCs to have an operating agreement, it is highly recommended. An operating agreement outlines the business structure and operational procedures, helping to prevent misunderstandings. If you're contemplating starting a door contracting business, consider drafting a Missouri Door Contractor Agreement - Self-Employed to complement your operating agreement.

An independent contractor is regarded as self-employed as they work independently and manage their own business affairs. This status provides the contractor with more control over their work environment and client relationships. When working as a contractor in Missouri, a Missouri Door Contractor Agreement - Self-Employed can safeguard your interests.

Yes, an independent contractor is indeed considered self-employed. This classification means you have the flexibility to choose your clients and projects. By formalizing your work through a Missouri Door Contractor Agreement - Self-Employed, you can clearly define your relationship with clients while ensuring compliance with local regulations.